Form MO 1065 Partnership Return of Income 2022-2026

What is the Form MO 1065 Partnership Return of Income

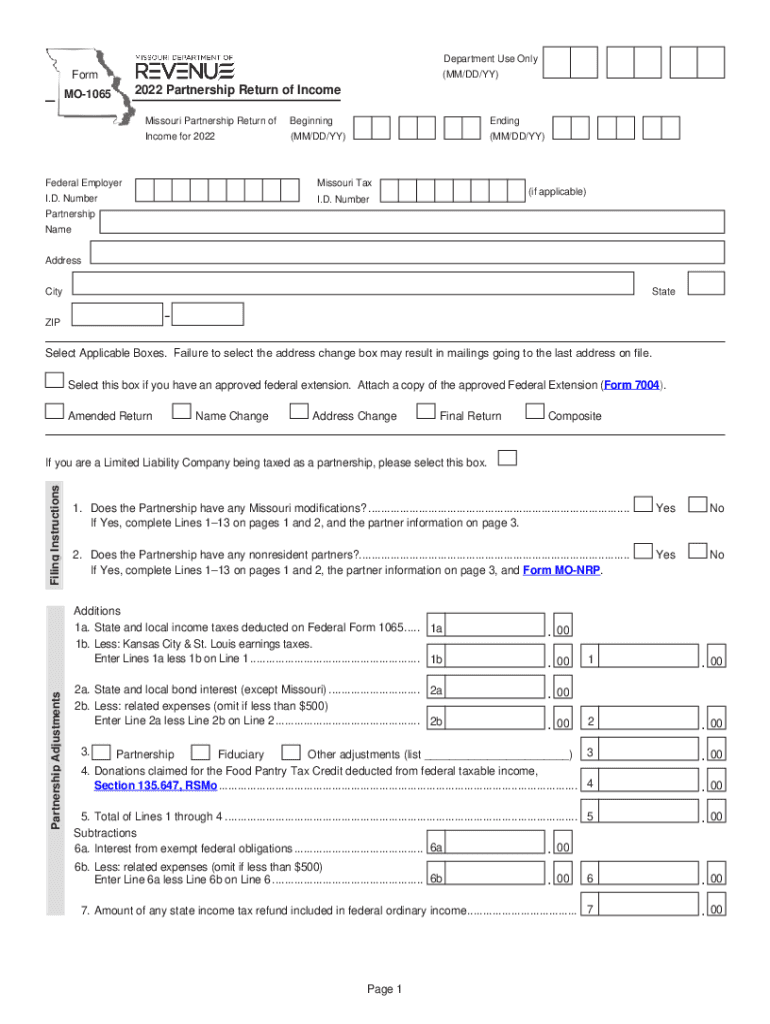

The Form MO 1065 is a tax document used by partnerships operating in Missouri to report income, deductions, gains, and losses. This form is essential for partnerships to fulfill their tax obligations under state law. Each partner's share of the partnership's income is reported on their individual tax returns, making the accurate completion of this form crucial for compliance with both state and federal tax regulations.

Steps to Complete the Form MO 1065 Partnership Return of Income

Completing the Form MO 1065 involves several key steps:

- Gather Financial Information: Collect all relevant financial documents, including income statements, expense records, and previous tax returns.

- Fill Out Basic Information: Enter the partnership's name, address, and federal employer identification number (EIN) at the top of the form.

- Report Income: Complete the income section by detailing all sources of revenue generated by the partnership.

- Deduct Expenses: List all allowable deductions, including operating expenses and other business-related costs.

- Calculate Net Income: Subtract total deductions from total income to determine the partnership's net income.

- Distribute Income to Partners: Allocate the net income among partners based on the partnership agreement.

- Review and Submit: Double-check all entries for accuracy before submitting the form by the deadline.

Filing Deadlines / Important Dates

Partnerships must file the Form MO 1065 by the 15th day of the fourth month following the close of the tax year. For partnerships operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is important to be aware of these dates to avoid penalties and ensure timely compliance.

Legal Use of the Form MO 1065 Partnership Return of Income

The Form MO 1065 is legally binding and must be completed accurately to reflect the partnership's financial activities. Filing this form is essential for fulfilling tax obligations under Missouri law. Failure to comply with filing requirements can result in penalties, interest on unpaid taxes, and potential audits by the Missouri Department of Revenue. Therefore, it is crucial to ensure that all information provided is truthful and complete.

Required Documents

To complete the Form MO 1065, partnerships should have the following documents ready:

- Financial statements, including profit and loss statements

- Records of all income sources

- Documentation of expenses and deductions

- Previous year’s tax returns

- Partnership agreement outlining income distribution among partners

Form Submission Methods (Online / Mail / In-Person)

The Form MO 1065 can be submitted in several ways:

- Online: Partnerships can file electronically through the Missouri Department of Revenue's e-filing system.

- By Mail: Completed forms can be mailed to the appropriate address provided by the Missouri Department of Revenue.

- In-Person: Partnerships may also choose to file in person at designated Department of Revenue offices.

Quick guide on how to complete form mo 1065 2022 partnership return of income

Effortlessly Prepare Form MO 1065 Partnership Return Of Income on Any Device

The management of documents online has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without delays. Handle Form MO 1065 Partnership Return Of Income on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and Electronically Sign Form MO 1065 Partnership Return Of Income with Minimal Effort

- Locate Form MO 1065 Partnership Return Of Income and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive data using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or incorrectly placed documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Form MO 1065 Partnership Return Of Income and ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1065 2022 partnership return of income

Create this form in 5 minutes!

People also ask

-

What are the key features of the mo 1065 instructions 2024 form?

The mo 1065 instructions 2024 form provides clear guidelines for filing partnership tax returns in Missouri. It includes information on income reporting, deductions, and credits that partnerships can claim. Understanding these features is crucial for compliance and ensuring accurate filings.

-

How can I access the mo 1065 instructions 2024?

You can access the mo 1065 instructions 2024 online through the Missouri Department of Revenue's website. They provide downloadable PDFs which detail every aspect of the filing process. This ensures you have the most up-to-date information available for your tax needs.

-

Are there any new changes in the mo 1065 instructions 2024 compared to previous years?

Yes, the mo 1065 instructions 2024 include several updates to the requirements and forms utilized for filing. These changes may affect how partnerships report income and deductions. It's essential to review the instructions carefully to stay compliant with the latest tax laws.

-

What are the benefits of using airSlate SignNow for signing mo 1065 instructions 2024 documents?

Using airSlate SignNow allows you to eSign mo 1065 instructions 2024 documents securely and efficiently. This ensures your signatures are legally binding and easily affixed to digital forms. Additionally, the service streamlines the signing process, saving you time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for the mo 1065 instructions 2024?

AirSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget and usage requirements. While there is a cost associated, the ease of electronic signing and document management provides signNow value.

-

What integrations does airSlate SignNow offer for managing mo 1065 instructions 2024?

AirSlate SignNow integrates seamlessly with various productivity tools, including Google Drive and Dropbox. This allows you to easily access and manage your mo 1065 instructions 2024 files. Such integrations enhance your workflow by centralizing document management.

-

How can I ensure compliance when following the mo 1065 instructions 2024?

To ensure compliance with the mo 1065 instructions 2024, it’s advisable to read through the instructions thoroughly and double-check your entries. Using software like airSlate SignNow helps in maintaining digital copies and proper documentation. Additionally, consulting with a tax professional can provide clarity on any uncertainties.

Get more for Form MO 1065 Partnership Return Of Income

- Nh last will testament form

- Nh civil union form

- Legal last will and testament form for a married person with no children new hampshire

- Nh civil form

- New hampshire legal 497318992 form

- New hampshire form 497318993

- Nh will template form

- Legal last will and testament form for married person with adult and minor children from prior marriage new hampshire

Find out other Form MO 1065 Partnership Return Of Income

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form