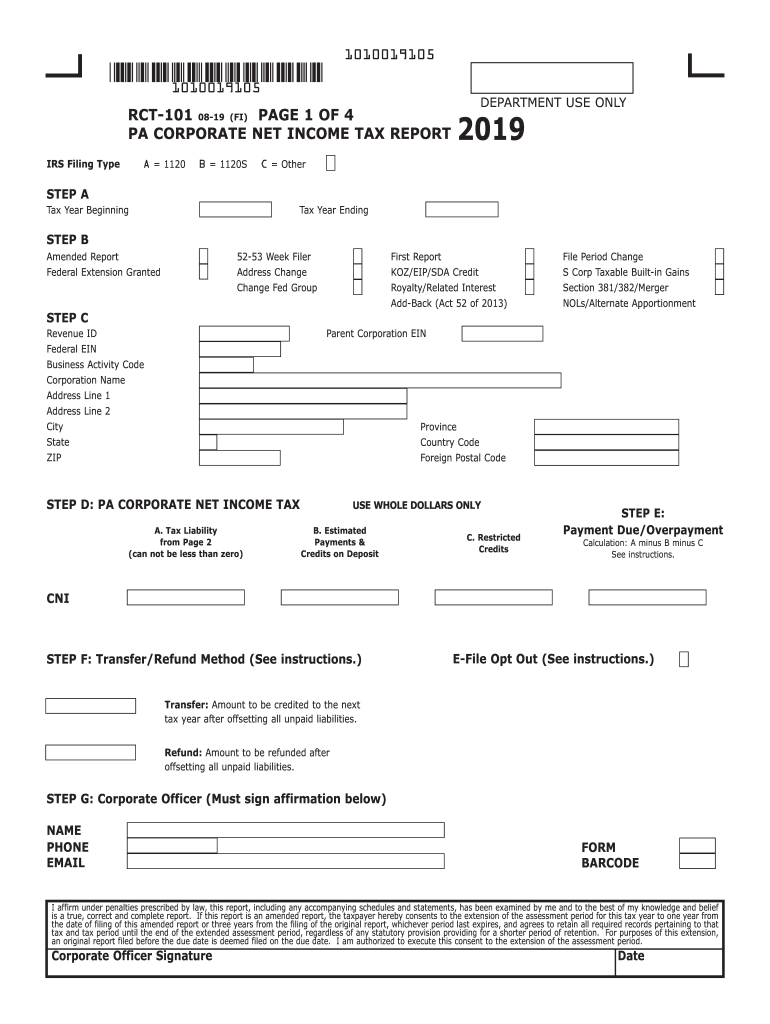

Pa Rct 101 2019

What is the PA RCT 101?

The PA RCT 101 is the Pennsylvania Corporate Tax Report, which businesses must file to report their income and calculate their corporate tax liability. This form is essential for corporations operating within Pennsylvania, as it provides the Department of Revenue with necessary financial information. The RCT 101 is used to determine the amount of corporate net income tax owed to the state, ensuring compliance with Pennsylvania tax laws.

Steps to Complete the PA RCT 101

Completing the PA RCT 101 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Calculate your corporation's net income, which is essential for determining tax liability.

- Fill out the PA RCT 101 form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Pennsylvania Department of Revenue by the filing deadline.

How to Obtain the PA RCT 101

The PA RCT 101 form can be obtained directly from the Pennsylvania Department of Revenue's website. It is available as a downloadable PDF, which can be printed and filled out manually, or as an electronic form that can be completed online. Ensure you have the latest version of the form to comply with current tax regulations.

Legal Use of the PA RCT 101

The PA RCT 101 is legally binding when completed and submitted according to Pennsylvania tax laws. To ensure its legal validity, businesses must adhere to the guidelines set forth by the Pennsylvania Department of Revenue. This includes providing accurate financial information and meeting all filing deadlines. Utilizing a reliable electronic signature solution can enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the PA RCT 101 are crucial for compliance. Corporations must file their tax reports by the fifteenth day of the fourth month following the end of their fiscal year. For most businesses operating on a calendar year, this means the deadline is April 15. Late submissions may incur penalties, so it is essential to be aware of these important dates.

Form Submission Methods (Online / Mail / In-Person)

The PA RCT 101 can be submitted through various methods, providing flexibility for businesses. Corporations can file the form online through the Pennsylvania Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax reports. Alternatively, the form can be mailed to the appropriate address or submitted in person at local Department of Revenue offices. Each method has specific guidelines to follow, so businesses should choose the one that best fits their needs.

Quick guide on how to complete 2019 pa corporate net income tax report rct 101 formspublications

Complete Pa Rct 101 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Pa Rct 101 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and electronically sign Pa Rct 101 effortlessly

- Obtain Pa Rct 101 and then click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Pa Rct 101 to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 pa corporate net income tax report rct 101 formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2019 pa corporate net income tax report rct 101 formspublications

How to create an eSignature for your 2019 Pa Corporate Net Income Tax Report Rct 101 Formspublications in the online mode

How to create an eSignature for the 2019 Pa Corporate Net Income Tax Report Rct 101 Formspublications in Google Chrome

How to make an eSignature for signing the 2019 Pa Corporate Net Income Tax Report Rct 101 Formspublications in Gmail

How to make an electronic signature for the 2019 Pa Corporate Net Income Tax Report Rct 101 Formspublications right from your smart phone

How to generate an eSignature for the 2019 Pa Corporate Net Income Tax Report Rct 101 Formspublications on iOS

How to make an eSignature for the 2019 Pa Corporate Net Income Tax Report Rct 101 Formspublications on Android OS

People also ask

-

What is PA corporate tax?

PA corporate tax refers to the tax imposed on the income of corporations operating in Pennsylvania. Understanding this tax is essential for businesses to ensure compliance and optimize their tax strategies. Utilizing platforms like airSlate SignNow can streamline document management related to PA corporate tax filings.

-

How can airSlate SignNow help with PA corporate tax documentation?

airSlate SignNow allows businesses to easily prepare, send, and eSign crucial documents related to PA corporate tax. This eSigning solution simplifies the process, making it efficient and cost-effective. By reducing paperwork, you can focus more on managing your tax obligations.

-

What features does airSlate SignNow offer for corporate tax solutions?

AirSlate SignNow provides features such as document templates, automated workflows, and secure eSignature technology specifically designed to handle corporate tax documents seamlessly. These features ensure that your PA corporate tax processes are efficient and legally compliant, saving your business time and reducing errors.

-

Is airSlate SignNow cost-effective for managing PA corporate tax?

Yes, airSlate SignNow is a cost-effective solution for managing PA corporate tax documentation. With flexible pricing plans tailored for various business sizes, users can access essential features without breaking the bank. This makes it an ideal choice for businesses looking to streamline their tax processes.

-

What are the benefits of using airSlate SignNow for PA corporate tax filings?

Utilizing airSlate SignNow for PA corporate tax filings provides benefits like enhanced efficiency, reduced processing times, and simplified document tracking. By digitizing paper-heavy processes, businesses can improve their operational workflow and ensure timely compliance with tax requirements.

-

Can I integrate airSlate SignNow with other accounting software for PA corporate tax?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software and platforms, making it easier to manage your PA corporate tax filings. These integrations allow for smooth data transfer and improved accuracy in your financial documentation.

-

How secure is airSlate SignNow for handling sensitive PA corporate tax information?

Security is paramount when handling sensitive PA corporate tax information, and airSlate SignNow employs advanced security measures including encryption and secure sign-in protocols. This ensures that your documents and data remain protected while you manage your tax-related processes.

Get more for Pa Rct 101

- 2014 form ri 1040x r tax ri

- Calswec faq 2013 2019 form

- The attached form is designed to meet minimal statutory filing requirements pursuant to the relevant sos texas

- New york city department of buildings rf1 refund request application form must be type written 1 2 please read the instructions

- Form 297

- Verification of crime pd pd 542 061 form

- Nevada support 2015 2019 form

- Form et 14 department of taxation and finance new york state tax ny

Find out other Pa Rct 101

- How To Use Electronic signature in Banking

- How To Integrate Electronic signature in Banking

- How To Install Electronic signature in Banking

- How To Add Electronic signature in Banking

- How To Set Up Electronic signature in Banking

- How To Save Electronic signature in Banking

- How To Implement Electronic signature in Banking

- Can I Implement Electronic signature in Car Dealer

- How To Install Electronic signature in Charity

- How To Add Electronic signature in Charity

- How To Set Up Electronic signature in Charity

- How To Save Electronic signature in Charity

- How To Use Electronic signature in Construction

- How To Implement Electronic signature in Charity

- How To Set Up Electronic signature in Construction

- How To Integrate Electronic signature in Doctors

- How To Use Electronic signature in Doctors

- How To Install Electronic signature in Doctors

- How To Add Electronic signature in Doctors

- How To Set Up Electronic signature in Doctors