Form W 8 IMY Rev October Certificate of Foreign Intermediary, Foreign Flow through Entity, or Certain U S Branches for United St 2021-2026

What is the Form W-8IMY?

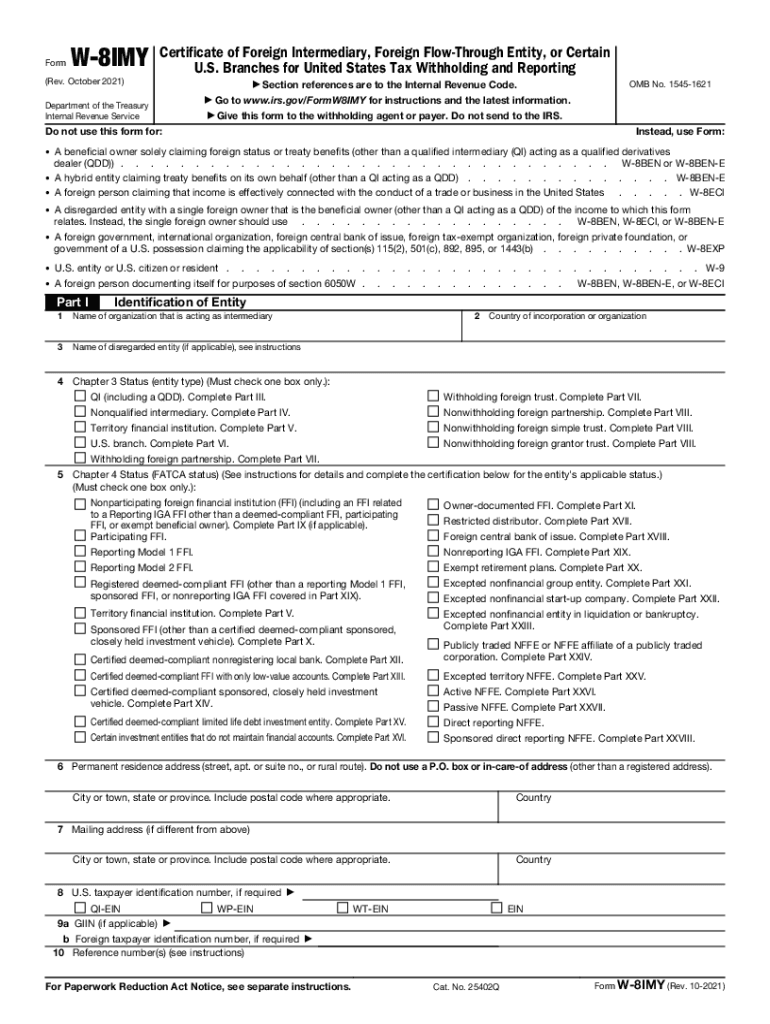

The Form W-8IMY, officially known as the Certificate of Foreign Intermediary, Foreign Flow Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting, is a critical document used by foreign entities. This form certifies the status of the entity as a foreign intermediary or flow-through entity for U.S. tax purposes. It is essential for ensuring that the appropriate withholding tax rates are applied to income received from U.S. sources.

The W-8IMY form is primarily utilized by foreign financial institutions, partnerships, and other entities that receive payments from U.S. sources on behalf of their clients. By submitting this form, these entities can help their clients avoid excessive withholding taxes and ensure compliance with U.S. tax regulations.

Steps to complete the Form W-8IMY

Completing the Form W-8IMY involves several key steps to ensure accuracy and compliance. The following process outlines how to fill out the form correctly:

- Identify the entity type: Determine whether the entity is a foreign intermediary, foreign flow-through entity, or a U.S. branch. This classification affects the information required on the form.

- Provide entity information: Fill in the entity's name, country of incorporation, and address. Ensure that this information matches the entity's official records.

- Claim the appropriate tax treaty benefits: If applicable, indicate any tax treaty benefits that the entity is entitled to claim. This can reduce the withholding tax rate on certain types of income.

- Sign and date the form: The form must be signed by an authorized representative of the entity. The date of signature is also required to validate the submission.

After completing the form, it should be submitted to the U.S. withholding agent or financial institution that requested it. Keeping a copy for your records is also advisable.

Legal use of the Form W-8IMY

The Form W-8IMY serves a significant legal purpose in U.S. tax compliance. By accurately completing and submitting this form, foreign entities can establish their status for tax purposes, which is crucial for avoiding unnecessary withholding taxes. This form is recognized under U.S. tax law and is essential for entities that engage in transactions involving U.S. source income.

Failure to submit the W-8IMY when required may result in the application of a default withholding tax rate, which can be as high as thirty percent. Therefore, understanding the legal implications and ensuring timely submission of the W-8IMY is vital for foreign entities operating in or receiving income from the United States.

IRS Guidelines for the Form W-8IMY

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Form W-8IMY. These guidelines outline who must file the form, the information required, and the circumstances under which the form must be updated or renewed. It is essential for entities to familiarize themselves with these guidelines to ensure compliance and avoid penalties.

According to IRS regulations, the W-8IMY must be submitted to the withholding agent before any payments are made to the foreign entity. Additionally, the form must be updated every three years or whenever there are changes to the entity's status or information.

Examples of using the Form W-8IMY

There are various scenarios in which the Form W-8IMY may be utilized. For instance, a foreign bank receiving interest payments from a U.S. financial institution would submit this form to certify its status as a foreign intermediary. This allows the bank to claim reduced withholding tax rates based on applicable tax treaties.

Another example includes a foreign partnership that receives dividends from U.S. corporations on behalf of its partners. By submitting the W-8IMY, the partnership can help its partners avoid excessive withholding taxes on their share of the income.

Quick guide on how to complete form w 8 imy rev october 2021 certificate of foreign intermediary foreign flow through entity or certain us branches for united

Effortlessly Prepare Form W 8 IMY Rev October Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U S Branches For United St on Any Device

Managing documents online has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly without delays. Handle Form W 8 IMY Rev October Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U S Branches For United St on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form W 8 IMY Rev October Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U S Branches For United St effortlessly

- Locate Form W 8 IMY Rev October Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U S Branches For United St and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether via email, SMS, an invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Alter and eSign Form W 8 IMY Rev October Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U S Branches For United St to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 8 imy rev october 2021 certificate of foreign intermediary foreign flow through entity or certain us branches for united

Create this form in 5 minutes!

How to create an eSignature for the form w 8 imy rev october 2021 certificate of foreign intermediary foreign flow through entity or certain us branches for united

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to generate an e-signature from your smart phone

How to generate an electronic signature for a PDF document on iOS

How to generate an e-signature for a PDF file on Android OS

People also ask

-

What is w 8imy and how does it work with airSlate SignNow?

w 8imy is a specific form utilized for signNowing foreign status of beneficial owners for tax purposes. With airSlate SignNow, you can easily create, fill out, and eSign your w 8imy documents, streamlining the process and ensuring compliance with IRS regulations.

-

How much does it cost to use airSlate SignNow for w 8imy?

airSlate SignNow offers competitive pricing options for businesses looking to manage their w 8imy forms. Plans start at a low monthly fee, providing you access to unlimited eSigning and document management features tailored for your w 8imy needs.

-

What features does airSlate SignNow offer for completing a w 8imy?

With airSlate SignNow, users can benefit from features like customizable templates, real-time tracking, and secure storage for w 8imy documents. The platform also supports in-app signing, making it easier and faster to get your w 8imy forms signed.

-

Are there any integrations available for managing w 8imy with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications like CRMs and cloud storage services, enabling efficient management of your w 8imy forms. These integrations ensure that your workflow is streamlined and that you can access your documents easily.

-

What are the benefits of using airSlate SignNow for w 8imy forms?

Using airSlate SignNow for your w 8imy forms provides several benefits, including enhanced efficiency, improved accuracy, and reduced turnaround time. The user-friendly interface and powerful tools help you to manage your w 8imy documents effortlessly.

-

Can I access my w 8imy documents from anywhere?

Absolutely! With airSlate SignNow, you can access your w 8imy documents from any device with an internet connection. This flexibility ensures that you can manage and sign your forms anytime and anywhere.

-

Is it secure to use airSlate SignNow for my w 8imy documents?

Yes, airSlate SignNow prioritizes the security of your documents, including w 8imy forms. The platform employs robust encryption, multi-factor authentication, and secure cloud storage to ensure that your sensitive information is always protected.

Get more for Form W 8 IMY Rev October Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U S Branches For United St

- Wedding planning or consultant package district of columbia form

- Hunting forms package district of columbia

- Identity theft recovery package district of columbia form

- Statutory power of attorney for health care district of columbia form

- Revocation of statutory power of attorney for health care district of columbia form

- Aging parent package district of columbia form

- Sale of a business package district of columbia form

- Legal documents for the guardian of a minor package district of columbia form

Find out other Form W 8 IMY Rev October Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U S Branches For United St

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure