I 119 Instructions for Wisconsin Schedule T 2017

What is the I 119 Instructions For Wisconsin Schedule T

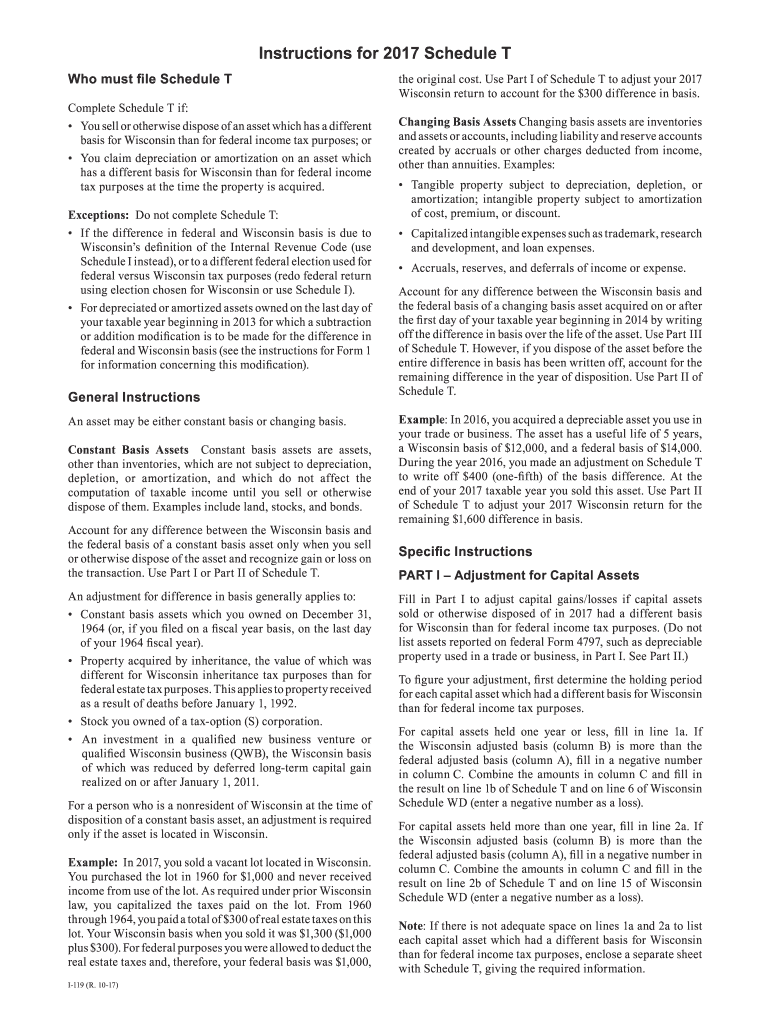

The I 119 Instructions For Wisconsin Schedule T is a crucial document for taxpayers in Wisconsin who need to report their income and calculate their tax liability. This form specifically addresses the taxation of certain types of income, including those related to partnerships and S corporations. Understanding this form is essential for ensuring compliance with state tax regulations and for accurately reporting income to the Wisconsin Department of Revenue.

Steps to complete the I 119 Instructions For Wisconsin Schedule T

Completing the I 119 Instructions For Wisconsin Schedule T involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Carefully read the instructions provided with the form to understand each section.

- Fill out the form by entering your income details accurately, ensuring that you follow the guidelines for reporting various types of income.

- Review your entries for accuracy and completeness before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Legal use of the I 119 Instructions For Wisconsin Schedule T

The legal use of the I 119 Instructions For Wisconsin Schedule T is governed by state tax laws. This form must be filled out accurately to ensure that taxpayers comply with Wisconsin's tax regulations. It is important to note that any discrepancies or inaccuracies can lead to legal issues, including audits or penalties. Therefore, using the form correctly is not only a matter of compliance but also of protecting your rights as a taxpayer.

Key elements of the I 119 Instructions For Wisconsin Schedule T

Several key elements are essential to the I 119 Instructions For Wisconsin Schedule T:

- Income Reporting: Accurate reporting of all income types is critical.

- Deductions: Understanding allowable deductions can significantly affect tax liability.

- Filing Status: Correctly identifying your filing status is necessary for accurate calculations.

- Signature Requirements: Ensure that all required signatures are included to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the I 119 Instructions For Wisconsin Schedule T are typically aligned with the annual tax filing deadlines. Taxpayers should be aware of the following important dates:

- April 15: Standard deadline for individual income tax returns.

- Extensions: If you file for an extension, be aware of the extended deadlines and ensure timely submission.

Who Issues the Form

The I 119 Instructions For Wisconsin Schedule T is issued by the Wisconsin Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. For any updates or changes to the form, taxpayers should refer to the official website of the Wisconsin Department of Revenue.

Quick guide on how to complete 2017 i 119 instructions for wisconsin schedule t

Effortlessly Prepare I 119 Instructions For Wisconsin Schedule T on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly and without delays. Handle I 119 Instructions For Wisconsin Schedule T on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign I 119 Instructions For Wisconsin Schedule T with Ease

- Obtain I 119 Instructions For Wisconsin Schedule T and click Get Form to initiate.

- Utilize the tools provided to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Construct your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your changes.

- Select your preferred method for sending your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Alter and eSign I 119 Instructions For Wisconsin Schedule T while ensuring outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 i 119 instructions for wisconsin schedule t

Create this form in 5 minutes!

How to create an eSignature for the 2017 i 119 instructions for wisconsin schedule t

How to make an electronic signature for the 2017 I 119 Instructions For Wisconsin Schedule T online

How to generate an eSignature for the 2017 I 119 Instructions For Wisconsin Schedule T in Chrome

How to create an electronic signature for putting it on the 2017 I 119 Instructions For Wisconsin Schedule T in Gmail

How to generate an eSignature for the 2017 I 119 Instructions For Wisconsin Schedule T from your smart phone

How to generate an electronic signature for the 2017 I 119 Instructions For Wisconsin Schedule T on iOS

How to generate an eSignature for the 2017 I 119 Instructions For Wisconsin Schedule T on Android OS

People also ask

-

What are the I 119 Instructions For Wisconsin Schedule T?

The I 119 Instructions For Wisconsin Schedule T provide guidance on how to complete the Schedule T form for taxpayers in Wisconsin. It outlines the criteria for reporting certain income and deductions related to business activities. Understanding these instructions is essential for accurately filing your tax return.

-

How can airSlate SignNow help with the I 119 Instructions For Wisconsin Schedule T?

airSlate SignNow offers a seamless way to eSign and send documents, including tax forms like the I 119 Instructions For Wisconsin Schedule T. Our platform ensures that all your important tax documents are securely signed and stored, simplifying your tax filing process.

-

What features does airSlate SignNow provide for managing documents related to I 119 Instructions For Wisconsin Schedule T?

airSlate SignNow includes features like templates, easy collaboration, and real-time tracking, making document management for the I 119 Instructions For Wisconsin Schedule T hassle-free. You can create reusable templates to streamline your tax filing process, ensuring you never miss a detail.

-

Is there a cost associated with using airSlate SignNow for the I 119 Instructions For Wisconsin Schedule T?

Yes, airSlate SignNow operates on a subscription-based pricing model designed to be cost-effective. Subscriptions offer various tiers to suit different business needs, ensuring you only pay for the features necessary for managing the I 119 Instructions For Wisconsin Schedule T effectively.

-

Can I integrate airSlate SignNow with other tools for the I 119 Instructions For Wisconsin Schedule T?

Absolutely! airSlate SignNow integrates with a variety of tools, allowing you to connect your workflow for the I 119 Instructions For Wisconsin Schedule T. This means you can combine it with your accounting software, email platforms, and more for a streamlined tax preparation process.

-

What benefits does airSlate SignNow offer for working with tax documents like the I 119 Instructions For Wisconsin Schedule T?

Using airSlate SignNow for tax documents like the I 119 Instructions For Wisconsin Schedule T enhances efficiency and security. You can sign documents from anywhere, reduce paper usage, and ensure that all signatures are legally binding, simplifying your tax filing process.

-

Is airSlate SignNow secure for handling sensitive documents like the I 119 Instructions For Wisconsin Schedule T?

Yes, airSlate SignNow takes security seriously, implementing advanced encryption protocols to protect sensitive documents like the I 119 Instructions For Wisconsin Schedule T. Your data remains secure and private, allowing you to eSign with peace of mind.

Get more for I 119 Instructions For Wisconsin Schedule T

Find out other I 119 Instructions For Wisconsin Schedule T

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document