Form 994 Application for Property Valuation Limitation and Additional Homestead Exemption 2021

What is the Form 994 Application for Property Valuation Limitation and Additional Homestead Exemption

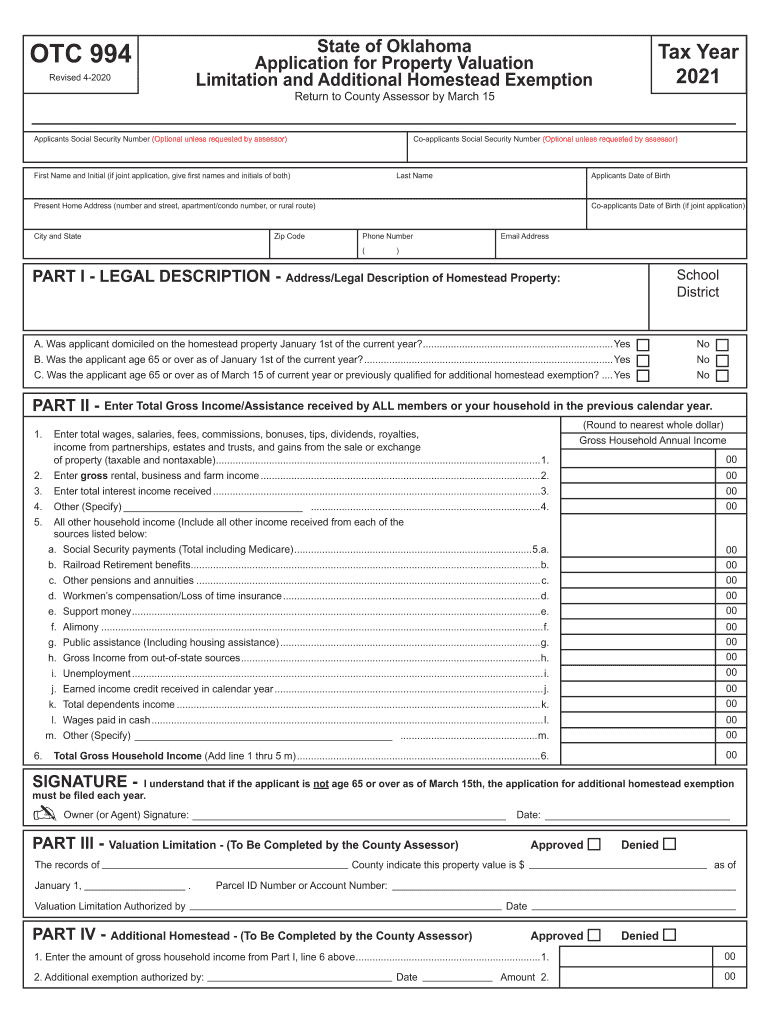

The Oklahoma Form OTC 994 is a crucial document designed for homeowners seeking property valuation limitations and additional homestead exemptions. This form allows eligible individuals to apply for a reduction in property taxes based on specific criteria, which can significantly lower their financial burden. The homestead exemption is particularly beneficial for those who meet the eligibility requirements, including age, disability status, or income limitations. Understanding the purpose of this form is essential for homeowners looking to maximize their tax benefits.

Steps to Complete the Form 994 Application for Property Valuation Limitation and Additional Homestead Exemption

Completing the Oklahoma Form OTC 994 involves several straightforward steps. First, gather all necessary documentation, such as proof of identity, property ownership, and any relevant financial information. Next, carefully fill out the form, ensuring that all sections are completed accurately. Pay special attention to the eligibility criteria and provide any required supporting documents. Once the form is filled out, review it for accuracy and completeness before submission. Finally, submit the form by the specified deadline to ensure timely processing of your application.

Eligibility Criteria for the Form 994 Application for Property Valuation Limitation and Additional Homestead Exemption

To qualify for the benefits associated with the Oklahoma Form OTC 994, applicants must meet specific eligibility criteria. Generally, this includes being a homeowner who occupies the property as their primary residence. Additional requirements may include being at least sixty-five years old, having a disability, or meeting certain income thresholds. It is important to review the detailed eligibility guidelines provided by the Oklahoma Tax Commission to ensure compliance and maximize the chances of approval.

Required Documents for the Form 994 Application for Property Valuation Limitation and Additional Homestead Exemption

When applying for the Oklahoma Form OTC 994, applicants must provide several essential documents to support their application. These typically include proof of residency, such as a utility bill or lease agreement, identification documents like a driver's license or state ID, and any documentation that verifies age or disability status. Additionally, financial statements may be required to demonstrate income eligibility. Ensuring that all required documents are submitted with the form can facilitate a smoother application process.

Form Submission Methods for the Form 994 Application for Property Valuation Limitation and Additional Homestead Exemption

The Oklahoma Form OTC 994 can be submitted through various methods to accommodate different preferences. Homeowners can choose to file the form online via the Oklahoma Tax Commission's website, which offers a convenient and efficient way to complete the application. Alternatively, applicants may opt to submit the form by mail, ensuring that it is sent to the correct address provided by the tax commission. In-person submissions are also possible at designated offices, allowing for direct assistance if needed.

Legal Use of the Form 994 Application for Property Valuation Limitation and Additional Homestead Exemption

The legal use of the Oklahoma Form OTC 994 is governed by state tax laws and regulations. Completing this form accurately and submitting it within the designated timeframe ensures compliance with Oklahoma's property tax statutes. The form serves as a formal request for tax relief, and any inaccuracies or omissions may result in delays or denials. Therefore, understanding the legal implications of the form and adhering to the guidelines is crucial for homeowners seeking to benefit from property valuation limitations and exemptions.

Quick guide on how to complete 2021 form 994 application for property valuation limitation and additional homestead exemption

Effortlessly Prepare Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption with Ease

- Locate Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant portions of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 994 application for property valuation limitation and additional homestead exemption

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 994 application for property valuation limitation and additional homestead exemption

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

How to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Oklahoma form OTC 994?

Oklahoma form OTC 994 is a document used for tax purposes in the state of Oklahoma. This form is designed to help businesses report certain tax information efficiently. By utilizing airSlate SignNow, you can easily fill out and eSign the Oklahoma form OTC 994 with minimal effort.

-

How can I eSign the Oklahoma form OTC 994 using airSlate SignNow?

To eSign the Oklahoma form OTC 994 with airSlate SignNow, simply upload the completed document to our platform. Once uploaded, you can use our intuitive eSignature tools to sign the form electronically. This streamlines your process and ensures compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the Oklahoma form OTC 994?

airSlate SignNow offers affordable pricing plans tailored for businesses. While there may be a subscription fee, the time and resources saved by using our service to manage the Oklahoma form OTC 994 make it a cost-effective solution. Visit our pricing page for more details.

-

What features does airSlate SignNow offer for the Oklahoma form OTC 994?

AirSlate SignNow provides a range of features for handling the Oklahoma form OTC 994, including customizable templates, document tracking, and secure cloud storage. These features enhance your productivity and ensure your documents are managed safely and efficiently.

-

Can I integrate airSlate SignNow with other software for processing the Oklahoma form OTC 994?

Yes, airSlate SignNow integrates seamlessly with various software solutions to streamline your workflow. You can connect with CRMs, cloud storage applications, and more to efficiently process the Oklahoma form OTC 994 without switching between multiple platforms.

-

What benefits does airSlate SignNow provide for handling the Oklahoma form OTC 994?

Using airSlate SignNow for the Oklahoma form OTC 994 offers numerous benefits, including increased efficiency, enhanced accuracy, and improved collaboration among team members. Our electronic signature solution reduces turnaround time and ensures that your documents are securely managed.

-

Is airSlate SignNow legally compliant for Oklahoma form OTC 994?

Yes, airSlate SignNow is designed to comply with electronic signature laws, including those applicable to the Oklahoma form OTC 994. Our platform meets the requirements outlined by the UETA and ESIGN Acts, ensuring that your signed documents are legally valid and enforceable.

Get more for Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption

Find out other Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document