Form 1040x Instructions 2017

What is the Form 1040x Instructions

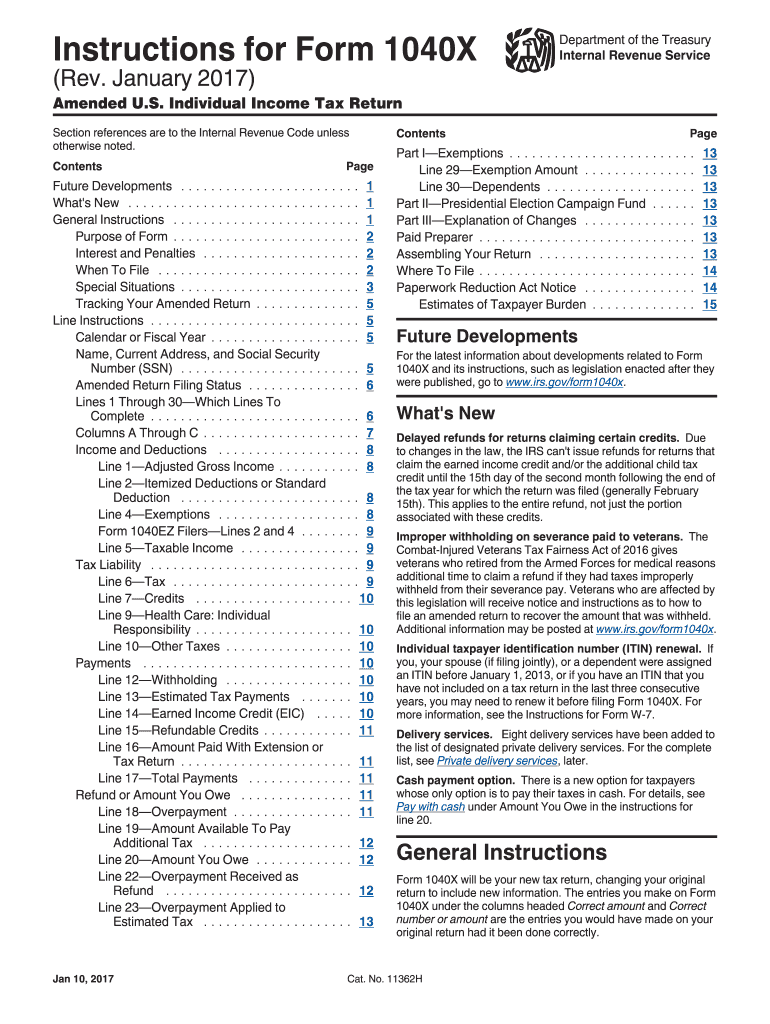

The Form 1040x Instructions provide guidance for taxpayers who need to amend their federal income tax returns. This form is essential for correcting errors or making changes to previously filed Forms 1040, 1040A, or 1040EZ. Common reasons for filing the Form 1040x include correcting filing status, income, deductions, or credits. Understanding these instructions is crucial for ensuring compliance with IRS regulations and facilitating a smooth amendment process.

Steps to complete the Form 1040x Instructions

Completing the Form 1040x involves several key steps:

- Gather all relevant documents, including your original tax return and any new information that necessitates the amendment.

- Fill out the Form 1040x, ensuring to provide accurate information in the designated sections, including the reason for amending.

- Clearly indicate the changes made by completing the columns that show the original amounts, the corrected amounts, and the difference.

- Sign and date the form, as the IRS requires your signature for processing.

- Submit the completed form to the appropriate IRS address based on your state of residence.

Legal use of the Form 1040x Instructions

The Form 1040x Instructions are legally binding when completed accurately and submitted in accordance with IRS guidelines. It is important to ensure that all information provided is truthful and reflects your financial situation accurately. Failure to comply with these legal requirements can result in penalties or delays in processing your amendment. Utilizing reliable electronic tools for submission can also enhance the legal standing of your document.

Filing Deadlines / Important Dates

When filing the Form 1040x, it is essential to be aware of the deadlines to avoid penalties. Generally, you must file the form within three years from the original due date of the return you are amending. If you are claiming a refund, the same three-year rule applies. For specific situations, such as those involving certain credits or deductions, different deadlines may apply. Always check the IRS guidelines for the most current information regarding deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040x can be submitted in several ways. While electronic filing is not available for this form, you can mail it to the appropriate IRS address based on your state. Ensure that you use the correct address to avoid processing delays. In-person submissions are not typical for this form, as it is primarily handled through mail. Keeping a copy of the submitted form for your records is advisable.

Key elements of the Form 1040x Instructions

Understanding the key elements of the Form 1040x Instructions is vital for successful completion. Essential components include:

- The reason for amending your return, which must be clearly stated.

- The original amounts reported on your tax return alongside the corrected amounts.

- Signature and date fields, which confirm your agreement with the information provided.

- Any additional schedules or forms that may need to accompany the amendment.

How to obtain the Form 1040x Instructions

The Form 1040x Instructions can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. You may also request a paper copy by calling the IRS or visiting a local IRS office. It is important to ensure you have the most current version of the instructions to avoid errors in the amendment process.

Quick guide on how to complete form 1040x instructions 2017

Complete Form 1040x Instructions seamlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage Form 1040x Instructions on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 1040x Instructions effortlessly

- Locate Form 1040x Instructions and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would prefer to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you choose. Modify and eSign Form 1040x Instructions and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040x instructions 2017

Create this form in 5 minutes!

How to create an eSignature for the form 1040x instructions 2017

How to create an eSignature for the Form 1040x Instructions 2017 online

How to create an eSignature for your Form 1040x Instructions 2017 in Chrome

How to create an electronic signature for putting it on the Form 1040x Instructions 2017 in Gmail

How to create an eSignature for the Form 1040x Instructions 2017 right from your mobile device

How to generate an eSignature for the Form 1040x Instructions 2017 on iOS devices

How to create an electronic signature for the Form 1040x Instructions 2017 on Android

People also ask

-

What are the Form 1040x Instructions for filing a tax return amendment?

The Form 1040x Instructions detail the process for amending your tax return. You will need to provide specific information about the original return and the changes you are making. Make sure to follow the Form 1040x Instructions carefully to avoid delays in processing your amendment.

-

How can airSlate SignNow assist with Form 1040x Instructions?

airSlate SignNow can streamline the process of signing and submitting your Form 1040x Instructions. With our easy-to-use platform, you can quickly eSign your amended return and send it securely online. This ensures that your amendments are processed efficiently and accurately.

-

Are there any costs associated with using airSlate SignNow for Form 1040x Instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when handling Form 1040x Instructions. Our plans are designed to be cost-effective, ensuring that you get the best value while managing your document signing and eSigning requirements.

-

What features does airSlate SignNow provide for handling Form 1040x Instructions?

With airSlate SignNow, you can easily create, edit, and eSign documents, including Form 1040x Instructions. Our platform also provides templates, secure storage, and tracking features that simplify the amendment process, making it easier for you to manage your tax documents.

-

Can I integrate airSlate SignNow with other software while using Form 1040x Instructions?

Absolutely! airSlate SignNow offers seamless integrations with various software applications that can enhance your efficiency when working with Form 1040x Instructions. This allows you to connect your existing tools and streamline your workflow for tax amendments.

-

Is airSlate SignNow user-friendly for those unfamiliar with Form 1040x Instructions?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those who may not be familiar with Form 1040x Instructions. Our intuitive interface guides you through the process of eSigning and submitting your documents, ensuring a smooth experience.

-

What security measures does airSlate SignNow offer for Form 1040x Instructions?

airSlate SignNow prioritizes security, employing advanced encryption and secure access protocols to protect your documents, including Form 1040x Instructions. You can trust that your sensitive information will remain confidential and secure throughout the signing process.

Get more for Form 1040x Instructions

Find out other Form 1040x Instructions

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document