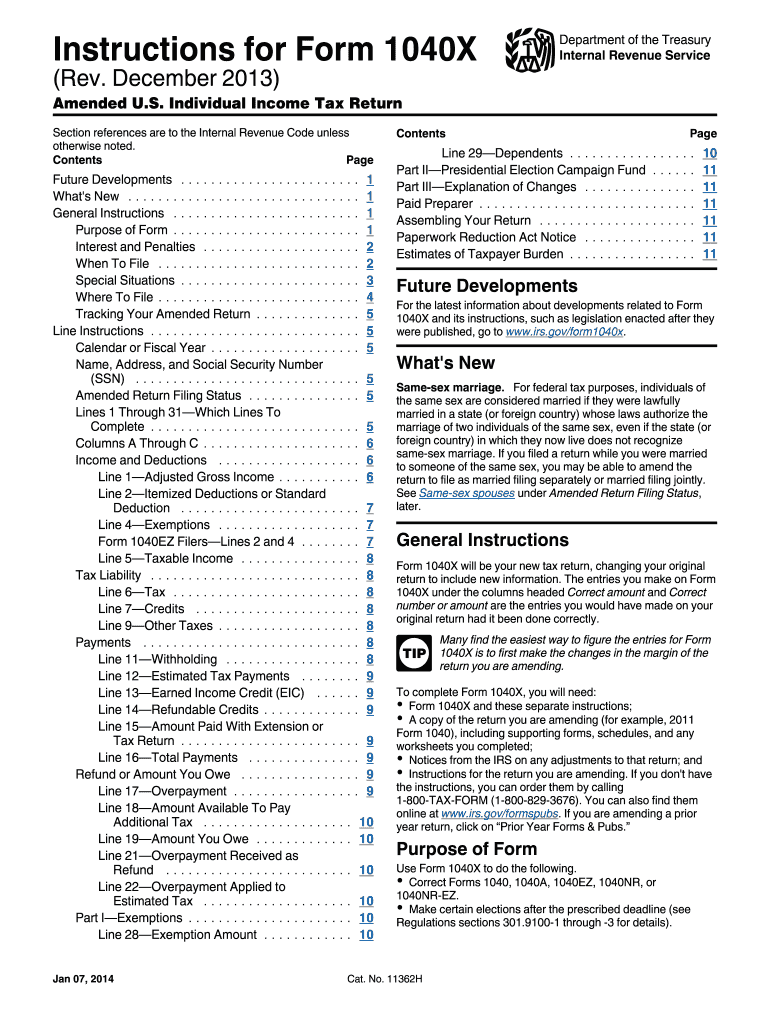

1040x Instructions Form 2013

What is the 1040x Instructions Form

The 1040x Instructions Form is a crucial document used by taxpayers in the United States to amend their previously filed federal income tax returns. This form allows individuals to correct errors, claim overlooked deductions, or adjust their filing status. It is specifically designed for use with the IRS Form 1040, which is the standard individual income tax return. Understanding the purpose and function of the 1040x Instructions Form is essential for ensuring accurate tax reporting and compliance with federal tax laws.

How to use the 1040x Instructions Form

Using the 1040x Instructions Form involves several key steps to ensure proper completion and submission. First, gather all relevant documents, including your original tax return and any supporting materials that pertain to the changes you wish to make. Next, carefully read the instructions provided with the form to understand the specific requirements for your amendments. Fill out the 1040x form by providing the correct information in the designated fields, ensuring that you clearly indicate the changes being made. Finally, review the completed form for accuracy before submitting it to the IRS, either electronically or via mail.

Steps to complete the 1040x Instructions Form

Completing the 1040x Instructions Form involves a systematic approach. Start by obtaining the form from the IRS website or through tax preparation software. Follow these steps:

- Enter your personal information at the top of the form, including your name, address, and Social Security number.

- Indicate the tax year you are amending.

- Complete the sections that reflect the changes you are making, including adjustments to income, deductions, or credits.

- Provide explanations for each change in the designated area to clarify your amendments.

- Calculate any additional tax owed or refund due based on the changes.

- Sign and date the form before submission.

Legal use of the 1040x Instructions Form

The legal use of the 1040x Instructions Form is governed by IRS regulations. This form must be filed within three years of the original return's due date or within two years of the date the tax was paid, whichever is later. Filing the 1040x correctly ensures that taxpayers can amend their returns without facing penalties for inaccuracies. It is important to retain copies of all submitted documents for personal records and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the 1040x Instructions Form are critical for compliance. Generally, the form must be submitted within three years from the original filing deadline of the tax return being amended. For example, if you are amending a return for the tax year 2020, you would need to file the 1040x by April 15, 2024. Additionally, if you are expecting a refund due to the amendment, it is advisable to file as soon as possible to avoid delays in receiving your refund.

Form Submission Methods (Online / Mail / In-Person)

The 1040x Instructions Form can be submitted through various methods, depending on your preference and the IRS guidelines. Currently, the IRS allows electronic filing for the 1040x form through approved tax software. Alternatively, you can print the completed form and mail it to the appropriate IRS address based on your state of residence. In-person submission is not typically available for this form, as it is primarily processed through mail or electronic channels. Ensure that you check the IRS website for the latest submission methods and guidelines.

Quick guide on how to complete 1040x 2013 instructions form

Complete 1040x Instructions Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without interruptions. Handle 1040x Instructions Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

The easiest method to modify and eSign 1040x Instructions Form seamlessly

- Find 1040x Instructions Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting document searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign 1040x Instructions Form to ensure outstanding communication throughout every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040x 2013 instructions form

Create this form in 5 minutes!

How to create an eSignature for the 1040x 2013 instructions form

The way to create an electronic signature for a PDF document in the online mode

The way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the 1040x Instructions Form?

The 1040x Instructions Form is a document that provides guidance on how to amend a previously filed tax return. It explains the necessary steps to complete Form 1040x and details the information required for successful submission. Understanding these instructions is critical for ensuring your tax amendments are accurate and timely.

-

How can airSlate SignNow help with the 1040x Instructions Form?

airSlate SignNow streamlines the process of filling out the 1040x Instructions Form by allowing users to eSign and send documents seamlessly. Its user-friendly interface ensures that you can easily navigate through the instructions and gather necessary signatures, making tax amendments less stressful. Our platform enhances efficiency and helps you stay organized during tax season.

-

Is there a cost associated with using airSlate SignNow for the 1040x Instructions Form?

Yes, airSlate SignNow offers flexible pricing plans designed to accommodate diverse business needs, including features beneficial for managing the 1040x Instructions Form. By investing in our service, you can manage and eSign documents cost-effectively while ensuring compliance with tax regulations. Visit our pricing page to find a plan that suits your requirements.

-

What features are included with airSlate SignNow for handling the 1040x Instructions Form?

When using airSlate SignNow for the 1040x Instructions Form, you gain access to features like document templates, eSignature capabilities, and real-time tracking. These features streamline the amendment process and help maintain accuracy when submitting tax documents. Additionally, you can easily collaborate with teammates and professionals to ensure that everything is completed properly.

-

Can I integrate airSlate SignNow with other tax software for the 1040x Instructions Form?

Absolutely! airSlate SignNow offers robust integrations with various tax software, enabling you to efficiently manage the 1040x Instructions Form alongside your other tax documentation. Integrating our solution enhances your workflow by allowing seamless data exchange, reducing the risk of errors, and improving overall productivity during tax season.

-

How does eSigning the 1040x Instructions Form with airSlate SignNow improve efficiency?

eSigning the 1040x Instructions Form with airSlate SignNow enhances efficiency by eliminating the need for physical signatures and paper documents. This digital process helps save time, reduces errors, and allows for quicker processing of your tax amendments. By using electronic signatures, you can also ensure that your documents are secure and compliant with legal standards.

-

What support is available when using airSlate SignNow for the 1040x Instructions Form?

When you use airSlate SignNow for the 1040x Instructions Form, you have access to comprehensive support resources, including help articles, tutorials, and live customer service. Our team is dedicated to assisting you with any questions or issues that may arise during the process. Ensuring that you accurately complete and submit your 1040x Instructions Form is our priority.

Get more for 1040x Instructions Form

- Immigrant investorstuart investments form

- Humanitarian and compassionate considerations under the form

- Order replacement stcw certificatesalt services form

- Short courses for electro technical officer certificate of form

- Illinois speciality universal decals and request guidelines form

- Sp4 134 32001pennsylvania state police form

- W 588aa e rev form

- Customer servicelake havasu city form

Find out other 1040x Instructions Form

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy