Resident Individual Income Tax Forms and Instructions 2022

What is the OTC 994 Form?

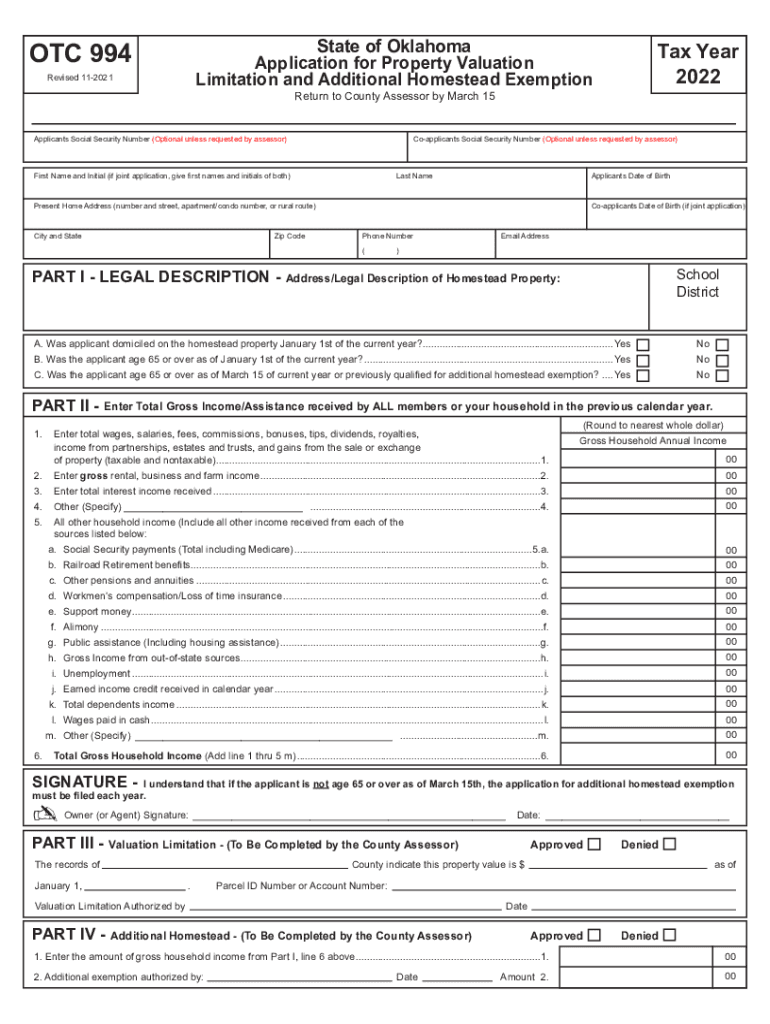

The OTC 994 form, also known as the Oklahoma Homestead Exemption Form, is a crucial document for homeowners in Oklahoma seeking to reduce their property taxes. This form allows eligible individuals to claim a homestead exemption, which can significantly lower the assessed value of their primary residence. By filing this form, homeowners may qualify for a reduction in property taxes, making homeownership more affordable. Understanding the specifics of the OTC 994 form is essential for anyone looking to benefit from this exemption.

Eligibility Criteria for the OTC 994 Form

To qualify for the OTC 994 form, applicants must meet certain criteria set by the state of Oklahoma. Generally, the following conditions apply:

- The property must be the applicant's primary residence.

- The applicant must be the owner of the property as of January 1 of the tax year.

- The applicant must not have claimed a homestead exemption on any other property.

- Specific age or disability criteria may apply for additional exemptions.

It is important for applicants to review these criteria carefully to ensure they meet all requirements before submitting the form.

Steps to Complete the OTC 994 Form

Completing the OTC 994 form involves several straightforward steps. Here is a guide to help you through the process:

- Obtain the OTC 994 form from the Oklahoma Tax Commission or a local county assessor's office.

- Fill out the form with accurate information, including your name, address, and property details.

- Provide any required documentation that supports your eligibility, such as proof of ownership.

- Review the completed form to ensure all information is correct.

- Submit the form to your local county assessor's office by the deadline, typically by March 15 for the current tax year.

Following these steps can help ensure a smooth application process and increase the likelihood of receiving the homestead exemption.

Legal Use of the OTC 994 Form

The OTC 994 form is legally recognized in Oklahoma as a means for homeowners to claim their homestead exemption. For the exemption to be valid, the form must be completed accurately and submitted within the designated timeframe. Failure to comply with the legal requirements may result in the denial of the exemption. It is essential for applicants to understand their rights and responsibilities when using this form to ensure compliance with state laws.

Form Submission Methods for the OTC 994

Homeowners can submit the OTC 994 form through various methods, ensuring convenience and accessibility. The available submission methods include:

- Online submission through the Oklahoma Tax Commission's website, where applicable.

- Mailing the completed form to the local county assessor's office.

- In-person delivery at the county assessor's office during business hours.

Choosing the appropriate submission method can help expedite the processing of the homestead exemption application.

Required Documents for the OTC 994 Form

When submitting the OTC 994 form, certain documents may be required to verify eligibility. Commonly requested documents include:

- Proof of property ownership, such as a deed or tax statement.

- Identification that verifies the applicant's identity and residency.

- Additional documentation for applicants seeking senior or disability exemptions.

Providing these documents can help facilitate the approval process and ensure that the application is complete.

Quick guide on how to complete resident individual income tax forms and instructions

Accomplish Resident Individual Income Tax Forms And Instructions seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without interruption. Handle Resident Individual Income Tax Forms And Instructions on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric task today.

How to adjust and electronically sign Resident Individual Income Tax Forms And Instructions effortlessly

- Obtain Resident Individual Income Tax Forms And Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your changes.

- Select how you would like to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Resident Individual Income Tax Forms And Instructions and assure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct resident individual income tax forms and instructions

Create this form in 5 minutes!

How to create an eSignature for the resident individual income tax forms and instructions

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an e-signature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an e-signature for a PDF document on Android

People also ask

-

What is otc 994 and how does it relate to airSlate SignNow?

otc 994 refers to a specific feature within the airSlate SignNow platform that facilitates seamless electronic signatures on documents. This functionality allows businesses to easily manage and sign documents digitally, increasing efficiency and reducing paper waste.

-

How can airSlate SignNow assist businesses in complying with otc 994 regulations?

airSlate SignNow is designed to help businesses meet the requirements of otc 994 by providing a secure, compliant electronic signature solution. The platform ensures that all signed documents are legally binding and adheres to industry regulations, giving users peace of mind.

-

What pricing plans are available for airSlate SignNow that include otc 994 features?

airSlate SignNow offers various pricing plans that include features related to otc 994, catering to different business needs. These plans are competitively priced, making electronic signing accessible for businesses of all sizes without compromising on functionality.

-

What are the key benefits of using airSlate SignNow with otc 994?

Using airSlate SignNow with otc 994 provides numerous benefits, including improved document turnaround times and enhanced workflow efficiency. Additionally, it minimizes the risk of errors associated with manual signing, thereby optimizing overall business operations.

-

Does airSlate SignNow integrate with other tools relevant to otc 994?

Yes, airSlate SignNow offers integrations with a variety of popular tools that enhance the functionality related to otc 994. Users can connect the platform with CRM systems, cloud storage solutions, and other applications to streamline document management and signing processes.

-

What features does airSlate SignNow offer to simplify the otc 994 signing process?

airSlate SignNow provides a user-friendly interface, customizable templates, and automated workflows that simplify the signing process associated with otc 994. These features help ensure that users can efficiently manage, send, and track documents with ease.

-

Is airSlate SignNow secure for handling documents related to otc 994?

Absolutely. airSlate SignNow prioritizes security, employing advanced encryption methods to protect documents associated with otc 994. The platform also includes features like two-factor authentication, ensuring that sensitive information remains secure throughout the signing process.

Get more for Resident Individual Income Tax Forms And Instructions

Find out other Resident Individual Income Tax Forms And Instructions

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure