Oklahoma Form EF Oklahoma Income Tax Declaration for

Understanding the Oklahoma Form EF: Income Tax Declaration

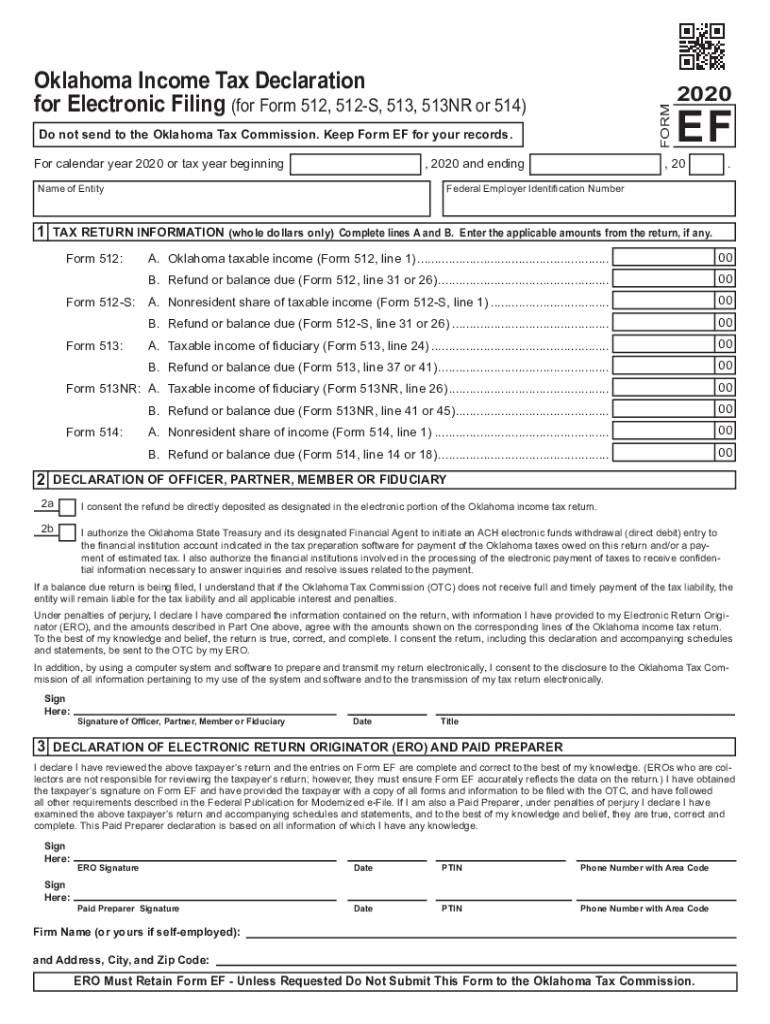

The Oklahoma Form EF serves as the Income Tax Declaration for individuals filing their state income tax returns. This form is essential for declaring income and calculating the amount owed or the refund due to the taxpayer. It is particularly relevant for residents of Oklahoma who need to report their income accurately to the Oklahoma Tax Commission. Understanding the purpose and requirements of this form is crucial for ensuring compliance with state tax laws.

Steps to Complete the Oklahoma Form EF

Completing the Oklahoma Form EF involves several key steps to ensure accuracy and compliance:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Enter personal information, such as your name, address, and Social Security number, at the top of the form.

- Report your total income by adding all sources of income as indicated on your documents.

- Calculate deductions and credits applicable to your situation, which can reduce your taxable income.

- Determine your total tax liability based on the calculated income and applicable tax rates.

- Sign and date the form to certify that the information provided is accurate and complete.

Obtaining the Oklahoma Form EF

The Oklahoma Form EF can be obtained through several methods to ensure accessibility for all taxpayers. You can download the form directly from the Oklahoma Tax Commission's website. Additionally, physical copies are available at local tax offices and public libraries. It is advisable to ensure you have the most current version of the form to avoid any compliance issues.

Legal Use of the Oklahoma Form EF

The Oklahoma Form EF is legally recognized as a valid document for declaring income and filing state taxes. To ensure its legal standing, it must be completed accurately and submitted by the specified deadlines. Compliance with state tax laws is crucial, as failure to file or inaccuracies can lead to penalties or legal repercussions.

Filing Deadlines for the Oklahoma Form EF

Timely submission of the Oklahoma Form EF is essential to avoid penalties. Typically, the deadline for filing is April fifteenth of each year, aligning with the federal tax filing deadline. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates to ensure compliance.

Form Submission Methods for the Oklahoma Form EF

Taxpayers have multiple options for submitting the Oklahoma Form EF. The form can be filed electronically through approved e-filing services, which is often the fastest method. Alternatively, taxpayers may choose to mail the completed form to the appropriate address provided by the Oklahoma Tax Commission. In-person submissions are also accepted at local tax offices, offering a direct way to ensure the form is received.

Quick guide on how to complete oklahoma form ef oklahoma income tax declaration for

Effortlessly prepare Oklahoma Form EF Oklahoma Income Tax Declaration For on any device

The management of documents online has become increasingly favored by businesses and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle Oklahoma Form EF Oklahoma Income Tax Declaration For on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to modify and electronically sign Oklahoma Form EF Oklahoma Income Tax Declaration For with ease

- Locate Oklahoma Form EF Oklahoma Income Tax Declaration For and click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, monotonous form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Alter and electronically sign Oklahoma Form EF Oklahoma Income Tax Declaration For while ensuring outstanding communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form ef oklahoma income tax declaration for

How to make an e-signature for your PDF file online

How to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the h512 form and how can it be used with airSlate SignNow?

The h512 form is a specific template used for various business purposes, which can be easily managed through airSlate SignNow. With our platform, you can electronically sign, send, and store h512 forms securely, ensuring compliance and efficiency in your document processes.

-

How does the pricing for airSlate SignNow work for users needing the h512 form?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who frequently use the h512 form. Our plans are designed to provide cost-effective solutions while delivering robust features like eSigning, document tracking, and integrations with various applications.

-

What features does airSlate SignNow offer for managing the h512 form?

When using airSlate SignNow for the h512 form, you benefit from features like customizable templates, real-time collaboration, and automated workflows. These tools help streamline the completion and management of the h512 form, saving your team valuable time.

-

Can I integrate airSlate SignNow with other tools for handling the h512 form?

Yes, airSlate SignNow supports integrations with various applications, which allows you to streamline your workflow when dealing with the h512 form. Popular tools like Google Drive, Salesforce, and Dropbox can be connected to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the h512 form?

Using airSlate SignNow for the h512 form provides numerous benefits, such as enhanced security, reduced turnaround times, and improved document tracking. This ensures that all stakeholders can efficiently complete the form while maintaining compliance with industry regulations.

-

How secure is the h512 form when using airSlate SignNow?

airSlate SignNow implements advanced security measures to protect your h512 form and sensitive data. Our platform uses encryption, secure access, and authentication protocols to ensure that your documents remain safe from unauthorized access or tampering.

-

Is there customer support available for issues related to the h512 form in airSlate SignNow?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any questions or issues you may encounter while working with the h512 form. Our support team is available through various channels to ensure you receive timely and effective assistance.

Get more for Oklahoma Form EF Oklahoma Income Tax Declaration For

Find out other Oklahoma Form EF Oklahoma Income Tax Declaration For

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online