Form 5498 ESA Coverdell ESA Contribution Information 2021

Understanding the Form 5498 ESA Coverdell ESA Contribution Information

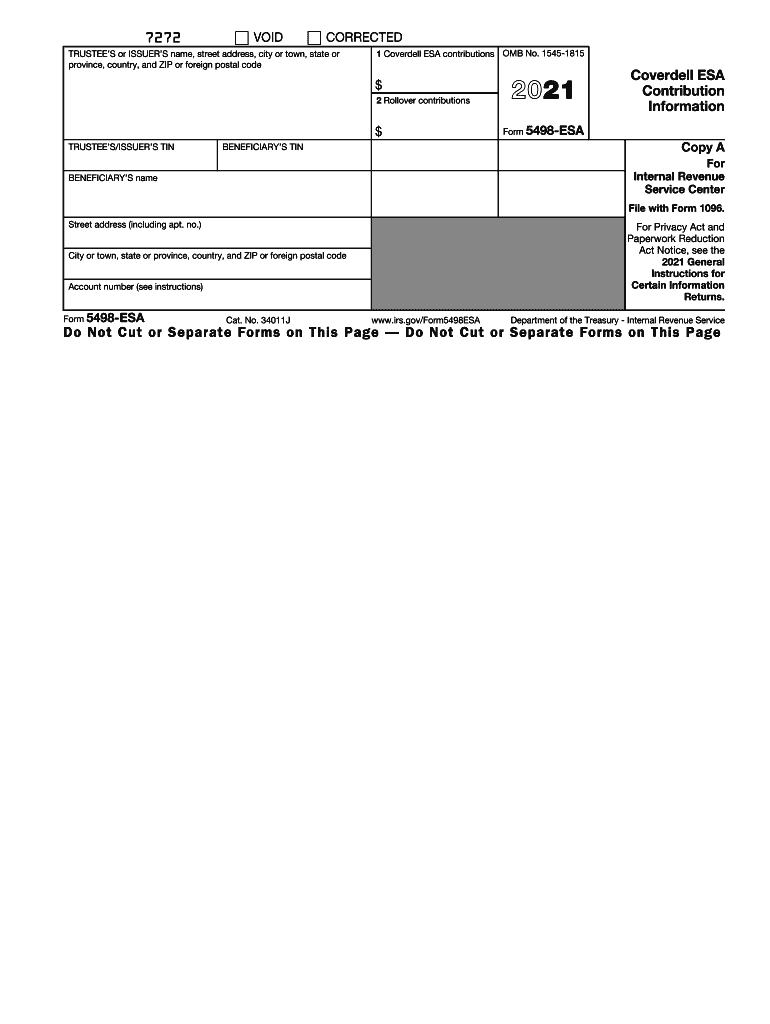

The Form 5498 ESA is essential for reporting contributions to Coverdell Education Savings Accounts (ESAs). This form provides detailed information about the contributions made during the tax year, including the total amount contributed and the fair market value of the account at year-end. It is important for both account holders and the IRS, as it ensures compliance with the contribution limits set by the IRS. The form typically includes the beneficiary's information, which is crucial for tracking educational savings and ensuring that funds are used appropriately for qualified education expenses.

Steps to Complete the Form 5498 ESA Coverdell ESA Contribution Information

Completing the Form 5498 ESA involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the beneficiary's name, Social Security number, and the account holder's details. Next, accurately report the total contributions made during the tax year in the designated fields. It's also important to indicate any rollovers or transfers that may have occurred. Finally, review the form for any errors before submission, as inaccuracies can lead to penalties or complications with the IRS.

Obtaining the Form 5498 ESA Coverdell ESA Contribution Information

The Form 5498 ESA can be obtained directly from the IRS website or through financial institutions that manage Coverdell ESAs. Most financial institutions provide this form to account holders by May 31 of each year, detailing contributions made in the previous tax year. If you do not receive the form, you can request it from your financial institution or download it from the IRS website. Ensure that you have the correct version for the applicable tax year, as forms may vary slightly from year to year.

IRS Guidelines for the Form 5498 ESA Coverdell ESA Contribution Information

The IRS has established specific guidelines for the completion and submission of Form 5498 ESA. It is crucial to adhere to these guidelines to avoid penalties. The form must be filed by the financial institution that maintains the ESA, but account holders should keep a copy for their records. The IRS requires that all contributions be reported accurately, including any contributions made on behalf of the beneficiary. Additionally, understanding the contribution limits and eligibility criteria for Coverdell ESAs is essential to ensure compliance with IRS regulations.

Legal Use of the Form 5498 ESA Coverdell ESA Contribution Information

The legal use of Form 5498 ESA is primarily to report contributions to Coverdell ESAs for tax purposes. This form serves as a record for both the IRS and the account holder, ensuring that contributions do not exceed the allowable limits. Proper use of the form helps maintain compliance with tax laws and regulations regarding educational savings accounts. It is also important for account holders to understand that failure to report contributions accurately can result in tax penalties or disqualification of the ESA.

Filing Deadlines and Important Dates for Form 5498 ESA

Filing deadlines for Form 5498 ESA are critical for compliance. Financial institutions must submit the form to the IRS by May 31 of the year following the tax year in which contributions were made. While account holders do not need to file this form with their personal tax returns, they should retain it for their records. Being aware of these deadlines helps ensure that all contributions are reported in a timely manner, which is essential for maintaining the tax-advantaged status of the ESA.

Quick guide on how to complete 2021 form 5498 esa coverdell esa contribution information

Fulfill Form 5498 ESA Coverdell ESA Contribution Information seamlessly on any device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage Form 5498 ESA Coverdell ESA Contribution Information on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Form 5498 ESA Coverdell ESA Contribution Information effortlessly

- Obtain Form 5498 ESA Coverdell ESA Contribution Information and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 5498 ESA Coverdell ESA Contribution Information to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 5498 esa coverdell esa contribution information

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 5498 esa coverdell esa contribution information

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the form 5498 ESA?

The form 5498 ESA is a tax document required for reporting contributions to Coverdell Education Savings Accounts. It provides the IRS with important information about the account, ensuring that you meet tax compliance requirements related to educational expenses.

-

How can airSlate SignNow help with the form 5498 ESA?

With airSlate SignNow, you can easily prepare, sign, and send the form 5498 ESA electronically. Our platform simplifies the document management process, allowing you to ensure all necessary forms are completed accurately and delivered on time.

-

Is there a cost associated with using airSlate SignNow for the form 5498 ESA?

Using airSlate SignNow to manage your form 5498 ESA comes with affordable pricing plans tailored to various business needs. Our cost-effective solution allows you to save time and money while ensuring compliance with necessary forms.

-

What features does airSlate SignNow offer for managing the form 5498 ESA?

AirSlate SignNow offers a range of features for managing the form 5498 ESA, including customizable templates, electronic signatures, and secure cloud storage. You can also track document completions, ensuring every step of the process is streamlined.

-

Can I integrate airSlate SignNow with my existing systems for the form 5498 ESA?

Yes, airSlate SignNow provides seamless integrations with various applications that you may already be using. This allows you to incorporate the form 5498 ESA into your existing workflows, enhancing efficiency and productivity.

-

What are the benefits of using airSlate SignNow for the form 5498 ESA?

Using airSlate SignNow for the form 5498 ESA ensures that your documents are processed quickly and efficiently. The platform not only saves time but also reduces errors, helping you stay organized and compliant with IRS regulations regarding educational savings accounts.

-

Is electronic signing of the form 5498 ESA legally valid?

Absolutely! Electronic signatures on the form 5498 ESA are legally valid and recognized by the IRS. AirSlate SignNow ensures that your electronic signature complies with all necessary legal standards, giving you peace of mind.

Get more for Form 5498 ESA Coverdell ESA Contribution Information

- Bill of sale with warranty for corporate seller delaware form

- Bill of sale without warranty by individual seller delaware form

- Bill of sale without warranty by corporate seller delaware form

- Chapter 13 plan delaware form

- Chapter 13 plan analysis delaware form

- Verification of creditors matrix delaware form

- Delaware civil procedure form

- Optional form for creditors seeking a deficiency default judgment delaware

Find out other Form 5498 ESA Coverdell ESA Contribution Information

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form