2023 Form 994 Application for Property Valuation Limitation and Additional Homestead Exemption 2023-2026

What is the 2023 Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption

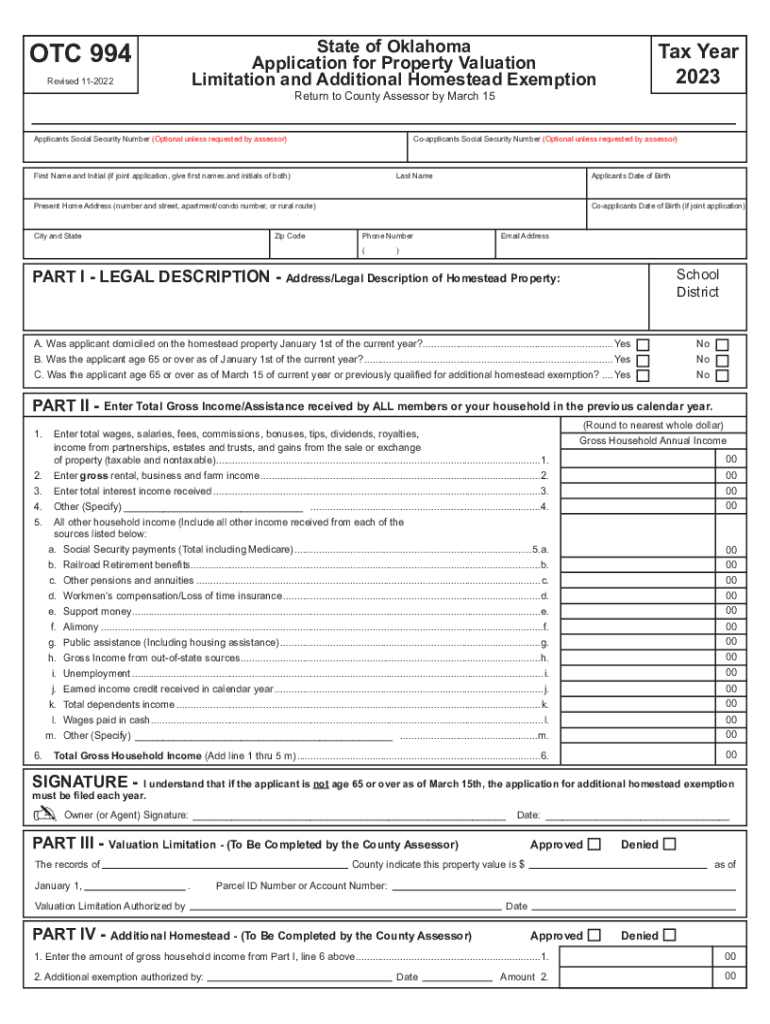

The 2023 Form 994 is an application that allows property owners in Oklahoma to apply for a property valuation limitation and an additional homestead exemption. This form is specifically designed for individuals seeking to reduce their property tax burden by qualifying for exemptions based on specific criteria. The homestead exemption is intended to provide financial relief to homeowners, particularly seniors, disabled individuals, and those with low income. By filing this form, eligible applicants can potentially lower the assessed value of their property, resulting in reduced property taxes.

How to use the 2023 Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption

To effectively use the 2023 Form 994, applicants should first ensure they meet the eligibility requirements outlined by the state. Once eligibility is confirmed, the form can be filled out with the necessary personal and property information. It is important to provide accurate details, as any discrepancies may delay processing or result in denial of the application. After completing the form, applicants must submit it to their local county assessor’s office, following any specific submission guidelines provided by the state.

Steps to complete the 2023 Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption

Completing the 2023 Form 994 involves several key steps:

- Gather necessary documentation, including proof of age, disability status, or income, depending on the exemption type.

- Fill out the form with accurate personal and property information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate county assessor’s office by the specified deadline.

Eligibility Criteria

Eligibility for the 2023 Form 994 is generally based on several factors, including:

- Age: Applicants must be at least sixty-five years old or meet other specific age-related criteria.

- Disability: Individuals with a qualifying disability may also be eligible for the exemption.

- Income: Certain income limits may apply, requiring applicants to provide financial documentation.

- Primary residence: The property must be the applicant's primary residence to qualify for the homestead exemption.

Required Documents

When applying for the 2023 Form 994, applicants must provide specific documentation to support their eligibility. Commonly required documents include:

- Proof of age, such as a birth certificate or government-issued ID.

- Documentation of disability, if applicable, such as a letter from a healthcare provider.

- Financial records, including tax returns or income statements, to verify income eligibility.

- Property deed or tax statement to confirm ownership of the property in question.

Form Submission Methods

The 2023 Form 994 can be submitted in various ways, depending on the preferences of the applicant and the guidelines of the local county assessor’s office. Common submission methods include:

- Online submission through the county assessor's website, if available.

- Mailing the completed form and required documents to the county assessor’s office.

- In-person submission at the local county assessor’s office during business hours.

Quick guide on how to complete 2023 form 994 application for property valuation limitation and additional homestead exemption

Effortlessly Prepare 2023 Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption on Any Device

The management of online documents has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents quickly without delays. Handle 2023 Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and eSign 2023 Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption with Ease

- Locate 2023 Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign 2023 Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2023 form 994 application for property valuation limitation and additional homestead exemption

Create this form in 5 minutes!

People also ask

-

What is otc 994 and how does airSlate SignNow support it?

The otc 994 refers to a specific regulatory category for certain transactions. airSlate SignNow provides an efficient platform to manage and eSign documents compliant with otc 994 requirements, ensuring that businesses adhere to industry standards.

-

What are the pricing options available for airSlate SignNow for otc 994 users?

airSlate SignNow offers flexible pricing plans tailored for businesses using otc 994. Users can choose from monthly, yearly, or pay-per-use options, ensuring that they find a cost-effective solution that fits their needs and budget.

-

What features does airSlate SignNow offer for managing otc 994 documents?

airSlate SignNow includes features such as customizable templates, secure eSignature options, and document tracking specifically for otc 994 transactions. These features enhance the efficiency and compliance of your document workflows.

-

How can airSlate SignNow improve the benefits of using otc 994?

By utilizing airSlate SignNow for otc 994 transactions, businesses can enhance their workflow efficiency and reduce turnaround times. The platform streamlines document signing processes, allowing for faster and more secure transactions.

-

Is airSlate SignNow compatible with other software for otc 994 integration?

Yes, airSlate SignNow offers seamless integrations with a variety of CRM, ERP, and third-party applications, making it ideal for users dealing with otc 994. This compatibility helps businesses streamline their operations and improve overall efficiency.

-

Can airSlate SignNow help ensure compliance with otc 994 regulations?

Absolutely! airSlate SignNow is designed to help businesses maintain compliance with otc 994 regulations through secure eSignature processes and comprehensive document management solutions. This ensures that all transactions are recorded and verifiable.

-

What types of documents can be managed with airSlate SignNow under otc 994?

airSlate SignNow allows users to manage a wide range of documents under otc 994, including contracts, agreements, and forms. Its versatile platform makes it easy for businesses to handle various document types securely and efficiently.

Get more for 2023 Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption

- Notice to beneficiaries of being named in will mississippi form

- Estate planning questionnaire and worksheets mississippi form

- Document locator and personal information package including burial information form mississippi

- Demand to produce copy of will from heir to executor or person in possession of will mississippi form

- Montana first report injury form

- Petition for workers compensation mediation conference montana form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497316007 form

- Medical provider billing request montana form

Find out other 2023 Form 994 Application For Property Valuation Limitation And Additional Homestead Exemption

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy