Azdor Govindividual Estimated Tax Payment FormIndividual Estimated Tax Payment FormArizona Department of 2021

What is the Azdor govindividual estimated tax payment formIndividual Estimated Tax Payment FormArizona Department Of

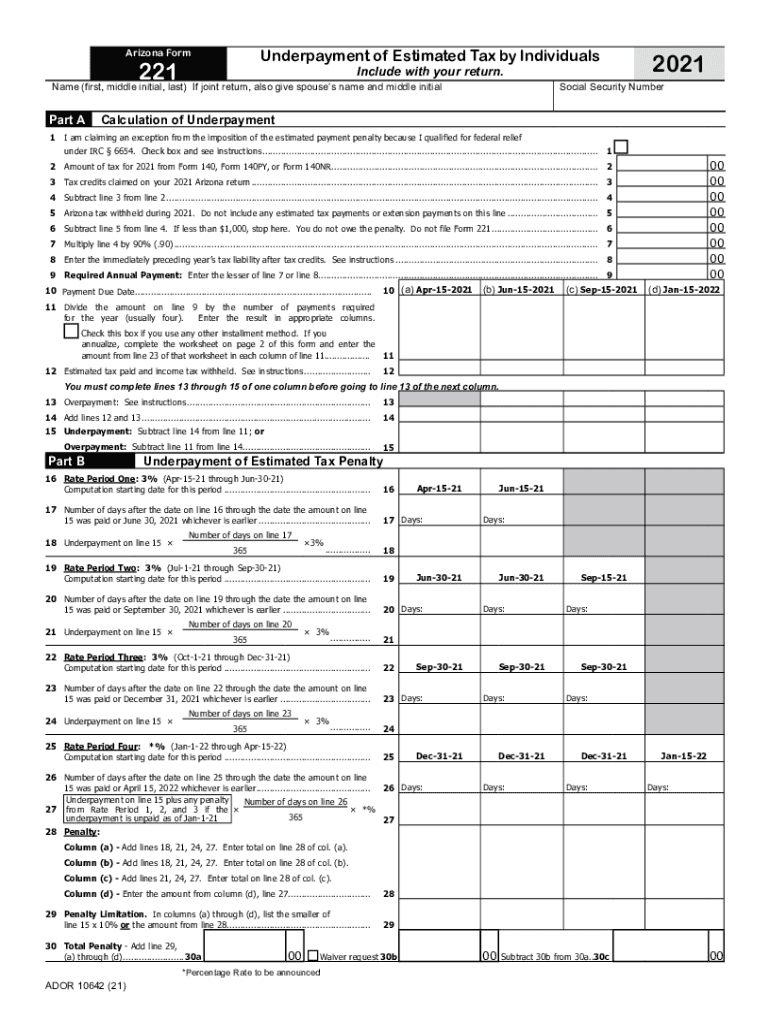

The Azdor govindividual estimated tax payment form, also known as the Individual Estimated Tax Payment Form, is a crucial document for individuals in Arizona who need to report and pay their estimated taxes. This form is designed for taxpayers who expect to owe tax of $1,000 or more when they file their return. It allows individuals to make quarterly payments to the Arizona Department of Revenue, ensuring they meet their tax obligations throughout the year. Proper use of this form helps avoid penalties and interest associated with underpayment of taxes.

How to use the Azdor govindividual estimated tax payment formIndividual Estimated Tax Payment FormArizona Department Of

Using the Azdor govindividual estimated tax payment form involves several key steps. First, gather your financial information, including your expected income, deductions, and credits for the year. Next, calculate your estimated tax liability using the appropriate tax rates. Once you have this information, complete the form by providing your personal details and the calculated tax amount. Finally, submit the form and make your payment by the due dates specified by the Arizona Department of Revenue to ensure compliance and avoid penalties.

Steps to complete the Azdor govindividual estimated tax payment formIndividual Estimated Tax Payment FormArizona Department Of

Completing the Azdor govindividual estimated tax payment form involves a systematic approach:

- Gather Information: Collect necessary financial documents such as income statements and prior tax returns.

- Calculate Estimated Tax: Use the Arizona tax tables to determine your expected tax liability based on your income and deductions.

- Fill Out the Form: Enter your personal information, including your name, address, and Social Security number, along with your estimated tax amount.

- Review and Verify: Double-check all entries for accuracy to prevent errors that could lead to penalties.

- Submit the Form: Choose your submission method—online, by mail, or in person—and ensure timely payment of your estimated taxes.

Key elements of the Azdor govindividual estimated tax payment formIndividual Estimated Tax Payment FormArizona Department Of

The key elements of the Azdor govindividual estimated tax payment form include personal identification information, estimated tax liability, and payment instructions. Taxpayers must provide their name, address, and Social Security number. The form also requires the calculation of estimated taxes for the current year, which is based on the taxpayer's income and applicable deductions. Additionally, instructions for making payments, including deadlines and methods, are crucial components of the form to ensure compliance with state tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Azdor govindividual estimated tax payment form are critical for taxpayers to avoid penalties. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. It is essential to mark these dates on your calendar to ensure timely submissions. Missing a deadline can result in interest and penalties, so staying informed about these important dates is vital for effective tax management.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Azdor govindividual estimated tax payment form can result in significant penalties. If taxpayers do not make the required estimated payments or underpay their taxes, they may face penalties that can accumulate over time. The Arizona Department of Revenue may impose interest on unpaid balances, and taxpayers could be subject to additional fines. Understanding these consequences emphasizes the importance of timely and accurate submission of estimated tax payments.

Quick guide on how to complete azdorgovindividual estimated tax payment formindividual estimated tax payment formarizona department of

Complete Azdor govindividual estimated tax payment formIndividual Estimated Tax Payment FormArizona Department Of effortlessly on any platform

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage Azdor govindividual estimated tax payment formIndividual Estimated Tax Payment FormArizona Department Of on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign Azdor govindividual estimated tax payment formIndividual Estimated Tax Payment FormArizona Department Of with ease

- Obtain Azdor govindividual estimated tax payment formIndividual Estimated Tax Payment FormArizona Department Of and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight key sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Azdor govindividual estimated tax payment formIndividual Estimated Tax Payment FormArizona Department Of to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct azdorgovindividual estimated tax payment formindividual estimated tax payment formarizona department of

Create this form in 5 minutes!

How to create an eSignature for the azdorgovindividual estimated tax payment formindividual estimated tax payment formarizona department of

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an e-signature for a PDF on Android

People also ask

-

What is the Azdor govindividual estimated tax payment form?

The Azdor govindividual estimated tax payment form is a document provided by the Arizona Department Of Revenue that allows individuals to report and pay their estimated income tax liabilities. It's vital for taxpayers to file this form accurately to avoid penalties. This form helps ensure compliance with state tax laws.

-

How can airSlate SignNow assist with the Azdor govindividual estimated tax payment form?

AirSlate SignNow simplifies the process of completing and submitting the Azdor govindividual estimated tax payment form. Our platform allows users to easily eSign and send documents electronically, ensuring that your form is submitted on time and securely. This enhances efficiency and reduces paper usage.

-

What features does airSlate SignNow offer for managing tax documents?

AirSlate SignNow offers features such as secure eSigning, document templates, and cloud storage that are essential for managing tax documents, including the Azdor govindividual estimated tax payment form. With these features, users can streamline their tax documentation process and ensure better organization of their financial records.

-

Are there any costs associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans catering to different business needs. These plans are designed to be cost-effective while providing the necessary tools to manage documents like the Azdor govindividual estimated tax payment form. Interested users can choose a plan that suits their budget and features required.

-

What are the benefits of using airSlate SignNow for eSigning documents?

Using airSlate SignNow for eSigning documents like the Azdor govindividual estimated tax payment form brings numerous benefits. Firstly, it enhances speed and efficiency by allowing users to sign documents electronically. Secondly, it increases security by providing a timestamped audit trail of all document activities.

-

Can I track the status of my submitted Azdor govindividual estimated tax payment form?

Yes, airSlate SignNow provides users with the ability to track the status of their submitted documents, including the Azdor govindividual estimated tax payment form. Users receive notifications about document delivery and signing status, which helps monitor important filings and manage deadlines effectively.

-

Is airSlate SignNow compliant with Arizona Department Of regulations for tax forms?

Absolutely! AirSlate SignNow is designed to comply with the relevant regulations set by the Arizona Department Of Revenue when it comes to tax forms, including the Azdor govindividual estimated tax payment form. This ensures that all electronic signatures and submissions meet state requirements for legal acceptance.

Get more for Azdor govindividual estimated tax payment formIndividual Estimated Tax Payment FormArizona Department Of

- Quitclaim deed two individuals to three individuals florida form

- Quitclaim deed three individuals to husband and wife as joint tenants florida form

- Quitclaim deed four individuals to husband and wife as joint tenants florida form

- 3 1 form

- Florida warranty deed 497303494 form

- Quitclaim deed two individuals to one individual florida form

- Florida code form

- Ucc 1 form

Find out other Azdor govindividual estimated tax payment formIndividual Estimated Tax Payment FormArizona Department Of

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself