Appointment of Taxpayer Representative, Form M 5008 R 2021-2026

What is the Appointment Of Taxpayer Representative, Form M 5008 R

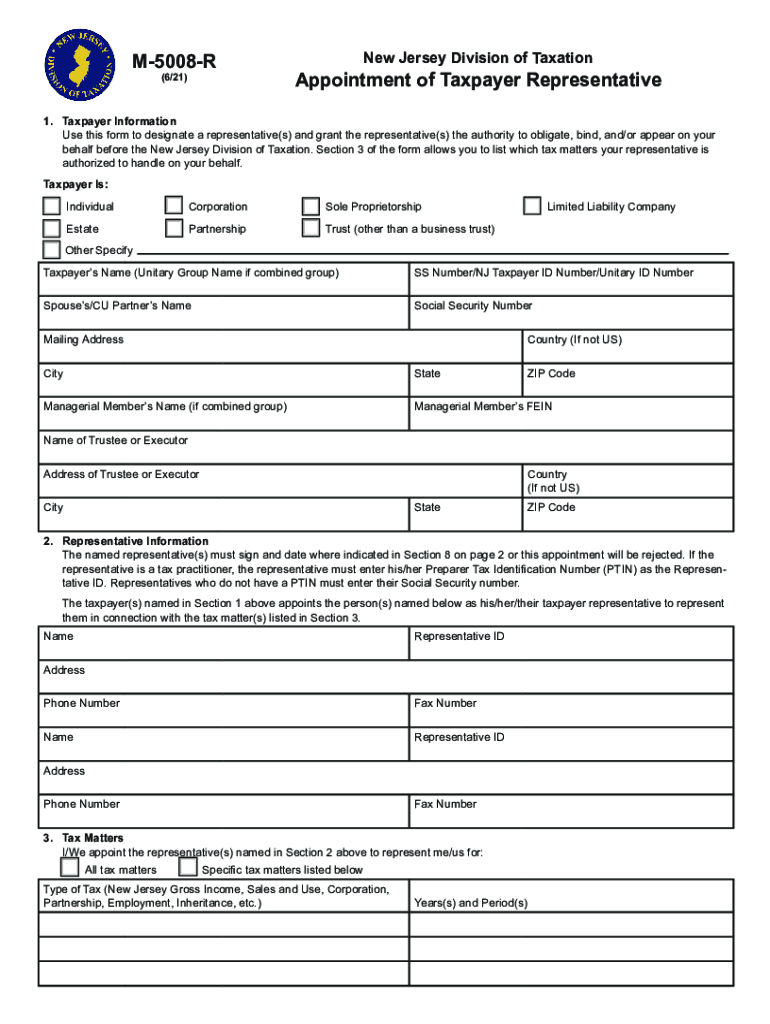

The Appointment Of Taxpayer Representative, Form M 5008 R, is a crucial document used in New Jersey for taxpayers who wish to designate a representative to act on their behalf regarding tax matters. This form allows a designated individual, such as an attorney or accountant, to communicate with the New Jersey Division of Taxation and manage tax-related issues, including audits and appeals. By completing this form, taxpayers ensure that their representative has the authority to receive confidential information and make decisions related to their tax obligations.

Steps to complete the Appointment Of Taxpayer Representative, Form M 5008 R

Completing the Appointment Of Taxpayer Representative, Form M 5008 R involves several important steps:

- Obtain the form: Access the form from the New Jersey Division of Taxation website or request a physical copy.

- Fill in taxpayer information: Provide your name, address, and identification number, ensuring accuracy to avoid processing delays.

- Designate a representative: Include the representative's name, address, and contact information, along with their relationship to you.

- Specify the scope of authority: Clearly outline the specific tax matters for which the representative is authorized to act.

- Sign and date the form: Your signature is essential for validating the appointment, along with the date of signing.

Once completed, the form should be submitted to the appropriate tax authority to ensure that your representative can act on your behalf.

Legal use of the Appointment Of Taxpayer Representative, Form M 5008 R

The legal use of the Appointment Of Taxpayer Representative, Form M 5008 R is governed by New Jersey state tax laws. This form grants legal authority to the designated representative, allowing them to access confidential tax information and represent the taxpayer in various tax matters. It is essential for the form to be filled out accurately and submitted properly to ensure compliance with legal requirements. Failure to adhere to these guidelines may result in delays or denial of representation.

Form Submission Methods for the Appointment Of Taxpayer Representative, Form M 5008 R

Taxpayers can submit the Appointment Of Taxpayer Representative, Form M 5008 R through various methods:

- Online: Submit the form electronically through the New Jersey Division of Taxation's online portal, if available.

- By Mail: Send the completed form to the designated address provided by the New Jersey Division of Taxation.

- In-Person: Deliver the form directly to a local Division of Taxation office for immediate processing.

Choosing the appropriate submission method can expedite the process and ensure that your representative is authorized without unnecessary delays.

Key elements of the Appointment Of Taxpayer Representative, Form M 5008 R

Understanding the key elements of the Appointment Of Taxpayer Representative, Form M 5008 R is vital for effective completion:

- Taxpayer Information: Accurate details about the taxpayer are necessary for identification and processing.

- Representative Information: Complete contact information for the representative ensures they can be reached by tax authorities.

- Scope of Authority: Clearly defining the scope allows for specific representation, limiting or expanding authority as needed.

- Signature: The taxpayer's signature is a legal requirement, affirming the appointment's validity.

These elements work together to create a comprehensive and legally binding document that facilitates effective representation in tax matters.

Eligibility Criteria for the Appointment Of Taxpayer Representative, Form M 5008 R

To use the Appointment Of Taxpayer Representative, Form M 5008 R, certain eligibility criteria must be met:

- Taxpayer Status: The individual must be a taxpayer in New Jersey, subject to state tax laws.

- Authorized Representative: The designated representative must be qualified and capable of handling tax matters, such as a licensed attorney or certified public accountant.

- Scope of Representation: The taxpayer must clearly define the tax matters for which the representative is authorized to act.

Meeting these criteria ensures that the appointment is valid and recognized by the New Jersey Division of Taxation.

Quick guide on how to complete appointment of taxpayer representative form m 5008 r 577675660

Complete Appointment Of Taxpayer Representative, Form M 5008 R effortlessly on any gadget

Digital document management has become increasingly favored by enterprises and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Handle Appointment Of Taxpayer Representative, Form M 5008 R on any device through the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Appointment Of Taxpayer Representative, Form M 5008 R with ease

- Locate Appointment Of Taxpayer Representative, Form M 5008 R and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and bears the same legal significance as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you prefer to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Appointment Of Taxpayer Representative, Form M 5008 R to ensure clear communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct appointment of taxpayer representative form m 5008 r 577675660

Create this form in 5 minutes!

How to create an eSignature for the appointment of taxpayer representative form m 5008 r 577675660

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an e-signature from your smartphone

The best way to create an e-signature for a PDF file on iOS devices

How to make an e-signature for a PDF file on Android

People also ask

-

What is the m 5008 r and how can it benefit my business?

The m 5008 r is a powerful eSignature solution that allows businesses to streamline their document signing processes. With its user-friendly interface, it enhances productivity by enabling quick and secure signing of documents. This ultimately helps businesses save time and reduce operational costs.

-

How much does the m 5008 r cost?

Pricing for the m 5008 r varies based on the chosen plan and the volume of document transactions. airSlate SignNow offers flexible pricing options that cater to different business needs, ensuring that you get the best value for your investment. Contact our sales team for a custom quote tailored to your requirements.

-

Can the m 5008 r be integrated with other software applications?

Yes, the m 5008 r can seamlessly integrate with a wide range of business applications. This includes popular tools such as Salesforce, Google Workspace, and Microsoft Office, among others. These integrations ensure that you can maintain workflow efficiency without any disruptions.

-

What features does the m 5008 r offer?

The m 5008 r comes equipped with a variety of features designed to facilitate easy document management. Key features include customizable templates, secure storage, and automated reminders for pending signatures. This makes managing your documents straightforward and efficient.

-

How does the m 5008 r ensure document security?

The m 5008 r prioritizes document security with industry-standard encryption and secure cloud storage. All signatures are legally binding and backed by comprehensive audit trails, ensuring that your documents remain protected. You can trust that sensitive information is handled with the utmost care.

-

Is the m 5008 r suitable for small businesses?

Absolutely! The m 5008 r is tailored to meet the needs of businesses of all sizes, including small businesses. Its cost-effective pricing and intuitive design allow even smaller teams to leverage eSigning capabilities to enhance their operational efficiency.

-

What types of documents can I sign with the m 5008 r?

With the m 5008 r, you can sign a wide variety of documents, including contracts, agreements, and forms. This versatility allows businesses to manage all their document signing needs in one place, simplifying workflows and improving collaboration within teams.

Get more for Appointment Of Taxpayer Representative, Form M 5008 R

- Legal last will and testament form for divorced and remarried person with mine yours and ours children district of columbia

- Dc will form

- Written revocation of will district of columbia form

- Last will and testament for other persons district of columbia form

- Notice to beneficiaries of being named in will district of columbia form

- Estate planning questionnaire and worksheets district of columbia form

- Document locator and personal information package including burial information form district of columbia

- Demand to produce copy of will from heir to executor or person in possession of will district of columbia form

Find out other Appointment Of Taxpayer Representative, Form M 5008 R

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe