Gross Receipts Tax Form1 Xlsx Read Only 2021

Understanding the Gross Receipts Tax Form

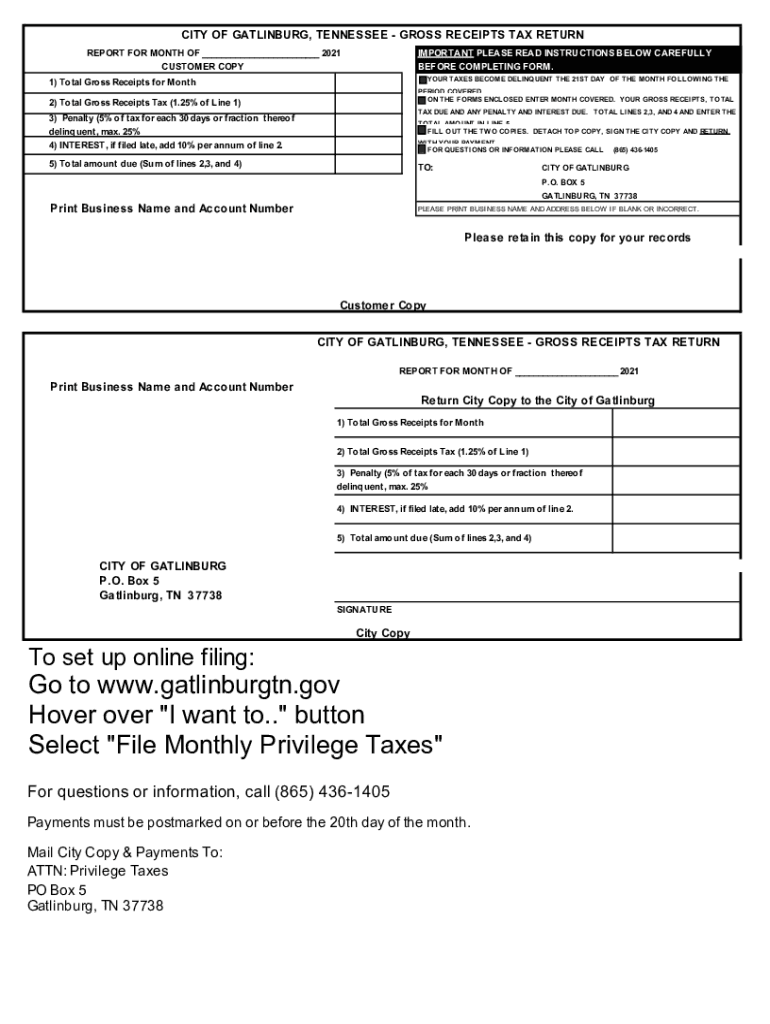

The gross receipts tax form is a crucial document for businesses operating within certain jurisdictions, including the city of Gatlinburg. This form is used to report the total revenue generated by a business, which is then subject to taxation. The gross receipts tax is typically levied on the total sales made by a business, regardless of the cost of goods sold or expenses incurred. Understanding the purpose and requirements of this form is essential for compliance and accurate tax reporting.

Steps to Complete the Gross Receipts Tax Form

Completing the gross receipts tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial records, including sales receipts and invoices. Next, accurately calculate your total gross receipts for the reporting period. Fill out the form by entering your total gross receipts in the designated fields. Ensure that you include any necessary documentation that supports your reported figures. Finally, review the form for errors before submission to avoid potential penalties.

Filing Deadlines and Important Dates

Filing deadlines for the gross receipts tax form can vary by jurisdiction. It is important to be aware of the specific dates to avoid late penalties. Generally, businesses must submit their gross receipts tax form annually or quarterly, depending on their revenue levels. Check with the local tax authority for the exact deadlines applicable to your business. Mark these dates on your calendar to ensure timely filing and compliance.

Required Documents for Submission

When submitting the gross receipts tax form, certain documents may be required to support your reported figures. Commonly required documents include sales records, invoices, and any relevant financial statements. These documents help verify the accuracy of your gross receipts and ensure compliance with local tax regulations. Keeping organized records will facilitate a smoother filing process and reduce the risk of errors.

Penalties for Non-Compliance

Failure to comply with gross receipts tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand their obligations and ensure timely and accurate filing of the gross receipts tax form. Regularly reviewing your compliance status can help mitigate risks associated with non-compliance.

Digital vs. Paper Version of the Form

Businesses have the option to complete the gross receipts tax form either digitally or on paper. The digital version often offers advantages such as ease of use, faster submission, and automatic calculations. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is essential to ensure that all information is accurately reported and that the form is submitted by the deadline.

Quick guide on how to complete gross receipts tax form1xlsx read only

Complete Gross Receipts Tax Form1 xlsx Read Only effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, since you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Gross Receipts Tax Form1 xlsx Read Only on any device using airSlate SignNow's Android or iOS applications and streamline any document-related operation today.

The simplest way to modify and eSign Gross Receipts Tax Form1 xlsx Read Only with ease

- Obtain Gross Receipts Tax Form1 xlsx Read Only and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you would like to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or mislaid documents, tedious form searching, or errors that necessitate printing out additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Gross Receipts Tax Form1 xlsx Read Only and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gross receipts tax form1xlsx read only

Create this form in 5 minutes!

How to create an eSignature for the gross receipts tax form1xlsx read only

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to generate an e-signature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

How to generate an e-signature for a PDF document on Android

People also ask

-

What are gross receipts?

Gross receipts refer to the total amount of money received by a business before any deductions or expenses are taken into account. This figure is essential for businesses as it impacts tax reporting and financial analysis. Understanding gross receipts helps ensure compliance with accounting standards and regulations.

-

How does airSlate SignNow support businesses in managing gross receipts?

airSlate SignNow facilitates document management by enabling businesses to send and eSign documents related to gross receipts efficiently. With our platform, you can streamline invoicing and payment processes, ensuring accurate tracking of gross receipts. This reduces administrative burdens and enhances financial transparency.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs. The pricing is designed to provide cost-effective solutions for managing documents, thereby supporting better tracking of gross receipts. Our plans include various features to ensure you get the most value for your investment.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow seamlessly integrates with a variety of accounting software solutions. This integration allows you to efficiently manage your gross receipts alongside financial records. By connecting your tools, you can automate data entry and ensure that your gross receipts are always up to date.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow enhances document management through its user-friendly interface and robust eSigning capabilities. This leads to quicker turnaround times and ensures that all documentation related to your gross receipts is handled in an organized manner. Businesses benefit from enhanced efficiency and reduced errors.

-

Is airSlate SignNow mobile-friendly?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing users to manage their documents and eSign on the go. This capability is especially useful for businesses needing quick access to gross receipts while away from the office. No matter where you are, you can ensure that your document processes remain efficient.

-

How secure is airSlate SignNow when handling documents with gross receipts?

airSlate SignNow prioritizes user security and confidentiality, employing advanced encryption protocols to protect all documents, including those related to gross receipts. Our security measures ensure that sensitive financial information remains safe from unauthorized access. You can confidently use our platform knowing your data is secure.

Get more for Gross Receipts Tax Form1 xlsx Read Only

- Warranty deed from individual to individual louisiana form

- Lady bird deed 497308412 form

- Louisiana quitclaim deed form

- Louisiana individual form

- La motion form

- Operating llc form

- Warranty deed to child reserving a life estate in the parents louisiana form

- Discovery interrogatories from plaintiff to defendant with production requests louisiana form

Find out other Gross Receipts Tax Form1 xlsx Read Only

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy