PA Corporate Net Income Tax Report RCT 101 FormsPublications 2020

Understanding the PA Corporate Net Income Tax Report RCT 101

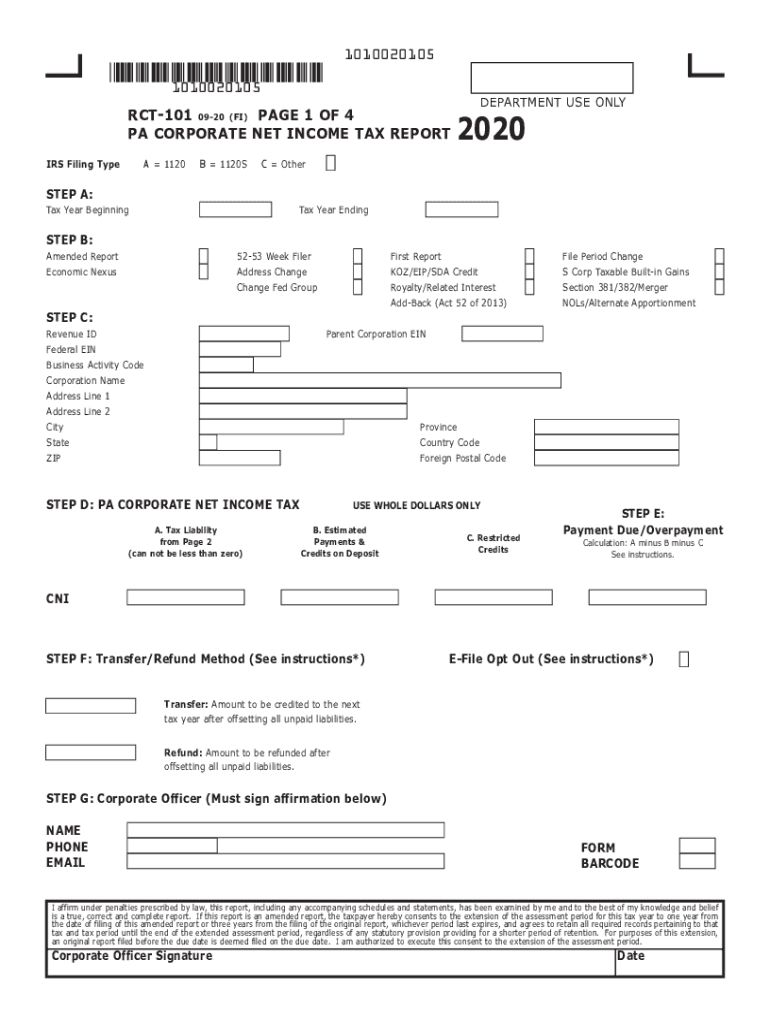

The PA Corporate Net Income Tax Report, commonly referred to as RCT 101, is a crucial document for corporations operating in Pennsylvania. This form is used to report the income of corporations and calculate the corporate net income tax owed to the state. It is essential for compliance with Pennsylvania tax regulations and is applicable to various business entities, including corporations, limited liability companies (LLCs), and partnerships. Understanding the requirements and implications of this form is vital for businesses to ensure accurate reporting and avoid potential penalties.

Steps to Complete the PA Corporate Net Income Tax Report RCT 101

Completing the RCT 101 involves several key steps. First, businesses must gather necessary financial documents, including income statements, balance sheets, and prior tax returns. Next, accurately report total income, deductions, and credits on the form. It is important to follow the specific instructions provided with the RCT 101 to ensure all calculations are correct. After filling out the form, review it for accuracy before submission. Finally, ensure that the form is submitted by the deadline to avoid late fees or penalties.

Filing Deadlines for the PA Corporate Net Income Tax Report RCT 101

Timely filing of the RCT 101 is crucial for compliance. The standard deadline for submitting the PA Corporate Net Income Tax Report is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is advisable for businesses to mark their calendars and prepare documentation in advance to meet these deadlines and avoid any penalties associated with late filing.

Legal Use of the PA Corporate Net Income Tax Report RCT 101

The RCT 101 is legally binding and must be filled out in accordance with Pennsylvania tax laws. The form must be signed by an authorized representative of the corporation, and electronic submissions are acceptable if they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that the electronic submission is treated as a traditional paper filing, provided that all legal requirements are met. Businesses should maintain copies of submitted forms for their records, as they may be required for future audits or inquiries.

Required Documents for the PA Corporate Net Income Tax Report RCT 101

To accurately complete the RCT 101, businesses must gather several documents. These typically include:

- Income statements detailing revenue and expenses

- Balance sheets showing assets and liabilities

- Prior year tax returns for reference

- Any applicable supporting documentation for deductions and credits

Having these documents ready will streamline the completion process and help ensure compliance with filing requirements.

Form Submission Methods for the PA Corporate Net Income Tax Report RCT 101

The RCT 101 can be submitted through various methods. Corporations have the option to file the form electronically via the Pennsylvania Department of Revenue's online portal, which is a secure and efficient method. Alternatively, businesses may choose to mail a paper copy of the form to the appropriate address provided in the instructions. It is essential to select a submission method that aligns with the corporation's operational capabilities and to confirm that the submission is completed by the deadline.

Quick guide on how to complete 2020 pa corporate net income tax report rct 101 formspublications

Complete PA Corporate Net Income Tax Report RCT 101 FormsPublications easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, as you can access the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage PA Corporate Net Income Tax Report RCT 101 FormsPublications on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign PA Corporate Net Income Tax Report RCT 101 FormsPublications without hassle

- Locate PA Corporate Net Income Tax Report RCT 101 FormsPublications and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device you prefer. Modify and eSign PA Corporate Net Income Tax Report RCT 101 FormsPublications and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 pa corporate net income tax report rct 101 formspublications

Create this form in 5 minutes!

How to create an eSignature for the 2020 pa corporate net income tax report rct 101 formspublications

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is PA corporate tax and why is it important?

PA corporate tax refers to the tax imposed on corporations operating in Pennsylvania. Understanding PA corporate tax is crucial for businesses to ensure compliance and optimize their tax obligations. It can signNowly impact overall profitability and cash flow.

-

How can airSlate SignNow help streamline PA corporate tax documentation?

AirSlate SignNow provides an efficient platform to create, send, and eSign essential PA corporate tax documents quickly. This streamlined process reduces the risk of errors, ensuring timely and accurate submissions. With its user-friendly interface, you can manage your tax documentation effortlessly.

-

What are the pricing options for using airSlate SignNow for PA corporate tax needs?

AirSlate SignNow offers various pricing plans that cater to different business sizes and needs, making it affordable for managing PA corporate tax processes. You can choose from monthly or annual subscriptions based on your usage and budget. The transparent pricing ensures that you only pay for what you need.

-

Does airSlate SignNow offer any features specifically for PA corporate tax compliance?

Yes, airSlate SignNow includes features designed to assist with PA corporate tax compliance, such as automated reminders for tax filing deadlines, template libraries for common tax forms, and secure eSigning capabilities. These tools help you stay organized and compliant with tax regulations.

-

Can airSlate SignNow integrate with accounting software to manage PA corporate tax?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage PA corporate tax data smoothly. This integration simplifies the process of tracking expenses, income, and preparing necessary documents for corporate tax filings.

-

What benefits does airSlate SignNow provide for businesses dealing with PA corporate tax?

Using airSlate SignNow for PA corporate tax offers numerous benefits, including enhanced document security, reduced turnaround times for eSigning, and improved operational efficiency. It helps businesses minimize the risk of tax-related errors, leading to better compliance and financial accuracy.

-

Is airSlate SignNow suitable for small businesses handling PA corporate tax?

Yes, airSlate SignNow is highly suitable for small businesses dealing with PA corporate tax. Its cost-effective pricing, user-friendly interface, and robust features make it an ideal choice for businesses looking to simplify their tax document management without incurring signNow costs.

Get more for PA Corporate Net Income Tax Report RCT 101 FormsPublications

Find out other PA Corporate Net Income Tax Report RCT 101 FormsPublications

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement