Gross Receipt Taxes Gatlinburg Tn 2019

What is the gross receipt taxes Gatlinburg TN

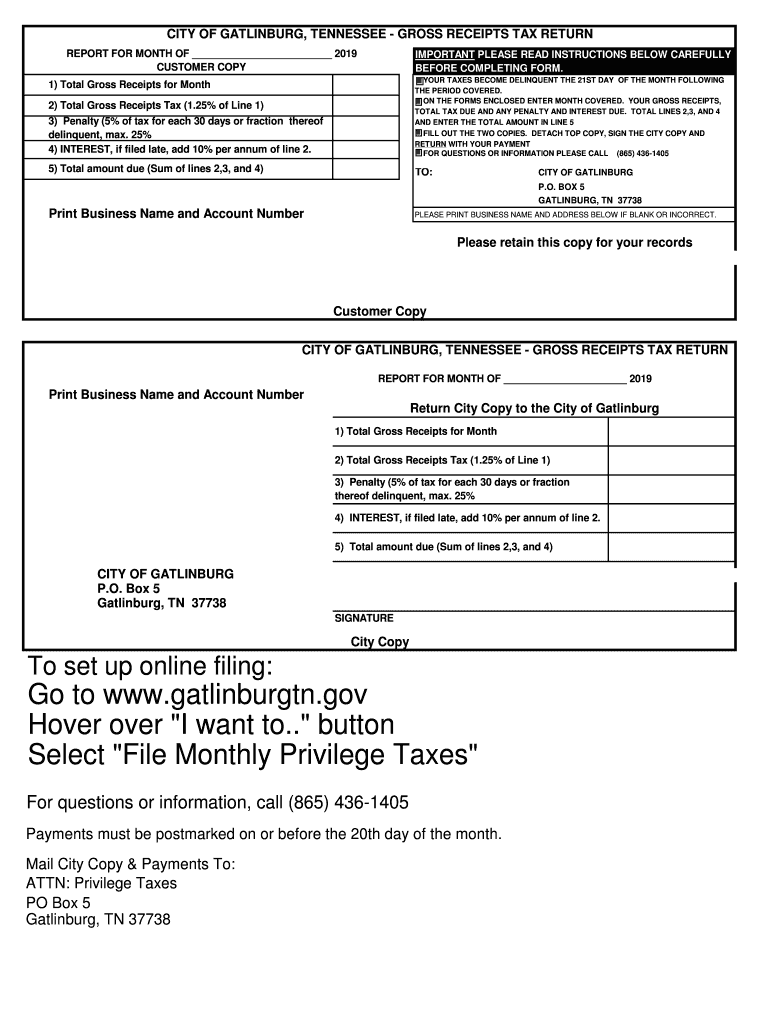

The gross receipt taxes in Gatlinburg, Tennessee, are locally imposed taxes on the total revenue generated by businesses operating within the city. These taxes apply to various business types, including retail, services, and hospitality. The tax is calculated based on the gross receipts, which encompass all income received from sales, services, and other business activities before any deductions. Understanding the specifics of the gross receipt taxes is essential for business owners to ensure compliance and accurate reporting.

Steps to complete the gross receipt taxes Gatlinburg TN

Completing the gross receipt taxes form for Gatlinburg involves several key steps:

- Gather necessary financial documents, including sales records and revenue statements.

- Access the appropriate gross receipt tax form, which can typically be found on the city’s official website or through local tax offices.

- Fill out the form accurately, ensuring all sections are completed, including business identification and total gross receipts.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail, depending on the submission options available.

Required documents

When filing the gross receipt taxes in Gatlinburg, certain documents are required to support the information provided on the tax form. These documents may include:

- Sales receipts and invoices that detail total revenue.

- Financial statements that summarize business income.

- Any previous tax returns that may be relevant for comparison.

- Documentation of any exemptions or deductions claimed.

Penalties for non-compliance

Failing to comply with the gross receipt tax requirements in Gatlinburg can lead to significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action. It is crucial for business owners to understand the importance of timely and accurate filing to avoid these consequences. Regularly reviewing tax obligations and maintaining organized financial records can help mitigate the risk of non-compliance.

Who issues the form

The gross receipt tax form for Gatlinburg is typically issued by the city’s finance department or local tax authority. This department is responsible for administering tax regulations, providing necessary forms, and offering guidance on compliance. Business owners should contact the finance department directly for any inquiries regarding the form, filing process, or tax obligations.

Digital vs. paper version

Business owners in Gatlinburg have the option to file their gross receipt taxes using either a digital or paper version of the form. The digital version often allows for easier completion and submission, with features such as auto-fill capabilities and electronic signatures. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, it is essential to ensure that all information is accurate and submitted by the deadline.

Quick guide on how to complete limited liability partnership llp annual e filing form 8 form 11

Your assistance manual on how to prepare your Gross Receipt Taxes Gatlinburg Tn

If you're interested in understanding how to complete and submit your Gross Receipt Taxes Gatlinburg Tn, here are some brief guidelines on how to simplify your tax filing process.

To get started, you simply need to register for your airSlate SignNow account to transform the way you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to modify, draft, and finalize your income tax paperwork with ease. Utilizing its editor, you can alternate between text, checkboxes, and electronic signatures while being able to return and adjust information as necessary. Streamline your tax management with enhanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to complete your Gross Receipt Taxes Gatlinburg Tn in just a few minutes:

- Establish your account and start working on PDFs swiftly.

- Utilize our catalog to locate any IRS tax form; browse through variations and schedules.

- Click Obtain form to open your Gross Receipt Taxes Gatlinburg Tn in our editor.

- Fill in the mandatory fields with your information (text, numbers, check marks).

- Employ the Signature Tool to affix your legally-recognized electronic signature (if necessary).

- Examine your document and correct any errors.

- Save your changes, print your copy, send it to your recipient, and download it to your device.

Make use of this guide to submit your taxes electronically with airSlate SignNow. Remember that paper filing can lead to return errors and delays in refunds. Additionally, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct limited liability partnership llp annual e filing form 8 form 11

FAQs

-

How much does it cost to file form 8 and form 11 for an Indian llp with no business done?

Each LLP is required to make annual compliances even if no business is done during the year.FORM 8 and FORM 11 is required to file 30.10.2016 and 30.05.2016 for FY 2015–16.Penalty for late filing is Rs. 100 per day.Generally, in case of NO business, a CA charge his professional fee which is approx 5k-6k.if you required further any info,you can contact at neerajbansalhome@gmail.comCA Neeraj Bansal

-

How much do tax firms charge to file form 8, 11, and income tax return for an early stage LLP?

My Principal charged Rs 5000/- for the same but it depends on turnover of the LLP and status of tax firms. Where the turnover of LLP was 22,00,000/- and audit firm is mediocre firm.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

What are the future prospects after becoming a CMA?

Thanks for A2A but I think institute has provided answer in detail ,Pls go through the same!The Institute of Cost Accountants of India(Statutory body under an Act of Parliament)Career ProspectsProfessional Avenues In this globalised world, organizations require professionals such as Cost Accountants (CMAs) who have specialized knowledge on business strategy and value creation. The Cost Accountant being the foundation on which the enterprises are built, the specialized education and training by the Institute make the Cost Accountant a multi-faceted professional. CMAs are driving force in all economic activities, as they are the value creator, value enabler, value preserver and value reporter.Cost Accountants are in great demand in government sector, private sector, banking & finance sector, developmental agencies, education, training & research sector as well as in service and public utility sector. Further, in view of their specialized knowledge and training, CMAs may hold top management position in public and private sectors’ enterprises like Chairman cum Managing Directors, Managing Director, Finance Director, Financial Controller, Chief Financial Officer, Cost Controller, Marketing Manager and Chief Internal Auditor and other important positions.Those CMAs managing their own businesses have found themselves as a Manager and as an Accountant can control and thereby flourish their businesses. There is no doubt that a Cost Accountant can attain the highest ladder of professional career.There is a sustained demand for qualified, trained and experienced cost accountants in India and abroad in different industries and Government Departments. Many members of the Institute are also engaged in providing professional and cost consultancy services and in teaching cost and management accountancy in Universities and Colleges.Cost accountancy edges over financial accounting. Cost accounting promotes study and adoption of scientific methods to secure maximum efficiency in industrial, commercial and other spheres, as compared to financial accounting. Financial accounting mainly draws conclusions on the basis of post facto data long after the operations are put through and expenditure were incurred enabling score keeping or at best statistical analysis. Therefore, role of cost accountants go beyond a financial accountant and they help the management in regulating production operations and processes of production.The members of the Institute are the driving force in the team of management while in employment, and as Cost Auditors, Internal Auditors, Auditors in case of VAT, Excise, SEBI, NSDL and under other statutes/ Regulatory requirements, Advisors and Consultants in practice. There are several areas of practice available for Cost Accountants, a list of which is given below:Independent practiceThere is vast scope for practice by a Cost Accountant for which he has to obtain Practice Certificate from the Institute. Details in this regard are available in the “Membership Section” of the Institute website: http://www.cmaicmai.in/external/.... A Cost Accountant may set up the practice at his own as Proprietor or set up a new partnership firm with like-minded Cost Accountants in practice or may be admitted as new partner in the existing firm of Cost Accountants in practice. His clientele include private and public companies, large, medium and small scale undertakings, partnership and proprietary concerns, industrial, commercial and service undertakings etc. For practicing Cost Accountants the Institute issued suggested fees guidelines, which may be seen athttp://icmai.in/upload/pd/Cost_A...There are several areas of practice available for Cost Accountants, which are as follows:Professional Avenues for CMAs in PracticeS. No.Statute/AuthorityDescriptionAAudit Assignments(i)Central Goods & Services Tax Act, 2017Audit of Accounts & Records under Section 35(5) of Central Goods & Service Tax Act, 2017.Special Audit under Section 66(1) of Central Goods & Service Tax Act, 2017.Access to business premises under Section 71.(ii)Central Board of Excise and Customs (CBEC)Special Audit under Section 14A & 14AA of the Central Excise Act, 1944 of Central Board of Excise and Customs (CBEC).Special Audit in certain cases under Section 11 of Customs Act, 1962, as authorized by Central Board Excise and Customs.(iii)Companies Act, 2013 Section 148 (2)Vide Companies (Cost Records and Audit) Rules, 2014, G.S.R. No. 425 (E) dated 1st July, 2014 under section 148(2), ibid Cost Accountants are exclusively authorized to appoint as Cost Auditor and conduct Cost Audit as per the provisions of the Companies (Cost Records and Audit) Rules, 2014.(iv)Companies Act, 2013 Section 138 (1)Section 138(1) of the Companies Act, 2013 empowers the Cost Accountants/Firms of Cost Accountant to conduct the Internal Audit of the Class of Companies. Companies (Accounts) Rules, 2014 issued by the Government vide GSR 239 (E) dated 31st March, 2014 defines the class of companies in which the Cost Accountants/Firms of Cost Accountant can be appointed/empanelled as Internal Auditor.(v)Ministry of FinanceSpecial Audit under Customes Act, 1962 vide Circular no. 88/98-Customs., Dated 02/12/1998 issued by Ministry of Finance, Department of Revenue for Liberalisation of bonding procedures in respect of 100% EOUs;(vi)Ministry of Health & Family WelfareInternal Audit/Concurrent Audit under National Health Mission (NHM) as empowered by the Ministry of Health & Family Welfare, New Delhi.(vii)Ministry of Road Transport and HighwaysModel Concession Agreement (MCA) on infrastructure for PPP Projects in Highways empowered by Ministry of Road Transport and Highways.(viii)National Bank for Agriculture and Rural Development (NABARD)Stock audit for Working Capital Finance as prescribed by National Bank for Agriculture and Rural Development (NABARD).(ix)National Securities Depository Limited (NSDL)Internal and Concurrent Audit for depository operations under National Securities Depository Ltd (NSDL).(x)Respective Bank CircularsStock Audit, Concurrent Audit, Forensic Audit and other professional services of various Public Sector and Private Sector Banks in India. Please referAnnexure – I.(xi)State Co-operative Societies ActFinancial Audit of Cooperative Societies in states Maharashtra, Karnataka, Himachal Pradesh and West Bengal.(xii)State Co-operative Societies ActSpecial Audit i.e. Cost Audit and Performance Audit of co-operative societies under the respective Co-operative Societies Act of West Bengal, Maharashtra, Karnataka, Punjab, and Delhi.(xiii)Respective State Govt. CircularsInternal Audit in various State Public Sector Enterprises in Punjab, Tamil Nadu, Andhra Pradesh & Odisha.(xiv)Securities Exchange Board of India (SEBI)Half-yearly Internal Audit of Stock Brokers and Credit Rating Agencies as prescribed by Securities Exchange Board of India (SEBI).(xv)Securities Exchange Board of India (SEBI)Stock Brokers and Credit Rating Agencies as prescribed by Securities Exchange Board of India.(xvi)Securities Exchange Board of India (SEBI)Internal audit of Registrars to an Issue / Share Transfer Agents (RTAs) .(xvii)Telecom Regulatory Authority of India (TRAI)Audit for Metering and Billing Accuracy – authorised to conduct audit for Telecom Regulatory Authority of India (TRAI).(xviii)Various State VAT Act/ RulesStatutory Auditors under Value Added Tax Act of States. Please referAnnexure – II.BCertification Areas(i)Ministry of Commerce and Industry, Department of Industrial Policy and PromotionCertificate for verification of Local content in case of procurement for a value in excess of Rs. 10 Crores. ( Order No. P-45021/2/2017-B.E.-II dated 15th June, 2017 on Public Procurement (Preference to Make in India), Order, 2017).(ii)Companies Act, 2013signNowing e-forms which are to be filled by companies under Companies Act and Rules.(iii)Central Excise Act, 1944Certificate of Cost of production of captively consumed goods as per Rule 8 of Central Excise Act, 1944 in accordance with Cost Accounting Standard CAS – 4 issued by the Institute.(iv)Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000Certificate for Average Cost of Transportation as per Rule 5 of the Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000.(v)Central Electricity Regulatory Commission (CERC)Certification of various forms prescribed under the Central Electricity Regulatory Commission (CERC).(vi)Customs Act, 1962Certificate towards the amount of duty paid on the materials used for the manufacture of exported goods as indicated in Forms DBK-I,II, IIA,III, IIIA under Customs Act, 1962.(vii)Directorate of Advertising and Visual Publicity (DAVP)Certificate towards the authenticated figures of circulation, as per the Annexure XII of the DAVP guidelines representing a statement signed by the both publisher and Cost Accountant with their officials seals giving the details of newsprint and ink stored and consumed during the period.(viii)Fertilizer Industry Coordination Committee (FICC)Certificate of product wise position of production dispatches stock etc. for the year (Annexure III–A) under FICC.(ix)Fertilizer Industry Coordination Committee (FICC)Issuance of various certificates as prescribed by Fertilizer Industry Coordination Committee (FICC) in respect of signNowing Cost Data for Subsidy Scheme, Transportation Claims, Escalation Claims and Equalize Freight Claims.(x)Foreign Exchange Management Act, 1999Valuation Certificate under Notification No. FEMA.298/2014-RB: Foreign Exchange Management (Transfer of Issue of Security by a Person Resident Outside India) (Third Amendment) Regulations, 2014 dated 13th March, 2014.(xi)Insurance Regulatory and Development Authority (IRDA)Certification of Application for License and renewal thereof to act as Surveyor and Loss Assessor under Insurance Regulatory and Development Authority (IRDA)(xii)Ministry of Commerce and IndustryIssuance of various certificates under Foreign Trade Policy & Procedures 2015-20 and Aayat Niryat (Import and Export) Forms (ANF). Vide http://F.No.01/94/180/468-Appendices/AM12/PC4 dated 11th October 2012, Cost Accountants are authorized to authenticate various forms and statements, under Foreign Trade Policy & Procedures 2015-20 issued by the Ministry of Commerce and Industry. Please referAnnexure – III.(xiii)Ministry of Commerce and IndustrysignNowing Performa CI & C2 under Anti–Dumping as prescribed by Ministry of Commerce & Industry.(xiv)Ministry of Commerce and IndustrysignNowing Statement of cost of production for Anti-dumping petition to Government of India.(xv)Ministry of Consumer Affairs, Food and Public DistributionAnnual utilization certificate under Incentive Scheme for New Sugar Factories and Expansion Projects vide Notification No. F.3 (4)/89-PC/Vol.IV of Ministry of Food Dated 28th February, 1997.(xvii)Ministry of TextileCertificate of fulfillment of Hank Yarn obligation for Textile Industry and Textile Committee Cess – Monthly Return in Form – A.(xviii)National Pharmaceutical Pricing Authority (NPPA)Certification of various Forms as mentioned in SECOND SCHEDULE of Drugs (Prices Control) Order, 1995;(xix)Reserve Bank of India (RBI)Compliance Certificate of Reserve Bank of India for Scheduled Banks/ Urban Development Banks/ Urban Co-operative Banks in respect of Consortium Arrangement / Multiple Banking Arrangements.(xx)Reserve Bank of India (RBI)Valuation Certificate as per RBI Circular No.2006-2007/224 DBOD.BP.BC No. 50 / 21.04.018/ 2006-07 dated January 4, 2007 for valuation of different classes of assets (e.g. land and building, plant and machinery, agricultural land, etc.)(xxi)Rubber Board Rubber Rules, 1955signNowing half yearly return in Form ‘N’ for Quantity of Rubber purchased & consumed by manufacturers under rule 33 (f) of the Rubber Rules, 1955.(xxii)Telecom Regulatory Authority of India (TRAI)Reporting and Audit for System on Accounting Separation- Certification Work Telecom Regulatory Authority of India (TRAI).(xxiii)e-MudhraJoin us as a Partner for issuing e-Mudhra Digital Certificates. http://e-mudhra.com/portal/Partn...(xxiv)Ministry of Finance, Department of ExpenditureCertification regarding average annual financial turnover of bidder :Annexure 9 Sample Prequalification Criteria of Manual for Procurement of Goods 2017CCompanies Act, 2013(i)Companies (Cost Records and Audit) Rules, 2014As per Companies (Cost Records and Audit) Rules, 2014, the class of companies which also include foreign companies, are required to maintain “Cost Records”. Cost accountant in practice may assist the company to maintain the Cost Records as per the Companies (Cost Records and Audit) Rules, 2014.(ii)Section 2(38)An expert who has the power or authority to issue a certificate in pursuance of any law for the time being in force.(iii)Section 7(1)(b)Declaration in the prescribed form no. INC.8. form no.INC 14 that the memorandum and articles have been drawn as per the provisions and in conformity.(iv)Form DIR – 12Sections 7(1)(c), 168 & 170(2) and rule 17 of the Companies (Incorporation) Rules 2014 and 8, 15 & 18 of the Companies (Appointment and Qualification of Directors) Rules, 2014 – Particulars of appointment of Directors and the Key Managerial Personnel and the changes among them in form no. DIR 12.(v)Form INC – 14Declaration that the draft memorandum and articles of association have been drawn up in conformity with the provisions of section 8 in form No. INC.14.(vi)Form INC – 21Section 11(1)(a) read with Rule 24 of the Companies (Incorporation) Rules, 2014- Declaration prior to commencement of business or exercising borrowing powers in form No. INC 21.(vii)Form INC – 22Section 12(2) & (4) and Rule 25 and 27 of The Companies (Incorporation) Rules 2014- Notice of situation or change of situation of registered office in form no. INC 22.(viii)Form – PAS 3Section 39(4) and 42 (9) and Rule 12 and 14 Companies (Prospectus and Allotment of Securities) Rules, 2014- Return of Allotment in form no. PAS 3.(ix)Form – SH7Section 64(1) and pursuant to Rule 15 of the Companies (Share Capital & Debentures) Rules, 2014 - Notice to Registrar of any alteration of share capital in form no. SH 7.(x)Form – CHG 9Sections 71(3), 77, 78 & 79 and pursuant to Section 384 read with 71(3), 77, 78 and 79 and Rule 3 of The Companies (Registration of charges) Rules 2014 Application for registration of creation or modification of charge for debentures or rectification of particulars filed in respect of creation or modification of charge for debentures in form no. CHG 9.(xi)Form – CHG 1Sections 77, 78 and 79 and pursuant to Section 384 read with 77, 78 and 79 andRule 3(1) of the Companies (Registration of Charges) Rules 2014- Registration of creation, modification of charge (other than those related to debentures) including particulars of modification of charge by Asset Reconstruction Company in terms of Securitization and Reconstruction of Finance Assets and Enforcement of Securities Act, 2002 (SARFAESI) in form no. CHG 1.(xii)Form – CHG 4Section 82(1) and Rule 8(1) of the Companies (Registration of charges) Rules 2014- Particulars of satisfaction of charges thereof in form no. CHG 4.(xiii)Form – MGT 14Section 94(1), 117(1) and section 192 – The Companies Act, 1956- Filing of resolutions and agreements to the Registrar in form no. MGT 14.(xiv)Section 137Under form no. AOC – 4 disclosures of related party transactions.(xv)Section 143Report to the Central Government if a fraud is being or has been committed against the company by officers or employees of the company.(xvi)Section 149(4)Section 149 (4) read with Rule 5 of the Companies (Appointment and Qualification of Directors) Rules, 2014: Independent Director Possess skills, experience and knowledge in one or more fields inter alia finance to be an Independent Director.(xvii)Section 153Section 153 and & Rule 9(1) of The Companies (Appointment and Qualification of Directors) Rules, 2014 & Rule 10 of Limited Liability Partnership Rules, 2009: Digital verification of the Form DIR-3: Application for allotment of Director Identification Number(xviii)Section 196Section 196 read with Section 197 and Schedule V of the Companies Act, 2013 and pursuant to Rule 3 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014- Return of appointment of key managerial personnel in form no. MR 1(xix)Section 196, 197, 200, 201(1), 203(1)Section 196, 197, 200, 201(1), 203(1) and Schedule V & Rule 7 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules 2014- Form of application to the Central Government for approval of appointment and remuneration or increase in remuneration or waiver for excess or over payment to Managing Director or Whole Time Director or Manager and commission or remuneration to Directors in form no. MR 2.(xx)Section 232(7)Declaration of compliance alongwith Statement to be filed with Registrar of Companies.(xxi)Section 247(1)Eligible to apply for being registered as a valuer.(xxii)Section 259(1)Appointment as Company Administrator by the tribunal.(xxiii)Section 275(1)Appointment as Company liquidator for winding up of the Company.(xxiv)Section 366Application by a company for registration in Form No. URC–1.(xxv)Section 409(3)Appointment as Technical person of Tribunal (15 years of experience is required)(xxvi)Section 432Appearance in the Tribunal for public examination of promoters/directors.(xxvii)Section 455(1)Section 455(1) read with Rule 3 of The Companies (Miscellaneous) Rules, 2014 – Application to Registrar for obtaining the status of dormant company in form no. MSC 1(xxviii)Section 455(5)Section 455(5) and Rule 7 and 8 of the Companies (Miscellaneous) Rules, 2014- Return of dormant companies in form no. MSC 3.(xxix)Rule 5(2)Nidhi Rules, 2014- Return of statutory compliances in form no. NDH 1.(xxx)Rule 5(3)Nidhi Rules, 2014- Application for extension of time in form no. NDH 2.(xxxi)Rule 21Nidhi Rules, 2014- Half yearly return in form no. NDH 3.(xxxii)Rule 8(8)As per Companies (Registration Offices and Fees) Rules, 2014, documents or form or application filed may contain a power of attorney issued to Cost Accountant.(xxxiii)Form GNL – 1Rule 12(2) of the companies (Registration offices and Fees) Rules, 2014- Form for filing an application with Registrar of Companies in form no. GNL 1.(xxxiv)Form GNL – 3Rule 12(3) of the Companies (Registration offices and Fees) Rules, 2014 – Particulars of person(s) or key managerial personnel charged or specified for the purpose of sub-clause (iii) or (iv) of clause 60 of Section 2 in form no. GNL 3.(xxxv)Rule 20(3)(ix)Rule 20(3)(ix) of the Companies (Management and Administration) Rules, 2014: Scrutinizer for supervising the Voting through electronic means (e-voting) process.(xxxvi)Form INC – 28Rule 31 of Companies (Incorporation) Rules, 2014 – Notice of the order of the Court or any other competent authority in form no. INC – 28.DOther Statutory Work(i)Calcutta High CourtValuer: Members can now apply directly as ‘Valuer’ for empanelment of Calcutta High Court.(ii)Securities and Exchange Board of India Infrastructure Investment Trusts Regulations, 2014Authorized to act as “Valuer” in respect of financial valuation under section 2(zzf) of the Securities and Exchange Board of India Infrastructure Investment Trusts Regulations, 2014 as amended on 30.11.2016.(iii)Securities and Exchange Board of India (Real Estate Investment Trusts) Regulations, 2014Authorized to act as “Valuer” in respect of financial valuation under section 2(zz) of the Securities and Exchange Board of India (Real Estate Investment Trusts) Regulations, 2014 as amended on 30.11.2016.(iv)Central Board of Direct Taxes (CBDT)Central Board of Direct Taxes (CBDT): CBDT vide their Notification no. S.O. 2670(E) recognized Cost Accountants as e-return intermediaries;(v)Central Board of Excise and Customs (CBEC)Accepting of services of the Cost Accountant’s may also be considered by the respective Commissionrates depending upon the extent of complexity of the cases as provided under Circular No.04/2006 dated 12th January, 2006 modified and its inclusion in the assessed value as extended cost of transportation;(vi)Central Board of Excise and Customs (CBEC)Audit of accounts of SEZ developer as directed by the Commissioner of Customs/Central Excise [refer Circular No. 52/2002-Customs dated 14th August, 2002];(vii)Central Board of Excise and Customs (CBEC)Certified Facilitation Centers (CFCs) – under ACES-CBEC Scheme: As per MOU with CBEC, Ministry of Finance, Cost Accountants in whole-time practice are authorized to set up Certified Facilitation Centers (CFCs) under Certified Facilitation Centre Scheme in filing various Excise and Service Tax Returns under the provisions of Central Excise Act and Service Tax Act;(viii)Central Board of Excise and Customs (CBEC)Computation of freight of time chartered/daughter vessel and its inclusion in the assessed value as extended cost of transportation [refer Circular No.04/2006 dated 12th January, 2006].(ix)Central Board of Excise and Customs (CBEC)Custom Broker: Central Board of Excise and Customs (CBEC) Amended Customs Brokers Licensing Regulations, 2013 and included the Cost Accountant qualification for Customs Brokers Examination to be held from the year 2017 onwards;(x)Central Board of Excise and Customs (CBEC)Ministry of Finance amended Circular No.18/2010 Customs dated 08.07.2010 vide Circular No 01/ 2012-Customs dated 5th January 2012 to authorize inter alia Cost Accountants to issue a certificate, signNowing that burden of 4% CVD has not been passed on by the importers to any other person;(xi)Central Board of Excise and Customs (CBEC)The Commissioner of Customs/Central Excise may direct the concerned developer to get his accounts audited by a Cost Accountant nominated by him in this behalf. The expenses of and incidental to such audit shall be borne by the concerned developer, vide Circular No. 52/2002-Customs dated 14th August, 2002;(xii)Central Board of Excise and Customs (CBEC)Under Rules 6 and 7 of the Customs and Central Excise Duties Drawback Rules, 1995, the exporters may be asked to furnish the purchase invoice as to the procurement of the raw hides/wet blue leather. They should also furnish a certificate inter alia from the Cost Accountant as to the consumption and cost of processing chemicals used for its processing and other incidental overhead charges incurred;(xiii)Customs Act, 1962Certification of refund of additional duty of Customs on the goods imported for subsequent sale under Indian Customs Act;(xiv)Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000Valuation Certificate for Cost of goods produced for Captive Consumption, in accordance with Cost Accounting Standard CAS – 4 issued by the Institute, under Rule 8 of the Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000;(xv)Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000Certificate for Average Cost of Transportation, in accordance with Cost Accounting Standard CAS – 5 issued by the Institute, under Rule 5 of the Central Excise Valuation (Determination of Price of Excisable Goods) Rules, 2000;(xvi)Customs Valuation (Determination of Value of Export Goods) Rules, 2007Under Rule 5 of Customs valuation (Determination of Value of Export Goods) Rules, 2007, the proper officer shall give due consideration to the cost-certificate issued by a Cost Accountant;(xvii)Customs Act, 1962Under the Fixation of brand rate of Drawback without pre-verification – Simplified procedure Scheme, unless there are any special reasons, drawback rates are to be fixed without pre-verification of the date filed, (which should be duly verified by the applicant and Cost Accountant or Chartered Accountant or Chartered Engineers) and the exporter would be authorised by provisional brand rate letters issued by the Ministry to claim the drawback rate considered admissible from the concerned Customs House(s);(xviii)Indian Council of ArbitrationAs Arbitrator: The Indian Council of Arbitration authorizes Cost Accountants and Cost Accounting Firms for empanelment in the panel of arbitrators under the category of financial experts;(xix)Insolvency and Bankruptcy Code, 2016Regulation 5 and 9 of the Insolvency and Bankruptcy Board of India (Insolvency Professionals) Regulations, 2016authorized to act as an Insolvency Professional as per the section 206 and 207 of the Insolvency and Bankruptcy Code, 2016;(xx)Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017Regulation 11 of the Foreign Exchange Management (Transfer or Issue of Security by a Person Resident Outside India) Regulations, 2017 authorises Cost Accountant in practice for valuation of capital instruments of an Indian company and also under Schedule 2 - Purchase/ Sale of capital instruments of a listed Indian company on a recognised stock exchange in India by Foreign Portfolio Investors and Schedule 6 - Investment in a Limited Liability Partnership (LLP) for valuation on an arm’s length basis as per pricing methodology.(xxi)Companies (Registered Valuers and Valuation) Rules, 2017Under Annexure IV of the Companies (Registered Valuers and Valuation) Rules, 2017, the Member of the Institute of Cost Accountants of India are recognised as Registered Valuer for valuation of Securities or Financial Assets.(xxii)Indian Banks Association (IBA)Recognized Firms of Cost Accountants for Empanelment as Forensic Auditor for frauds.Reserve Bank of India mandated that in respect of all borrowing arrangement exceeding Rs. 500 crores, an Independent Evaluation Committee (IEC) would carry out an evaluation of the Techno-Economic Viability (TEV) and the proposed restructuring package. Number of Cost Accountants are members of “Independent Evaluation Committees (IEC) “.Advised all members Banks to engage Cost Accountants/Firms of Cost Accountants for Stock Audit and Risk Based Internal Audit and other Banking operations.(xxiii)Maharashtra unaided Private Professional Educational ( Regulation of Admissions and Fees ) Act,2015Member of Fee Regulating Authority under Maharashtra unaided Private Professional Educational ( Regulation of Admissions and Fees ) Act,2015EAppearance as an Authorized Representative(i)Companies Act, 2013(a) Right to legal representation: Section 432 of the Companies Act 2013;(b) Rights of a party to appear before the Bench: Regulation 19(2) of Company Law Board Regulations, 1991;(ii)Competition Commission of India (CCI)(a) Appearance before Commission:Section 35 of the Competition (Amendment) Act, 2007;(b) Right to legal representation: Appeal to the Appellate Tribunal: Section 53(1) of the Competition (Amendment) Act, 2007;(iii)Central Board of Excise and Customs (CBEC)(a) Appearance by Authorized Representative: Section 35Q of the Central Excises Act, 1944;(b) Appearance by Authorized Representative: Section 146A of the Customs Act, 1962;(c) Appearance by Authorized Representative: Rule 2(c) of Customs, Excise and Gold (Control) Appellate Tribunal (Procedure) Rules, 1982;(iv)Central Electricity Regulatory Commission (CERC)Authority to represent before the Commission: vide Notification No. 8/ (1)/99/CERC dated 27th August, 1999;(v)Depositories Act, 1996Right to Legal Representations: Section 23C, Explanation (c) of Depositories Act, 1996;(vi)Income Tax Act, 1961Appearance by Authorized Representative:Section 288 of the Income Tax Act 1961 read with Rule 50 of the Income Tax Rules, 1962;(vii)Real Estate (Regulation and Development) Act, 2016Right to legal representation: Section 56 of the Real Estate (Regulation and Development) Act, 2016;(viii)Securities Exchange Board of India (SEBI)Right to Legal Representations: Clause 22C under Conditions for listing: Chapter IV of Listing of Securities;(ix)Service TaxAppearance by Authorized Representative:Section 96D (5) of the Service Tax Act 1994;(x)Special Economic Zone (SEZ)Rights of appellant to appear before the Board: Rule 61 of the Special Economic Zone Rules 2006;(xi)Telecom Regulatory Authority of India (TRAI)Right to Legal Representation before Appellate Tribunal as per Section 17 of TRAI Act, 1997;(xii)Value Added Tax Acts/ RulesCost Accountants are authorized to appear before authorities under VAT Acts/ Rules of various State Government(s).(xiii)Central Goods & Services Tax Act, 2017.Appearance by authorized representative under Section 116 of Central Goods & Services Tax Act, 2017.FReserve Bank of India(a)For Valuation of Properties - Empanelment of Valuers. (Circular no. RBI No.2006-2007/224 DBOD.BP.BC No. 50/21.04.018/ 2006-07 January 4, 2007).(b)For certification of borrowal companies in respect of Lending under Consortium Arrangement/ Multiple Banking Arrangements. (Circular No. RBI/2008-2009/379 DBOD. No. BP.BC.110/08.12.001/2008-09 dated 10thFebruary, 2009).(c)For certification of borrowal companies in respect of Lending under Consortium Arrangement / Multiple Banking Arrangements. (Circular No. RBI/2008-2009/382 UBD. PCB.No. 49 /13.05.000/2008-09 dated 12thFebruary, 2009)(d)In respect of the Forensic Scrutiny – Guidelines for prevention of frauds (Circular no. RBI/2010-11/555 DBS. CO.FrMC.BC.No.10/ 23.04.001/2010-11 dated 31stMay, 2011 read with Circular no. RBI/2008-09/508 DBS.CO.FrMC.Bc.No.8 /23.04.001/2008-09 dated June 24, 2009 on Frauds in borrowal accounts having multiple banking arrangements and Circular no. RBI/2008-2009/183 DBOD No BP BC 46 / 08.12.001/2008-09 dated September 19, 2008 on Lending under Consortium Arrangement/ Multi Banking Arrangements).(e)For Certificate indicating fair price of capital contribution/profit share of an LLP and a valuation certificate- Foreign Direct Investment (FDI) in Limited Liability Partnership (LLP) (Circular no. RBI/201314/566 A.P. (DIR Series) Circular No. 123 dated April 16, 2014).(f)For Certificate in respect of Foreign Investment in India (Circular no. RBI/2014-15/6 Master Circular No.15/2014-15 July 01, 2014 (Amended upto February 09, 2015).(g)For certification in respect of Loans and Advances – Statutory and Other Restrictions for Lending under Consortium Arrangement/Multiple Banking Arrangement (Circular no. RBI/2014-15/64 DBOD.No.Dir.BC. 16/13.03.00/2014-15 July 1, 2014).(h)For Certification in respect of Guarantees, Co-Acceptances & Letters of Credit – UCBs (Circular no. RBI/2013-14/19 UBD.BPD.(PCB) MC No.4/09.27.000/2013-14 July 1, 2013).(i)For Certification in respect of Management of Advances – UCBs for Exchange of information–Lending under Consortium Arrangement/Multiple Banking Arrangements (Circular No.RBI/2014-15/21 UBD.BPD.(PCB) MC No.5/13.05.000/2014-15 July 1, 2014).(j)Valuation Certificate in respect of Foreign Exchange Management (Transfer of Issue of Security by a Person Resident Outside India) (Third Amendment) Regulations, 2014 (Notification No. FEMA.298/2014-RB: dated 13th March, 2014).(k)Valuation Certificate for Foreign Direct Investment (FDI) in Limited Liability Partnership (LLP) under Master Circular No. 15/2014-15 dated 1st July, 2014.Cost Accountants in Employment:As mentioned in the beginning, the Cost Accountants are most sought in the business world. There services are deemed vital in investment planning, profit planning, project management and overall managerial decision making process. Many members of the Institute are occupying the top positions in the organizations, as Chairman & Managing Director, Managing Director, Finance Director, Financial Controller, Chief Financial Officer (CFO), Cost Controller, Marketing Manager and Chief Internal Auditor etc.Cost Accountants in Government Department:Realising the importance of the profession of the Cost and Management Accountancy in the economic development of the nation, the Central Government has constituted an all-India cadre known as Indian Cost Accounts Service (ICoAS) at par with other Class-I services such as IAS, IFS etc. to advise the government in cost pricing and in framing the appropriate fiscal and tax policies.Cost Accountants in Education:University Grants Commission (UGC) has notified “UGC Regulations on Minimum Qualifications for Appointment of Teachers and Other Academic Staff in Universities and Colleges and Measures for the Maintenance of Standards in Higher Education, 2010 vide its Circular No. F.3-1/2009 dated 30th June 2010.The Regulations prescribe the minimum qualification for appointment of teaching faculty in universities and colleges in the area of Management/ Business Administration. The qualifications specified for appointment of Assistant Professor, Associate Professor and Professor in the above area and Principal/Director/Head of the Institution include First Class Graduate and professionally qualified Cost Accountant among other qualifications and subject to other requirements including qualifying NET/SLET/SET as the minimum eligibility condition for recruitment and appointment of Assistant Professors.Further Academic pursuits:A member of the Institute can get enrolled as a member of IMA USA.Recognised by the Academic Councils of many Universities in India for the purpose of admission to the Ph.D. courses in Commerce. Various Universities have recognized CMA qualification for registration as M.Phil. and Ph.D. candidates in commerce and allied disciplines.The MoU between CIMA (The Chartered Institute of Management Accountants), UK and The Institute of Cost Accountants of India introduces a new CIMA Professional Gateway examination (available from May 2009) for the students who have successfully completed the whole of the Institute’s professional examination, enabling a ‘fast track’ route into CIMA’s Strategic level examinations, final tests of professional competence and ultimately CIMA Membership.MOU between Indira Gandhi National Open University (IGNOU): As per MOU dated 11th July, 2008, IGNOU offers specialized http://B.Com and http://M.Com Programs for the students. The Students can simultaneously study the specialized http://B.Com (Financial & Cost Accounting) programme with the Institute’s Intermediate Course and specialized http://M.Com (Management Accounting & Financial Strategies) with the Institute’s final course.

Create this form in 5 minutes!

How to create an eSignature for the limited liability partnership llp annual e filing form 8 form 11

How to create an electronic signature for the Limited Liability Partnership Llp Annual E Filing Form 8 Form 11 in the online mode

How to create an eSignature for the Limited Liability Partnership Llp Annual E Filing Form 8 Form 11 in Google Chrome

How to make an electronic signature for putting it on the Limited Liability Partnership Llp Annual E Filing Form 8 Form 11 in Gmail

How to create an eSignature for the Limited Liability Partnership Llp Annual E Filing Form 8 Form 11 right from your smartphone

How to make an eSignature for the Limited Liability Partnership Llp Annual E Filing Form 8 Form 11 on iOS devices

How to create an electronic signature for the Limited Liability Partnership Llp Annual E Filing Form 8 Form 11 on Android OS

People also ask

-

What is the city of Gatlinburg tax and how does it apply to businesses?

The city of Gatlinburg tax is a local tax imposed on businesses operating within Gatlinburg, designed to support city services and infrastructure. For businesses, understanding this tax is crucial to ensure compliance and avoid penalties. Using tools like airSlate SignNow can help manage related documentation efficiently.

-

How can airSlate SignNow help me with city of Gatlinburg tax documentation?

airSlate SignNow simplifies the process of managing and signing documents related to the city of Gatlinburg tax. With its easy-to-use interface, you can quickly send tax forms and receive electronic signatures, ensuring your compliance documentation is handled swiftly. This streamlines your workflow and keeps your business organized.

-

What are the pricing plans for airSlate SignNow, and do they include features for tax documentation?

airSlate SignNow offers various pricing plans tailored to meet different business needs, starting from a basic plan to more comprehensive options. All plans include essential features for managing city of Gatlinburg tax documentation, such as electronic signatures and document templates, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other financial software for managing city of Gatlinburg tax?

Yes, airSlate SignNow seamlessly integrates with various financial and accounting software, making it easier to manage your city of Gatlinburg tax records. This integration allows you to synchronize your tax-related documents and automate workflows, enhancing efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for city of Gatlinburg tax compliance?

Using airSlate SignNow for city of Gatlinburg tax compliance provides signNow benefits, such as reducing the time spent on document handling and ensuring secure, legally binding eSignatures. This solution also enhances collaboration among team members, allowing for a smoother tax reporting process and increased peace of mind.

-

Is airSlate SignNow secure for handling sensitive city of Gatlinburg tax documents?

Absolutely, airSlate SignNow prioritizes security and uses advanced encryption technologies to protect sensitive information, including city of Gatlinburg tax documents. This commitment to security ensures that your data remains confidential and secure during the entire document workflow process.

-

How does airSlate SignNow support remote teams dealing with city of Gatlinburg tax?

airSlate SignNow is designed for remote team collaboration, making it ideal for managing city of Gatlinburg tax documents from anywhere. Team members can easily access, review, and sign documents electronically, facilitating efficient communication and workflow regardless of location.

Get more for Gross Receipt Taxes Gatlinburg Tn

- Lead paint disclosure ny sale form

- Animal care facilities act program licenseregistration application mda missouri form

- Entouch wireless online application form

- Employee enrolment form

- Rc foul ball pdf goethe international charter school goethecharterschool form

- Ppc application form 83785310

- Sale of asset agreement template form

- Sale of business agreement template form

Find out other Gross Receipt Taxes Gatlinburg Tn

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now