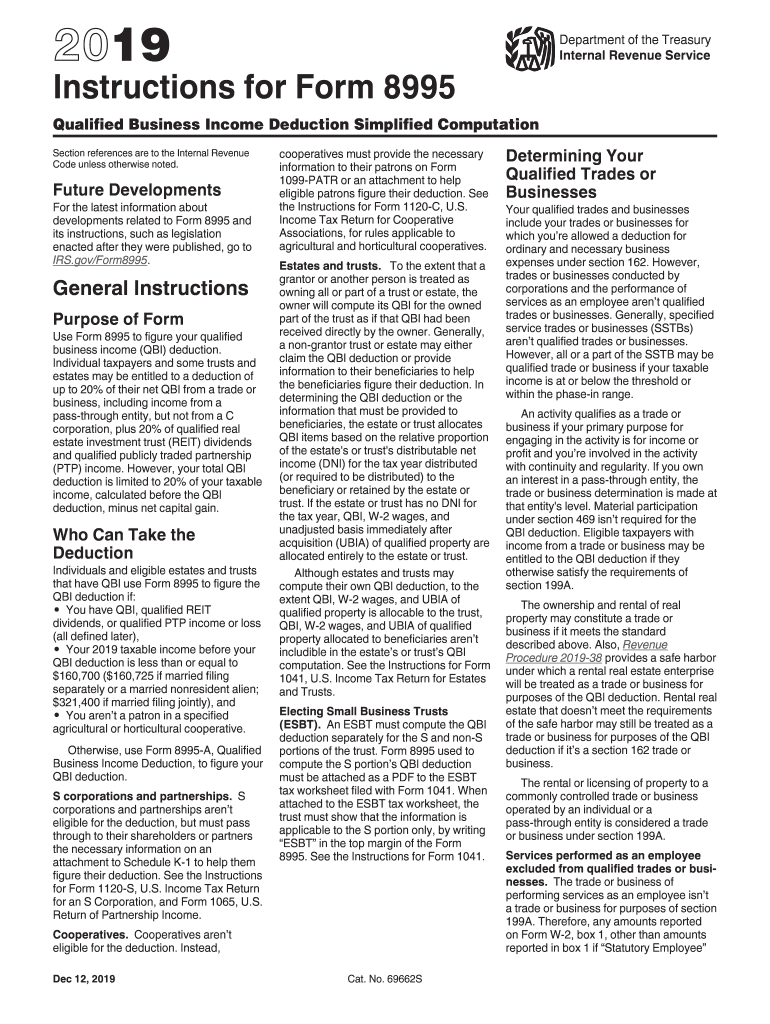

Instructions for Form 8995 2019

What is the Instructions For Form 8995

The Instructions For Form 8995 provide detailed guidance for taxpayers who are claiming the qualified business income deduction under Section 199A of the Internal Revenue Code. This form is primarily used by individuals, partnerships, S corporations, and certain trusts and estates to calculate their eligible deduction based on their qualified business income. Understanding these instructions is crucial for ensuring compliance with IRS regulations and maximizing potential tax benefits.

Steps to complete the Instructions For Form 8995

Completing the Instructions For Form 8995 involves several key steps:

- Gather all necessary financial documents, including income statements and expense records related to your business.

- Review the eligibility criteria to confirm that you qualify for the deduction.

- Follow the instructions carefully to fill out each section of the form, ensuring accuracy in your calculations.

- Double-check all entries for completeness and correctness before submission.

- Submit the completed form along with your tax return by the applicable deadline.

Legal use of the Instructions For Form 8995

The legal use of the Instructions For Form 8995 is essential for taxpayers seeking to claim the qualified business income deduction. Compliance with IRS guidelines ensures that the deductions claimed are legitimate and substantiated by proper documentation. Failing to adhere to these instructions may lead to penalties or disallowance of the deduction during an audit. It is advisable to maintain thorough records to support the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Form 8995 align with the general tax return deadlines. Typically, individual taxpayers must submit their returns by April 15 of the following year. If you are unable to meet this deadline, you may request an extension, which generally provides an additional six months to file. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Who Issues the Form

The Instructions For Form 8995 are issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and tax law enforcement. The IRS provides these instructions to help taxpayers understand how to properly complete the form and comply with tax regulations. It is important to ensure that you are using the most current version of the form and its instructions, as updates may occur annually.

Eligibility Criteria

To qualify for the deductions outlined in the Instructions For Form 8995, taxpayers must meet specific eligibility criteria. Generally, this includes having qualified business income from a qualified trade or business, which can include sole proprietorships, partnerships, and S corporations. Additionally, income thresholds may apply, affecting the deduction amount based on total taxable income. It is important to review these criteria carefully to determine your eligibility.

Quick guide on how to complete 2019 instructions for form 8995

Effortlessly Prepare Instructions For Form 8995 on Any Device

The management of online documents has gained popularity among both organizations and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Instructions For Form 8995 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The Easiest Way to Alter and eSign Instructions For Form 8995 Without Strain

- Find Instructions For Form 8995 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Annotate important sections of the documents or redact sensitive details using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or dislocated documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Instructions For Form 8995 to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 instructions for form 8995

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 8995

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What are the basic Instructions For Form 8995?

The Instructions For Form 8995 provide detailed guidance on how to complete the Qualified Business Income Deduction. This form is crucial for taxpayers to claim the deduction correctly while ensuring compliance with IRS regulations. Familiarizing yourself with the instructions can streamline the filing process and improve accuracy.

-

How can airSlate SignNow assist in filing Instructions For Form 8995?

AirSlate SignNow can simplify the document signing process, making it easier to collect necessary signatures on your Instructions For Form 8995. With its user-friendly interface, you can quickly upload and send your forms for electronic signatures, ensuring a hassle-free experience. Additionally, our platform allows for secure document storage and retrieval, enhancing your filing process.

-

What features does airSlate SignNow offer for handling tax documents like Form 8995?

AirSlate SignNow offers powerful features like customizable templates, in-app collaboration, and secure e-signature capabilities, which are essential for handling tax documents such as Form 8995. These features streamline the preparation process, reduce turnaround time, and help ensure compliance with the necessary regulations. Moreover, you can track document status in real-time, giving you peace of mind.

-

Is airSlate SignNow cost-effective for managing Instructions For Form 8995?

Yes, airSlate SignNow provides a cost-effective solution for managing your Instructions For Form 8995. With scalable pricing plans, users can choose an option that fits their needs without breaking the bank. Our software's efficiency in document handling can reduce overall operational costs, ultimately saving you money during tax season.

-

What integrations does airSlate SignNow support for tax preparation?

AirSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the process of managing Instructions For Form 8995. Popular integrations include QuickBooks and Xero, which allow you to synchronize your documents and data effectively. This ensures that you can maintain accurate records while preparing for tax submissions.

-

Can airSlate SignNow handle bulk signing for tax forms?

Absolutely! AirSlate SignNow enables bulk signing for tax forms, including Instructions For Form 8995. This feature is particularly beneficial for businesses that need to send multiple forms for signature simultaneously, ensuring timely completion and efficiency during tax preparation.

-

What benefits does using airSlate SignNow provide for tax professionals handling Form 8995?

Using airSlate SignNow provides signNow benefits for tax professionals handling Form 8995, such as enhanced productivity and reduced paper handling. The platform allows instant document tracking and communications, leading to faster response times. Additionally, its secure signing process minimizes the risks associated with document fraud.

Get more for Instructions For Form 8995

- Board resolution account opening form

- Psx pakistan stock exchange stock exchange building form

- Securities withdrawl form 26 2 2021

- Bzu form fill

- 21 a kashmir block allama iqbal town lahore form

- Chapter 4 accounting cycle form

- Recommendation of supervisory staff for sschssc annual examination 20 form

- Application form nto

Find out other Instructions For Form 8995

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation