I 119 Instructions for Wisconsin Schedule T 2020

What is the I 119 Instructions For Wisconsin Schedule T

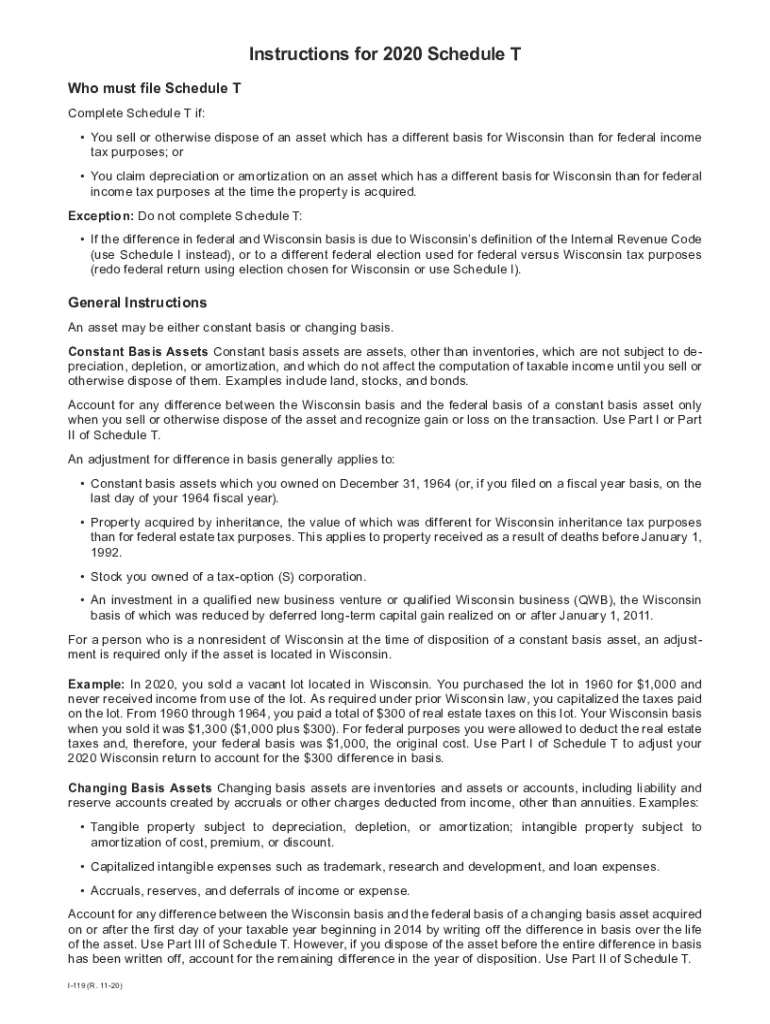

The I 119 Instructions for Wisconsin Schedule T is a specific guideline provided by the Wisconsin Department of Revenue for taxpayers who need to report their income and deductions related to tax credits for the state. This form is essential for individuals and businesses claiming certain credits, ensuring they understand how to accurately complete their tax filings. It outlines the necessary steps, calculations, and documentation required to comply with Wisconsin tax regulations.

Steps to complete the I 119 Instructions For Wisconsin Schedule T

Completing the I 119 Instructions for Wisconsin Schedule T involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Review the instructions carefully to understand the specific requirements for your situation.

- Fill out the form accurately, ensuring all required information is included.

- Calculate any applicable credits and deductions as outlined in the instructions.

- Review your completed form for accuracy before submission.

Following these steps helps ensure compliance and reduces the risk of errors that could lead to penalties.

Legal use of the I 119 Instructions For Wisconsin Schedule T

The legal use of the I 119 Instructions for Wisconsin Schedule T is critical for ensuring that taxpayers adhere to state tax laws. This document provides the framework for claiming tax credits legally, and any misrepresentation or omission can lead to legal consequences. It is important to follow the guidelines strictly, as they are designed to protect both the taxpayer and the state’s revenue system.

Key elements of the I 119 Instructions For Wisconsin Schedule T

Several key elements are essential when working with the I 119 Instructions for Wisconsin Schedule T:

- Eligibility Criteria: Understanding who qualifies for the credits and deductions outlined in the form.

- Required Documentation: Knowing what supporting documents are necessary to validate claims.

- Filing Deadlines: Being aware of important dates to avoid late penalties.

- Submission Methods: Familiarizing yourself with how to submit the form, whether online, by mail, or in person.

These elements are crucial for a successful filing experience and compliance with state tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the I 119 Instructions for Wisconsin Schedule T are critical to ensure timely submission and avoid penalties. Generally, the deadline aligns with the federal tax filing date, which is typically April 15. However, taxpayers should verify any changes or extensions that may apply in a given year. Staying informed about these dates helps in planning and ensures that all necessary documentation is submitted on time.

Form Submission Methods (Online / Mail / In-Person)

Submitting the I 119 Instructions for Wisconsin Schedule T can be done through various methods:

- Online: Many taxpayers prefer to file electronically, which can streamline the process and reduce errors.

- Mail: Completing the form by hand and sending it via postal service is another option, but it may take longer for processing.

- In-Person: Some individuals may choose to submit their forms directly at local tax offices for immediate feedback.

Each method has its advantages, and taxpayers should choose the one that best suits their needs and circumstances.

Quick guide on how to complete 2020 i 119 instructions for wisconsin schedule t

Prepare I 119 Instructions For Wisconsin Schedule T effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the needed form and securely store it online. airSlate SignNow equips you with all the instruments necessary to create, amend, and eSign your documents swiftly without interruptions. Manage I 119 Instructions For Wisconsin Schedule T on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign I 119 Instructions For Wisconsin Schedule T without hassle

- Search for I 119 Instructions For Wisconsin Schedule T and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for sending your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign I 119 Instructions For Wisconsin Schedule T and ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 i 119 instructions for wisconsin schedule t

Create this form in 5 minutes!

How to create an eSignature for the 2020 i 119 instructions for wisconsin schedule t

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is the Wisconsin Schedule T and how does it work?

The Wisconsin Schedule T is a form used by taxpayers in Wisconsin to report their income from various sources. It allows users to accurately declare their income and take advantage of available credits. By utilizing airSlate SignNow, businesses can easily eSign and send their Wisconsin Schedule T securely and efficiently.

-

How can airSlate SignNow help with filling out the Wisconsin Schedule T?

airSlate SignNow provides an intuitive platform that simplifies the eSigning and document management process for the Wisconsin Schedule T. Our solution includes templates and guides that streamline filling out this form. Users can sign and send documents seamlessly, ensuring compliance and accuracy in their submissions.

-

What features does airSlate SignNow offer for managing the Wisconsin Schedule T?

With airSlate SignNow, you can easily manage, eSign, and track your Wisconsin Schedule T documents in one place. Key features include cloud storage, templates, and audit trails to keep everything organized. This user-friendly solution helps you maintain efficiency while managing important tax documents.

-

Is airSlate SignNow cost-effective for handling the Wisconsin Schedule T?

Yes! airSlate SignNow offers a budget-friendly solution for managing the Wisconsin Schedule T and other documents. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you get the most value while streamlining your document processes.

-

Can I integrate airSlate SignNow with other tools for the Wisconsin Schedule T?

Absolutely! airSlate SignNow integrates with numerous software applications, allowing seamless workflow for processing the Wisconsin Schedule T. Whether you use accounting software or customer relationship management systems, our integrations enhance efficiency and ease of use.

-

What benefits does eSigning offer for the Wisconsin Schedule T?

eSigning the Wisconsin Schedule T with airSlate SignNow provides a quick and secure way to finalize your documents. No more printing, scanning, or mailing; everything can be done digitally. This not only saves time but also enhances the overall document management process.

-

How secure is airSlate SignNow for handling the Wisconsin Schedule T?

Security is a top priority at airSlate SignNow. When managing the Wisconsin Schedule T, your data is protected with advanced encryption and secure storage. We ensure that all documents are safely stored and only accessible to authorized users, giving you peace of mind.

Get more for I 119 Instructions For Wisconsin Schedule T

- Delaware annual statement form

- Notice of default for past due payments in connection with contract for deed delaware form

- Final notice of default for past due payments in connection with contract for deed delaware form

- Assignment of contract for deed by seller delaware form

- Notice of assignment of contract for deed delaware form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement delaware form

- Buyers home inspection checklist delaware form

- Sellers information for appraiser provided to buyer delaware

Find out other I 119 Instructions For Wisconsin Schedule T

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later