Corporation Tax Forms PA Department of Revenue 2021

Understanding the PA RCT 101 Instructions 2021

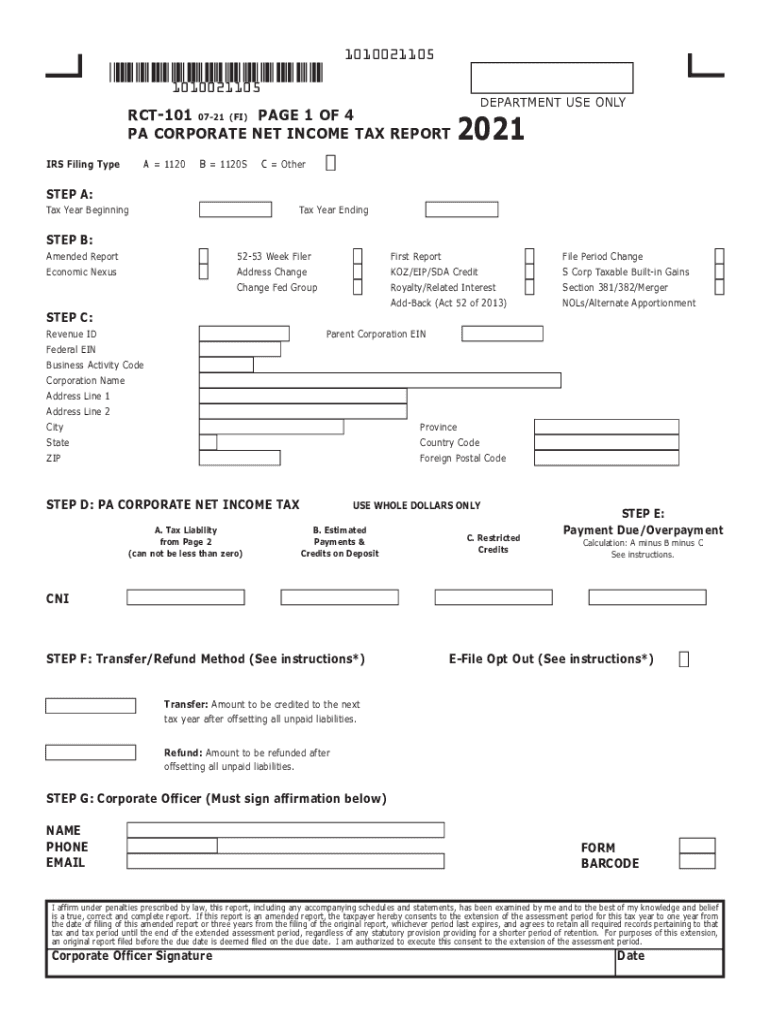

The PA RCT 101 instructions provide essential guidelines for corporations filing their Pennsylvania corporate tax returns. This form is crucial for businesses operating in Pennsylvania, as it outlines how to report income, calculate taxes owed, and ensure compliance with state tax laws. The instructions detail the necessary steps for completing the form accurately, including required information and documentation.

Steps to Complete the PA RCT 101 Instructions 2021

Completing the PA RCT 101 requires careful attention to detail. Here are the key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Follow the instructions to fill out each section of the form, ensuring all figures are accurate.

- Calculate your total taxable income and the tax owed based on the provided rates.

- Review the form for completeness and accuracy before submission.

Legal Use of the PA RCT 101 Instructions 2021

The PA RCT 101 instructions are legally binding and must be followed to ensure compliance with Pennsylvania tax regulations. Proper completion of this form is necessary to avoid penalties and ensure that your business remains in good standing with the state. Understanding the legal implications of the instructions helps businesses navigate their tax obligations effectively.

Filing Deadlines for the PA RCT 101

Timely submission of the PA RCT 101 is critical to avoid late fees and penalties. The standard deadline for filing is typically the fifteenth day of the fourth month following the end of your fiscal year. Businesses should be aware of any changes to deadlines that may occur due to state regulations or extensions.

Required Documents for the PA RCT 101

To complete the PA RCT 101, certain documents are essential. These include:

- Financial statements, including profit and loss statements.

- Balance sheets that reflect the company’s financial position.

- Any supporting documentation for deductions and credits claimed.

Form Submission Methods for the PA RCT 101

The PA RCT 101 can be submitted through various methods. Businesses have the option to file online, which is often the most efficient method, or send the completed form by mail. In-person submissions may also be available at designated state offices. Each method has its own requirements and processing times, so it is important to choose the one that best suits your needs.

Quick guide on how to complete corporation tax forms pa department of revenue

Effortlessly Prepare Corporation Tax Forms PA Department Of Revenue on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers you all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Corporation Tax Forms PA Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and enhance your document-based tasks today.

How to Edit and Electronically Sign Corporation Tax Forms PA Department Of Revenue with Ease

- Locate Corporation Tax Forms PA Department Of Revenue and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Corporation Tax Forms PA Department Of Revenue and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporation tax forms pa department of revenue

Create this form in 5 minutes!

How to create an eSignature for the corporation tax forms pa department of revenue

The way to make an e-signature for your PDF online

The way to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What are the PA RCT 101 instructions 2021 for eSigning documents?

The PA RCT 101 instructions 2021 provide detailed guidelines for completing and submitting the tax form electronically. These instructions outline the steps necessary to ensure compliance while using electronic signatures, making the process easier and more efficient.

-

How can airSlate SignNow help with PA RCT 101 instructions 2021?

airSlate SignNow simplifies the process of managing the PA RCT 101 form by offering a user-friendly platform for eSigning documents. With our solution, you can easily upload, edit, and send documents while adhering to the PA RCT 101 instructions 2021 for accurate submission.

-

What features are included in airSlate SignNow for handling PA RCT 101 instructions 2021?

airSlate SignNow includes features such as document templates, automated reminders, and real-time tracking, all tailored to meet the PA RCT 101 instructions 2021. These tools enhance efficiency and ensure your documents meet the necessary requirements with ease.

-

Is airSlate SignNow a cost-effective solution for PA RCT 101 instructions 2021?

Yes, airSlate SignNow offers a competitive pricing model that delivers signNow savings for businesses managing PA RCT 101 instructions 2021. Our subscription plans are designed to fit various budgets while providing an array of features that enhance document management.

-

What are the benefits of using airSlate SignNow for PA RCT 101 instructions 2021?

Using airSlate SignNow to comply with PA RCT 101 instructions 2021 streamlines your document management process and improves accuracy. You'll benefit from faster turnaround times, reduced paperwork, and a secure platform for electronic signatures.

-

Can I integrate airSlate SignNow with other tools for PA RCT 101 instructions 2021?

Absolutely! airSlate SignNow integrates seamlessly with various software applications to enhance your workflow when managing PA RCT 101 instructions 2021. Popular integrations include CRM systems, cloud storage solutions, and collaboration tools, ensuring a smooth experience.

-

How secure is my information when using airSlate SignNow for PA RCT 101 instructions 2021?

Security is a top priority at airSlate SignNow. When following the PA RCT 101 instructions 2021, your confidential information is protected with industry-leading encryption and secure access controls to safeguard your documents throughout the signing process.

Get more for Corporation Tax Forms PA Department Of Revenue

- Commercial rental lease application questionnaire louisiana form

- Apartment lease rental application questionnaire louisiana form

- Residential rental lease application louisiana form

- Salary verification form for potential lease louisiana

- Landlord agreement to allow tenant alterations to premises louisiana form

- Notice of default on residential lease louisiana form

- Louisiana landlord 497309200 form

- Application for sublease louisiana form

Find out other Corporation Tax Forms PA Department Of Revenue

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free