Dor Georgia GovsitesdorState of Georgia Department of Revenue 2020

Understanding the GA G7 Form

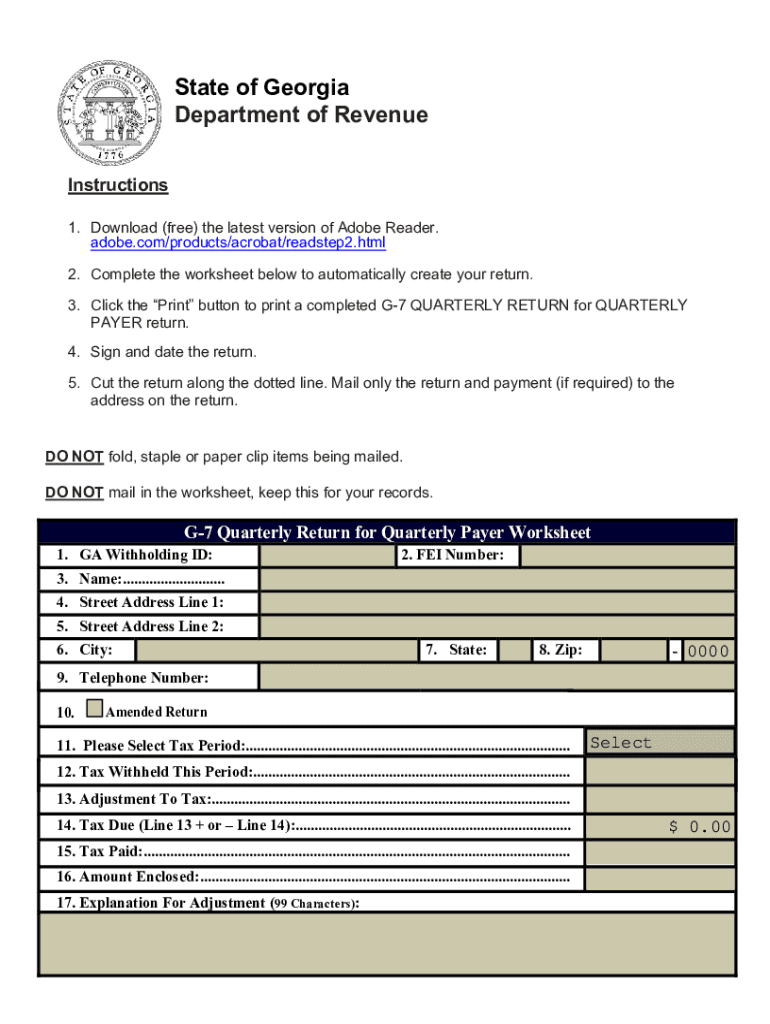

The GA G7 form, also known as the G7 quarterly return, is a crucial document for businesses operating in Georgia. This form is used to report and remit sales and use tax to the Georgia Department of Revenue. It is essential for ensuring compliance with state tax regulations and avoiding penalties. Understanding the specific requirements and deadlines associated with the GA G7 form can help businesses maintain good standing with tax authorities.

Steps to Complete the GA G7 Form

Completing the GA G7 form involves several key steps:

- Gather all necessary sales and use tax information for the reporting period.

- Accurately calculate the total sales and use tax due based on your business's transactions.

- Fill out the GA G7 form with the calculated figures, ensuring all entries are correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with the payment by the due date to avoid late fees.

Filing Deadlines for the GA G7 Form

It is important to be aware of the filing deadlines for the GA G7 form to ensure timely submission. The GA G7 form is typically due on the 20th day of the month following the end of the quarter. For example:

- For the first quarter (January to March), the due date is April 20.

- For the second quarter (April to June), the due date is July 20.

- For the third quarter (July to September), the due date is October 20.

- For the fourth quarter (October to December), the due date is January 20 of the following year.

Legal Use of the GA G7 Form

The GA G7 form is legally binding when completed and submitted according to Georgia's tax laws. It is essential for businesses to ensure that all information provided is accurate and complete. Failure to comply with the legal requirements associated with the GA G7 form can result in penalties, including fines and interest on unpaid taxes. Utilizing a reliable eSignature solution can help ensure that your submission is both secure and compliant with legal standards.

Form Submission Methods

Businesses can submit the GA G7 form through various methods, including:

- Online submission via the Georgia Department of Revenue's website.

- Mailing a paper copy of the form to the appropriate address.

- In-person submission at designated Georgia Department of Revenue offices.

Choosing the right submission method can help streamline the filing process and ensure that your form is received on time.

Penalties for Non-Compliance

Non-compliance with the GA G7 filing requirements can lead to significant penalties. Businesses may incur fines for late submissions, which can accumulate over time. Additionally, failure to pay the owed sales and use tax can result in interest charges. It is crucial for businesses to stay informed about their filing obligations to avoid these consequences and maintain compliance with state tax laws.

Quick guide on how to complete dorgeorgiagovsitesdorstate of georgia department of revenue

Complete Dor georgia govsitesdorState Of Georgia Department Of Revenue seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the suitable form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Dor georgia govsitesdorState Of Georgia Department Of Revenue on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The optimal method to adjust and eSign Dor georgia govsitesdorState Of Georgia Department Of Revenue effortlessly

- Obtain Dor georgia govsitesdorState Of Georgia Department Of Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Disregard concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Dor georgia govsitesdorState Of Georgia Department Of Revenue and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dorgeorgiagovsitesdorstate of georgia department of revenue

Create this form in 5 minutes!

How to create an eSignature for the dorgeorgiagovsitesdorstate of georgia department of revenue

The way to create an e-signature for a PDF online

The way to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an e-signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the 'ga g7' feature of airSlate SignNow?

The 'ga g7' feature in airSlate SignNow allows for seamless document signing and sharing within a secure environment. This feature enhances your workflow by offering customizable templates and automation capabilities, making it easier to manage contracts and agreements.

-

How does the pricing for 'ga g7' compare with other eSignature solutions?

The 'ga g7' pricing is competitive and offers exceptional value for businesses looking for a cost-effective eSignature solution. With flexible pricing plans, users can choose the package that best fits their needs, ensuring affordability without compromising on features.

-

What are the key benefits of using the 'ga g7' functionality?

Using the 'ga g7' functionality can signNowly enhance productivity and efficiency in document management. It simplifies the signing process, minimizes delays, and reduces paper waste, allowing businesses to go green while streamlining operations.

-

Can I integrate 'ga g7' with other software solutions?

Yes, 'ga g7' can effortlessly integrate with various business applications such as CRM tools, cloud storage, and project management tools. This compatibility enables businesses to maintain a connected workflow and improve efficiency across platforms.

-

Is the 'ga g7' feature secure for sensitive documents?

Absolutely, the 'ga g7' feature prioritizes security with advanced encryption protocols to protect sensitive documents. Users can trust that their information remains confidential and secure throughout the signing process.

-

How easy is it to use the 'ga g7' feature for new users?

The 'ga g7' feature is designed with user-friendliness in mind, making it accessible even for those new to eSigning. With a simple interface and guided steps, anyone can quickly learn to send and sign documents effortlessly.

-

What types of documents can I sign using 'ga g7'?

You can sign a wide array of documents using the 'ga g7' feature, including contracts, agreements, and forms. Its versatility makes it suitable for various industries, allowing for customization based on your specific needs.

Get more for Dor georgia govsitesdorState Of Georgia Department Of Revenue

Find out other Dor georgia govsitesdorState Of Georgia Department Of Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors