Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form 2022

What is the Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form

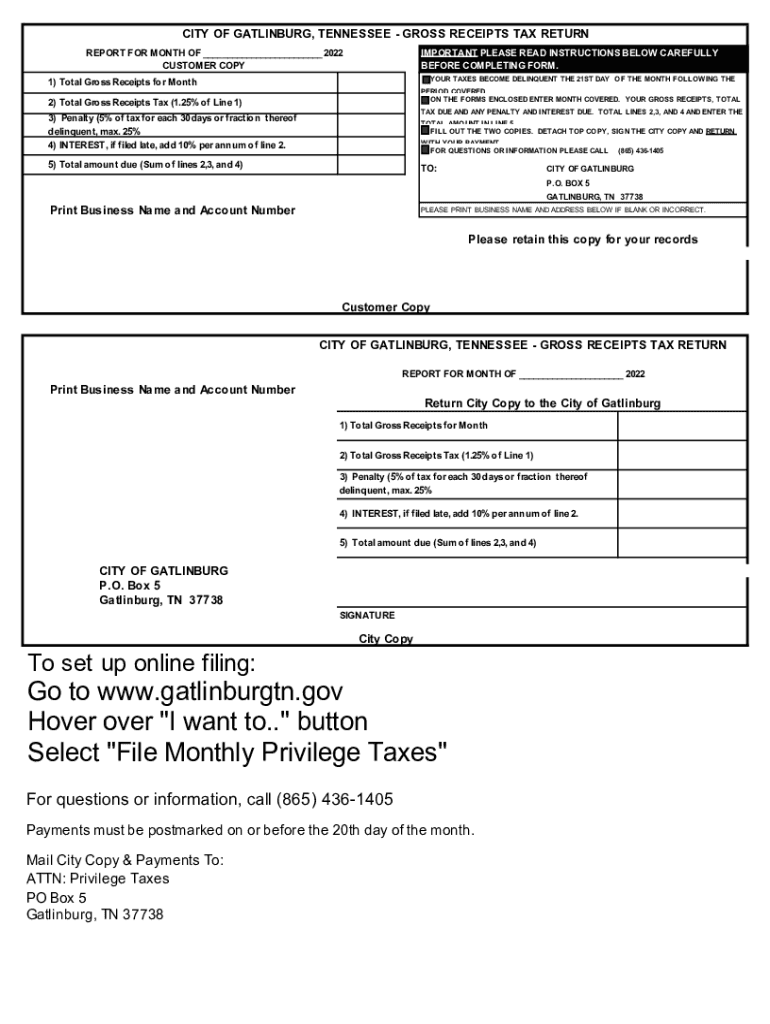

The Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form is a specific document required for businesses operating in Gatlinburg that sell alcoholic beverages. This form is essential for reporting gross receipts from sales and ensuring compliance with local tax regulations. It is designed to capture the total revenue generated from the sale of alcoholic drinks, which is subject to taxation. Understanding this form is crucial for business owners to meet their tax obligations and avoid penalties.

How to use the Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form

Using the Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form involves several steps. First, gather all necessary financial records, including sales receipts and invoices related to alcoholic beverage sales. Next, accurately fill out the form, ensuring that all gross receipts are reported. It is important to double-check the calculations to avoid errors. Once completed, the form can be submitted according to the specified guidelines, either online or via traditional mail.

Steps to complete the Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form

Completing the Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form requires careful attention to detail. Follow these steps:

- Gather all relevant sales data for the reporting period.

- Fill in the business information section, including the business name and address.

- Report total gross receipts from sales of alcoholic beverages.

- Calculate the tax owed based on the applicable rate.

- Review the form for accuracy and completeness.

- Submit the form by the deadline set by the local tax authority.

Required Documents

To complete the Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form, certain documents are necessary. These typically include:

- Sales records for the reporting period.

- Invoices related to alcoholic beverage sales.

- Previous tax returns, if applicable.

- Any correspondence from the tax authority regarding tax obligations.

Penalties for Non-Compliance

Failure to comply with the requirements of the Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form can result in significant penalties. These may include:

- Fines for late submission of the form.

- Interest on unpaid taxes.

- Potential legal action for persistent non-compliance.

Form Submission Methods

The Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form can be submitted through various methods. Business owners have the option to:

- Submit the form online via the designated tax authority portal.

- Mail the completed form to the appropriate tax office address.

- Deliver the form in person to the local tax office.

Quick guide on how to complete gatlinburg tn gross receipts tax return mixing bar tax form

Effortlessly Prepare Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to Edit and eSign Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form with Ease

- Find Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form and click Get Form to begin.

- Utilize our tools to complete your document.

- Select important areas of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet signature.

- Verify all the details and click the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Leave behind issues of lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from whichever device you prefer. Modify and eSign Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gatlinburg tn gross receipts tax return mixing bar tax form

Create this form in 5 minutes!

People also ask

-

What is a gross receipts tax and how does it affect my business?

A gross receipts tax is a tax on the total revenues of a business, regardless of profit. This type of tax can impact your cash flow, making it crucial to understand how it applies to your operations. Utilizing airSlate SignNow can streamline your invoicing and documentation processes related to gross receipts tax, ensuring compliance and efficiency.

-

Does airSlate SignNow assist with gross receipts tax documentation?

Yes, airSlate SignNow offers tools for easily eSigning and sending documents related to gross receipts tax. Our platform ensures that you can manage your tax documentation securely and efficiently. This helps eliminate delays and keeps your business organized during tax season.

-

What features does airSlate SignNow provide for managing taxes like gross receipts tax?

airSlate SignNow includes features such as eSignature capabilities, document templates, and automated workflows that cater to gross receipts tax management. These tools help businesses create and manage tax documents easily. Additionally, tracking and storing tax-related documents securely becomes effortless with our platform.

-

How does pricing work for airSlate SignNow regarding gross receipts tax services?

Our pricing model for airSlate SignNow is flexible and tailored to the needs of businesses handling gross receipts tax requirements. We offer various subscription plans that account for different user needs and tax documentation volumes. You can choose a plan that provides the most value for managing your gross receipts tax effectively.

-

Can I integrate airSlate SignNow with my accounting software to manage gross receipts tax?

Yes, airSlate SignNow can seamlessly integrate with various accounting software systems, facilitating the management of gross receipts tax documentation. This integration ensures that your gross receipts tax records are automated and accurately maintained. It simplifies your workflow, making tax calculations and reporting more efficient.

-

What are the benefits of using airSlate SignNow for gross receipts tax compliance?

Using airSlate SignNow for gross receipts tax compliance offers numerous benefits, including enhanced accuracy in document handling and quicker turnaround times for eSigned documents. The platform's security features also protect sensitive tax information, ensuring confidentiality. Additionally, it streamlines communication between parties, making tax submissions smoother.

-

Is airSlate SignNow user-friendly for businesses new to gross receipts tax?

Absolutely! airSlate SignNow is designed to be user-friendly, even for those new to gross receipts tax. Our intuitive interface makes it easy to navigate through eSigning and document management processes. You can get started quickly, ensuring that you can focus on your core business operations while managing your tax obligations efficiently.

Get more for Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form

- Nc termination form

- Claim lien property form

- Notice of breach of written lease for violating specific provisions of lease with right to cure for residential property from 497316987 form

- North carolina notice form

- North carolina violating form

- Nc notice property form

- Business credit application north carolina form

- Individual credit application north carolina form

Find out other Gatlinburg, TN Gross Receipts Tax Return Mixing Bar Tax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors