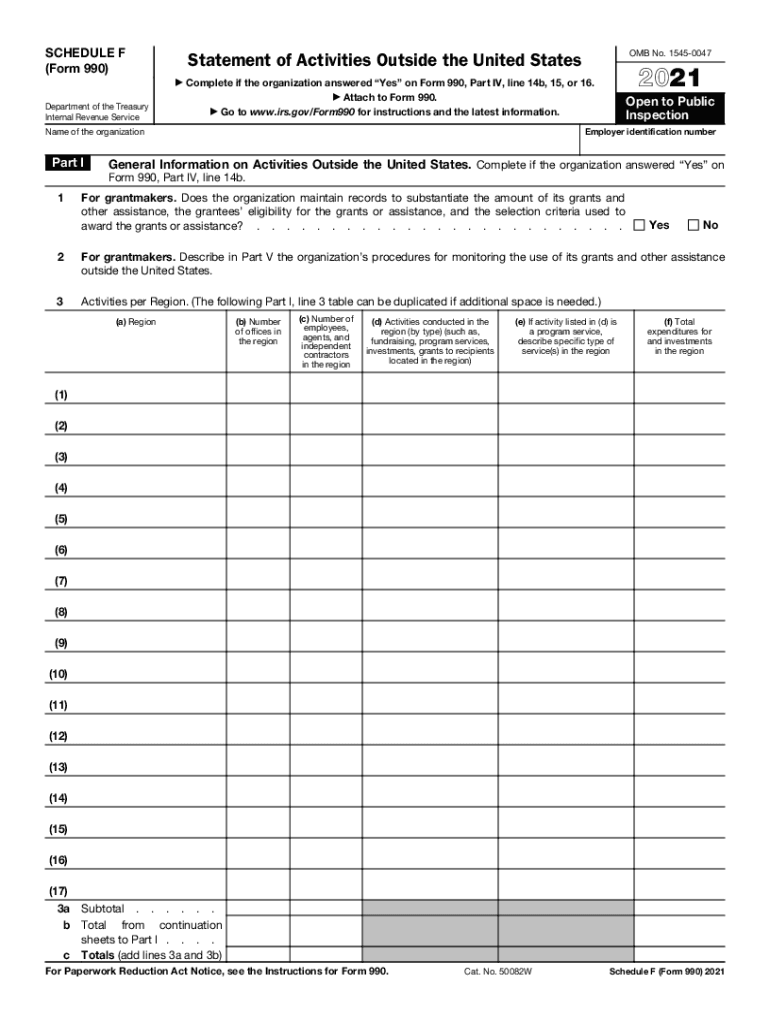

Schedule F Form 990 Statement of Activities Outside the United States 2021

What is the IRS Schedule F?

The IRS Schedule F is a tax form that farmers and ranchers use to report income and expenses related to their farming operations. It is part of the IRS Form 1040 and is specifically designed for individuals who earn income from farming activities. This form allows taxpayers to detail their farm income, which includes sales of livestock, produce, and other farm products, as well as any expenses incurred in the process of farming. Understanding the Schedule F is crucial for accurately reporting farm income and maximizing potential tax deductions.

Key Elements of the IRS Schedule F

Several important components make up the IRS Schedule F. The primary sections include:

- Farm Income: This section captures all income generated from farming activities, including sales of crops and livestock.

- Deductible Farm Expenses: Taxpayers can list various expenses, such as seeds, fertilizers, labor, and equipment costs, which can be deducted from their total income.

- Net Farm Profit or Loss: This is calculated by subtracting total expenses from total income, determining the overall profitability of the farming operation.

Steps to Complete the IRS Schedule F

Completing the IRS Schedule F involves several steps:

- Gather Financial Records: Collect all income statements, receipts, and invoices related to farm operations.

- Fill Out Income Section: Report all sources of farm income, ensuring accuracy in figures.

- Detail Expenses: List all deductible expenses related to farming, categorizing them appropriately.

- Calculate Net Profit or Loss: Subtract total expenses from total income to determine the net result.

- Review for Accuracy: Double-check all entries to ensure compliance with IRS guidelines.

IRS Guidelines for Schedule F

The IRS provides specific guidelines for completing Schedule F. These guidelines emphasize the importance of accuracy and the necessity of supporting documentation for all reported income and expenses. Taxpayers should refer to the IRS instructions for Schedule F to understand eligibility, filing requirements, and any updates to the form. Adhering to these guidelines helps ensure compliance and minimizes the risk of audits or penalties.

Filing Deadlines for Schedule F

Taxpayers must be aware of the filing deadlines associated with the IRS Schedule F. Generally, the form is due on the same date as the individual income tax return, which is April 15 for most taxpayers. However, if an extension is filed, the deadline may be extended to October 15. It is essential to submit the form on time to avoid penalties and interest on any taxes owed.

Form Submission Methods

Taxpayers have several options for submitting the IRS Schedule F. The form can be filed electronically using tax preparation software, which often simplifies the process and ensures accuracy. Alternatively, taxpayers may choose to print the completed form and mail it directly to the IRS. In-person submission is not typically available for individual tax forms. Regardless of the method chosen, ensuring that the form is filed accurately and on time is crucial for compliance.

Quick guide on how to complete 2021 schedule f form 990 statement of activities outside the united states

Complete Schedule F Form 990 Statement Of Activities Outside The United States seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Schedule F Form 990 Statement Of Activities Outside The United States on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Schedule F Form 990 Statement Of Activities Outside The United States with ease

- Obtain Schedule F Form 990 Statement Of Activities Outside The United States and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Modify and eSign Schedule F Form 990 Statement Of Activities Outside The United States and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule f form 990 statement of activities outside the united states

Create this form in 5 minutes!

How to create an eSignature for the 2021 schedule f form 990 statement of activities outside the united states

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the IRS Schedule F and why is it important?

The IRS Schedule F is a tax form used by farmers to report profit or loss from farming activities. It is essential for accurately calculating taxable income and ensuring compliance with IRS regulations related to agricultural businesses.

-

How can airSlate SignNow assist in completing IRS Schedule F?

airSlate SignNow simplifies the process of completing IRS Schedule F by allowing users to easily send and eSign necessary documents. This streamlines the workflow, enabling farmers to efficiently manage their paperwork and stay organized for tax season.

-

What features does airSlate SignNow offer for tax preparation?

airSlate SignNow offers features like secure eSigning, automated workflows, and easy document sharing that can enhance the preparation of IRS Schedule F. These tools make it easier to gather signatures and collaborate with accountants or tax professionals.

-

Is airSlate SignNow cost-effective for small farmers managing IRS Schedule F?

Yes, airSlate SignNow is designed to be budget-friendly, making it an ideal solution for small farmers who need to complete IRS Schedule F without incurring high costs. The subscription plans are competitively priced, providing excellent value for essential eSignature services.

-

Can I integrate airSlate SignNow with accounting software for IRS Schedule F?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing users to streamline their documentation processes related to IRS Schedule F. This integration helps ensure that all relevant financial data is easily accessible and up to date.

-

How secure is airSlate SignNow when handling documents for IRS Schedule F?

airSlate SignNow prioritizes security with advanced encryption and compliance standards, ensuring that sensitive information related to IRS Schedule F is protected. Users can sign and send documents with confidence, knowing their data is secure.

-

What devices can I use to access airSlate SignNow for IRS Schedule F?

You can access airSlate SignNow from any device, including smartphones, tablets, and computers. This flexibility is crucial for farmers needing to manage their IRS Schedule F documentation on the go, ensuring that they can work from anywhere.

Get more for Schedule F Form 990 Statement Of Activities Outside The United States

- Agreement no children 497303918 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts where 497303919 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts effective 497303920 form

- Georgia limited form

- Georgia protective order form

- Living trust for husband and wife with no children georgia form

- Georgia living trust form

- Living trust for individual who is single divorced or widow or widower with children georgia form

Find out other Schedule F Form 990 Statement Of Activities Outside The United States

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online