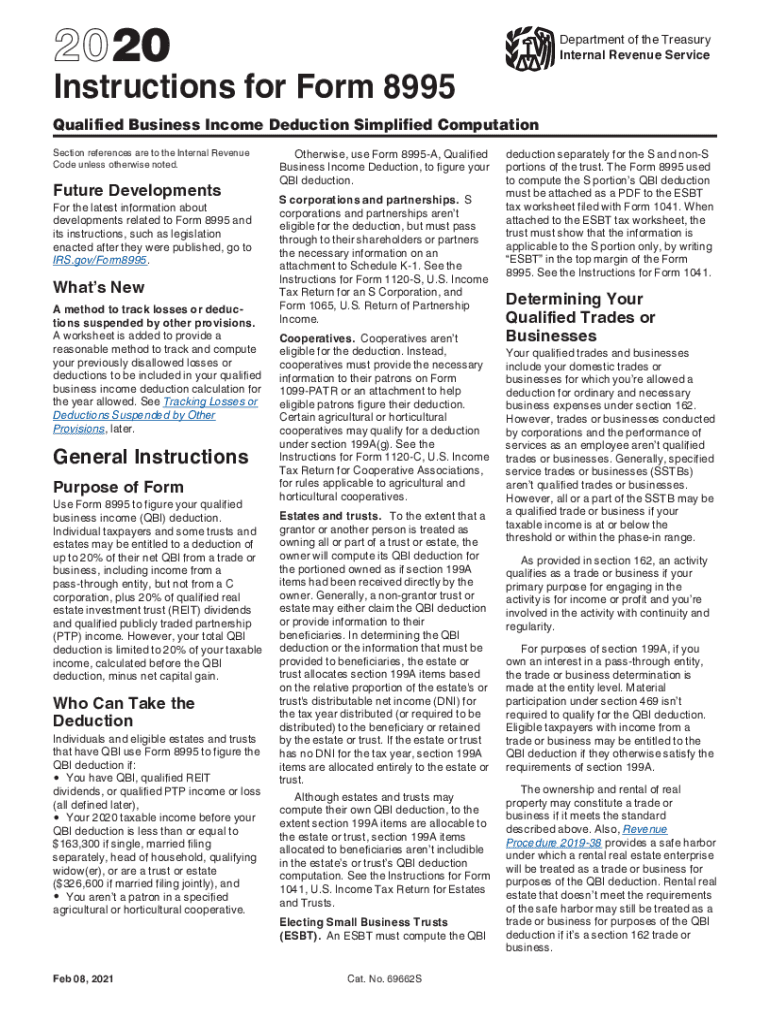

Instructions for Form 8995 Internal Revenue Service 2020

What is the 2020 Instructions for Form 8995?

The 2020 Instructions for Form 8995 provide guidance for taxpayers who wish to claim the qualified business income (QBI) deduction. This deduction allows eligible taxpayers to deduct a percentage of their QBI from their taxable income. The instructions detail eligibility criteria, calculation methods, and necessary documentation required to complete the form accurately. Understanding these instructions is crucial for ensuring compliance with IRS regulations and maximizing potential tax benefits.

Steps to Complete the 2020 Instructions for Form 8995

Completing the 2020 Instructions for Form 8995 involves several key steps:

- Gather necessary financial documentation, including income statements and business expenses.

- Determine eligibility for the QBI deduction based on your business type and income level.

- Follow the detailed instructions to calculate your QBI and any limitations that may apply.

- Fill out Form 8995 accurately, ensuring all required fields are completed.

- Review the form for accuracy before submission.

Key Elements of the 2020 Instructions for Form 8995

Key elements of the 2020 Instructions for Form 8995 include:

- Eligibility Requirements: Specifies who can claim the QBI deduction.

- Calculation Method: Outlines how to calculate the deduction based on QBI.

- Documentation Needed: Lists the documents required to support your claim.

- Filing Procedures: Provides details on how to submit the form, whether electronically or by mail.

IRS Guidelines for Form 8995

The IRS guidelines for Form 8995 emphasize the importance of accurate reporting and compliance with tax laws. Taxpayers must ensure that all calculations are correct and that they meet the necessary criteria for the QBI deduction. The guidelines also highlight the importance of maintaining thorough records to substantiate claims made on the form. Following these guidelines helps avoid penalties and ensures a smooth filing process.

Filing Deadlines for Form 8995

Filing deadlines for Form 8995 are aligned with the standard tax return deadlines. For most individual taxpayers, the deadline is April 15 of the following year. If you require additional time, you may file for an extension, but it's essential to ensure that any taxes owed are paid by the original deadline to avoid penalties and interest. Keeping track of these dates is crucial for timely and compliant filing.

Eligibility Criteria for the QBI Deduction

Eligibility for the QBI deduction as outlined in the 2020 Instructions for Form 8995 includes:

- Taxpayers must have qualified business income from a qualified trade or business.

- Income thresholds apply, which may limit the deduction based on total taxable income.

- Certain businesses, such as specified service trades or businesses, may face additional limitations.

Required Documents for Form 8995

To complete Form 8995, taxpayers should prepare the following documents:

- Financial statements detailing income and expenses.

- Tax returns from previous years for reference.

- Any additional documentation that supports the calculation of qualified business income.

Quick guide on how to complete 2020 instructions for form 8995 internal revenue service

Complete Instructions For Form 8995 Internal Revenue Service seamlessly on any device

Digital document management has become prevalent among both organizations and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle Instructions For Form 8995 Internal Revenue Service on any device using airSlate SignNow's Android or iOS apps and simplify any document-focused process today.

The easiest way to modify and electronically sign Instructions For Form 8995 Internal Revenue Service with ease

- Find Instructions For Form 8995 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to secure your updates.

- Select how you prefer to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious document searches, or errors that necessitate new printouts. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Instructions For Form 8995 Internal Revenue Service while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 8995 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 8995 internal revenue service

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is the 2020 8995 qualified business income form?

The 2020 8995 qualified business income form is designed for tax filers to report deductions related to qualified business income from pass-through entities. It simplifies the process of calculating and claiming the Qualified Business Income deduction. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with the 2020 8995 qualified business income form?

airSlate SignNow can streamline the electronic signing process for your 2020 8995 qualified business income form, making it easier to manage and send documents securely. With our user-friendly interface, you can prepare and eSign documents from anywhere. This efficiency can save you time and enhance productivity during tax season.

-

Are there any costs associated with using airSlate SignNow for the 2020 8995 qualified business income form?

airSlate SignNow offers various pricing plans that suit different business needs, ensuring cost-effectiveness for everyone. You can choose a plan that fits your budget while still getting the tools needed for processing your 2020 8995 qualified business income form seamlessly. Explore our pricing page for more details on your options.

-

What features does airSlate SignNow provide for handling the 2020 8995 qualified business income form?

With airSlate SignNow, you get features like customizable templates, document tracking, and secure cloud storage that are vital for managing your 2020 8995 qualified business income form efficiently. Our platform enables easy collaboration and ensures that your documents are signed quickly and securely. Enhance your signing experience with our robust feature set.

-

Can I integrate airSlate SignNow with other tools for managing the 2020 8995 qualified business income form?

Yes, airSlate SignNow offers integration with a wide range of applications, making it convenient to manage your workflow alongside your 2020 8995 qualified business income form. Whether you use CRM systems or accounting software, our integrations help streamline document management while enhancing productivity. Explore our integration options for seamless workflows.

-

What are the benefits of using airSlate SignNow for my 2020 8995 qualified business income form?

Using airSlate SignNow for your 2020 8995 qualified business income form provides numerous benefits, including faster turnaround times for document signing and improved accuracy with electronic signatures. Our platform also enhances security, ensuring that your sensitive tax documents are protected. Enjoy the convenience of managing your forms digitally.

-

Is it easy to eSign the 2020 8995 qualified business income form with airSlate SignNow?

Absolutely! eSigning the 2020 8995 qualified business income form with airSlate SignNow is quick and straightforward. Our intuitive platform allows you to sign documents in just a few clicks, ensuring that you can complete your tax filings efficiently. Experience hassle-free signing without the need for printing or scanning.

Get more for Instructions For Form 8995 Internal Revenue Service

Find out other Instructions For Form 8995 Internal Revenue Service

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free