Form MO 1065 Partnership Return of Income 2019

What is the Form MO 1065 Partnership Return Of Income

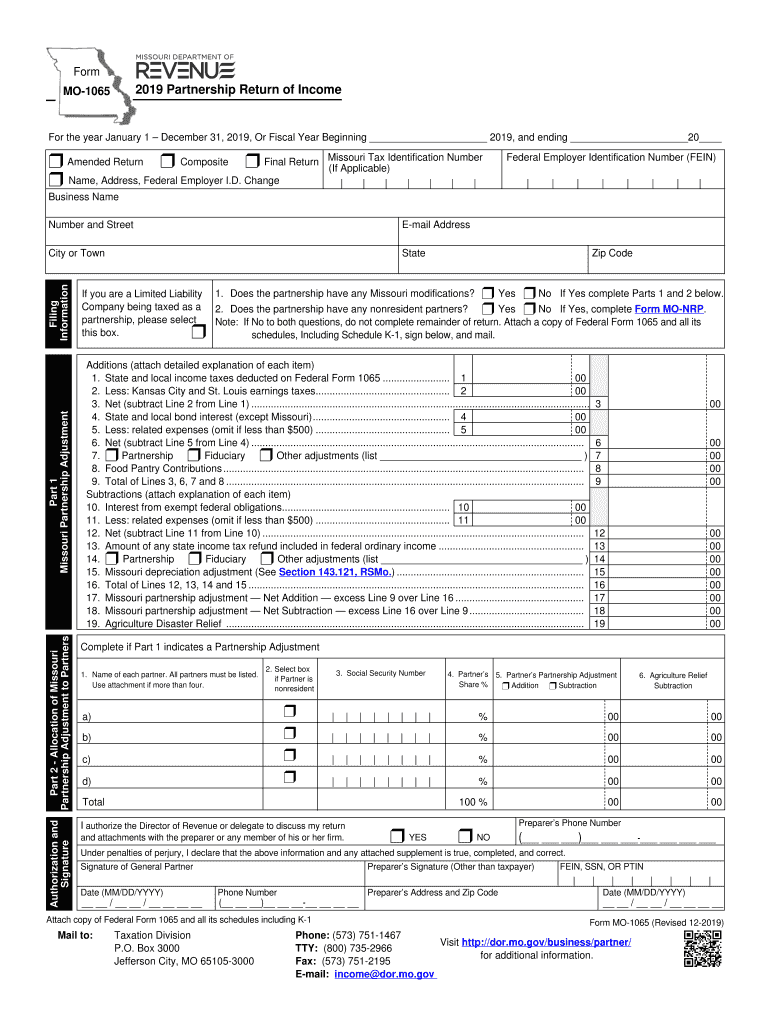

The Form MO 1065 is a tax document used by partnerships in Missouri to report income, deductions, and other relevant financial information. This form is essential for partnerships to fulfill their tax obligations and is similar to the federal Form 1065. It allows partnerships to calculate their income tax liability and report the distribution of income to partners. Each partner will receive a Schedule K-1, detailing their share of the partnership's income, deductions, and credits, which they will need for their individual tax returns.

Steps to complete the Form MO 1065 Partnership Return Of Income

Completing the Form MO 1065 requires careful attention to detail. Here are the key steps to follow:

- Gather necessary financial documents, including income statements, expense records, and previous year tax returns.

- Fill out the basic information section, including the partnership's name, address, and federal employer identification number (EIN).

- Report the partnership's income, including gross receipts, interest income, and any other income sources.

- List all allowable deductions, such as business expenses, salaries, and rent.

- Calculate the partnership's total income and deductions to determine the net income or loss.

- Complete the Schedule K-1 for each partner, detailing their share of income, deductions, and credits.

- Review the form for accuracy and completeness before submission.

Legal use of the Form MO 1065 Partnership Return Of Income

The Form MO 1065 is legally binding when completed accurately and submitted on time. It must comply with both state and federal tax laws. Partnerships are required to file this form annually, and failure to do so may result in penalties. Electronic filing is accepted, which can streamline the process and ensure timely submission. It is essential for partnerships to maintain accurate records and documentation to support the information reported on the form, as this may be subject to review by the Missouri Department of Revenue.

Filing Deadlines / Important Dates

The filing deadline for the Form MO 1065 is typically the 15th day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Partnerships may also apply for a six-month extension to file, but any tax owed must be paid by the original deadline to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

Partnerships can submit the Form MO 1065 through various methods. The preferred method is electronic filing, which is efficient and allows for quicker processing. For those who prefer to file by mail, the completed form should be sent to the appropriate address provided by the Missouri Department of Revenue. In-person submissions are also accepted at designated state offices. It is important to ensure that the form is submitted by the deadline to avoid any penalties.

Key elements of the Form MO 1065 Partnership Return Of Income

The Form MO 1065 includes several key elements that are crucial for accurate reporting. These elements include:

- Partnership Information: Basic details about the partnership, including name, address, and EIN.

- Income Section: Reporting of all income sources, including gross receipts and other income.

- Deductions Section: Listing of all allowable business expenses and deductions.

- Schedule K-1: Individual partner allocations of income, deductions, and credits.

- Signature Section: Required signatures from partners or authorized representatives to validate the form.

Quick guide on how to complete form mo 1065 2019 partnership return of income

Complete Form MO 1065 Partnership Return Of Income effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an optimal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the right format and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without hold-ups. Utilize Form MO 1065 Partnership Return Of Income on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to update and eSign Form MO 1065 Partnership Return Of Income with ease

- Obtain Form MO 1065 Partnership Return Of Income and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or conceal sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal authority as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form MO 1065 Partnership Return Of Income and guarantee effective communication at every phase of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form mo 1065 2019 partnership return of income

Create this form in 5 minutes!

People also ask

-

What are the mo 1065 instructions 2020?

The mo 1065 instructions 2020 provide guidelines on how partnerships in Missouri should file their income tax returns. These instructions detail what information is required, how to report income, and any deductions that are allowed. Understanding these instructions is crucial for proper tax compliance.

-

How can airSlate SignNow help with filing mo 1065 instructions 2020?

AirSlate SignNow simplifies the document signing process, making it easy to gather necessary signatures for your mo 1065 instructions 2020. You can send, sign, and manage your tax documents securely and efficiently. This ensures you stay organized while preparing your partnership tax returns.

-

What features does airSlate SignNow offer that relate to the mo 1065 instructions 2020?

AirSlate SignNow offers features such as customizable templates, multi-party signing, and real-time tracking. These tools make it easier to prepare and submit your documents according to the mo 1065 instructions 2020. With these features, you can handle any document seamlessly.

-

Is airSlate SignNow a cost-effective solution for managing mo 1065 instructions 2020?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to manage their mo 1065 instructions 2020. With various pricing plans, you can choose an option that fits your budget while ensuring you meet all necessary document requirements. This helps save on both time and expenses.

-

What integrations does airSlate SignNow offer for handling the mo 1065 instructions 2020?

AirSlate SignNow integrates with various productivity tools and cloud storage platforms, facilitating a smoother workflow for the mo 1065 instructions 2020. This means you can easily access, sign, and store your documents across different applications. Such integration helps streamline your tax preparation process.

-

Can I use airSlate SignNow on mobile devices for the mo 1065 instructions 2020?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage your mo 1065 instructions 2020 on the go. You can send and sign documents from your smartphone or tablet, ensuring you can always stay on top of your tax responsibilities. This flexibility is beneficial for busy professionals.

-

What benefits does airSlate SignNow provide when dealing with the mo 1065 instructions 2020?

AirSlate SignNow streamlines document workflows, reducing the time spent on paperwork related to the mo 1065 instructions 2020. Enhanced security features protect sensitive information, and easy tracking helps ensure you never miss a deadline. The overall efficiency leads to a better experience in tax management.

Get more for Form MO 1065 Partnership Return Of Income

- The above named employee claims additional medical compensation as a result of an injury by accident or an form

- Mogov unemployment services mogov form

- Form 28u notice of accident to employer ncgov

- Fillable online important employment application form

- Disability insurance elective coverage forms and publications

- Pdf transitional work offer and acceptance form ohio bwc

- Hawaiian or form

- For your benefit california employment development form

Find out other Form MO 1065 Partnership Return Of Income

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online