Instructions for Form 1040 X Rev September Instructions for Form 1040 X, Amended U S Individual Income Tax Return Use with the J 2021-2026

Key elements of the Instructions For Form 1040 X Rev September

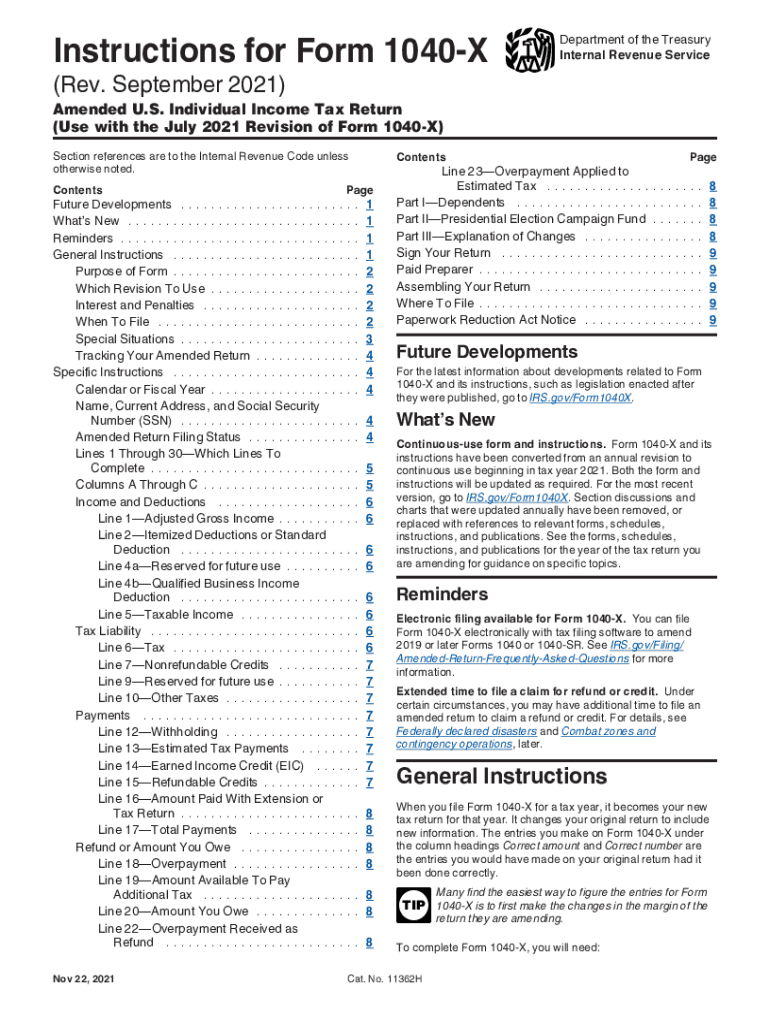

The Instructions For Form 1040 X are essential for taxpayers who need to amend their previously filed tax returns. This form allows individuals to correct errors, claim overlooked deductions, or adjust their filing status. Key elements include:

- Eligibility: Taxpayers must have filed a Form 1040, 1040-SR, or 1040-NR to use the 1040 X.

- Amendment reasons: Common reasons include correcting income, changing filing status, or claiming additional credits.

- Filing deadlines: Generally, amended returns must be filed within three years from the original filing date or within two years of paying the tax owed.

Steps to complete the Instructions For Form 1040 X Rev September

Completing the Form 1040 X involves several steps to ensure accuracy and compliance. Follow these steps:

- Gather your original tax return and any supporting documents.

- Complete the Form 1040 X by entering the correct information in the appropriate sections.

- Clearly explain the reason for the amendment in the designated area.

- Attach any necessary documentation that supports your changes.

- Sign and date the form before submission.

Legal use of the Instructions For Form 1040 X Rev September

The legal use of the Instructions For Form 1040 X is crucial for ensuring that amendments are recognized by the IRS. To be legally binding, the form must:

- Be completed accurately and truthfully.

- Be submitted within the required time frame.

- Include proper signatures from all relevant parties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 1040 X is essential to avoid penalties. Important dates include:

- The original return filing deadline for the tax year.

- The three-year period from the original filing date to submit an amendment.

- The two-year period from the date of tax payment for claiming a refund.

Required Documents

To successfully complete the Form 1040 X, certain documents are necessary. These include:

- Your original tax return.

- Any W-2s, 1099s, or other income statements.

- Documentation for any deductions or credits you are claiming.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form 1040 X can be done through various methods. Options include:

- Online: Use e-filing options available through approved tax software.

- Mail: Send the completed form to the appropriate IRS address based on your state.

- In-Person: Visit a local IRS office for assistance with your amendment.

Quick guide on how to complete instructions for form 1040 x rev september 2021 instructions for form 1040 x amended us individual income tax return use with

Effortlessly Prepare Instructions For Form 1040 X Rev September Instructions For Form 1040 X, Amended U S Individual Income Tax Return Use With The J on Any Device

Digital document management has gained popularity among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the tools necessary to swiftly create, edit, and electronically sign your documents without unnecessary delays. Manage Instructions For Form 1040 X Rev September Instructions For Form 1040 X, Amended U S Individual Income Tax Return Use With The J on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Alter and Electronically Sign Instructions For Form 1040 X Rev September Instructions For Form 1040 X, Amended U S Individual Income Tax Return Use With The J with Ease

- Find Instructions For Form 1040 X Rev September Instructions For Form 1040 X, Amended U S Individual Income Tax Return Use With The J and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Instructions For Form 1040 X Rev September Instructions For Form 1040 X, Amended U S Individual Income Tax Return Use With The J to ensure effective communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 1040 x rev september 2021 instructions for form 1040 x amended us individual income tax return use with

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1040 x rev september 2021 instructions for form 1040 x amended us individual income tax return use with

The way to generate an e-signature for a PDF in the online mode

The way to generate an e-signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

How to generate an e-signature right from your smart phone

The way to create an e-signature for a PDF on iOS devices

How to generate an e-signature for a PDF on Android OS

People also ask

-

What are the IRS Form 1040X instructions 2021?

The IRS Form 1040X instructions 2021 provide a detailed guide for individuals looking to amend their tax returns. These instructions explain how to fill out the form correctly, including what information is needed and how to submit it to the IRS.

-

How can airSlate SignNow help with IRS Form 1040X instructions 2021?

AirSlate SignNow offers an efficient way to electronically sign and send your amended tax documents, including any related to IRS Form 1040X instructions 2021. By using our platform, you can ensure your documents are securely signed and quickly delivered to the IRS.

-

Are there any costs associated with using airSlate SignNow for IRS Form 1040X instructions 2021?

AirSlate SignNow provides a cost-effective solution for all your document signing needs, including those related to IRS Form 1040X instructions 2021. Our pricing plans are transparent and designed to fit various business sizes, so you only pay for what you need.

-

What features does airSlate SignNow offer for document management related to IRS Form 1040X instructions 2021?

With airSlate SignNow, you gain access to a variety of features that simplify document management, including templates for IRS Form 1040X instructions 2021, reminders for deadlines, and a user-friendly interface for easy navigation. This allows you to streamline your workflow and reduce errors effectively.

-

Can I integrate airSlate SignNow with other applications while handling IRS Form 1040X instructions 2021?

Yes, airSlate SignNow supports integrations with various applications, which can enhance your workflow while dealing with IRS Form 1040X instructions 2021. Integrations with popular tools like Google Drive, Dropbox, and CRMs allow you to manage your documents seamlessly.

-

Is it easy to use airSlate SignNow for signing IRS Form 1040X instructions 2021?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it easy for anyone to sign documents, including those involving IRS Form 1040X instructions 2021. Our platform features an intuitive interface that simplifies the signing process for users of all levels.

-

What are the benefits of using airSlate SignNow for IRS Form 1040X instructions 2021?

By using airSlate SignNow, you can enjoy a number of benefits when working with IRS Form 1040X instructions 2021, including enhanced security, faster turnaround times, and the elimination of paper-based processes. These advantages help you stay organized and improve your efficiency.

Get more for Instructions For Form 1040 X Rev September Instructions For Form 1040 X, Amended U S Individual Income Tax Return Use With The J

- Order of appointment of confidential intermediary colorado form

- Consent release or refusal colorado form

- Request for order requiring disclosure of information colorado

- Request to maintain open status colorado form

- Adopt form

- Search pursuant form

- Appearance bond 497300397 form

- Colorado consent surety form

Find out other Instructions For Form 1040 X Rev September Instructions For Form 1040 X, Amended U S Individual Income Tax Return Use With The J

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free