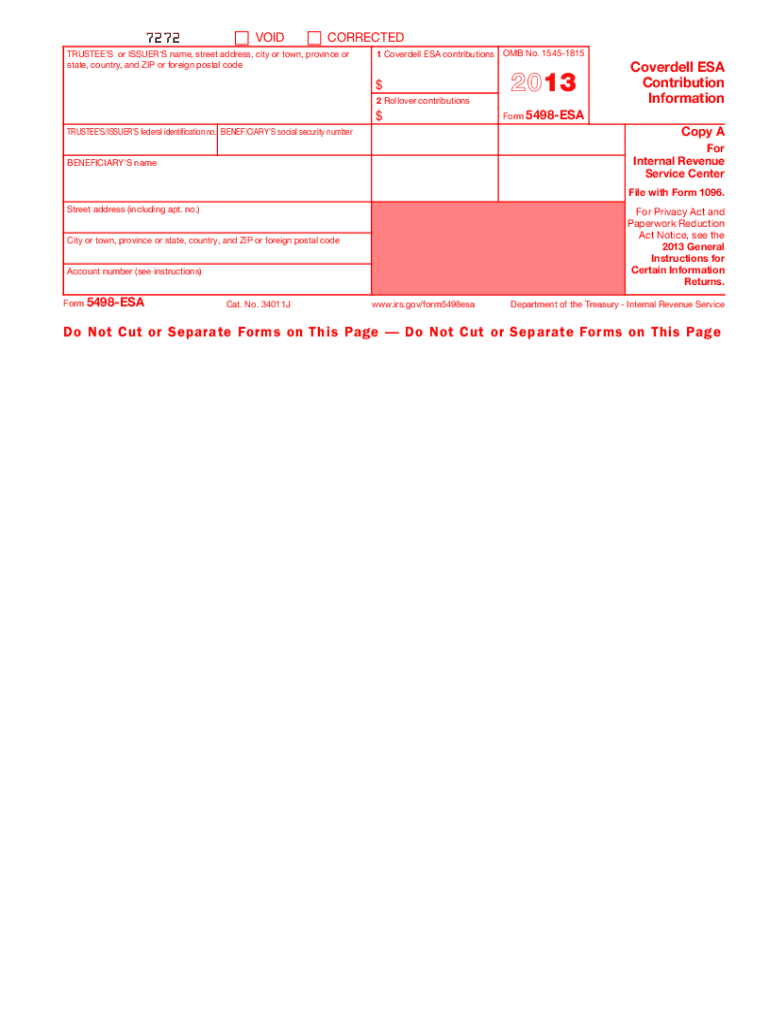

Treasury  Irs 2013

What is the Treasury Irs

The Treasury Irs refers to various forms and documents issued by the U.S. Department of the Treasury and the Internal Revenue Service (IRS). These documents are essential for tax reporting and compliance. They encompass a range of forms used for different purposes, including income tax returns, information reporting, and other financial disclosures. Understanding the specific purpose and requirements of each form is crucial for individuals and businesses alike.

How to use the Treasury Irs

Using the Treasury Irs forms involves several steps, depending on the specific form required. Generally, you will need to gather necessary financial information, complete the form accurately, and submit it to the appropriate agency. Many forms can be filled out electronically, which simplifies the process and reduces the likelihood of errors. Ensure that you follow the instructions provided with each form to meet all requirements.

Steps to complete the Treasury Irs

Completing the Treasury Irs forms typically involves the following steps:

- Identify the specific form you need based on your tax situation.

- Gather all required documentation, such as income statements, deductions, and credits.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail, following the submission guidelines provided.

Legal use of the Treasury Irs

The legal use of Treasury Irs forms is governed by federal tax laws and regulations. These forms must be completed and submitted in accordance with IRS guidelines to ensure compliance. Failure to use these forms legally can result in penalties, including fines and interest on unpaid taxes. It is essential to understand the legal implications of each form and to keep accurate records of submissions.

Filing Deadlines / Important Dates

Filing deadlines for Treasury Irs forms vary depending on the type of form and the taxpayer's situation. Generally, individual income tax returns are due by April 15 each year. However, extensions may be available under certain circumstances. It is important to stay informed about specific deadlines to avoid late fees and penalties. Mark your calendar with important dates related to tax filing and payments.

Required Documents

When completing Treasury Irs forms, you may need to provide various supporting documents. Common required documents include:

- W-2 forms from employers for income verification.

- 1099 forms for other sources of income.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Having these documents ready can streamline the process and help ensure accuracy in your submissions.

Quick guide on how to complete treasuryampnbsp irs

Effortlessly Prepare Treasury Irs on Any Device

Digital document management has gained increasing popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without hassle. Manage Treasury Irs on any device using the airSlate SignNow apps available for Android or iOS, and simplify any document-related task today.

Easy Steps to Modify and eSign Treasury Irs without Any Hassle

- Obtain Treasury Irs and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from whichever device you choose. Modify and eSign Treasury Irs and ensure excellent communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct treasuryampnbsp irs

Create this form in 5 minutes!

How to create an eSignature for the treasuryampnbsp irs

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is Treasury Irs and how can airSlate SignNow help?

Treasury Irs refers to the electronic systems used by the U.S. Department of the Treasury for various tax obligations. AirSlate SignNow streamlines the process of eSigning tax documents, ensuring that you can efficiently manage compliance with Treasury Irs requirements and reduce the risk of errors.

-

How does airSlate SignNow integrate with Treasury Irs services?

AirSlate SignNow provides seamless integrations with popular financial platforms, making it easier for users to comply with Treasury Irs requirements. By automating document flow and ensuring secure eSignature capabilities, businesses can enhance their efficiency and accuracy in handling Treasury Irs-related tasks.

-

What features of airSlate SignNow are beneficial for managing Treasury Irs documents?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure storage, which are particularly beneficial for handling Treasury Irs documents. These tools help ensure compliance, increase productivity, and simplify the process of obtaining necessary signatures in a timely manner.

-

Is airSlate SignNow cost-effective for businesses dealing with Treasury Irs paperwork?

Yes, airSlate SignNow is a cost-effective solution for businesses that need to manage Treasury Irs paperwork efficiently. Our pricing plans are designed to accommodate companies of all sizes, ensuring that you get the valuable features needed for Treasury Irs compliance without overspending.

-

Can I use airSlate SignNow for multiple users handling Treasury Irs documents?

Absolutely! AirSlate SignNow allows for multiple user accounts, enabling teams to collaboratively handle Treasury Irs documents. With user management features, you can assign roles and permissions, ensuring that everyone on your team can contribute efficiently to compliance efforts.

-

How secure is airSlate SignNow when dealing with Treasury Irs information?

AirSlate SignNow prioritizes security, especially when handling sensitive Treasury Irs information. We implement advanced encryption, secure servers, and compliance with eSignature laws to protect your data and maintain integrity throughout the document signing process.

-

What benefits does airSlate SignNow offer for tax season related to Treasury Irs?

During tax season, businesses can benefit from airSlate SignNow by ensuring fast and secure eSigning of Treasury Irs documents. Our platform helps reduce turnaround times, decreases errors, and allows timely submission of essential paperwork, contributing to a smoother tax filing experience.

Get more for Treasury  Irs

- Georgia contested form

- Quitclaim deed from husband and wife to llc georgia form

- Warranty deed from husband and wife to llc georgia form

- Georgia satisfaction judgment form

- Georgia landlord notice form

- Letter tenant notice 497303701 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497303702 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair georgia form

Find out other Treasury  Irs

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT