Form 4506 T EZ Rev 11 Short Form Request for Individual Tax Return Transcript 2021

What is the Form 4506-T EZ?

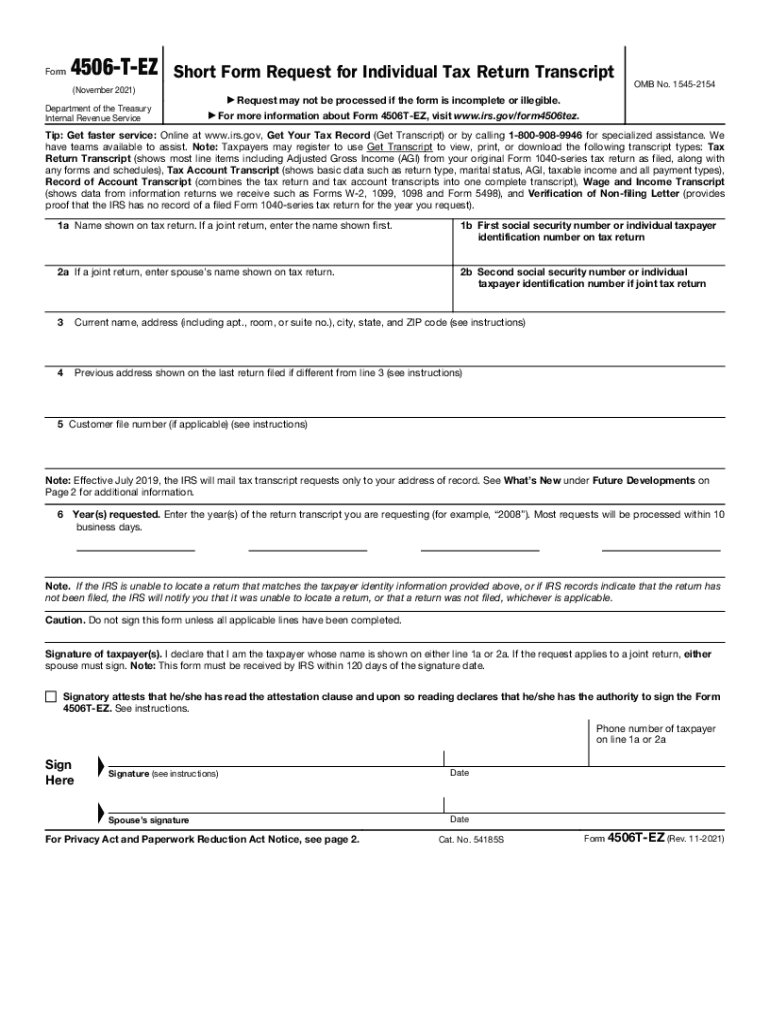

The IRS Form 4506-T EZ, officially known as the Short Form Request for Individual Tax Return Transcript, is a simplified version of the standard Form 4506-T. This form allows taxpayers to request a transcript of their tax return information directly from the Internal Revenue Service (IRS). It is particularly useful for individuals who need to verify their income for purposes such as applying for a loan, mortgage, or financial aid. The form can be used to obtain transcripts for specific tax years, making it a vital resource for those needing to provide proof of income.

How to Use the Form 4506-T EZ

Using the Form 4506-T EZ is straightforward. Taxpayers must fill out the form with their personal information, including name, address, and Social Security number. They will also need to specify the type of transcript required and the tax years for which they are requesting information. Once completed, the form can be submitted to the IRS either by mail or electronically, depending on the submission options available. It is essential to ensure that all information is accurate to avoid delays in processing.

Steps to Complete the Form 4506-T EZ

Completing the Form 4506-T EZ involves several key steps:

- Provide personal details: Enter your name, address, and Social Security number accurately.

- Select the type of transcript: Indicate whether you need a tax return transcript or an account transcript.

- Specify tax years: Clearly list the years for which you are requesting transcripts.

- Sign and date the form: Ensure that you sign the form to validate your request.

- Submit the form: Choose to send it via mail or electronically, according to your preference.

Legal Use of the Form 4506-T EZ

The Form 4506-T EZ is legally recognized as a valid request for tax return transcripts. When properly filled out and submitted, it allows taxpayers to obtain official documentation from the IRS. This form is often required by lenders and financial institutions to verify income and tax filing status. Compliance with IRS guidelines ensures that the information obtained through this form can be used for legal and financial purposes, such as loan applications or audits.

Required Documents for Submission

When submitting the Form 4506-T EZ, certain documents may be required to support your request. Typically, you should have:

- A valid form of identification, such as a driver's license or state ID.

- Any previous tax returns or documents that may assist in verifying your identity.

- Proof of address if it differs from the address on your tax return.

Having these documents ready can expedite the processing of your request and ensure compliance with IRS requirements.

Form Submission Methods

The Form 4506-T EZ can be submitted through various methods, including:

- By Mail: Print the completed form and send it to the appropriate IRS address based on your location.

- Electronically: Some tax software programs offer the option to submit the form electronically, which can speed up the process.

Choosing the right submission method can affect the time it takes to receive your tax transcripts, so consider your needs when deciding how to send the form.

Quick guide on how to complete form 4506 t ez rev 11 2021 short form request for individual tax return transcript

Complete Form 4506 T EZ Rev 11 Short Form Request For Individual Tax Return Transcript effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Manage Form 4506 T EZ Rev 11 Short Form Request For Individual Tax Return Transcript on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Form 4506 T EZ Rev 11 Short Form Request For Individual Tax Return Transcript with minimal effort

- Find Form 4506 T EZ Rev 11 Short Form Request For Individual Tax Return Transcript and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and eSign Form 4506 T EZ Rev 11 Short Form Request For Individual Tax Return Transcript and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4506 t ez rev 11 2021 short form request for individual tax return transcript

Create this form in 5 minutes!

How to create an eSignature for the form 4506 t ez rev 11 2021 short form request for individual tax return transcript

How to create an e-signature for a PDF document online

How to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an e-signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the IRS Form 4506T EZ used for?

The IRS Form 4506T EZ is primarily used to request a transcript of a tax return. This simplified version allows individuals to easily obtain their tax information from the IRS without the need to provide additional documentation.

-

How can I use airSlate SignNow to sign the IRS Form 4506T EZ?

With airSlate SignNow, you can easily upload, fill out, and eSign the IRS Form 4506T EZ digitally. Our platform streamlines the process, ensuring your form is legally binding and securely stored.

-

Is airSlate SignNow compatible with the IRS Form 4506T EZ?

Yes, airSlate SignNow is fully compatible with the IRS Form 4506T EZ. You can efficiently complete and submit the form online, making it convenient for both individuals and businesses.

-

What are the benefits of using airSlate SignNow for the IRS Form 4506T EZ?

Using airSlate SignNow for the IRS Form 4506T EZ provides convenience, security, and efficiency. You can fill out the form from anywhere, reduce processing time, and ensure that your information is protected.

-

Are there any fees associated with using airSlate SignNow for the IRS Form 4506T EZ?

Yes, airSlate SignNow offers competitive pricing for its services, including the eSigning of the IRS Form 4506T EZ. You can choose from various plans that cater to individual users or teams, ensuring a solution that fits your budget.

-

Can I integrate airSlate SignNow with other software for the IRS Form 4506T EZ?

Absolutely! airSlate SignNow integrates with various applications, streamlining your workflow when handling the IRS Form 4506T EZ. This allows you to automate processes and enhance productivity.

-

What features does airSlate SignNow offer for eSigning IRS Form 4506T EZ?

airSlate SignNow provides a range of eSigning features for the IRS Form 4506T EZ, including customizable templates, real-time tracking, and notifications. These features make the signing process efficient and user-friendly.

Get more for Form 4506 T EZ Rev 11 Short Form Request For Individual Tax Return Transcript

- Letter from tenant to landlord with demand that landlord repair floors stairs or railings hawaii form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises hawaii form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles hawaii form

- Letter from tenant to landlord about landlords failure to make repairs hawaii form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497304385 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession hawaii form

- Letter from tenant to landlord about illegal entry by landlord hawaii form

- Letter from landlord to tenant about time of intent to enter premises hawaii form

Find out other Form 4506 T EZ Rev 11 Short Form Request For Individual Tax Return Transcript

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer