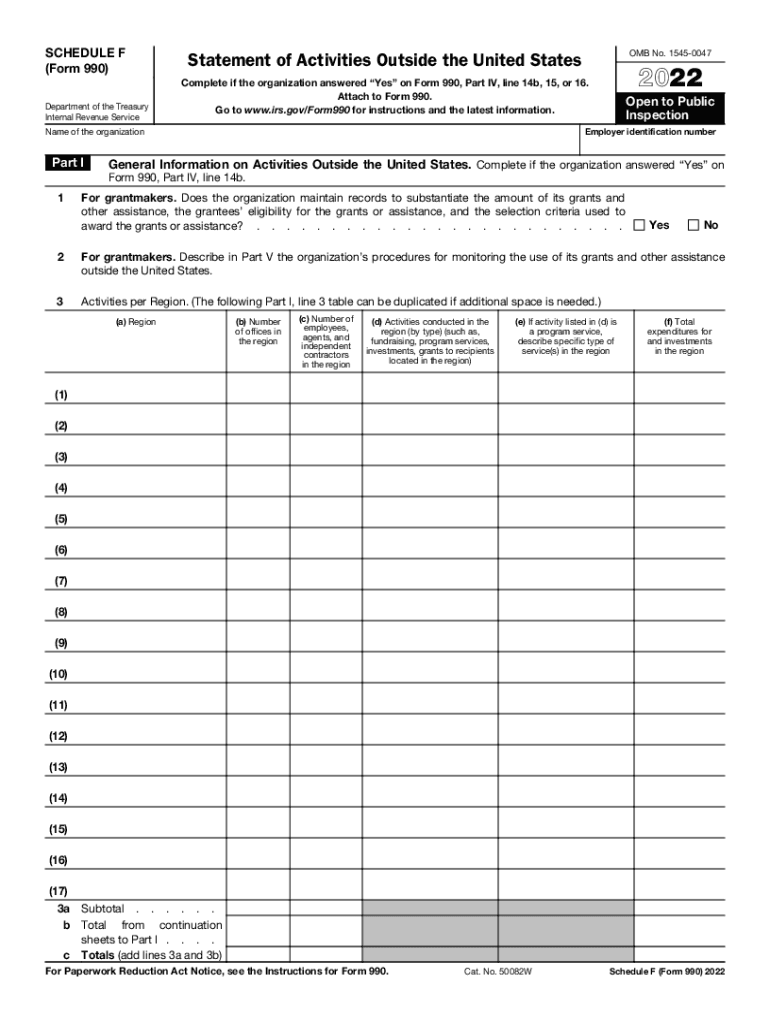

Www Coursehero Comfile155033365f990sf PDF SCHEDULE F Form 990 Department of the Treasury 2022

What is the 2017 Schedule F tax form?

The 2017 Schedule F tax form is a supplemental form used by farmers and ranchers to report income and expenses related to farming activities. This form is part of the IRS Form 1040 series and is specifically designed for individuals who earn income from farming. It allows taxpayers to detail their deductible farm expenses, which can include costs related to feed, seed, fertilizer, and other operational expenses. Properly completing the Schedule F is essential for accurately reporting income and ensuring compliance with IRS regulations.

Steps to complete the 2017 Schedule F

Completing the 2017 Schedule F involves several key steps:

- Gather documentation: Collect all relevant financial records, including receipts for farm expenses and records of income received from farming activities.

- Fill out income section: Report all income earned from farming on the form, including sales of livestock, crops, and other farm products.

- Detail expenses: List all deductible expenses associated with farming operations. This includes costs for supplies, labor, equipment, and maintenance.

- Calculate net profit or loss: Subtract total expenses from total income to determine your net profit or loss from farming.

- Review and sign: Ensure all information is accurate before signing and dating the form. This step is critical for legal compliance.

IRS Guidelines for Schedule F

The IRS provides specific guidelines for completing the Schedule F form. These guidelines include instructions on what constitutes deductible expenses, how to report income, and the necessary documentation required to support claims. It is important to refer to the latest IRS publications and instructions to ensure compliance with current tax laws. Understanding these guidelines can help taxpayers avoid common pitfalls and ensure that their filings are accurate and complete.

Filing deadlines for the 2017 Schedule F

The filing deadline for the 2017 Schedule F aligns with the general tax filing deadline for individual taxpayers. Typically, this deadline is April 15 of the following year, unless it falls on a weekend or holiday. If additional time is needed, taxpayers can file for an extension, which generally provides an extra six months to submit their tax returns. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Legal use of the 2017 Schedule F

The 2017 Schedule F is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal standing, taxpayers must provide accurate information and maintain supporting documentation for all reported income and expenses. Electronic signatures and submissions are accepted, provided they comply with the relevant eSignature laws, such as the ESIGN Act and UETA, which govern the validity of electronic documents in the United States.

Required documents for completing Schedule F

To accurately complete the 2017 Schedule F, several documents are typically required:

- Income records: Documentation of all income received from farming activities, such as sales receipts and invoices.

- Expense records: Receipts and invoices for all farm-related expenses, including supplies, labor, and equipment.

- Previous tax returns: Access to prior year returns can provide useful context and help ensure consistency in reporting.

- Bank statements: Statements can help verify income and expenses related to farming operations.

Quick guide on how to complete wwwcourseherocomfile155033365f990sfpdf schedule f form 990 department of the treasury

Complete Www coursehero comfile155033365f990sf pdf SCHEDULE F Form 990 Department Of The Treasury effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides all the features necessary to create, modify, and electronically sign your documents swiftly without delays. Administer Www coursehero comfile155033365f990sf pdf SCHEDULE F Form 990 Department Of The Treasury on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Www coursehero comfile155033365f990sf pdf SCHEDULE F Form 990 Department Of The Treasury without any hassle

- Locate Www coursehero comfile155033365f990sf pdf SCHEDULE F Form 990 Department Of The Treasury and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which only takes seconds and has the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Www coursehero comfile155033365f990sf pdf SCHEDULE F Form 990 Department Of The Treasury and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwcourseherocomfile155033365f990sfpdf schedule f form 990 department of the treasury

Create this form in 5 minutes!

People also ask

-

What is the 2017 Schedule F and how does it relate to airSlate SignNow?

The 2017 Schedule F is a tax form used by farmers and fishermen to report income and expenses from farming operations. airSlate SignNow enables users to easily sign and send necessary documents related to the 2017 Schedule F, streamlining the process of tax submission and making it simpler for professionals in the agriculture sector.

-

What features does airSlate SignNow offer for managing 2017 Schedule F documents?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure storage which are beneficial for handling 2017 Schedule F documents. You can easily create, sign, and send these forms electronically, reducing the risk of errors and enhancing efficiency during the tax filing process.

-

Is there a cost associated with using airSlate SignNow for 2017 Schedule F forms?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. By investing in a plan, users gain access to all the features necessary for managing the 2017 Schedule F, ensuring a cost-effective solution for eSigning and document management.

-

How can airSlate SignNow benefit my business in relation to the 2017 Schedule F?

Using airSlate SignNow can signNowly streamline your business's document processes related to the 2017 Schedule F. With easy eSigning and storage options, you’ll improve compliance, save time, and reduce costs, allowing you to focus on your business operations rather than paperwork.

-

Does airSlate SignNow integrate with other platforms for managing 2017 Schedule F documents?

Yes, airSlate SignNow integrates seamlessly with various software platforms, such as CRMs and cloud storage services. This ensures that you can easily manage your 2017 Schedule F documents alongside other business operations, enhancing overall productivity.

-

Can I collaborate with others on my 2017 Schedule F using airSlate SignNow?

Absolutely! airSlate SignNow allows for real-time collaboration on your 2017 Schedule F documents. You can invite team members to review, eSign, or add comments, making it easy to work together even when you're not in the same location.

-

Is airSlate SignNow secure for handling sensitive 2017 Schedule F information?

Yes, airSlate SignNow prioritizes security, utilizing encryption and compliance measures to protect your 2017 Schedule F data. You can trust that your sensitive information is safe while using our platform for your document needs.

Get more for Www coursehero comfile155033365f990sf pdf SCHEDULE F Form 990 Department Of The Treasury

- Living trust for husband and wife with one child new york form

- Living trust for husband and wife with minor and or adult children new york form

- Ny trust form

- Living trust property record new york form

- Financial account transfer to living trust new york form

- Assignment to living trust new york form

- Notice of assignment to living trust new york form

- Revocation of living trust new york form

Find out other Www coursehero comfile155033365f990sf pdf SCHEDULE F Form 990 Department Of The Treasury

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online