DR 1A Doug R 01 22F 12 14 21 Florida Dept of Revenue 2022-2026

Understanding the Florida Form 1

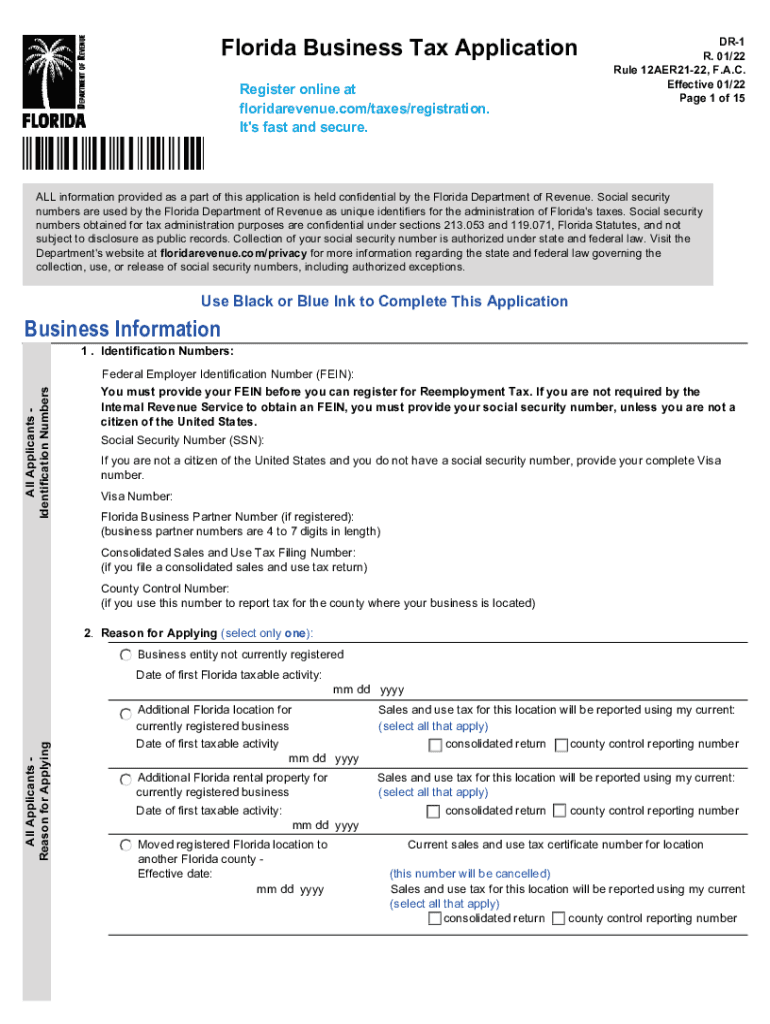

The Florida Form 1, also known as the Florida Business Tax Application, is a crucial document for businesses operating in the state. This form is primarily used to register for various business taxes, including sales tax, corporate income tax, and other applicable taxes. Understanding the purpose and requirements of this form is essential for compliance and successful business operations in Florida.

Steps to Complete the Florida Form 1

Completing the Florida Form 1 involves several key steps:

- Gather necessary information about your business, including the legal structure, ownership details, and business activities.

- Provide accurate contact information, including the business address and phone number.

- Indicate the type of taxes you are registering for, ensuring you select all applicable options.

- Review the form for accuracy before submission, as errors can lead to delays or compliance issues.

Legal Use of the Florida Form 1

The Florida Form 1 is legally binding once completed and submitted to the Florida Department of Revenue. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may result in penalties or legal consequences. Utilizing a reliable electronic signature solution can enhance the legal standing of your submission, ensuring compliance with eSignature regulations.

Required Documents for Submission

When completing the Florida Form 1, certain documents may be required to support your application. These may include:

- Proof of business registration, such as articles of incorporation or a partnership agreement.

- Identification documents for business owners or partners.

- Any relevant licenses or permits specific to your business activities.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for compliance. The Florida Form 1 should be submitted before the start of business operations or as soon as a business is established. Additionally, keep track of any annual renewal dates or updates required by the Florida Department of Revenue to maintain your business tax registration.

Form Submission Methods

The Florida Form 1 can be submitted through various methods, ensuring flexibility for business owners:

- Online submission via the Florida Department of Revenue's website, which allows for immediate processing.

- Mailing a hard copy of the form to the appropriate department address.

- In-person submission at designated Florida Department of Revenue offices for direct assistance.

Quick guide on how to complete dr 1a doug r 01 22f 12 14 21 florida dept of revenue

Complete DR 1A Doug R 01 22F 12 14 21 Florida Dept Of Revenue effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage DR 1A Doug R 01 22F 12 14 21 Florida Dept Of Revenue on any device using airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The simplest way to modify and eSign DR 1A Doug R 01 22F 12 14 21 Florida Dept Of Revenue with ease

- Find DR 1A Doug R 01 22F 12 14 21 Florida Dept Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements within a few clicks from any device you prefer. Modify and eSign DR 1A Doug R 01 22F 12 14 21 Florida Dept Of Revenue and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 1a doug r 01 22f 12 14 21 florida dept of revenue

Create this form in 5 minutes!

How to create an eSignature for the dr 1a doug r 01 22f 12 14 21 florida dept of revenue

The best way to make an e-signature for a PDF file in the online mode

The best way to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an e-signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is Florida Form DR 1 and who needs it?

Florida Form DR 1 is a crucial document used for registering businesses for sales tax purposes in Florida. Any business that intends to sell tangible goods or taxable services in the state needs to complete this form. This registration allows businesses to collect sales tax and fulfill their obligations under Florida law.

-

How can airSlate SignNow help with Florida Form DR 1?

airSlate SignNow simplifies the process of managing Florida Form DR 1 by allowing users to eSign and send documents electronically. This means businesses can quickly complete and submit their registration documents without the hassle of printing and scanning. With our platform, ensuring compliance becomes efficient and effective.

-

Is there a fee associated with filing Florida Form DR 1?

While airSlate SignNow offers affordable pricing for its services, the state of Florida may require a registration fee when submitting Form DR 1. It's important to check with the Florida Department of Revenue for the specific fees associated with registering your business. Using airSlate SignNow can help reduce administrative costs by streamlining the eSignature process.

-

What features does airSlate SignNow offer for managing Florida Form DR 1?

airSlate SignNow provides a range of features including templates, document storage, and automated reminders to keep track of deadlines associated with Florida Form DR 1. Our easy-to-use interface enables users to create documents quickly and collect signatures effortlessly. These features ensure a smooth and efficient filing process.

-

Can airSlate SignNow integrate with accounting software for managing Florida Form DR 1?

Yes, airSlate SignNow offers integrations with various accounting software solutions, making it easier to manage your financial records alongside your Florida Form DR 1 filings. This integration allows for seamless tracking of sales tax collections and filings, enhancing your overall business efficiency.

-

What are the benefits of using airSlate SignNow for Florida Form DR 1 filings?

Using airSlate SignNow for your Florida Form DR 1 filings saves time and money while increasing document security. You can track the status of your documents in real-time and ensure compliance with state regulations. Additionally, the eSignature functionality allows for quicker approvals, expediting the registration process.

-

Is airSlate SignNow compliant with Florida's legal requirements for Form DR 1?

Yes, airSlate SignNow is designed to comply with all relevant legal requirements, including those specific to Florida Form DR 1. Our platform employs top-notch security measures to protect sensitive information and follows regulations for electronic signatures, ensuring your documents are legally binding.

Get more for DR 1A Doug R 01 22F 12 14 21 Florida Dept Of Revenue

Find out other DR 1A Doug R 01 22F 12 14 21 Florida Dept Of Revenue

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed