4 61 13 Dual Consolidated LossesInternal Revenue Service Form

Understanding Form 8858

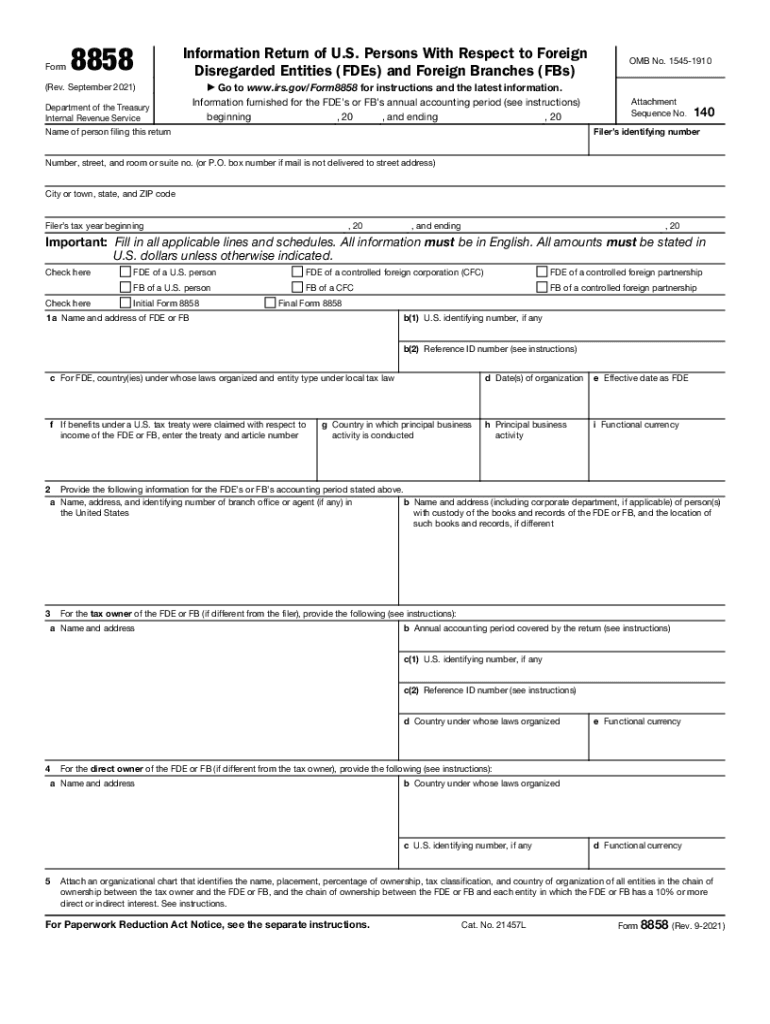

The IRS Form 8858, also known as the Information Return of U.S. Persons With Respect to Foreign Disregarded Entities, is a crucial document for U.S. taxpayers who own foreign disregarded entities. This form is used to report the financial activities of these entities, ensuring compliance with U.S. tax laws. It is essential for taxpayers to understand what constitutes a foreign disregarded entity and the implications of failing to file this form accurately.

Steps to Complete Form 8858

Completing Form 8858 involves several key steps. First, gather all necessary financial information regarding the foreign disregarded entity, including income, expenses, and assets. Next, fill out the form accurately, ensuring that all sections are completed according to IRS guidelines. It is important to pay attention to details, as inaccuracies can lead to penalties. After completing the form, review it thoroughly before submission to confirm all information is correct.

Filing Deadlines for Form 8858

The deadline for filing Form 8858 aligns with the tax return deadline for U.S. taxpayers. Typically, this means it is due on April 15 of the following year. However, if additional time is needed, taxpayers can request an extension, which may extend the deadline by six months. It is vital to adhere to these deadlines to avoid potential penalties for late filing.

Required Documents for Form 8858

When preparing to file Form 8858, certain documents are necessary to ensure compliance. These include financial statements of the foreign disregarded entity, records of income and expenses, and any relevant tax documentation. Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Penalties for Non-Compliance with Form 8858

Failure to file Form 8858 can result in significant penalties. The IRS imposes a penalty of $10,000 for each form not filed or filed late. Additionally, if the failure to file is deemed willful, further penalties may apply. Understanding these consequences underscores the importance of timely and accurate filing to maintain compliance with U.S. tax laws.

Legal Use of Form 8858

Form 8858 serves a legal purpose in the context of U.S. tax compliance. It ensures that U.S. taxpayers report their foreign disregarded entities appropriately, which is essential for accurate tax assessment. The information provided on this form helps the IRS track foreign income and prevent tax evasion, making it a critical component of the U.S. tax system.

Quick guide on how to complete 46113 dual consolidated lossesinternal revenue service

Complete 4 61 13 Dual Consolidated LossesInternal Revenue Service effortlessly on any device

Digital document management has become widely accepted by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly without delays. Manage 4 61 13 Dual Consolidated LossesInternal Revenue Service on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign 4 61 13 Dual Consolidated LossesInternal Revenue Service without hassle

- Find 4 61 13 Dual Consolidated LossesInternal Revenue Service and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 4 61 13 Dual Consolidated LossesInternal Revenue Service and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 46113 dual consolidated lossesinternal revenue service

The best way to make an e-signature for your PDF online

The best way to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is form 8858 and why is it important?

Form 8858 is used by U.S. taxpayers to report information regarding foreign disregarded entities. It's important because it helps the IRS track foreign income and ensures compliance with tax laws. Businesses using airSlate SignNow can simplify the signing process for form 8858, making documentation handling more efficient.

-

How can airSlate SignNow help with completing form 8858?

airSlate SignNow provides an easy-to-use platform for electronic signatures, allowing you to quickly sign and send form 8858. Its features streamline the documentation process, ensuring you don’t miss any essential signatures or deadlines. With airSlate SignNow, managing your tax forms like form 8858 becomes hassle-free.

-

What are the pricing options for airSlate SignNow for businesses dealing with form 8858?

airSlate SignNow offers various pricing plans tailored to businesses of all sizes, making it affordable for managing documents like form 8858. You can choose from monthly or annual subscriptions, which can be adjusted based on your transaction volume. This flexibility ensures businesses can utilize the features they need without overspending.

-

Is airSlate SignNow compliant with tax regulations for form 8858?

Yes, airSlate SignNow is designed to comply with all necessary regulations, ensuring secure and valid electronic signatures for form 8858. Our platform adheres to industry standards, giving you peace of mind that your documents are legally binding. Compliance is crucial, especially for sensitive tax documents like form 8858.

-

What features does airSlate SignNow offer to streamline the signing of form 8858?

airSlate SignNow offers features like customizable templates, bulk sending, and automated reminders to track the signing process for form 8858. These tools enhance efficiency and ensure that all parties are timely notified, helping you to manage your tax documentation effectively. Simplifying the signing process has never been easier.

-

Can I integrate airSlate SignNow with other software for managing form 8858?

Yes, airSlate SignNow integrates seamlessly with various business applications, enabling you to manage documents like form 8858 alongside your existing tools. Whether you use CRM software, accounting platforms, or cloud storage, integration enhances workflow efficiency. This connectivity empowers businesses to streamline their document processes without disruption.

-

How does airSlate SignNow ensure the security of sensitive documents like form 8858?

airSlate SignNow prioritizes security with advanced encryption methods and secure servers to protect documents, including form 8858. We adhere to compliance standards to safeguard your information and maintain your confidentiality throughout the signing process. This focus on security helps businesses feel confident when handling sensitive tax documents.

Get more for 4 61 13 Dual Consolidated LossesInternal Revenue Service

- Sellers information for appraiser provided to buyer georgia

- Subcontractors agreement georgia form

- Option to purchase addendum to residential lease lease or rent to own georgia form

- Georgia prenuptial premarital agreement with financial statements georgia form

- Georgia prenuptial premarital agreement without financial statements georgia form

- Amendment to prenuptial or premarital agreement georgia form

- Financial statements only in connection with prenuptial premarital agreement georgia form

- Misfeasance in public office raw statistics from the form

Find out other 4 61 13 Dual Consolidated LossesInternal Revenue Service

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship