Missouri Form MO 1120S S Corporation Income Tax Return 2020

Understanding the Missouri Form MO 1065

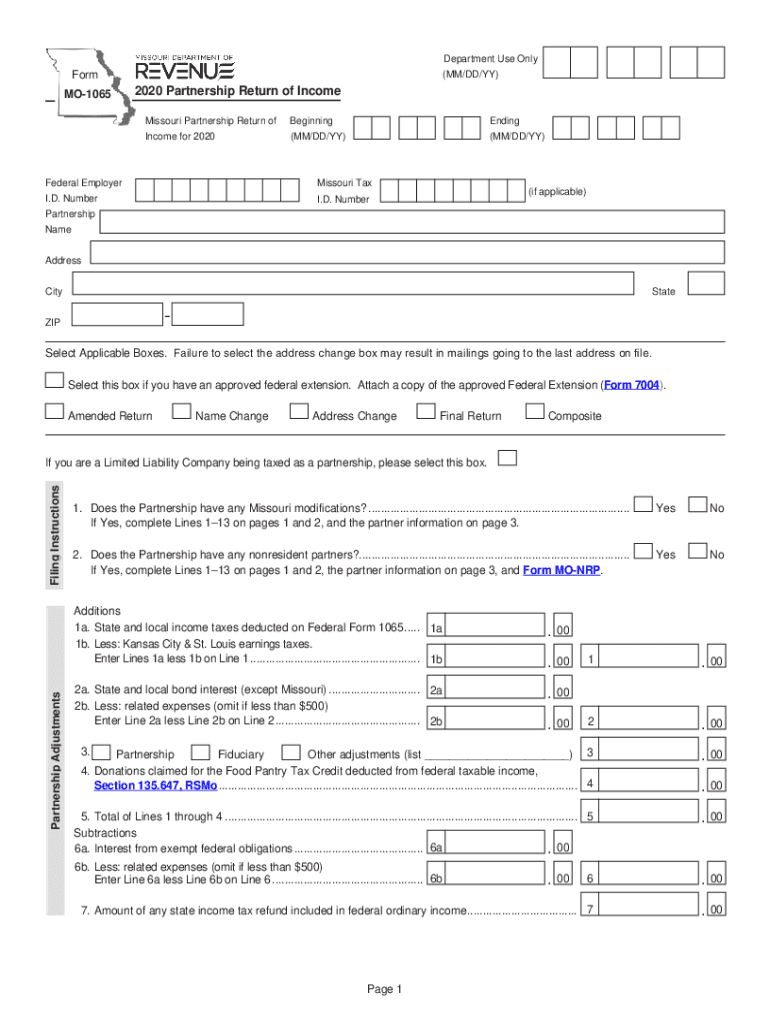

The Missouri Form MO 1065 is specifically designed for partnerships operating within the state. This form serves as the Missouri partnership return, allowing partnerships to report their income, deductions, and credits. It is essential for ensuring compliance with state tax regulations and for accurately reflecting the financial activities of the partnership. The MO 1065 is vital for both tax reporting and for providing necessary information to partners regarding their share of income and losses.

Steps to Complete the Missouri Form MO 1065

Filling out the Missouri Form MO 1065 involves several important steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, such as income statements and expense records. Next, follow these steps:

- Enter the partnership's name, address, and federal employer identification number (EIN).

- Report total income, including sales and other revenue sources.

- Detail allowable deductions, such as business expenses and depreciation.

- Calculate the partnership's net income or loss.

- Distribute the income or loss among partners based on their ownership percentages.

- Complete any additional schedules required for specific deductions or credits.

Review the completed form for accuracy before submission to avoid penalties or delays.

Filing Deadlines for the Missouri Form MO 1065

Timely submission of the Missouri Form MO 1065 is crucial to avoid late fees and penalties. The filing deadline for the MO 1065 typically aligns with the federal tax deadline, which is usually April fifteenth. However, if the partnership operates on a fiscal year basis, the deadline will be the fifteenth day of the fourth month following the end of the fiscal year. It is advisable to check for any changes or extensions that may apply in a given tax year.

Required Documents for the Missouri Form MO 1065

To complete the Missouri Form MO 1065 accurately, certain documents are required. These include:

- Financial statements reflecting income and expenses.

- Partner agreements outlining ownership percentages and profit-sharing arrangements.

- Records of any deductions or credits claimed.

- Previous year’s tax return, if applicable, for reference.

Having these documents ready will facilitate a smoother filing process and ensure that all necessary information is included.

Penalties for Non-Compliance with the Missouri Form MO 1065

Failing to file the Missouri Form MO 1065 on time or providing inaccurate information can lead to significant penalties. Common penalties include:

- Late filing penalties, which can accumulate daily until the form is submitted.

- Interest on any unpaid taxes, which accrues from the due date until payment is made.

- Potential audits or further scrutiny from the Missouri Department of Revenue.

To avoid these penalties, it is essential to file accurately and on time.

Digital vs. Paper Version of the Missouri Form MO 1065

Partnerships have the option to file the Missouri Form MO 1065 either digitally or via paper submission. The digital version offers several advantages, including:

- Faster processing times, leading to quicker confirmations of receipt.

- Reduced risk of errors, as many software programs provide prompts and checks.

- Convenience of filing from any location with internet access.

Choosing the digital option can streamline the filing process and enhance overall efficiency.

Quick guide on how to complete missouri form mo 1120s s corporation income tax return

Complete Missouri Form MO 1120S S Corporation Income Tax Return seamlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Missouri Form MO 1120S S Corporation Income Tax Return on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign Missouri Form MO 1120S S Corporation Income Tax Return effortlessly

- Locate Missouri Form MO 1120S S Corporation Income Tax Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Missouri Form MO 1120S S Corporation Income Tax Return to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct missouri form mo 1120s s corporation income tax return

Create this form in 5 minutes!

How to create an eSignature for the missouri form mo 1120s s corporation income tax return

The way to make an e-signature for a PDF file in the online mode

The way to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an e-signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What are the mo 1065 instructions 2021?

The mo 1065 instructions 2021 refer to the guidelines provided by the Missouri Department of Revenue for filing the state’s partnership income tax return. These instructions outline how to accurately complete Form 1065 and report partnership income, deductions, and other tax information required for compliance.

-

How can airSlate SignNow help with completing the mo 1065 instructions 2021?

With airSlate SignNow, you can easily create, send, and eSign documents necessary for filing the mo 1065 instructions 2021. Our platform ensures that your tax documents are accurate, securely signed, and stored in one convenient location, streamlining your filing process.

-

Are there costs associated with using airSlate SignNow for mo 1065 instructions 2021?

AirSlate SignNow offers a variety of pricing plans designed to fit different business needs. Whether you need basic eSignature capabilities or advanced document management features, our solutions provide cost-effective options that simplify the filing of forms like the mo 1065 instructions 2021.

-

What features does airSlate SignNow provide for managing taxes like the mo 1065 instructions 2021?

AirSlate SignNow includes features such as templates for common tax forms, bulk sending capabilities, and customizable workflows. These tools enhance the efficiency of completing tasks related to mo 1065 instructions 2021, reducing paper waste and speeding up the turnaround time for document signatures.

-

Can I integrate airSlate SignNow with accounting software for the mo 1065 instructions 2021?

Yes, airSlate SignNow integrates smoothly with various accounting software solutions, allowing you to streamline the process of managing financial documents associated with the mo 1065 instructions 2021. This integration eliminates double data entry, enhancing accuracy and saving you time.

-

What benefits does airSlate SignNow offer for small businesses needing the mo 1065 instructions 2021?

For small businesses, airSlate SignNow provides a user-friendly platform that simplifies the signing and sending of documents related to the mo 1065 instructions 2021. Our cost-effective solution helps reduce the complexity of tax filing, ensuring that you meet deadlines without unnecessary hassle.

-

Is airSlate SignNow secure for submitting documents related to the mo 1065 instructions 2021?

Absolutely! AirSlate SignNow utilizes advanced security features such as encryption and secure storage to protect your sensitive documents, including those related to the mo 1065 instructions 2021. You can trust that your information is safe while using our platform.

Get more for Missouri Form MO 1120S S Corporation Income Tax Return

- Colorado collection form

- Js 44 civil cover sheet federal district court colorado form

- Lead based paint disclosure for sales transaction colorado form

- Lead based paint disclosure for rental transaction colorado form

- Notice of lease for recording colorado form

- Co llc 497300605 form

- Supplemental residential lease forms package colorado

- Co landlord form

Find out other Missouri Form MO 1120S S Corporation Income Tax Return

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement