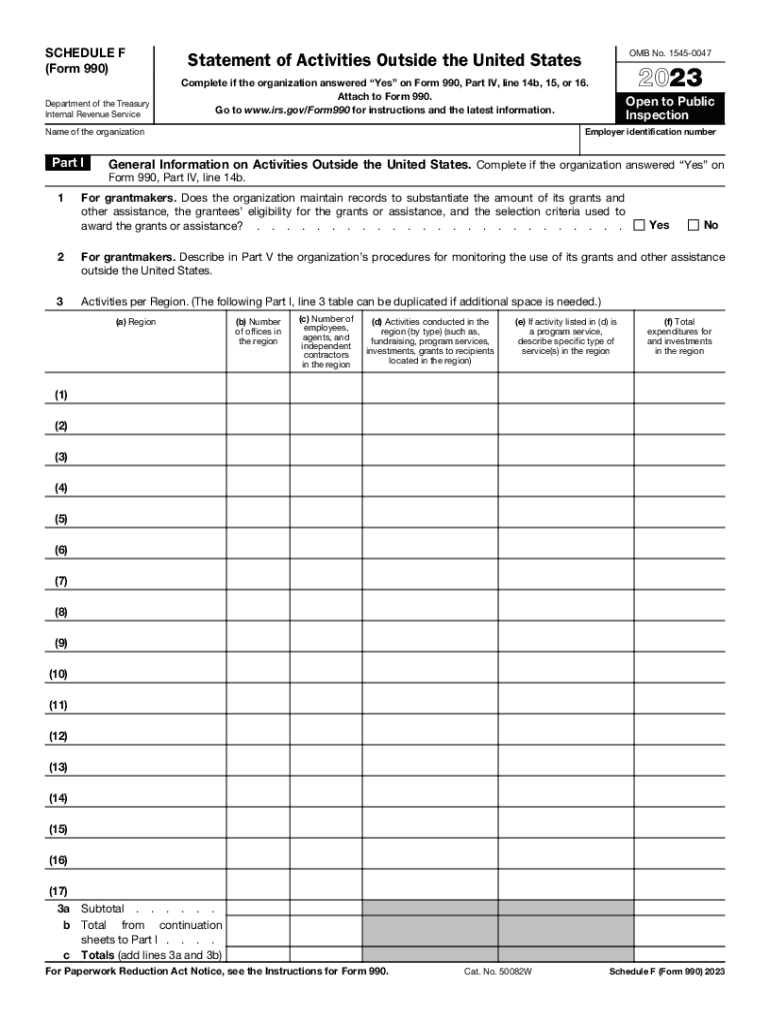

Irs Schedule F 2023-2026

What is the IRS Schedule F?

The IRS Schedule F is a tax form used by farmers to report income and expenses related to farming activities. This form is essential for individuals who operate a farm as a sole proprietorship or as a partnership. Schedule F allows farmers to detail their income from farming operations, as well as the deductible expenses incurred during the tax year. This form is filed alongside the IRS Form 1040, which is the standard individual income tax return.

How to Use the IRS Schedule F

Using the IRS Schedule F involves several steps. First, gather all relevant financial documents, including records of income and expenses related to farming. Next, complete the form by entering your gross income from farming in Part I. In Part II, list your deductible expenses, which may include costs for feed, seeds, equipment, and other farming-related expenditures. Finally, calculate your net profit or loss by subtracting total expenses from total income. This figure will then be transferred to your Form 1040.

Steps to Complete the IRS Schedule F

Completing the IRS Schedule F requires careful attention to detail. Here are the key steps:

- Gather all income documentation from farming activities.

- Document all farming-related expenses, ensuring to keep receipts and records.

- Fill out Part I with your gross income from farming.

- In Part II, list all deductible expenses, categorizing them as necessary.

- Calculate your net profit or loss and ensure accuracy.

- Transfer the net figure to your Form 1040.

Key Elements of the IRS Schedule F

Understanding the key elements of the IRS Schedule F is crucial for accurate reporting. The form consists of two main parts:

- Part I: This section is for reporting income, including sales of livestock, produce, and other farm products.

- Part II: This section is dedicated to reporting expenses, such as feed, fertilizer, and other operational costs.

Additionally, farmers may need to provide detailed explanations for certain expenses, ensuring compliance with IRS guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Schedule F align with the standard tax filing deadlines. Typically, individual tax returns, including Schedule F, are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for farmers to keep track of these dates to avoid penalties and ensure timely submission of their tax returns.

Required Documents

To complete the IRS Schedule F accurately, several documents are necessary:

- Income statements from farming activities.

- Receipts for all deductible expenses.

- Bank statements related to farming income and expenses.

- Any additional documentation that supports claims made on the form.

Having these documents organized will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Penalties for Non-Compliance

Failure to comply with IRS regulations regarding the Schedule F can result in significant penalties. These may include fines for late filing, inaccuracies in reporting income or expenses, and potential audits. It is crucial for farmers to ensure that all information is accurate and submitted on time to avoid these penalties. Keeping thorough records and seeking professional assistance when needed can help mitigate risks associated with non-compliance.

Quick guide on how to complete irs schedule f

Effortlessly Prepare Irs Schedule F on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Irs Schedule F on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Irs Schedule F with ease

- Obtain Irs Schedule F and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choosing. Modify and eSign Irs Schedule F and ensure effective communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs schedule f

Create this form in 5 minutes!

How to create an eSignature for the irs schedule f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule F 2015?

Schedule F 2015 is a tax form used by farmers and ranchers to report their income and expenses. It enables agricultural businesses to effectively document their earnings and deductible costs, ensuring compliance with IRS standards. Understanding how to fill it out correctly can help in maximizing your tax benefits.

-

How can airSlate SignNow assist with Schedule F 2015 documents?

airSlate SignNow provides a seamless way to eSign and manage your Schedule F 2015 documents digitally. The platform allows you to create, send, and store important tax documents securely, making the entire process more efficient for your business. With our user-friendly interface, you can easily coordinate with your tax professionals.

-

What are the benefits of using airSlate SignNow for Schedule F 2015?

Using airSlate SignNow for your Schedule F 2015 gives you a cost-effective and straightforward way to handle documents. Our solution simplifies the eSigning process, enhances collaboration, and reduces the risk of error by ensuring that forms are correctly filled and securely shared. It also saves you time, allowing you to focus on your agricultural business.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore our features for managing your Schedule F 2015 documents. This includes access to our eSigning capabilities and document management tools, helping you determine how our platform can meet your business needs. You can start your trial easily on our website.

-

Can I integrate airSlate SignNow with accounting software for my Schedule F 2015?

Absolutely! airSlate SignNow offers integrations with various accounting software, making it easier to manage your Schedule F 2015 and other tax-related documents. This feature allows for streamlined data sharing, which reduces the chance of errors and enhances efficiency during tax preparation.

-

What features should I look for when managing Schedule F 2015 documents?

When managing Schedule F 2015 documents, look for features like eSigning, document security, and customizable templates in a platform like airSlate SignNow. These features will facilitate smoother workflows, enhance security, and ensure that your tax documentation meets all necessary requirements. Additionally, notifications and tracking can help you stay organized.

-

How does airSlate SignNow ensure the security of my Schedule F 2015 documents?

airSlate SignNow prioritizes the security of your Schedule F 2015 documents with advanced encryption and strict data protection protocols. Our platform complies with industry regulations, providing peace of mind that your sensitive information is safely stored and shared. You also have control over who can access and edit your documents.

Get more for Irs Schedule F

- Da 7432 form

- Da 7574 form

- Sniper qualification firing table vi stationary and moving known distance targets m110 day dos with the tmr and anpvs 26 da form

- M240 qualification card form

- Family member status chra fe korea army form

- Fort leavenworth tax office form

- Dd form 2088 statement of ecclesiastical endorsement march 2004 vko va ngb army

- Da form 5646

Find out other Irs Schedule F

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form