Form 4506T EZ October Short Form Request for Individual Tax Return Transcript Makinghomeaffordable 2009

What is the Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable

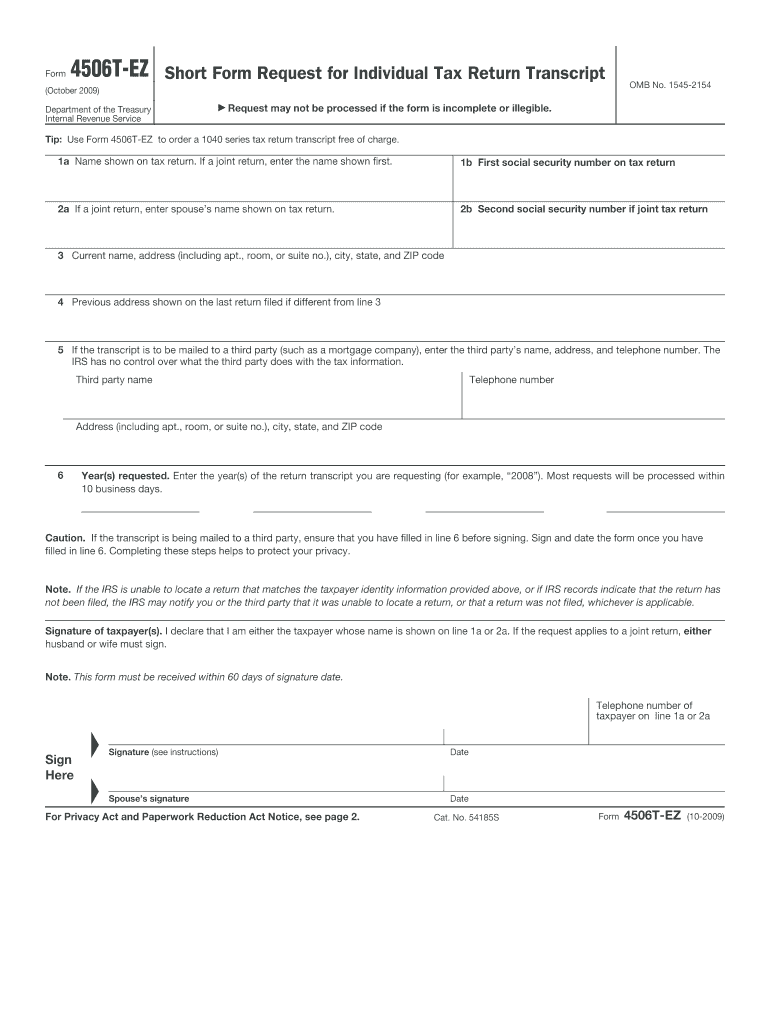

The Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable is a simplified version of the standard Form 4506-T. It allows individuals to request their tax return transcripts from the Internal Revenue Service (IRS) for specific years. This form is particularly useful for those seeking to verify income for mortgage applications or other financial purposes, especially under the Making Home Affordable program. By providing essential information, taxpayers can obtain their transcripts quickly and efficiently.

How to use the Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable

Using the Form 4506T EZ involves a straightforward process. First, ensure you have the correct version of the form, which can be downloaded from the IRS website. Fill in your personal details, including your name, Social Security number, and the address used on your last tax return. Specify the type of transcript needed and the years for which you are requesting information. After completing the form, you can submit it either by mail or electronically, depending on your preference and the requirements of the institution requesting the transcript.

Steps to complete the Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable

Completing the Form 4506T EZ requires careful attention to detail. Follow these steps:

- Download the form from the IRS website.

- Provide your full name and Social Security number in the designated fields.

- Enter your current address and the address used on your last tax return.

- Select the type of transcript you need, typically the tax return transcript.

- Indicate the tax years for which you are requesting transcripts.

- Sign and date the form to validate your request.

Legal use of the Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable

The Form 4506T EZ is legally recognized as a valid request for tax return transcripts. It complies with IRS regulations, ensuring that the information provided is secure and used appropriately. When filled out correctly, this form allows financial institutions and other authorized entities to access your tax information, which is crucial for processes like loan applications. It is important to ensure that all information is accurate to avoid delays or complications in obtaining your transcripts.

IRS Guidelines

The IRS provides specific guidelines for the use of the Form 4506T EZ. These guidelines include instructions on who can request transcripts, the types of transcripts available, and the necessary identification required. It is essential to follow these guidelines closely to ensure compliance and to facilitate the processing of your request. The IRS also outlines the expected timeframes for receiving transcripts, which can vary based on the method of submission.

Required Documents

To complete the Form 4506T EZ, you must have certain documents ready. These typically include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- The address used on your last tax return.

- Details of the tax years for which you are requesting transcripts.

Having these documents on hand will streamline the process and help ensure that your request is processed without issues.

Quick guide on how to complete form 4506t ez october 2009 short form request for individual tax return transcript makinghomeaffordable

Complete Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable effortlessly

- Locate Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or a link invitation, or download it to your computer.

Eliminate lost or misplaced files, time-consuming form retrieval, and errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4506t ez october 2009 short form request for individual tax return transcript makinghomeaffordable

Create this form in 5 minutes!

How to create an eSignature for the form 4506t ez october 2009 short form request for individual tax return transcript makinghomeaffordable

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

How to make an eSignature for a PDF file on Android devices

People also ask

-

What is the Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable?

The Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable is a simplified document used by individuals to request a transcript of their tax returns. This form is particularly valuable for those looking to verify income for mortgage or loan applications, especially under programs like Making Home Affordable.

-

How do I fill out the Form 4506T EZ October Short Form Request?

Filling out the Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable involves entering personal information such as your name, Social Security number, and the tax year for which you are requesting the transcript. airSlate SignNow provides intuitive templates to help streamline the completion process.

-

What are the benefits of using airSlate SignNow for Form 4506T EZ October Short Form Request?

Using airSlate SignNow for the Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable offers a convenient, electronic method to manage document signing and storage. This means faster processing times, enhanced security features, and easier tracking of your submission status.

-

Is there a fee to use airSlate SignNow for the Form 4506T EZ October Short Form?

While submitting the Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable to the IRS may have associated costs, using airSlate SignNow itself is generally budget-friendly. Our pricing structure is designed to provide value for users who need eSigning solutions, often with flexible plans to suit various needs.

-

Can I integrate airSlate SignNow with other applications for processing the Form 4506T EZ?

Yes, airSlate SignNow can seamlessly integrate with various applications to facilitate the processing of the Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable. This enables you to streamline workflows by connecting to platforms such as CRM systems, project management tools, and accounting software.

-

What features does airSlate SignNow offer for handling tax forms like Form 4506T EZ?

airSlate SignNow includes features such as easy document creation, secure eSigning, real-time tracking, and customizable templates specifically for forms like the Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable. These features enhance user experience and efficiency.

-

How quickly can I obtain my tax transcript using the Form 4506T EZ October Short Form?

The processing time for the Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable can vary based on the IRS workload. However, using airSlate SignNow can speed up your submission process, often resulting in quicker processing times compared to traditional mailing methods.

Get more for Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable

Find out other Form 4506T EZ October Short Form Request For Individual Tax Return Transcript Makinghomeaffordable

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF