a Gross Receipts Tax Form City of Pigeon Forge 2020

Understanding the Gatlinburg Gross Receipts Tax Return Form

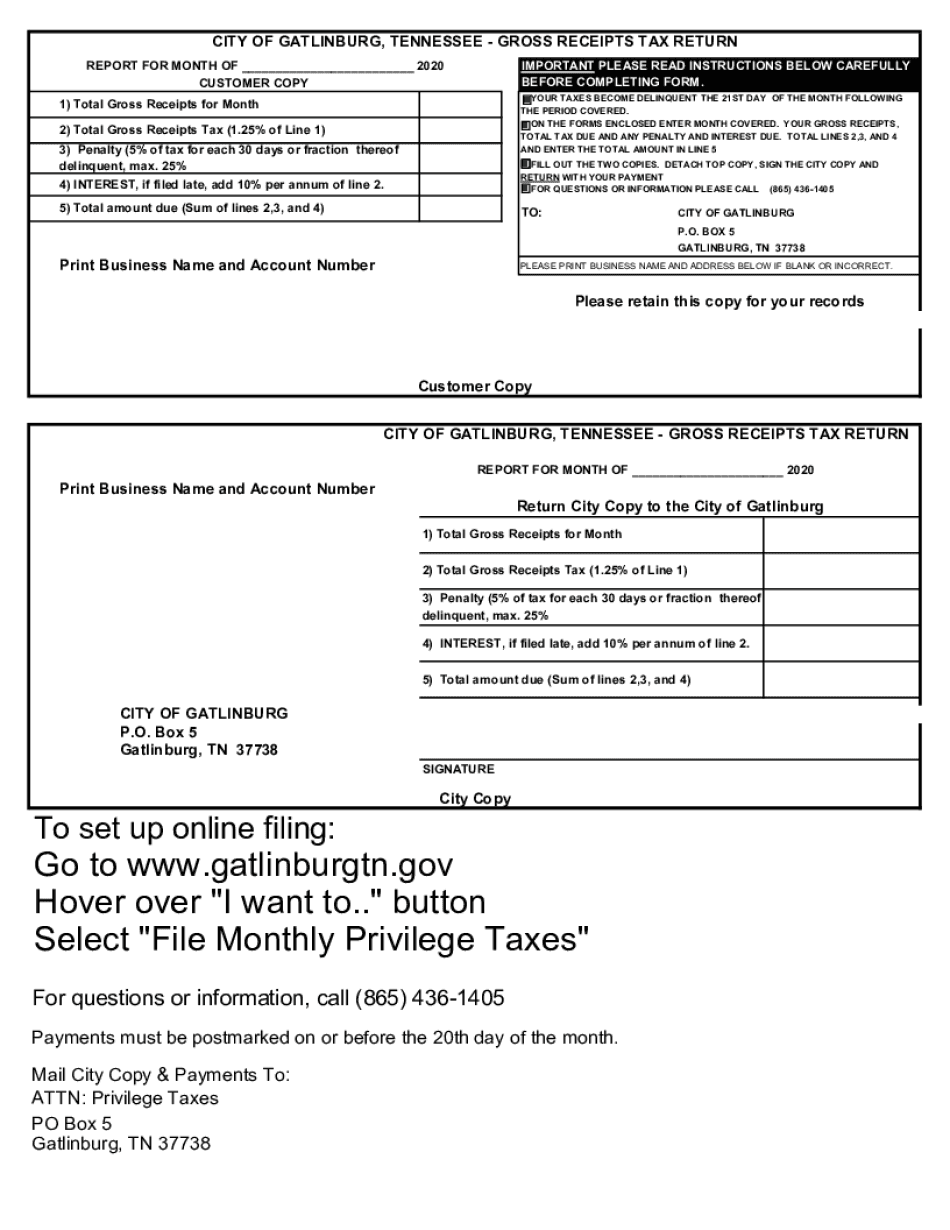

The Gatlinburg gross receipts tax return form is a crucial document for businesses operating within the city. This form is designed to report the gross receipts generated by a business, which is essential for calculating the local tax owed. The city of Gatlinburg imposes this tax on various business activities, ensuring that local services and infrastructure are funded appropriately. Understanding the details of this form is vital for compliance and to avoid penalties.

Steps to Complete the Gatlinburg Gross Receipts Tax Return Form

Completing the Gatlinburg gross receipts tax return form involves several key steps:

- Gather Financial Records: Collect all relevant financial documents, including sales records, invoices, and receipts that reflect your gross receipts for the reporting period.

- Fill Out the Form: Accurately enter your total gross receipts and any applicable deductions. Ensure that all figures are correct to avoid discrepancies.

- Review for Accuracy: Double-check all entries for accuracy. Mistakes can lead to delays or penalties.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

Filing Deadlines for the Gatlinburg Gross Receipts Tax Return Form

Filing deadlines for the Gatlinburg gross receipts tax return form vary depending on the business's reporting period. Typically, businesses must file their returns annually or quarterly. It is essential to be aware of these deadlines to avoid late fees or penalties. Businesses should keep track of these dates and plan accordingly to ensure timely submissions.

Penalties for Non-Compliance with the Gatlinburg Gross Receipts Tax

Failing to file the Gatlinburg gross receipts tax return form or submitting it late can result in significant penalties. The city may impose fines based on the amount of tax owed or a flat fee for late submissions. Additionally, persistent non-compliance can lead to further legal action or increased scrutiny from tax authorities. It is crucial for businesses to maintain compliance to avoid these repercussions.

Form Submission Methods for the Gatlinburg Gross Receipts Tax Return Form

Businesses have several options for submitting the Gatlinburg gross receipts tax return form:

- Online Submission: Many businesses prefer to file electronically for convenience and speed. This method often allows for immediate confirmation of receipt.

- Mail: Businesses can print and mail their completed forms to the appropriate city department. Ensure that the form is postmarked by the deadline.

- In-Person Submission: For those who prefer face-to-face interactions, submitting the form in person at the city tax office is an option.

Key Elements of the Gatlinburg Gross Receipts Tax Return Form

The Gatlinburg gross receipts tax return form includes several key elements that businesses must complete:

- Business Information: This section requires details about the business, including name, address, and tax identification number.

- Gross Receipts: Businesses must report their total gross receipts for the specified period, which is the basis for the tax calculation.

- Deductions: If applicable, businesses can list any deductions that may reduce their taxable gross receipts.

- Signature: The form must be signed by an authorized representative of the business, confirming the accuracy of the information provided.

Quick guide on how to complete a gross receipts tax form city of pigeon forge

Complete A Gross Receipts Tax Form City Of Pigeon Forge effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed forms, allowing you to obtain the necessary document and securely keep it online. airSlate SignNow equips you with all the features needed to create, modify, and electronically sign your documents swiftly without delays. Manage A Gross Receipts Tax Form City Of Pigeon Forge on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and electronically sign A Gross Receipts Tax Form City Of Pigeon Forge without hassle

- Obtain A Gross Receipts Tax Form City Of Pigeon Forge and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your document, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign A Gross Receipts Tax Form City Of Pigeon Forge to ensure effective communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct a gross receipts tax form city of pigeon forge

Create this form in 5 minutes!

How to create an eSignature for the a gross receipts tax form city of pigeon forge

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the Gatlinburg gross receipts tax return form?

The Gatlinburg gross receipts tax return form is a document required by the city for businesses to report their gross sales and calculate the accordingly owed taxes. This form ensures compliance with local tax regulations and helps streamline the filing process for businesses in Gatlinburg.

-

How do I obtain the Gatlinburg gross receipts tax return form?

You can obtain the Gatlinburg gross receipts tax return form directly from the city's official website or through the finance department. Additionally, airSlate SignNow offers an easy way to access and fill out this form digitally, making it convenient for businesses.

-

Can I file the Gatlinburg gross receipts tax return form online?

Yes, many businesses choose to file the Gatlinburg gross receipts tax return form online for efficiency. By using airSlate SignNow, users can fill out and eSign the form digitally, ensuring a faster submission process while maintaining compliance.

-

What documents do I need to complete the Gatlinburg gross receipts tax return form?

To complete the Gatlinburg gross receipts tax return form, businesses typically need their sales records, previous tax filings, and other financial documents that detail gross receipts. Having these documents organized will simplify the completion and submission process.

-

Are there any fees associated with filing the Gatlinburg gross receipts tax return form?

Possible fees for filing the Gatlinburg gross receipts tax return form depend on the gross receipt amounts and local taxation policies. Using airSlate SignNow for document management may include minimal service fees, but the ease of use often outweighs these costs.

-

What are the benefits of using airSlate SignNow for the Gatlinburg gross receipts tax return form?

Using airSlate SignNow to manage the Gatlinburg gross receipts tax return form provides businesses with a user-friendly interface, fast processing times, and the convenience of eSigning documents. Additionally, it reduces paperwork and enhances record-keeping efficiency.

-

Can I integrate airSlate SignNow with other tax software for the Gatlinburg gross receipts tax return form?

Yes, airSlate SignNow offers various integrations with popular tax software solutions to streamline the process of completing the Gatlinburg gross receipts tax return form. Integrating your tax software can help automate data entry and ensure accuracy in your filings.

Get more for A Gross Receipts Tax Form City Of Pigeon Forge

Find out other A Gross Receipts Tax Form City Of Pigeon Forge

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter