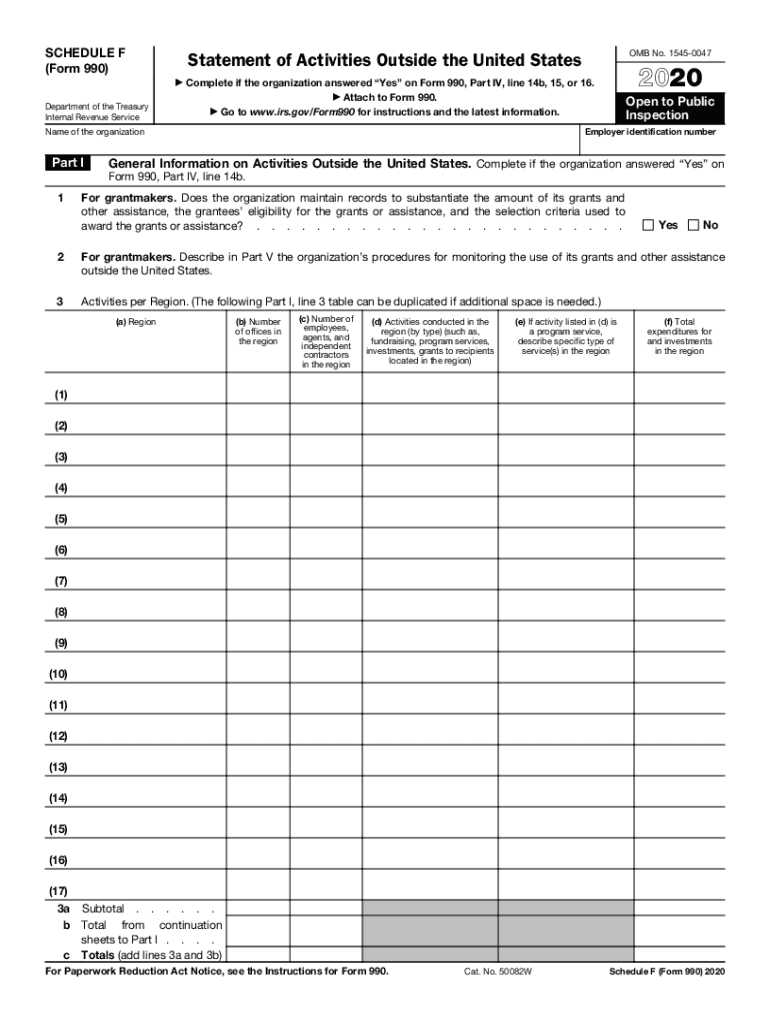

Schedule F Form 990 Statement of Activities Outside the United States 2020

Understanding the Schedule F Form 990 Statement of Activities Outside the United States

The Schedule F Form 990 is a crucial document for organizations engaged in activities outside the United States. This form provides detailed information about the organization’s international operations, including financial data and descriptions of activities conducted abroad. It is essential for non-profits to accurately report these activities to ensure compliance with IRS regulations and maintain transparency with stakeholders. The form helps in assessing the impact of foreign activities on the overall mission of the organization.

Steps to Complete the Schedule F Form 990 Statement of Activities Outside the United States

Completing the Schedule F Form 990 involves several key steps. First, gather all necessary financial records related to international activities, including income, expenses, and any grants received or given. Next, accurately fill out each section of the form, ensuring that all figures are correctly reported. Pay special attention to the descriptions of activities, as these must clearly outline the purpose and impact of the organization’s work abroad. Finally, review the completed form for accuracy before submission to avoid potential penalties.

IRS Guidelines for the Schedule F Form 990 Statement of Activities Outside the United States

The IRS provides specific guidelines for completing the Schedule F Form 990. Organizations must adhere to these guidelines to ensure compliance. Key elements include reporting all foreign income and expenses, detailing the nature of activities conducted outside the U.S., and providing information about foreign grants. Organizations should also be aware of the requirements for disclosure, including any relationships with foreign entities. Following IRS guidelines helps maintain the integrity of the reporting process and supports the organization’s mission.

Filing Deadlines for the Schedule F Form 990 Statement of Activities Outside the United States

It is important for organizations to be aware of the filing deadlines for the Schedule F Form 990. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due on May fifteenth. If additional time is needed, organizations can file for an extension, which allows for an additional six months to complete the submission. Adhering to these deadlines is crucial to avoid penalties and maintain good standing with the IRS.

Legal Use of the Schedule F Form 990 Statement of Activities Outside the United States

The Schedule F Form 990 is legally binding and must be used in accordance with IRS regulations. Organizations are required to provide truthful and accurate information regarding their activities outside the United States. Failure to comply with these legal requirements can result in significant penalties, including fines and loss of tax-exempt status. Therefore, it is essential for organizations to understand the legal implications of their reporting and ensure that all information submitted is complete and accurate.

Examples of Using the Schedule F Form 990 Statement of Activities Outside the United States

Organizations may use the Schedule F Form 990 to report various activities conducted abroad. For instance, a non-profit that provides educational resources in developing countries would detail the funding received and expenses incurred in those initiatives. Similarly, an organization involved in international disaster relief would report on the financial support provided to affected regions. These examples illustrate the diverse ways in which the Schedule F Form 990 can be utilized to convey the impact of an organization’s work on a global scale.

Quick guide on how to complete 2020 schedule f form 990 statement of activities outside the united states

Effortlessly Prepare Schedule F Form 990 Statement Of Activities Outside The United States on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without issues. Manage Schedule F Form 990 Statement Of Activities Outside The United States on any device using the airSlate SignNow Android or iOS apps and simplify any document-related process today.

How to Modify and eSign Schedule F Form 990 Statement Of Activities Outside The United States with Ease

- Obtain Schedule F Form 990 Statement Of Activities Outside The United States and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule F Form 990 Statement Of Activities Outside The United States and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule f form 990 statement of activities outside the united states

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule f form 990 statement of activities outside the united states

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is a 990 schedule a 2012 form?

The 990 schedule a 2012 form is a tax form used by nonprofit organizations to report financial information to the IRS. It specifically details their activities, fundraising, and expenses during the fiscal year. Understanding and accurately completing this form is crucial for compliance and transparency.

-

How can airSlate SignNow assist with filing the 990 schedule a 2012 form?

airSlate SignNow simplifies the process of preparing and submitting the 990 schedule a 2012 form by allowing users to electronically sign and send documents securely. This streamlines collaboration among team members and ensures documents are submitted efficiently and on time.

-

Is there a cost associated with using airSlate SignNow for the 990 schedule a 2012 form?

Yes, airSlate SignNow offers a range of pricing plans tailored to fit different business needs. Each plan provides access to features that can simplify the eSigning process for documents like the 990 schedule a 2012 form. Check our pricing page for detailed information on monthly or annual subscriptions.

-

What features does airSlate SignNow offer for managing the 990 schedule a 2012 form?

With airSlate SignNow, users benefit from features such as document templates, custom branding, audit trails, and real-time notifications. These tools enhance the management of the 990 schedule a 2012 form, ensuring accuracy and facilitating easy follow-ups on submissions.

-

Can airSlate SignNow integrate with accounting software for the 990 schedule a 2012 form?

Yes, airSlate SignNow integrates seamlessly with various accounting software, enabling easier data sharing and document management for the 990 schedule a 2012 form. This integration helps streamline processes, making it easier to keep track of financial activities throughout the year.

-

What are the benefits of using airSlate SignNow for eSigning the 990 schedule a 2012 form?

Using airSlate SignNow for eSigning the 990 schedule a 2012 form enhances security, compliance, and ease of use. The platform offers a legally binding eSignature, which not only saves time but also provides a clear audit trail for future reference.

-

How secure is airSlate SignNow when handling the 990 schedule a 2012 form?

airSlate SignNow employs advanced security measures including encryption and secure servers to protect sensitive information such as the 990 schedule a 2012 form. Our platform adheres to industry standards, ensuring that your data remains safe and confidential throughout the signing process.

Get more for Schedule F Form 990 Statement Of Activities Outside The United States

- Renovation contractor package wyoming form

- Concrete mason contractor package wyoming form

- Demolition contractor package wyoming form

- Security contractor package wyoming form

- Insulation contractor package wyoming form

- Paving contractor package wyoming form

- Site work contractor package wyoming form

- Siding contractor package wyoming form

Find out other Schedule F Form 990 Statement Of Activities Outside The United States

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document