Form 4506 T EZ Rev 6 Short Form Request for Individual Tax Return Transcript 2023

What is the Form 4506-T EZ?

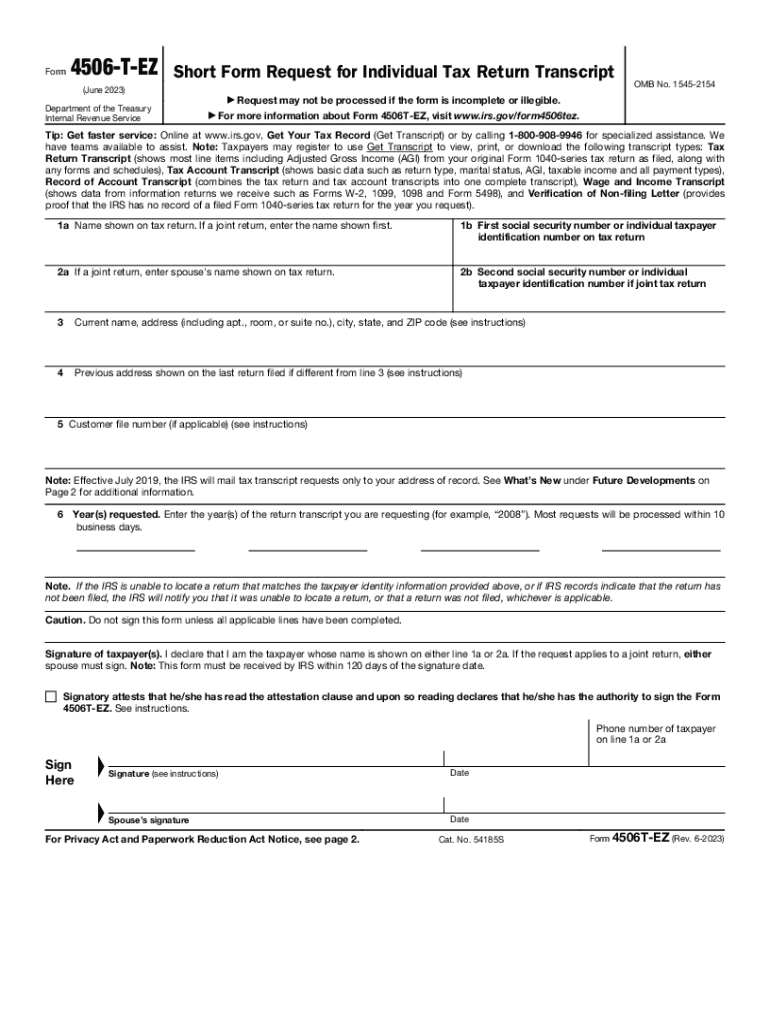

The Form 4506-T EZ is a simplified version of the standard Form 4506-T, designed specifically for individuals requesting a transcript of their tax returns from the Internal Revenue Service (IRS). This form allows taxpayers to obtain a copy of their tax return transcript, which is often necessary for various financial applications, including loans, mortgages, and other verification processes. The EZ version streamlines the request process, making it easier for individuals to access their tax information without unnecessary complexity.

How to Use the Form 4506-T EZ

Using the Form 4506-T EZ involves a straightforward process. Taxpayers need to fill out the form with their personal information, including their name, Social Security number, and the address used on their last tax return. The form also requires the year or years for which the transcript is being requested. Once completed, the form can be submitted to the IRS either by mail or electronically, depending on the submission options available. It is crucial to ensure that all information is accurate to prevent delays in processing the request.

Steps to Complete the Form 4506-T EZ

Completing the Form 4506-T EZ requires careful attention to detail. Here are the steps to follow:

- Provide your full name and Social Security number in the designated fields.

- Enter your current address and the address used on your last tax return, if different.

- Indicate the specific tax years for which you are requesting transcripts.

- Sign and date the form to validate your request.

- Submit the form to the IRS through the appropriate channel, either by mail or electronically.

Legal Use of the Form 4506-T EZ

The Form 4506-T EZ is legally recognized as a valid request for tax return transcripts. It complies with IRS regulations and can be used for various purposes, including verifying income for loan applications or financial aid. When properly completed and submitted, the form ensures that taxpayers can access their tax information securely and efficiently, maintaining compliance with federal tax laws.

Required Documents for Submission

When submitting the Form 4506-T EZ, it is essential to have certain documents prepared to facilitate the process. While the form itself does not require additional documentation, having your previous tax returns on hand can help ensure that the information provided is accurate. Additionally, if you are submitting the form on behalf of someone else, you may need to include a power of attorney or other authorization documents to validate your request.

Form Submission Methods

The Form 4506-T EZ can be submitted to the IRS through multiple methods. Taxpayers can choose to mail the completed form to the appropriate IRS address based on their location. Alternatively, some taxpayers may have the option to submit the form electronically through the IRS website or authorized e-filing services. It is important to check the IRS guidelines for the most current submission methods and any associated processing times.

Eligibility Criteria for Using the Form 4506-T EZ

To use the Form 4506-T EZ, taxpayers must meet specific eligibility criteria. This form is intended for individual taxpayers who need to request their own tax return transcripts. It is not suitable for businesses or entities seeking transcripts on behalf of others. Additionally, the request must pertain to tax years for which the IRS has records available. Ensuring that you meet these criteria will help streamline the process and avoid complications.

Quick guide on how to complete form 4506 t ez rev 6 short form request for individual tax return transcript

Complete Form 4506 T EZ Rev 6 Short Form Request For Individual Tax Return Transcript effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle Form 4506 T EZ Rev 6 Short Form Request For Individual Tax Return Transcript on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Form 4506 T EZ Rev 6 Short Form Request For Individual Tax Return Transcript with ease

- Locate Form 4506 T EZ Rev 6 Short Form Request For Individual Tax Return Transcript and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Alter and eSign Form 4506 T EZ Rev 6 Short Form Request For Individual Tax Return Transcript to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4506 t ez rev 6 short form request for individual tax return transcript

Create this form in 5 minutes!

How to create an eSignature for the form 4506 t ez rev 6 short form request for individual tax return transcript

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ez t tax and how does it work?

ez t tax is a streamlined tax preparation solution designed to simplify the filing process. With airSlate SignNow, users can easily send and eSign their tax documents, ensuring compliance and efficiency. The platform integrates seamlessly with your existing workflows to enhance productivity during tax season.

-

How much does ez t tax cost?

The pricing for ez t tax is designed to be affordable and competitive. Users can choose from various plans, including premium features for enhanced functionality. Check our website for the latest pricing options and any available promotions that can help you save on your tax preparation.

-

What features does ez t tax offer?

ez t tax comes with a suite of features, including online document signing, automated reminders, and secure storage options. These tools help simplify the entire tax filing process for individuals and businesses alike. Additionally, airSlate SignNow’s intuitive interface ensures that you can navigate easily while managing your tax documents.

-

How can ez t tax benefit small businesses?

For small businesses, ez t tax provides a cost-effective way to manage tax documentation and eSigning. With its user-friendly features, you can save time and reduce the stress associated with tax season. Furthermore, the integration with airSlate SignNow helps small businesses maintain compliance while focusing on growth and operations.

-

Is ez t tax customizable?

Yes, ez t tax offers customization options to fit the specific needs of users. You can tailor the template selections and workflows to align with your unique tax preparation process. This flexibility ensures that you are not only compliant but also making the most efficient use of your time and resources.

-

Does ez t tax integrate with other software?

Absolutely! ez t tax can be seamlessly integrated with various accounting and document management software. This integration allows for smooth data transfer, reducing the chances of errors and streamlining your overall tax preparation workflow using airSlate SignNow.

-

How secure is my information with ez t tax?

Security is a top priority for ez t tax. The airSlate SignNow platform employs advanced encryption and authentication methods to safeguard your sensitive tax information. Rest assured that your data is protected at all times, allowing you to focus on what matters most—getting your taxes done.

Get more for Form 4506 T EZ Rev 6 Short Form Request For Individual Tax Return Transcript

- Consent form and corporal punishment

- Da pubs form

- Elders insurance claim form

- Short form awi vpk 03s attendance verification 09 21 doc m jpeg s m e earlylearningcoalitionsarasota

- Henrico county sports physical form

- Usfj form 178 r

- Cable television in the united states form

- Ldss 3152 nyc rev 410 office of temporary and disability otda ny form

Find out other Form 4506 T EZ Rev 6 Short Form Request For Individual Tax Return Transcript

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service