Form 1040x Instructions 2016

What is the Form 1040x Instructions

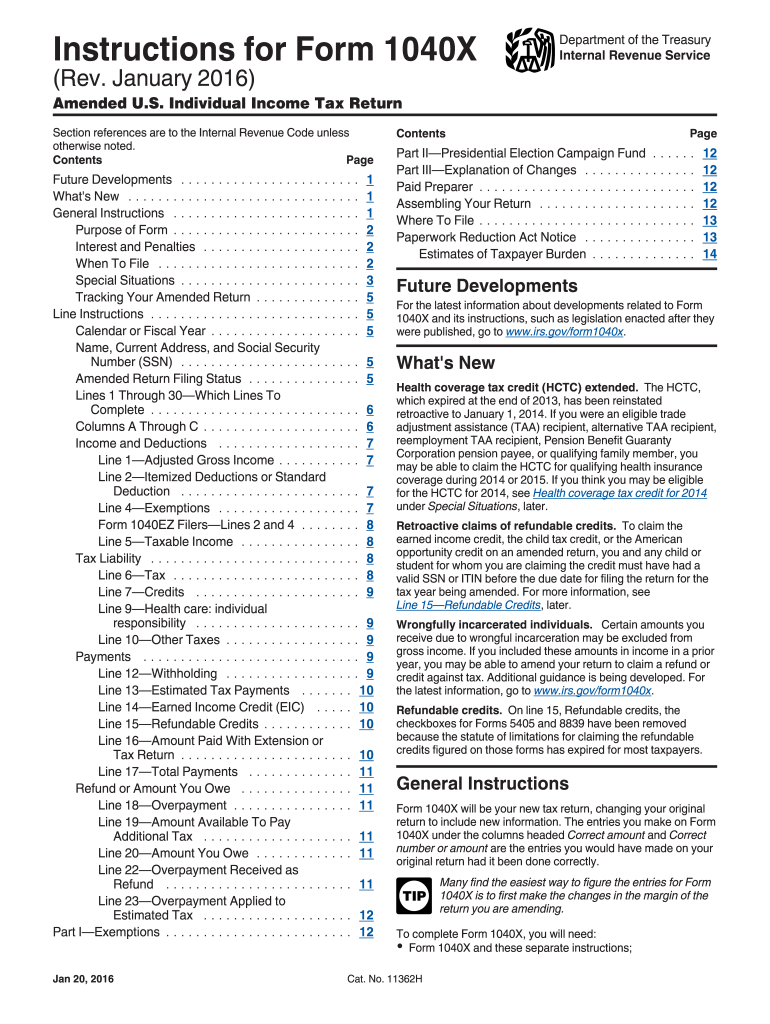

The Form 1040x Instructions provide detailed guidance for taxpayers who need to amend their federal income tax returns. This form is specifically designed for individuals who have already filed their Form 1040, 1040-SR, or 1040-NR and need to correct errors or make changes to their previously submitted information. Common reasons for filing include correcting filing status, income, deductions, or credits. Understanding these instructions is crucial for ensuring that amendments are processed correctly and efficiently by the IRS.

Steps to complete the Form 1040x Instructions

Completing the Form 1040x involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including your original tax return and any supporting documentation for the changes you are making. Next, clearly indicate the year of the return you are amending at the top of the form. Follow the instructions to fill out the form, paying close attention to the sections that require you to explain the changes made. After completing the form, review it for accuracy before signing and dating it. Finally, submit the form to the appropriate IRS address based on your state of residence.

Legal use of the Form 1040x Instructions

The legal use of the Form 1040x Instructions is governed by IRS regulations, which dictate how and when taxpayers can amend their returns. It is important to file the form within the specified time frame, generally within three years from the original filing date or two years from the date the tax was paid. Failure to adhere to these guidelines may result in the IRS rejecting the amendment. Additionally, properly completing the form ensures that the changes are recognized and processed legally, maintaining compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040x are critical for taxpayers to understand. Generally, you must file the amended return within three years from the original due date of the return or within two years from the date you paid the tax. For example, if you filed your 2020 tax return on April 15, 2021, you would have until April 15, 2024, to file an amendment. It is essential to keep track of these dates to avoid penalties and ensure that any refunds due are received in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040x can be submitted in various ways, depending on the preferences of the taxpayer. Currently, the IRS allows for electronic filing of the amended return through approved tax software. This method is often faster and more efficient, providing immediate confirmation of submission. Alternatively, taxpayers can choose to mail the completed form to the appropriate IRS address, which varies by state. In-person submission is generally not available for the 1040x, as it is primarily processed through mail or electronic means.

Required Documents

When filing the Form 1040x, certain documents are required to support the changes being made. Taxpayers should include a copy of the original tax return, any new or corrected forms that pertain to the changes, and relevant documentation that justifies the amendments, such as W-2s, 1099s, or receipts for deductions. Ensuring that all necessary documents are included with the submission helps facilitate a smoother review process by the IRS and reduces the likelihood of delays.

Quick guide on how to complete form 1040x instructions 2016

Complete Form 1040x Instructions effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the functionalities needed to create, edit, and eSign your documents quickly without interruptions. Handle Form 1040x Instructions on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form 1040x Instructions with ease

- Find Form 1040x Instructions and click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Highlight important sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate generating new document copies. airSlate SignNow satisfies your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 1040x Instructions and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040x instructions 2016

Create this form in 5 minutes!

How to create an eSignature for the form 1040x instructions 2016

How to create an electronic signature for your Form 1040x Instructions 2016 in the online mode

How to make an eSignature for the Form 1040x Instructions 2016 in Chrome

How to generate an electronic signature for signing the Form 1040x Instructions 2016 in Gmail

How to generate an eSignature for the Form 1040x Instructions 2016 from your mobile device

How to create an electronic signature for the Form 1040x Instructions 2016 on iOS devices

How to make an electronic signature for the Form 1040x Instructions 2016 on Android OS

People also ask

-

What are the key features of airSlate SignNow for handling Form 1040x Instructions?

airSlate SignNow offers a user-friendly platform for managing Form 1040x Instructions, including customizable templates, real-time collaboration, and secure eSignature capabilities. These features streamline the process of completing and submitting your tax forms, ensuring accuracy and compliance.

-

How can airSlate SignNow help me with the preparation of Form 1040x Instructions?

Using airSlate SignNow, you can easily prepare Form 1040x Instructions with our intuitive editing tools and templates. The platform allows you to fill out forms electronically, reducing the risk of errors and simplifying the revision process for your tax documents.

-

Is there a cost associated with using airSlate SignNow for Form 1040x Instructions?

Yes, airSlate SignNow offers various pricing plans tailored to fit different needs and budgets. Each plan provides access to essential features for managing Form 1040x Instructions, allowing users to choose the best option for their individual or business tax filing requirements.

-

Can I integrate airSlate SignNow with other software for managing Form 1040x Instructions?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax software, making it easier to manage Form 1040x Instructions alongside your other financial documents. This integration enhances productivity and ensures that your data remains consistent across platforms.

-

What benefits does airSlate SignNow offer for eSigning Form 1040x Instructions?

With airSlate SignNow, eSigning Form 1040x Instructions is quick and secure. The platform ensures that your signatures are legally binding and compliant with regulations, providing peace of mind while expediting the submission process of your tax documents.

-

How does airSlate SignNow ensure the security of my Form 1040x Instructions?

airSlate SignNow prioritizes the security of your documents, including Form 1040x Instructions, by employing advanced encryption and secure storage solutions. This commitment to security helps protect sensitive information and ensures that your tax documents are safe from unauthorized access.

-

What kind of customer support is available for users of airSlate SignNow concerning Form 1040x Instructions?

airSlate SignNow provides comprehensive customer support to assist users with their queries related to Form 1040x Instructions. Our support team is available through various channels, including chat, email, and phone, ensuring you receive timely assistance whenever you need it.

Get more for Form 1040x Instructions

- Concellationform

- Evidence to support variation of a support order form

- Iowa child support npa application 2013 form

- 1099 form 2012

- Use this form if you did not request an quotex partequot order or the judge refuses to issue an order without a hearing

- Fl 395 form 244803

- Stalking order form

- Forms vn028

Find out other Form 1040x Instructions

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy