Publication 962 Rev 10 Life's a Little Easier with EITC 2017

What is the Publication 962 Rev 10 Life's A Little Easier With EITC

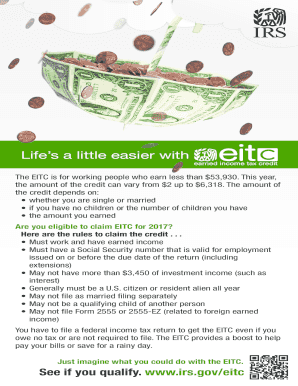

The Publication 962 Rev 10 Life's A Little Easier With EITC is a resource provided by the IRS that outlines the Earned Income Tax Credit (EITC) and its eligibility criteria. This publication serves to assist taxpayers in understanding how to claim the EITC, which is designed to benefit low to moderate-income working individuals and families. It provides detailed information on income limits, qualifying children, and filing requirements, making it an essential guide for those looking to maximize their tax benefits.

How to use the Publication 962 Rev 10 Life's A Little Easier With EITC

Using the Publication 962 Rev 10 Life's A Little Easier With EITC involves several steps. First, review the eligibility criteria to determine if you qualify for the EITC based on your income and family situation. Next, gather necessary documentation, such as proof of income and Social Security numbers for qualifying children. The publication also guides you on how to fill out the relevant tax forms, ensuring you accurately report your income and claim the credit. Finally, follow the instructions for submitting your tax return, whether electronically or by mail.

Steps to complete the Publication 962 Rev 10 Life's A Little Easier With EITC

Completing the Publication 962 Rev 10 Life's A Little Easier With EITC requires a systematic approach:

- Review the eligibility criteria outlined in the publication.

- Collect all necessary documentation, including W-2 forms and identification numbers.

- Fill out the appropriate tax forms, ensuring you include all relevant information.

- Double-check your calculations and ensure all required fields are completed.

- Submit your completed tax return by the designated deadline.

Legal use of the Publication 962 Rev 10 Life's A Little Easier With EITC

The legal use of the Publication 962 Rev 10 Life's A Little Easier With EITC is crucial for ensuring compliance with IRS regulations. This publication provides guidelines that help taxpayers understand their rights and responsibilities when claiming the EITC. It is important to follow the instructions carefully to avoid penalties or audits. The publication also outlines the legal requirements for documentation and verification, ensuring that taxpayers can substantiate their claims if needed.

Eligibility Criteria

Eligibility for the EITC as described in the Publication 962 Rev 10 Life's A Little Easier With EITC is based on several factors:

- Filing status: Must be single, married filing jointly, head of household, or qualifying widow(er).

- Income limits: Must meet specific income thresholds that vary based on filing status and number of qualifying children.

- Qualifying children: Must have children who meet age, relationship, and residency requirements.

- Investment income: Must not exceed a certain limit to qualify for the credit.

IRS Guidelines

The IRS guidelines provided in the Publication 962 Rev 10 Life's A Little Easier With EITC are essential for understanding the application process. These guidelines clarify how to calculate the EITC, including the specific forms and schedules needed. They also provide information on how to report income and claim the credit correctly. Adhering to these guidelines helps ensure that taxpayers receive the benefits they are entitled to while remaining compliant with tax laws.

Quick guide on how to complete publication 962 rev 10 2017 lifes a little easier with eitc

Manage Publication 962 Rev 10 Life's A Little Easier With EITC easily on any device

Digital document handling has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any hold-ups. Process Publication 962 Rev 10 Life's A Little Easier With EITC on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign Publication 962 Rev 10 Life's A Little Easier With EITC with ease

- Locate Publication 962 Rev 10 Life's A Little Easier With EITC and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it onto your computer.

Wave goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Publication 962 Rev 10 Life's A Little Easier With EITC and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 962 rev 10 2017 lifes a little easier with eitc

Create this form in 5 minutes!

How to create an eSignature for the publication 962 rev 10 2017 lifes a little easier with eitc

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is Publication 962 Rev 10 Life's A Little Easier With EITC?

Publication 962 Rev 10 Life's A Little Easier With EITC is a comprehensive resource designed to help taxpayers navigate the Earned Income Tax Credit (EITC). This publication outlines eligibility requirements, benefits, and filing instructions, making it an essential guide for individuals looking to optimize their tax returns and take advantage of EITC.

-

How does airSlate SignNow assist with utilizing Publication 962 Rev 10 Life's A Little Easier With EITC?

airSlate SignNow streamlines the document signing and e-filing process, enabling users to quickly access and complete forms related to Publication 962 Rev 10 Life's A Little Easier With EITC. This ensures that all necessary documents are signed, maintained, and filed efficiently, minimizing delays in tax preparation.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow provides a range of features including secure eSigning, document templates, automated workflows, and seamless cloud storage. With these tools, handling complex tax documents, including those related to Publication 962 Rev 10 Life's A Little Easier With EITC, becomes straightforward and stress-free.

-

Is the pricing for airSlate SignNow affordable for small businesses?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses. With plans that include access to essential features for managing documents related to Publication 962 Rev 10 Life's A Little Easier With EITC, users can find a solution that fits their budget and needs.

-

Can I integrate airSlate SignNow with other software used for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with popular tax preparation software and other business tools. This integration capability enhances functionality when working with documents tied to Publication 962 Rev 10 Life's A Little Easier With EITC, making processes smoother and more efficient.

-

What are the benefits of using airSlate SignNow for managing Publication 962 Rev 10 Life's A Little Easier With EITC related documents?

Using airSlate SignNow for managing Publication 962 Rev 10 Life's A Little Easier With EITC related documents allows for quick turnaround times, enhanced security for sensitive information, and increased collaboration capabilities. Additionally, users can easily track the entire signing process for peace of mind.

-

How secure is the information shared through airSlate SignNow?

airSlate SignNow takes security very seriously. With advanced encryption methods and compliance with industry standards, users can trust that any documents related to Publication 962 Rev 10 Life's A Little Easier With EITC are safeguarded, ensuring confidentiality and compliance.

Get more for Publication 962 Rev 10 Life's A Little Easier With EITC

- Tenant rental lease agreement form

- In name change form

- Indiana name change instructions and forms package for a minor indiana

- Name change instructions and forms package for a family indiana

- In name change indiana form

- Verified name change form

- Indiana name change form

- Affidavit of publication for name change indiana form

Find out other Publication 962 Rev 10 Life's A Little Easier With EITC

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors