Instructions for Form 941 Rev December Instructions for Form 941, Employer's QUARTERLY Federal Tax Return 2021

What is the 941 quarterly report?

The 941 quarterly report, officially known as the Employer's Quarterly Federal Tax Return, is a form used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for employers to accurately report their tax liabilities to the Internal Revenue Service (IRS) on a quarterly basis. It helps ensure compliance with federal tax regulations and provides a clear record of the taxes owed and paid.

Steps to complete the 941 quarterly report

Completing the 941 quarterly report involves several key steps:

- Gather necessary information, including total wages paid, tips received, and other compensation.

- Calculate the total taxes withheld for income, Social Security, and Medicare.

- Complete the form by entering the calculated figures in the appropriate sections.

- Review the form for accuracy, ensuring all figures match your payroll records.

- Submit the completed form to the IRS by the specified deadline.

Filing deadlines for the 941 quarterly report

Employers must adhere to specific filing deadlines for the 941 quarterly report. The form is due on the last day of the month following the end of each quarter. The deadlines are as follows:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Legal use of the 941 quarterly report

The 941 quarterly report is legally required for employers who withhold taxes from employee wages. Failing to file this form can result in penalties and interest on unpaid taxes. It is crucial for employers to ensure that the information provided is accurate and complete to avoid legal complications. The form serves as a record of compliance with federal tax laws, which can be reviewed by the IRS during audits.

Key elements of the 941 quarterly report

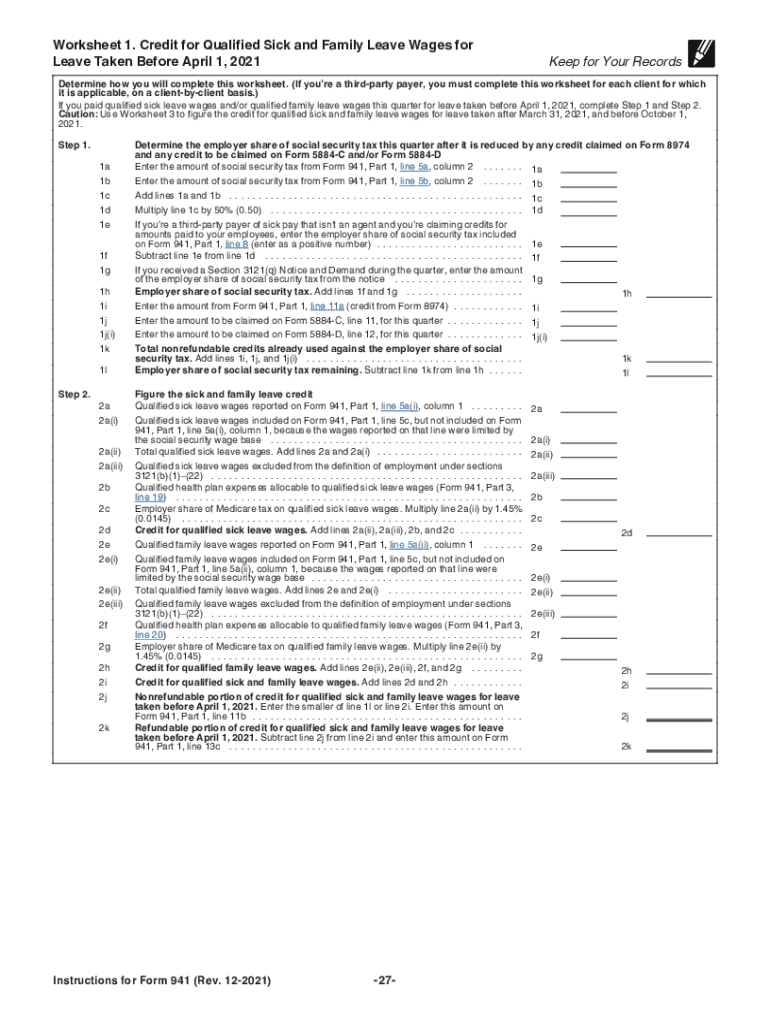

Several key elements must be included in the 941 quarterly report:

- Total wages paid to employees during the quarter

- Amount of federal income tax withheld

- Social Security and Medicare taxes withheld

- Employer's share of Social Security and Medicare taxes

- Adjustments for any overreported or underreported amounts from previous quarters

Form submission methods for the 941 quarterly report

Employers can submit the 941 quarterly report through various methods:

- Electronically via the IRS e-file system, which is the preferred method for faster processing.

- By mail, sending the completed form to the designated IRS address based on the employer's location.

- In-person at local IRS offices, although this method is less common.

Quick guide on how to complete instructions for form 941 rev december 2021 instructions for form 941 employers quarterly federal tax return

Effortlessly Prepare Instructions For Form 941 Rev December Instructions For Form 941, Employer's QUARTERLY Federal Tax Return on Any Device

Digital document management has risen in popularity among businesses and individuals alike. It offers a sustainable alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly, without delays. Manage Instructions For Form 941 Rev December Instructions For Form 941, Employer's QUARTERLY Federal Tax Return on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The Easiest Way to Modify and Electronically Sign Instructions For Form 941 Rev December Instructions For Form 941, Employer's QUARTERLY Federal Tax Return with Ease

- Find Instructions For Form 941 Rev December Instructions For Form 941, Employer's QUARTERLY Federal Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious searches for forms, or errors that require new document prints. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Edit and electronically sign Instructions For Form 941 Rev December Instructions For Form 941, Employer's QUARTERLY Federal Tax Return to ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 941 rev december 2021 instructions for form 941 employers quarterly federal tax return

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 941 rev december 2021 instructions for form 941 employers quarterly federal tax return

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an e-signature right from your mobile device

How to create an e-signature for a PDF file on iOS

How to create an e-signature for a PDF on Android devices

People also ask

-

What is a 941 quarterly report and why is it important?

The 941 quarterly report is a crucial form used by employers to report payroll taxes and calculate federal income tax withheld from employees. It provides the IRS with a comprehensive view of your employment tax liabilities, helping to ensure compliance and avoid penalties. Understanding how to properly complete the 941 quarterly report is essential for accurate tax reporting.

-

How does airSlate SignNow simplify the process of preparing a 941 quarterly report?

airSlate SignNow simplifies the preparation of your 941 quarterly report by allowing you to easily send, eSign, and store your tax documents securely. With its user-friendly interface, you can manage all your forms electronically, reducing the need for physical paperwork. This streamlined process helps save you time and minimizes the risk of errors.

-

Is airSlate SignNow cost-effective for managing 941 quarterly reports?

Yes, airSlate SignNow is a cost-effective solution for managing your 941 quarterly reports. With flexible pricing plans, businesses can choose a subscription that fits their budget while gaining access to powerful features like eSignature and document tracking. This affordability ensures you can maintain compliance without breaking the bank.

-

What features does airSlate SignNow offer for handling 941 quarterly reports?

airSlate SignNow offers a variety of features specifically designed to assist with your 941 quarterly reports. Key features include easy eSigning, document management, and template creation, which allow you to efficiently manage your payroll tax documents. These tools not only simplify the process but also ensure accuracy and compliance with IRS regulations.

-

Can I integrate airSlate SignNow with my existing accounting software for 941 quarterly reports?

Absolutely! airSlate SignNow offers integrations with several popular accounting and payroll software solutions, making it easy to sync your data for 941 quarterly reports. This integration streamlines the reporting process, ensuring that your tax information is up-to-date and accurate, ultimately saving you time and effort.

-

How secure is my data when using airSlate SignNow for 941 quarterly reports?

Data security is a top priority at airSlate SignNow. Your documents are protected with bank-level encryption and secure cloud storage, ensuring that your 941 quarterly reports are safeguarded against unauthorized access. This commitment to security provides peace of mind, knowing that your sensitive tax information is well-protected.

-

How can airSlate SignNow help with compliance regarding the 941 quarterly report?

airSlate SignNow helps ensure compliance with the 941 quarterly report by providing tools and resources to simplify the form completion process. Automatic reminders and document tracking features prevent missed deadlines and ensure accurate submissions, helping your business maintain compliance with IRS regulations. This proactive approach minimizes the risk of fines or penalties.

Get more for Instructions For Form 941 Rev December Instructions For Form 941, Employer's QUARTERLY Federal Tax Return

- Buyers home inspection checklist hawaii form

- Sellers information for appraiser provided to buyer hawaii

- Subcontractors agreement hawaii form

- Option to purchase addendum to residential lease lease or rent to own hawaii form

- Hawaii prenuptial premarital agreement with financial statements hawaii form

- Hawaii prenuptial form

- Amendment to prenuptial or premarital agreement hawaii form

- Demande de passeport express form

Find out other Instructions For Form 941 Rev December Instructions For Form 941, Employer's QUARTERLY Federal Tax Return

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter