Fillable Online HSAs PDF Form 8889 Department of the

What is Form 8889?

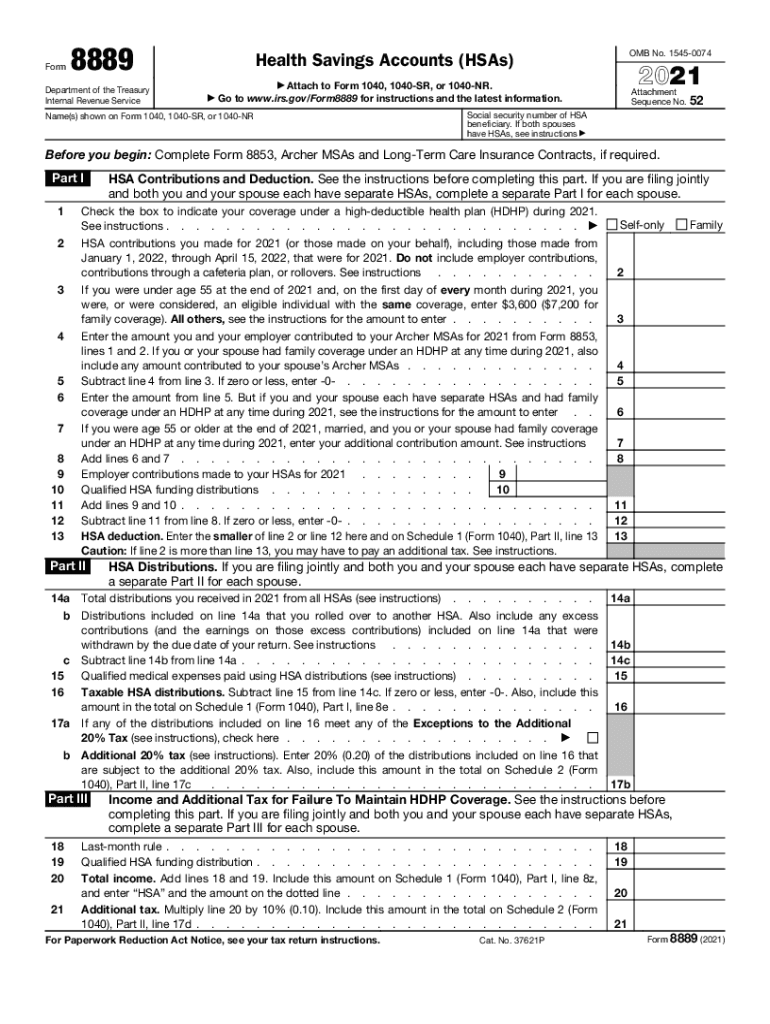

The 8889 form, officially known as the Health Savings Accounts (HSAs) form, is a tax document used by individuals to report contributions to and distributions from their Health Savings Accounts. This form is essential for taxpayers who wish to claim deductions for contributions made to their HSAs, as well as to report any distributions that may have been used for qualified medical expenses. Understanding the purpose of Form 8889 is crucial for ensuring compliance with IRS regulations and maximizing potential tax benefits.

Steps to Complete Form 8889

Completing Form 8889 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including records of HSA contributions and distributions. Next, begin filling out the form by providing your personal information, including your name and Social Security number. Follow the sections on the form to report contributions made to your HSA and any distributions taken during the tax year. It is important to accurately categorize distributions as qualified medical expenses to avoid penalties. Finally, review the completed form for any errors before submission.

IRS Guidelines for Form 8889

The IRS provides specific guidelines for completing Form 8889, which are crucial for ensuring that taxpayers meet all requirements. According to IRS regulations, contributions to HSAs must be made by eligible individuals, which typically includes those enrolled in a high-deductible health plan. The IRS also outlines the maximum contribution limits, which may change annually. Additionally, taxpayers must ensure that any distributions reported on the form are for qualified medical expenses to avoid tax penalties. Familiarizing oneself with these guidelines can help in accurate reporting and compliance.

Filing Deadlines for Form 8889

Filing deadlines for Form 8889 align with the general tax filing deadlines set by the IRS. For most taxpayers, the deadline to file Form 8889 is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers who require additional time to file may request an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Key Elements of Form 8889

Form 8889 consists of several key elements that taxpayers must understand to complete it correctly. The form includes sections for reporting contributions, distributions, and any adjustments related to HSAs. Taxpayers must also indicate whether they were eligible to contribute to an HSA during the tax year. Additionally, the form requires the reporting of any excess contributions that may be subject to penalties. Understanding these elements is essential for accurate completion and compliance with IRS regulations.

Eligibility Criteria for Form 8889

To be eligible to use Form 8889, individuals must meet specific criteria set forth by the IRS. Primarily, they must be enrolled in a high-deductible health plan (HDHP) and cannot be covered by other health insurance that is not an HDHP. Additionally, individuals cannot be enrolled in Medicare or be claimed as a dependent on someone else's tax return. Meeting these eligibility criteria is crucial for ensuring that contributions to an HSA are valid and that the taxpayer can benefit from the associated tax advantages.

Quick guide on how to complete fillable online hsaspdf form 8889 department of the

Prepare Fillable Online HSAs pdf Form 8889 Department Of The easily on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without any holdups. Manage Fillable Online HSAs pdf Form 8889 Department Of The on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Fillable Online HSAs pdf Form 8889 Department Of The with ease

- Find Fillable Online HSAs pdf Form 8889 Department Of The and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal value as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and electronically sign Fillable Online HSAs pdf Form 8889 Department Of The and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online hsaspdf form 8889 department of the

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an e-signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the 8889 tax form and why do I need it?

The 8889 tax form is used to report Health Savings Account (HSA) contributions and distributions. If you have an HSA, you need to complete this form to ensure accurate reporting on your tax return and to take advantage of tax benefits associated with your contributions.

-

How can airSlate SignNow help me with the 8889 tax form?

airSlate SignNow streamlines the process of sending and eSigning the 8889 tax form. Our platform offers an easy-to-use interface that allows you to quickly prepare, send, and securely sign your tax documents without any hassle.

-

Is there a cost associated with using airSlate SignNow for the 8889 tax form?

airSlate SignNow offers various pricing plans that cater to different business needs, including options suited for handling the 8889 tax form. We provide a cost-effective solution that enhances your document management and signing processes without breaking the bank.

-

What features does airSlate SignNow offer for managing the 8889 tax form?

With airSlate SignNow, you can easily create, edit, and eSign the 8889 tax form. Our platform includes features like templates, form fields, and reminders, ensuring you never miss a deadline and can efficiently manage all your tax documents.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software, allowing you to easily manage the 8889 tax form alongside your other financial documents. This integration simplifies your workflow and keeps your files organized.

-

What benefits does eSigning the 8889 tax form provide?

eSigning the 8889 tax form with airSlate SignNow enhances security, improves turnaround time, and ensures compliance with industry standards. You can track the status of your form and have peace of mind knowing your documents are stored securely and can be accessed whenever needed.

-

How does airSlate SignNow ensure the security of my 8889 tax form?

airSlate SignNow employs top-tier security measures, including encryption and secure cloud storage, to protect your 8889 tax form and all associated data. We prioritize your privacy and compliance with relevant regulations to ensure your information remains safe.

Get more for Fillable Online HSAs pdf Form 8889 Department Of The

- Questions for oral examination district of columbia form

- Dc deceased form

- Statement of claim district of columbia form

- Cases claims form

- Writ attachment sample form

- Subcontractors demand for statement notice to owner by corporation or llc district of columbia form

- Owners statement individual district of columbia form

- Quitclaim deed from husband and wife to husband wife and an individual district of columbia form

Find out other Fillable Online HSAs pdf Form 8889 Department Of The

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer