Mo 1065 Instructions 2005

What are the Missouri 1065 Instructions?

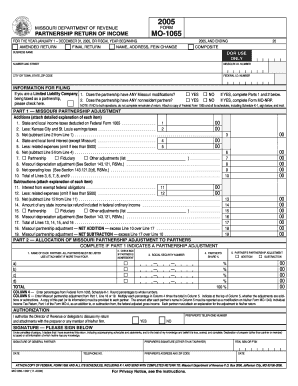

The Missouri 1065 instructions provide guidance for partnerships filing their state income tax return. This form is specifically for partnerships, including limited liability companies (LLCs) that elect to be treated as partnerships for tax purposes. The instructions detail the information required to complete the form accurately, ensuring compliance with Missouri tax laws. Understanding these instructions is crucial for partnerships to report their income, deductions, and credits correctly, ultimately determining their tax liability in the state.

Steps to Complete the Missouri 1065 Instructions

Completing the Missouri 1065 involves several key steps that ensure all necessary information is accurately reported. These steps include:

- Gathering all relevant financial documents, including income statements and expense records.

- Filling out the form with accurate partnership information, including names, addresses, and tax identification numbers.

- Calculating total income and allowable deductions as per Missouri tax guidelines.

- Reviewing the completed form for accuracy before submission.

- Submitting the form by the designated deadline, either electronically or by mail.

Legal Use of the Missouri 1065 Instructions

The Missouri 1065 instructions are legally binding, meaning that partnerships must adhere to them when filing their tax returns. These instructions outline the legal requirements for reporting income and deductions, ensuring compliance with state tax laws. Failure to follow these guidelines can result in penalties or audits. It is essential for partnerships to understand their obligations under these instructions to maintain good standing with the Missouri Department of Revenue.

Filing Deadlines / Important Dates

Partnerships must be aware of specific deadlines when submitting the Missouri 1065. Generally, the return is due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is April 15. Extensions may be available, but it is crucial to file for an extension before the original due date to avoid penalties. Keeping track of these dates helps ensure timely compliance with state tax requirements.

Required Documents for Missouri 1065 Instructions

To complete the Missouri 1065, several documents are necessary. These include:

- Partnership financial statements, including income and expense reports.

- Previous year’s tax return, if applicable.

- Records of any credits or deductions claimed.

- Tax identification numbers for all partners.

Having these documents readily available will streamline the process and help ensure accuracy when filling out the form.

Form Submission Methods

Partnerships have multiple options for submitting the Missouri 1065. The form can be filed electronically through the Missouri Department of Revenue's online portal, which often expedites processing times. Alternatively, partnerships may choose to mail their completed forms to the appropriate state address. In-person submissions may also be possible at designated tax offices. Each method has its own considerations, such as processing times and confirmation of receipt, which partnerships should evaluate based on their needs.

Quick guide on how to complete mo 1065 instructions 2020

Complete Mo 1065 Instructions effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Mo 1065 Instructions on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Mo 1065 Instructions with ease

- Obtain Mo 1065 Instructions and click Get Form to begin.

- Make use of the tools available to fill out your document.

- Mark signNow sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Mo 1065 Instructions and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mo 1065 instructions 2020

Create this form in 5 minutes!

How to create an eSignature for the mo 1065 instructions 2020

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What are the Missouri 1065 instructions for filing my business taxes?

The Missouri 1065 instructions provide detailed guidelines on how partnerships should report income, deductions, and credits to the state. These instructions are essential for ensuring compliance with state tax laws. Following the Missouri 1065 instructions accurately can help avoid penalties and ensure timely filing.

-

How does airSlate SignNow help with Missouri 1065 instructions?

airSlate SignNow simplifies the eSignature process for your Missouri 1065 instructions, allowing you to easily send, sign, and store important documents. Our platform ensures that you can manage your tax documents with efficiency and accuracy. By utilizing airSlate SignNow, you can streamline your filing process and stay organized.

-

What features does airSlate SignNow offer for handling Missouri 1065 instructions?

airSlate SignNow offers features like customizable templates, secure cloud storage, and automated reminders to help manage your Missouri 1065 instructions effectively. These features enhance productivity by reducing the time spent on paperwork. Additionally, you'll benefit from robust security, ensuring your sensitive tax information remains protected.

-

Is there a cost associated with using airSlate SignNow for Missouri 1065 instructions?

Yes, airSlate SignNow offers various pricing plans to suit different business needs when handling Missouri 1065 instructions. Our plans are designed to be cost-effective, ensuring you can manage your documents without breaking the bank. You can choose a plan that fits your volume of documents and frequency of use.

-

Can airSlate SignNow integrate with other software for Missouri 1065 instructions?

Absolutely! airSlate SignNow can integrate with various accounting and business software to streamline your workflow around Missouri 1065 instructions. This connectivity allows you to import and export necessary data seamlessly, reducing manual entry and potential errors. Integrating with your current tools enhances efficiency in your document management process.

-

What are the benefits of using airSlate SignNow for Missouri 1065 instructions?

Using airSlate SignNow for your Missouri 1065 instructions can drastically reduce the time spent on document handling. Benefits include ease of access, the ability to collaborate in real-time, and enhanced security. Additionally, you can track the status of your documents, ensuring that everything is processed promptly.

-

How secure is airSlate SignNow when dealing with Missouri 1065 instructions?

airSlate SignNow takes security seriously, employing advanced encryption and stringent access controls to protect your Missouri 1065 instructions. Our platform is designed to keep your sensitive information safe from unauthorized access. You can rest assured that your documents are secure while you manage your tax compliance.

Get more for Mo 1065 Instructions

- No 17 21 petitioner v respondent on writ of certiorari to form

- Boarding agreement acorn animal hospital form

- City of jacksonville beach paws park application rules form

- Summer camp guide portage public schools issuu form

- Wgc 07 cv 2142wpd government publishing office form

- Iii the centers inability to make a form

- Case 05 31656 elf form

- 52994 federal register vol 76 no 164wednesday august form

Find out other Mo 1065 Instructions

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors