Form 511 TX Credit for Tax Paid to Another State 2021

What is the Form 511 TX Credit For Tax Paid To Another State

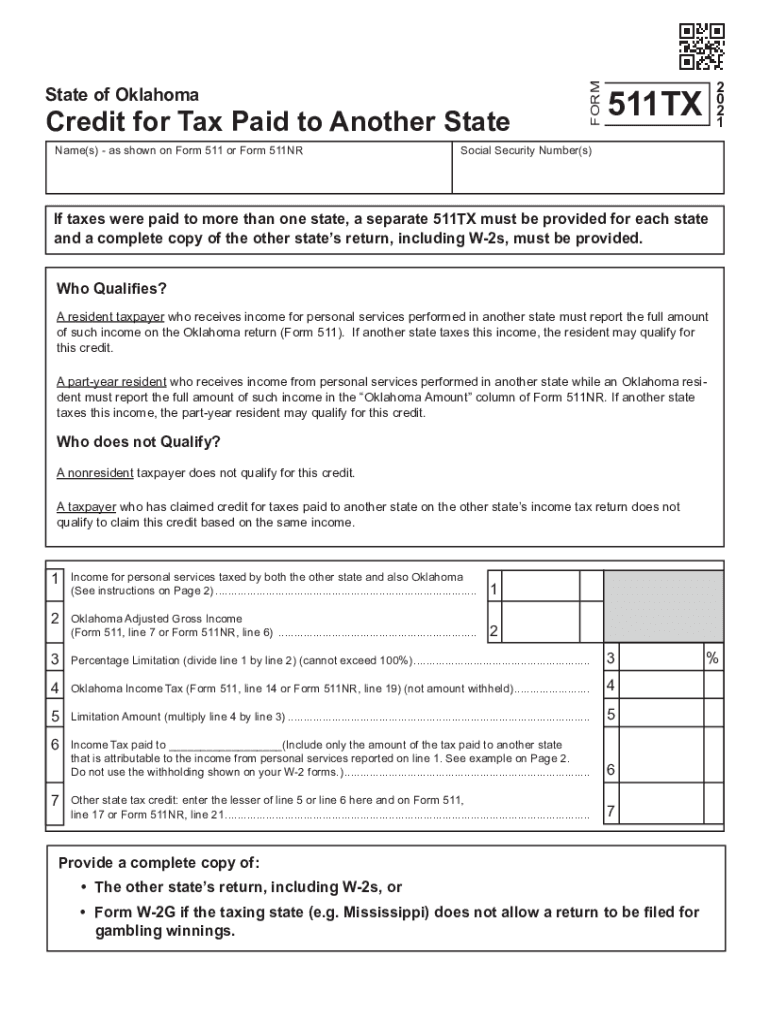

The Form 511 TX is designed for Oklahoma taxpayers who have paid income tax to another state and wish to claim a credit for those taxes on their Oklahoma tax return. This credit helps prevent double taxation on income earned in multiple states. By utilizing this form, taxpayers can reduce their Oklahoma tax liability by the amount of tax paid to another state, ensuring a fairer tax obligation.

How to use the Form 511 TX Credit For Tax Paid To Another State

To effectively use the Form 511 TX, taxpayers must first determine their eligibility based on the income earned in another state and the taxes paid. After confirming eligibility, complete the form by providing details such as the amount of tax paid to the other state and the corresponding income. Ensure all calculations are accurate, as this will directly affect the credit amount claimed. Once completed, the form should be submitted alongside the regular Oklahoma tax return.

Steps to complete the Form 511 TX Credit For Tax Paid To Another State

Completing the Form 511 TX involves several key steps:

- Gather necessary documents, including proof of tax paid to the other state.

- Fill out personal information, including name, address, and Social Security number.

- Provide details about the income earned in the other state and the tax amount paid.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the credit on the Form 511 TX, taxpayers must meet specific eligibility criteria. This includes being a resident of Oklahoma and having paid income taxes to another state on income that is also taxable in Oklahoma. The taxpayer must provide documentation of the taxes paid and ensure that the income is not exempt from Oklahoma taxation. Understanding these criteria is essential to successfully claiming the credit.

Required Documents

When filing the Form 511 TX, certain documents are required to substantiate the claim. Taxpayers must include:

- A copy of the tax return filed with the other state.

- Proof of payment of the taxes, such as receipts or bank statements.

- Any additional documentation that supports the income earned in the other state.

Having these documents ready will facilitate a smoother filing process and help avoid delays in processing the return.

Form Submission Methods

The Form 511 TX can be submitted through various methods, allowing taxpayers to choose the most convenient option. These methods include:

- Online submission through the Oklahoma Tax Commission's e-file system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Choosing the right submission method can impact the processing time and overall efficiency of the filing experience.

Quick guide on how to complete 2020 form 511 tx credit for tax paid to another state

Prepare Form 511 TX Credit For Tax Paid To Another State effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents rapidly and without delays. Manage Form 511 TX Credit For Tax Paid To Another State on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Form 511 TX Credit For Tax Paid To Another State seamlessly

- Locate Form 511 TX Credit For Tax Paid To Another State and click Get Form to commence.

- Employ the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you prefer to send your form—via email, SMS, or invitation link—or download it to your PC.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 511 TX Credit For Tax Paid To Another State and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 511 tx credit for tax paid to another state

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 511 tx credit for tax paid to another state

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an e-signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is 511tx and how does it relate to airSlate SignNow?

511tx is a powerful digital signing and document management solution offered by airSlate SignNow. It allows businesses to easily send, sign, and manage documents online, streamlining workflows and enhancing productivity. By using 511tx, you can ensure your documents are securely signed and executed with minimal effort.

-

What pricing plans are available for 511tx?

airSlate SignNow offers several pricing plans for 511tx, catering to businesses of all sizes. You can choose from flexible monthly or annual subscriptions that fit your budget and needs. Each plan includes various features designed to optimize your document management and signing experience.

-

What features does 511tx include?

511tx includes a variety of robust features designed to enhance your eSigning experience. Key features include customizable templates, real-time tracking, and multi-party signing. These capabilities ensure that signing documents is both fast and efficient for everyone involved.

-

How can 511tx benefit my business?

Implementing 511tx can signNowly benefit your business by speeding up the document signing process and reducing paperwork. With airSlate SignNow, you can increase efficiency, reduce turnaround time, and minimize errors. By digitizing your document workflows with 511tx, you can focus more on your core business operations.

-

Does 511tx integrate with other applications?

Yes, 511tx offers seamless integrations with various popular applications like Google Drive, Microsoft Office, and CRM tools. This flexibility allows you to incorporate airSlate SignNow into your existing workflow without disruptions. You can easily manage and send documents across platforms for a streamlined process.

-

Is 511tx secure for handling sensitive documents?

Absolutely, 511tx prioritizes security by utilizing end-to-end encryption and compliance with industry standards such as GDPR and HIPAA. airSlate SignNow ensures that your sensitive documents are safely stored and signed, giving you peace of mind. You can trust 511tx with your confidential information without worry.

-

How user-friendly is the 511tx platform?

The 511tx platform is designed to be user-friendly, ensuring that all users can quickly adapt to its interface. airSlate SignNow provides a simple and intuitive experience, which minimizes the learning curve. You can easily navigate through the features and start signing documents in no time.

Get more for Form 511 TX Credit For Tax Paid To Another State

- Quitclaim deed for trustee to beneficiary florida form

- Assumption agreement of mortgage and release of original mortgagors florida form

- Fl foreign judgment form

- Florida disability form

- Summary administration form

- Florida without administration form

- Fl detainer form

- Florida expungement instructions florida form

Find out other Form 511 TX Credit For Tax Paid To Another State

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself