Form 941 2020

What is the Form 941

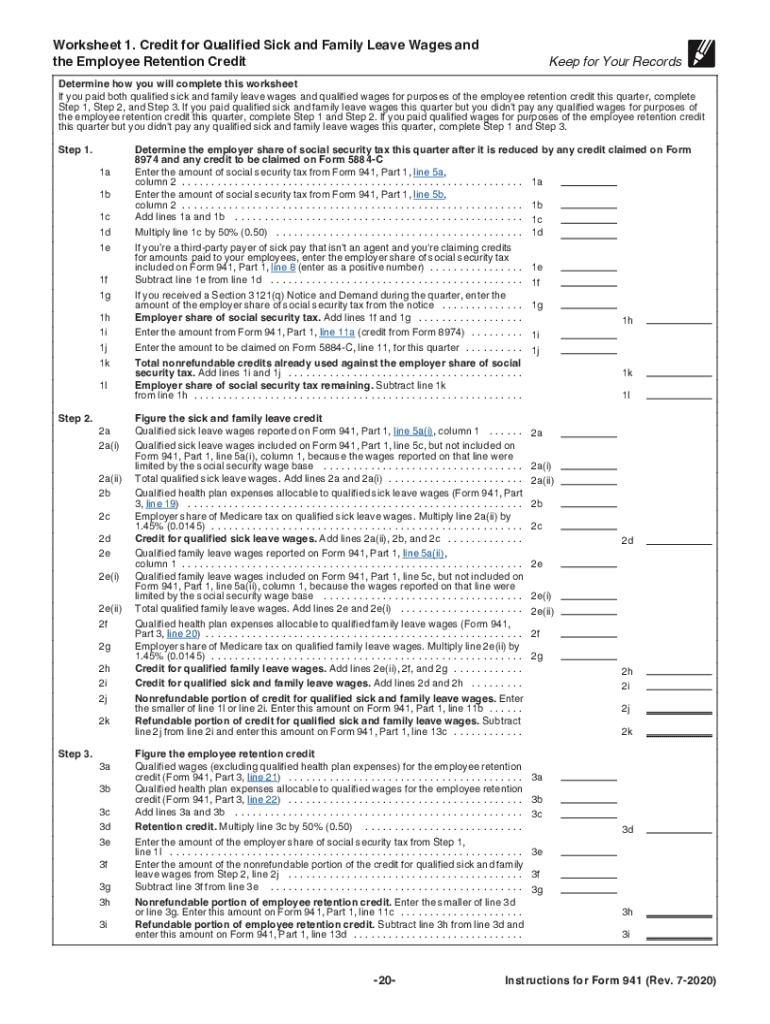

The Form 941, officially known as the Employer's Quarterly Federal Tax Return, is a crucial document used by employers in the United States to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is filed quarterly and is essential for ensuring compliance with federal tax obligations. It provides the IRS with information regarding the taxes owed by the employer and the amounts withheld from employees' paychecks.

Steps to complete the Form 941

Completing the Form 941 involves several steps to ensure accurate reporting. First, gather all necessary payroll information for the quarter, including total wages paid, tips, and other compensation. Next, calculate the total taxes owed, which includes federal income tax withheld, Social Security tax, and Medicare tax. After that, fill out the form by entering the required information in the appropriate sections. Finally, review the completed form for accuracy before submitting it to the IRS. It is important to keep a copy for your records.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing Form 941. The form is due on the last day of the month following the end of each quarter. For example, the deadlines for 2020 are as follows:

- 1st Quarter: April 30, 2020

- 2nd Quarter: July 31, 2020

- 3rd Quarter: October 31, 2020

- 4th Quarter: January 31, 2021

Employers who fail to file by these deadlines may face penalties, so it is crucial to stay informed about these dates.

Legal use of the Form 941

The legal use of Form 941 is governed by IRS regulations. Employers must file this form to report and pay employment taxes accurately. Failure to do so can result in penalties and interest on unpaid taxes. Additionally, the information reported on Form 941 is used by the IRS to verify compliance with federal tax laws. It is essential for employers to ensure that the form is completed correctly and submitted on time to maintain legal compliance.

How to obtain the Form 941

Employers can obtain the Form 941 from the IRS website, where it is available for download in a fillable format. Additionally, the form can be requested through various tax software programs that support IRS filings. It is advisable to use the most recent version of the form to ensure compliance with current tax laws and regulations.

Key elements of the Form 941

Form 941 consists of several key elements that employers must complete accurately. These include:

- Employer identification information, such as name and address

- Number of employees and total wages paid

- Taxes withheld for federal income, Social Security, and Medicare

- Adjustments for any overreported amounts from previous quarters

- Signature of an authorized person certifying the information

Each of these elements is critical for the accurate reporting of employment taxes and compliance with IRS requirements.

Quick guide on how to complete 2018 form 941

Finalize Form 941 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Manage Form 941 on any platform using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to alter and eSign Form 941 without any hassle

- Obtain Form 941 and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize essential sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 941 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form 941

Create this form in 5 minutes!

How to create an eSignature for the 2018 form 941

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the 941 quarterly report 2020 and why is it important?

The 941 quarterly report 2020 is a tax document that employers use to report payroll taxes withheld from employees' paychecks. It's crucial for compliance with federal tax obligations, as it reflects the taxes due for each quarter. Accurate reporting helps avoid penalties and ensures that your business remains in good standing.

-

How can airSlate SignNow help with my 941 quarterly report 2020?

AirSlate SignNow streamlines the process of gathering signatures and sending documents related to your 941 quarterly report 2020. Our easy-to-use platform allows you to eSign and securely share documents, making the filing process quicker and more efficient. Experience a hassle-free way to manage your tax documents.

-

What features does airSlate SignNow offer for managing tax documents like the 941 quarterly report 2020?

AirSlate SignNow offers features such as customizable templates, eSignature capabilities, and secure cloud storage to help manage your 941 quarterly report 2020 effectively. With our intuitive interface, you can easily share and track documents, ensuring that all parties are up to date. Plus, our platform is accessible from any device.

-

Is airSlate SignNow cost-effective for handling documents like the 941 quarterly report 2020?

Yes, airSlate SignNow provides a cost-effective solution for businesses managing documents such as the 941 quarterly report 2020. With competitive pricing plans, you can reduce overhead costs associated with printing and mailing physical documents. Save time and money while maintaining compliance with tax regulations.

-

Can I integrate airSlate SignNow with my existing tools for handling the 941 quarterly report 2020?

Absolutely! AirSlate SignNow integrates seamlessly with various platforms including accounting software and CRMs, making it easier to manage your 941 quarterly report 2020 alongside your other business processes. These integrations enhance workflow efficiency and ensure accurate data transfer.

-

What are the benefits of using airSlate SignNow for the 941 quarterly report 2020?

Using airSlate SignNow for the 941 quarterly report 2020 provides benefits such as enhanced security, reduced processing time, and greater accuracy in document management. Our platform ensures your sensitive tax information is securely shared and stored, while also simplifying the eSignature process for stakeholders.

-

How secure is my data when using airSlate SignNow for sensitive documents like the 941 quarterly report 2020?

At airSlate SignNow, we prioritize the security of your data. Our platform employs industry-leading encryption and compliance measures to protect your documents, including the 941 quarterly report 2020, from unauthorized access. You can trust that your sensitive information is safe with us.

Get more for Form 941

Find out other Form 941

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer