Individual Estimated Tax Payment FormArizona Department of 2019

What is the Individual Estimated Tax Payment Form Arizona Department Of

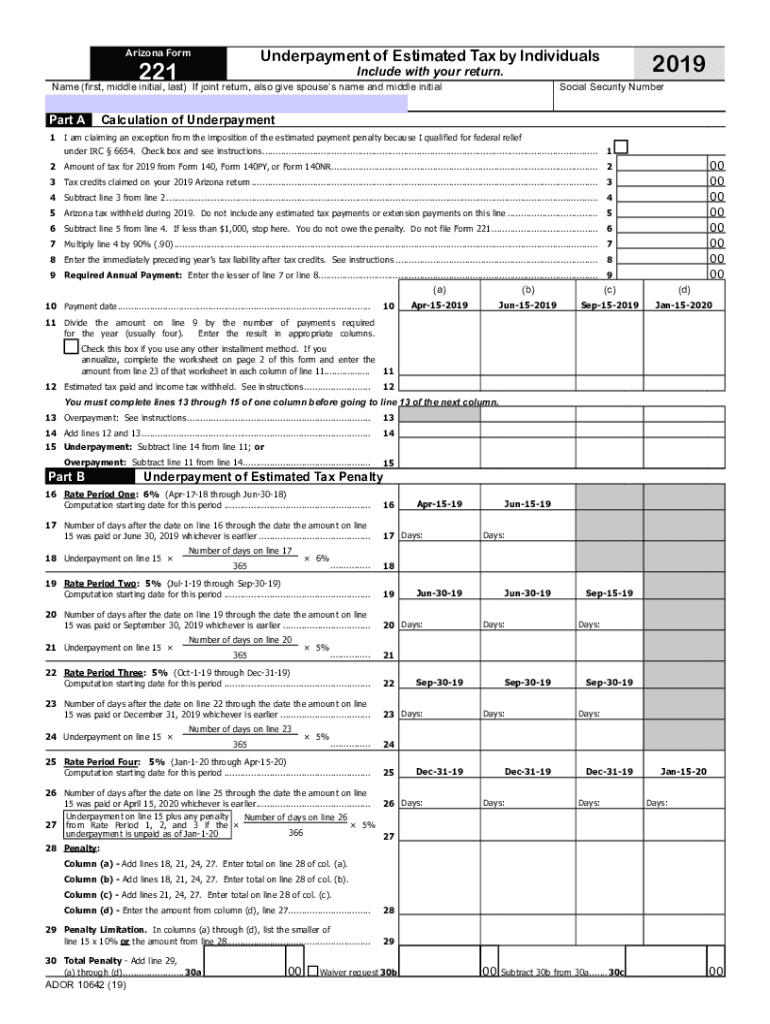

The Individual Estimated Tax Payment Form Arizona Department Of is a crucial document for taxpayers in Arizona who expect to owe tax of $1,000 or more when filing their annual return. This form allows individuals to make estimated tax payments throughout the year, ensuring they meet their tax obligations and avoid penalties. It is particularly important for self-employed individuals, freelancers, and those with income not subject to withholding.

How to use the Individual Estimated Tax Payment Form Arizona Department Of

Using the Individual Estimated Tax Payment Form Arizona Department Of involves several steps. First, determine your expected taxable income for the year to calculate your estimated tax liability. Next, complete the form by providing necessary personal information, including your name, address, and Social Security number. After calculating your payments, submit the form along with your payment to the Arizona Department of Revenue. Ensure you keep a copy of the form for your records.

Steps to complete the Individual Estimated Tax Payment Form Arizona Department Of

Completing the Individual Estimated Tax Payment Form Arizona Department Of requires careful attention to detail. Follow these steps:

- Gather your financial information, including income sources and deductions.

- Calculate your estimated tax liability based on your expected income.

- Fill out the form with your personal details and estimated payment amounts.

- Review the form for accuracy to avoid mistakes.

- Submit the form via the preferred method, either online or by mail, along with your payment.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Individual Estimated Tax Payment Form Arizona Department Of. Generally, estimated tax payments are due quarterly, with deadlines falling on April 15, June 15, September 15, and January 15 of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes, so timely submission is crucial.

Key elements of the Individual Estimated Tax Payment Form Arizona Department Of

The Individual Estimated Tax Payment Form Arizona Department Of includes several key elements that must be completed accurately. These elements typically include:

- Taxpayer identification information, such as name and Social Security number.

- Estimated income and deductions for the year.

- Calculation of the estimated tax owed.

- Payment options and methods for submitting the payment.

Legal use of the Individual Estimated Tax Payment Form Arizona Department Of

The legal use of the Individual Estimated Tax Payment Form Arizona Department Of ensures that taxpayers comply with state tax laws. Proper completion and timely submission of this form help individuals avoid penalties for underpayment and demonstrate good faith in fulfilling tax obligations. It is advisable to retain copies of submitted forms for future reference and to support any claims during tax audits.

Quick guide on how to complete individual estimated tax payment formarizona department of

Complete Individual Estimated Tax Payment FormArizona Department Of effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It presents a flawless eco-friendly substitute to conventional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents promptly without delays. Manage Individual Estimated Tax Payment FormArizona Department Of on any device using airSlate SignNow apps for Android or iOS and enhance any document-based operation today.

How to modify and eSign Individual Estimated Tax Payment FormArizona Department Of with ease

- Find Individual Estimated Tax Payment FormArizona Department Of and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Alter and eSign Individual Estimated Tax Payment FormArizona Department Of and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual estimated tax payment formarizona department of

Create this form in 5 minutes!

How to create an eSignature for the individual estimated tax payment formarizona department of

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the Individual Estimated Tax Payment Form Arizona Department Of?

The Individual Estimated Tax Payment Form Arizona Department Of is a document that individuals use to estimate and pay their state taxes throughout the year. This form is essential for taxpayers who expect to owe additional taxes that are not being withheld from their income. It helps ensure you meet your tax obligations and avoid penalties.

-

How can airSlate SignNow assist with the Individual Estimated Tax Payment Form Arizona Department Of?

airSlate SignNow provides a seamless solution for filling out and eSigning the Individual Estimated Tax Payment Form Arizona Department Of. Our user-friendly platform simplifies the document submission process, ensuring you can easily handle your tax forms from anywhere, at any time. This means less stress and more efficient tax management.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs. While there are costs involved, users find that the benefits of streamlined document management and eSignature capabilities far outweigh the expense. You can choose a plan that suits your budget while effectively managing your Individual Estimated Tax Payment Form Arizona Department Of.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely! airSlate SignNow easily integrates with numerous accounting and tax software systems, making it a perfect companion for managing your Individual Estimated Tax Payment Form Arizona Department Of. This integration allows for a smoother workflow, reducing the time spent on manual data entry and ensuring greater accuracy in your tax submissions.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow is equipped with multiple features tailored for managing tax documents such as template creation, eSignature capabilities, and secure cloud storage. These features enhance the handling of the Individual Estimated Tax Payment Form Arizona Department Of, ensuring that your documents are always accessible and secure. You can efficiently manage deadlines and stay organized for tax season.

-

How secure is the information shared on the Individual Estimated Tax Payment Form Arizona Department Of with airSlate SignNow?

The security of your information is our top priority at airSlate SignNow. We use advanced encryption technology and secure protocols to ensure that all documents, including the Individual Estimated Tax Payment Form Arizona Department Of, are protected. You can trust us to keep your sensitive data safe while you manage your tax obligations.

-

What are the benefits of submitting the Individual Estimated Tax Payment Form Arizona Department Of electronically?

Submitting the Individual Estimated Tax Payment Form Arizona Department Of electronically through airSlate SignNow comes with numerous benefits. It streamlines the process, reduces the risk of errors, and provides instant confirmation of submission. Additionally, it saves time and helps ensure that your payments are made on time, avoiding potential late fees.

Get more for Individual Estimated Tax Payment FormArizona Department Of

- Culvert design form tapered inlet in

- State of hawaii driver license application honolulugov form

- Duplicate temporary lost nameaddress change form

- Pdf application for a drivers license or photo id card wv department form

- St 9 virginia form

- Med 2 virginia dmv form

- State of virginia insurance id card fillable form

- Individual vehicle mileage and fuel report idaho state tax form

Find out other Individual Estimated Tax Payment FormArizona Department Of

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement