I 119 Instructions for Wisconsin Schedule T Wisconsin Schedule T Instructions 2022

What is the I-119 Instructions for Wisconsin Schedule T?

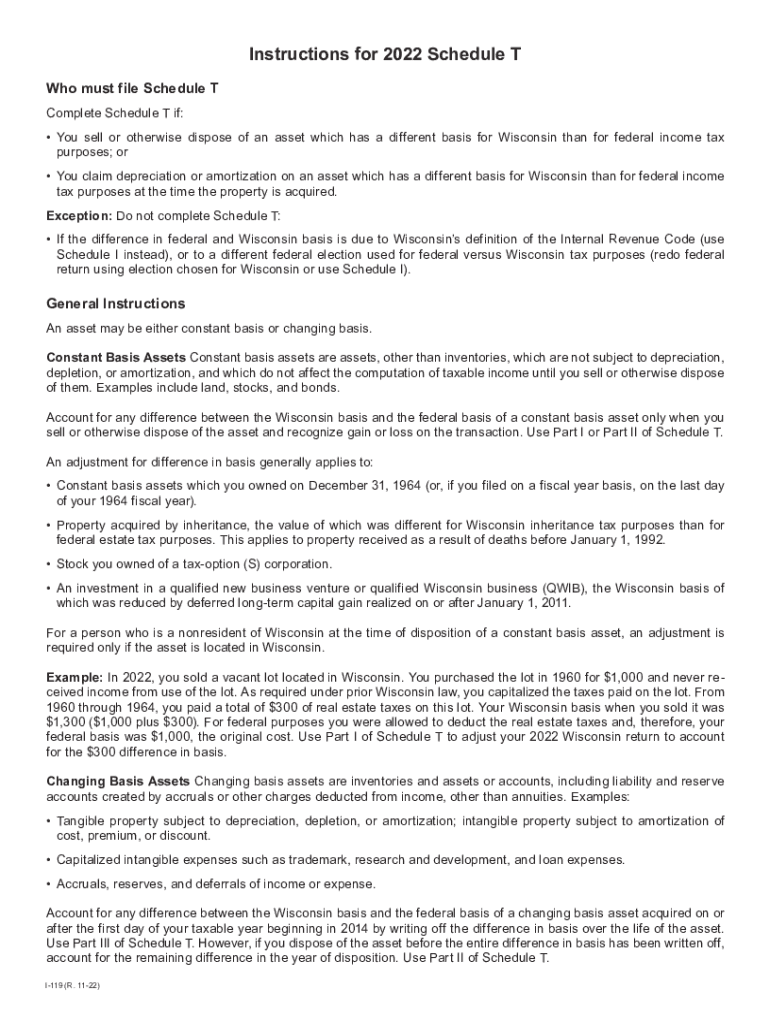

The I-119 instructions for Wisconsin Schedule T provide essential guidelines for taxpayers in Wisconsin regarding the reporting of certain income and expenses. This form is specifically designed for individuals who need to report income from various sources, including self-employment, rental properties, or other business activities. Understanding these instructions ensures that taxpayers can accurately complete their forms and comply with state tax regulations.

Steps to Complete the I-119 Instructions for Wisconsin Schedule T

Completing the I-119 instructions involves several important steps:

- Gather all necessary documentation, including income statements and expense receipts.

- Review the specific sections of the I-119 instructions to understand the requirements for your situation.

- Fill out the form carefully, ensuring that all information is accurate and complete.

- Double-check calculations and ensure that all income and expenses are reported correctly.

- Submit the completed form by the designated deadline, either online or by mail.

Legal Use of the I-119 Instructions for Wisconsin Schedule T

The I-119 instructions are legally binding documents that must be completed in accordance with Wisconsin state tax laws. Proper use of these instructions ensures compliance with regulations set forth by the Wisconsin Department of Revenue. Failure to adhere to these guidelines can result in penalties or delays in processing your tax return. Therefore, it is crucial to understand the legal implications of the information provided in the I-119 instructions.

Filing Deadlines / Important Dates

Taxpayers must be aware of important deadlines when filing the I-119 instructions for Wisconsin Schedule T. Typically, the deadline for filing state tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Wisconsin Department of Revenue website for any updates or changes to filing deadlines to avoid late penalties.

Required Documents

To complete the I-119 instructions effectively, taxpayers should prepare the following documents:

- W-2 forms from employers, if applicable.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses related to business activities.

- Bank statements and financial records that support reported income.

IRS Guidelines

While the I-119 instructions are specific to Wisconsin, they must also align with federal IRS guidelines. Taxpayers should familiarize themselves with IRS rules regarding income reporting, deductions, and credits to ensure that they are compliant at both state and federal levels. This alignment helps prevent discrepancies that could lead to audits or penalties.

Quick guide on how to complete 2022 i 119 instructions for wisconsin schedule t wisconsin schedule t instructions

Effortlessly Prepare I 119 Instructions For Wisconsin Schedule T Wisconsin Schedule T Instructions on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option compared to traditional printed and signed documents, as you can access the correct form and securely store it on the internet. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle I 119 Instructions For Wisconsin Schedule T Wisconsin Schedule T Instructions on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric procedure today.

Steps to Modify and Electronically Sign I 119 Instructions For Wisconsin Schedule T Wisconsin Schedule T Instructions with Ease

- Find I 119 Instructions For Wisconsin Schedule T Wisconsin Schedule T Instructions and click Get Form to initiate.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign I 119 Instructions For Wisconsin Schedule T Wisconsin Schedule T Instructions to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 i 119 instructions for wisconsin schedule t wisconsin schedule t instructions

Create this form in 5 minutes!

People also ask

-

What are the WI Schedule I 2018 instructions for filing?

The WI Schedule I 2018 instructions provide detailed guidance on how to report various types of income and deductions on your state tax return. It's essential to follow these instructions carefully to ensure accuracy and compliance. You can find the official instructions on the Wisconsin Department of Revenue website.

-

How can airSlate SignNow help me with WI Schedule I 2018 instructions?

airSlate SignNow simplifies the process of electronically signing and submitting tax documents. With our platform, you can easily create and manage your forms to include the necessary WI Schedule I 2018 instructions. This streamlines your workflow, helping you focus on completing your tax filing efficiently.

-

Is there a cost associated with using airSlate SignNow for WI Schedule I 2018 instructions?

Yes, airSlate SignNow offers a range of pricing plans to suit different business needs. Costs depend on the features you choose. However, many users find that the ease of use and the ability to efficiently manage documents justifies the investment, especially when dealing with tasks like following the WI Schedule I 2018 instructions.

-

What features does airSlate SignNow offer for completing WI Schedule I 2018 instructions?

airSlate SignNow provides features like document templates, electronic signatures, and secure storage. These tools help you follow the WI Schedule I 2018 instructions effectively, ensuring that you can fill out your forms accurately and submit them on time. The platform is designed to enhance productivity for users in need of tax-related solutions.

-

Can I integrate airSlate SignNow with other applications while using WI Schedule I 2018 instructions?

Absolutely! airSlate SignNow supports integration with various applications, allowing you to connect your tax software or financial tools. This means you can seamlessly manage your documentation and compliance related to WI Schedule I 2018 instructions without losing data. Check our integrations page for more details.

-

What benefits does airSlate SignNow provide when managing WI Schedule I 2018 instructions?

Using airSlate SignNow enhances productivity and ensures your documents are securely signed and stored. This is particularly beneficial when dealing with important tax instructions like the WI Schedule I 2018 instructions. Plus, our user-friendly interface makes the process straightforward for all users.

-

Are there any customer support options available for help with WI Schedule I 2018 instructions?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions regarding your documents or the WI Schedule I 2018 instructions. Our support team is available via live chat, email, and phone to ensure you have the help you need when filing your taxes.

Get more for I 119 Instructions For Wisconsin Schedule T Wisconsin Schedule T Instructions

- Nd judgment 497317501 form

- Conditional waiver and release of claim of lien upon final payment north dakota form

- North dakota tenant form

- North dakota landlord tenant form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497317506 form

- North dakota landlord form

- Landlord doors form

- Letter from tenant to landlord with demand that landlord repair broken windows north dakota form

Find out other I 119 Instructions For Wisconsin Schedule T Wisconsin Schedule T Instructions

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA