Internal Revenue Service Proposed Collection; Requesting 2021

IRS Guidelines

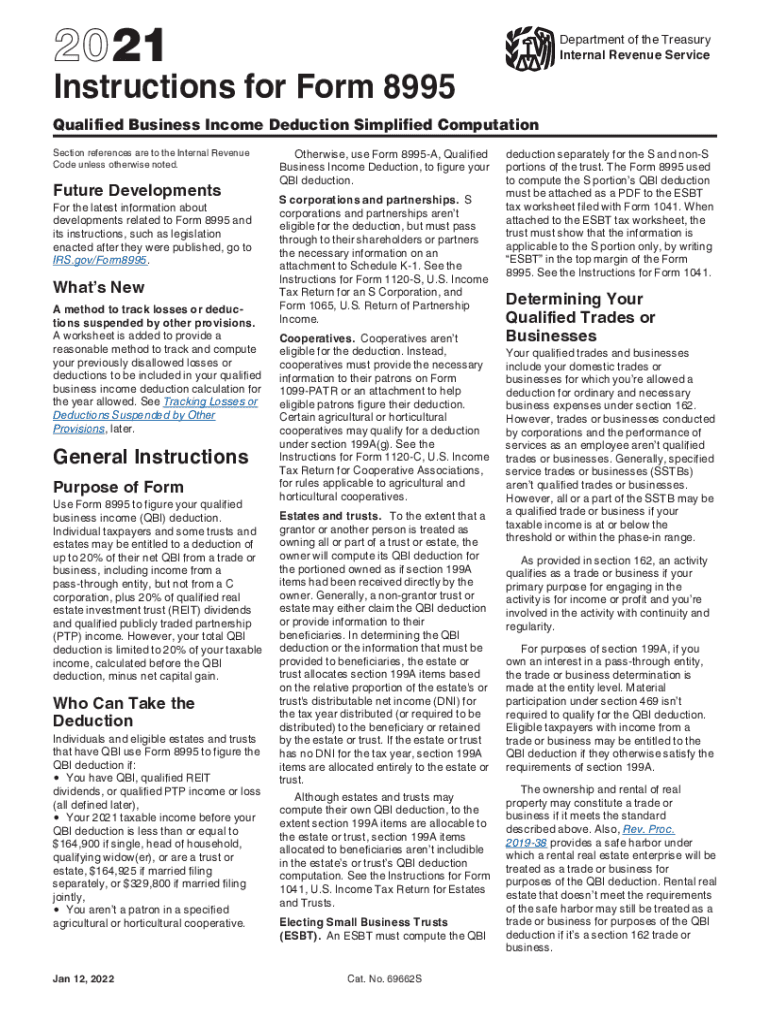

The IRS provides specific guidelines for the 2 qualified business income deduction. This form is designed for eligible taxpayers, including sole proprietors, partnerships, and S corporations, to calculate their qualified business income (QBI) deduction. The IRS outlines eligibility criteria, which include having qualified business income from a qualified trade or business. It is essential to review the IRS instructions for Form 8995 to ensure compliance and accurate reporting.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines when filing the 2 qualified business income deduction. Typically, the deadline for filing individual tax returns is April 15 of the following year. However, if you file for an extension, the deadline may be extended to October 15. It is crucial to keep track of these dates to avoid penalties and ensure timely submission of your tax documents.

Required Documents

To complete the 2 qualified business income form, certain documents are necessary. Taxpayers should gather their financial records, including profit and loss statements, business income statements, and any relevant documentation that supports the claim for qualified business income. Having these documents organized will facilitate the accurate completion of the form and help in case of an audit.

Form Submission Methods (Online / Mail / In-Person)

The 2 qualified business income form can be submitted through various methods. Taxpayers can file electronically using tax preparation software, which often includes e-filing options. Alternatively, the form can be printed and mailed to the appropriate IRS address. In some cases, individuals may choose to file in person at local IRS offices, though this method is less common. Each method has its own processing times and requirements, so it is important to choose the one that best suits your situation.

Penalties for Non-Compliance

Failing to comply with the IRS regulations regarding the 2 qualified business income deduction can lead to significant penalties. Taxpayers who do not accurately report their qualified business income may face fines, interest on unpaid taxes, and potential audits. It is essential to ensure that all information provided on the form is accurate and complete to avoid these consequences.

Eligibility Criteria

Understanding the eligibility criteria for the 2 qualified business income deduction is vital for taxpayers. To qualify, individuals must have qualified business income from a qualified trade or business. Certain limitations apply based on income levels and the type of business entity. It is advisable to review the IRS guidelines to determine if you meet the necessary criteria to claim this deduction.

Quick guide on how to complete internal revenue service proposed collection requesting

Manage Internal Revenue Service Proposed Collection; Requesting seamlessly on any device

Digital document administration has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents promptly without any hold-ups. Handle Internal Revenue Service Proposed Collection; Requesting on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Internal Revenue Service Proposed Collection; Requesting with ease

- Find Internal Revenue Service Proposed Collection; Requesting and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign Internal Revenue Service Proposed Collection; Requesting and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct internal revenue service proposed collection requesting

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service proposed collection requesting

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to make an e-signature straight from your smartphone

The way to make an e-signature for a PDF on iOS

How to make an e-signature for a PDF document on Android

People also ask

-

What is the 2021 8995 qualified business income deduction?

The 2021 8995 qualified business income deduction allows business owners to deduct a portion of their qualified business income from their taxable income. This deduction can signNowly lower your overall tax liability. Understanding how this works can help you utilize airSlate SignNow to manage the paperwork involved efficiently.

-

How does airSlate SignNow help with managing 2021 8995 qualified business income documentation?

airSlate SignNow streamlines document management associated with the 2021 8995 qualified business income deduction. With features like eSigning and document templates, you can quickly prepare and send forms necessary for claiming deductions. This user-friendly platform saves you time and reduces errors in your tax documentation.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs, ensuring affordability for those dealing with 2021 8995 qualified business income. Our plans are competitive and provide extensive features to enhance your eSigning and document management capabilities. Consider a free trial to explore how it meets your specific requirements.

-

Can airSlate SignNow integrate with accounting software to assist with 2021 8995 qualified business income?

Yes, airSlate SignNow integrates seamlessly with various accounting software and tools. This feature enables businesses to synchronize their documents and financial data, streamlining the process of managing their 2021 8995 qualified business income. Effective integration ensures all necessary documentation is easily accessible during tax filing.

-

What benefits does using airSlate SignNow provide for tax filing related to 2021 8995 qualified business income?

Using airSlate SignNow simplifies the eSigning and documentation process necessary for tax filings, including those related to 2021 8995 qualified business income. Its secure and efficient platform can help reduce time spent on paperwork, enabling you to focus on maximizing your deduction opportunities while ensuring compliance with tax regulations.

-

Is there a mobile version of airSlate SignNow for managing 2021 8995 qualified business income?

Absolutely! airSlate SignNow offers a mobile application that allows you to manage your documents on-the-go. This capability is particularly useful for business owners looking to prepare necessary documentation for the 2021 8995 qualified business income deduction without being tied to their desks.

-

How secure is the information managed about 2021 8995 qualified business income in airSlate SignNow?

Security is a top priority for airSlate SignNow. We utilize industry-leading encryption protocols and secure storage solutions to protect sensitive information regarding your 2021 8995 qualified business income. You can trust that your data will remain confidential and secure while using our platform.

Get more for Internal Revenue Service Proposed Collection; Requesting

- Amendment of residential lease district of columbia form

- Agreement for payment of unpaid rent district of columbia form

- Commercial lease assignment from tenant to new tenant district of columbia form

- Tenant consent to background and reference check district of columbia form

- Residential lease or rental agreement for month to month district of columbia form

- Residential rental lease agreement district of columbia form

- Tenant welcome letter district of columbia form

- Warning of default on commercial lease district of columbia form

Find out other Internal Revenue Service Proposed Collection; Requesting

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy