Form 511 TX Credit for Tax Paid to Another State 2022

What is the Form 511 TX Credit For Tax Paid To Another State

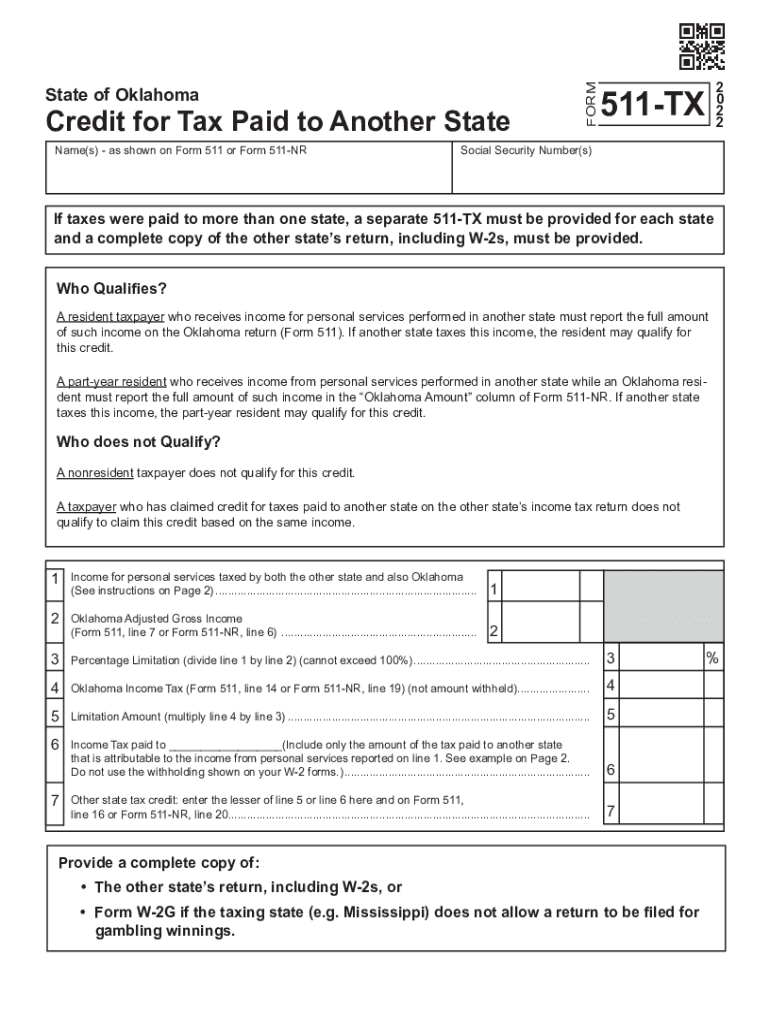

The Form 511 TX is specifically designed for residents of Oklahoma who wish to claim a credit for taxes paid to another state. This form allows taxpayers to avoid double taxation on income that has already been taxed by another jurisdiction. By utilizing the 511 TX form, individuals can ensure they receive the appropriate credit, which can significantly reduce their overall tax liability. This credit is particularly beneficial for those who have earned income in states outside of Oklahoma while maintaining their residency in the state.

How to use the Form 511 TX Credit For Tax Paid To Another State

To effectively use the Form 511 TX, taxpayers should first gather all relevant tax documents from both Oklahoma and the other state where taxes were paid. This includes W-2s, 1099s, and any other income statements. Once the necessary information is collected, individuals can fill out the form by providing details such as the amount of tax paid to the other state and the corresponding income. It is essential to follow the instructions carefully to ensure accuracy and compliance with state regulations.

Steps to complete the Form 511 TX Credit For Tax Paid To Another State

Completing the Form 511 TX involves several key steps:

- Begin by downloading the form from the Oklahoma Tax Commission website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report the income earned in the other state and the amount of tax paid.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Review the completed form for accuracy before submitting it.

Legal use of the Form 511 TX Credit For Tax Paid To Another State

The legal use of the Form 511 TX is governed by Oklahoma state tax laws, which stipulate that residents can claim a credit for taxes paid to another state. This form must be completed accurately and submitted within the designated filing period to ensure compliance. Failure to adhere to these regulations may result in penalties or denial of the credit. It is advisable for taxpayers to keep records of all relevant documents and correspondence related to their tax filings.

Eligibility Criteria

To be eligible for the credit claimed on the Form 511 TX, taxpayers must meet specific criteria. Primarily, individuals must be residents of Oklahoma and have paid income tax to another state on income that is also subject to taxation in Oklahoma. Additionally, the income must be reported on the Oklahoma tax return. It is crucial for taxpayers to verify their eligibility before filing to avoid complications or delays in processing their claims.

Required Documents

When completing the Form 511 TX, several documents are required to substantiate the claim for credit. These include:

- Tax returns from the other state showing the amount of tax paid.

- W-2 forms or 1099 forms that report income earned in both Oklahoma and the other state.

- Any additional documentation that supports the claim, such as receipts or statements from the other state's tax authority.

Form Submission Methods

The Form 511 TX can be submitted through various methods, ensuring convenience for taxpayers. Individuals have the option to file the form online through the Oklahoma Tax Commission's electronic filing system, which provides a streamlined process. Alternatively, taxpayers can mail a printed copy of the completed form to the appropriate address listed on the form. In-person submissions may also be accepted at designated tax offices, providing further flexibility for those who prefer face-to-face assistance.

Quick guide on how to complete 2022 form 511 tx credit for tax paid to another state

Prepare Form 511 TX Credit For Tax Paid To Another State effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the resources you need to generate, alter, and eSign your documents promptly without delays. Manage Form 511 TX Credit For Tax Paid To Another State on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign Form 511 TX Credit For Tax Paid To Another State seamlessly

- Locate Form 511 TX Credit For Tax Paid To Another State and then click Get Form to initiate.

- Use the tools we provide to complete your document.

- Emphasize relevant parts of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for that task.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign Form 511 TX Credit For Tax Paid To Another State while ensuring exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 511 tx credit for tax paid to another state

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 511 tx credit for tax paid to another state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the OK 511TX printable form?

The OK 511TX printable form is a document designed to help users quickly and efficiently provide essential information. It is especially useful for businesses requiring a standardized format that is easy to fill out and share electronically. With airSlate SignNow, you can easily create, send, and eSign your OK 511TX printable documents.

-

How can I access the OK 511TX printable form?

You can access the OK 511TX printable form directly through airSlate SignNow by logging into your account. Once logged in, navigate to the 'Templates' section where you can find and customize the OK 511TX printable form as needed. This allows for a quick and seamless document preparation process.

-

Are there any costs associated with the OK 511TX printable feature?

airSlate SignNow offers competitive pricing plans that include access to the OK 511TX printable feature. Depending on the plan you choose, you may enjoy various features, including unlimited document eSigning and secure cloud storage. Review our pricing page to find the best plan for your business needs.

-

What are the benefits of using the OK 511TX printable form with airSlate SignNow?

Using the OK 511TX printable form with airSlate SignNow provides numerous benefits, including enhanced efficiency, reduced turnaround times, and an intuitive eSigning experience. Additionally, this feature allows you to maintain compliance with industry standards while streamlining your document management process.

-

Can I integrate airSlate SignNow with other software while using the OK 511TX printable form?

Yes, airSlate SignNow supports integrations with various software platforms, enhancing the utility of the OK 511TX printable form. Whether you're using CRM systems, project management tools, or other applications, you can effortlessly connect them to airSlate SignNow for improved workflow efficiency.

-

Is the OK 511TX printable form customizable?

Absolutely! The OK 511TX printable form is fully customizable within the airSlate SignNow platform. You can modify fields, add your branding, and tailor the document to meet your specific requirements, ensuring it fits your business needs perfectly.

-

How secure is the OK 511TX printable document when using airSlate SignNow?

The security of your OK 511TX printable document is a top priority at airSlate SignNow. We employ advanced encryption protocols and compliance with industry regulations to protect your sensitive information, giving you peace of mind when eSigning documents.

Get more for Form 511 TX Credit For Tax Paid To Another State

- Legal last will form for a widow or widower with no children south carolina

- Legal last will and testament form for a widow or widower with adult and minor children south carolina

- Legal last will and testament form for divorced and remarried person with mine yours and ours children south carolina

- Legal last will and testament form with all property to trust called a pour over will south carolina

- Written revocation of will south carolina form

- Last will and testament for other persons south carolina form

- Notice to beneficiaries of being named in will south carolina form

- Estate planning questionnaire and worksheets south carolina form

Find out other Form 511 TX Credit For Tax Paid To Another State

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure