PA Corporate Net Income Report RCT 101 2023-2026

What is the PA Corporate Net Income Report RCT 101

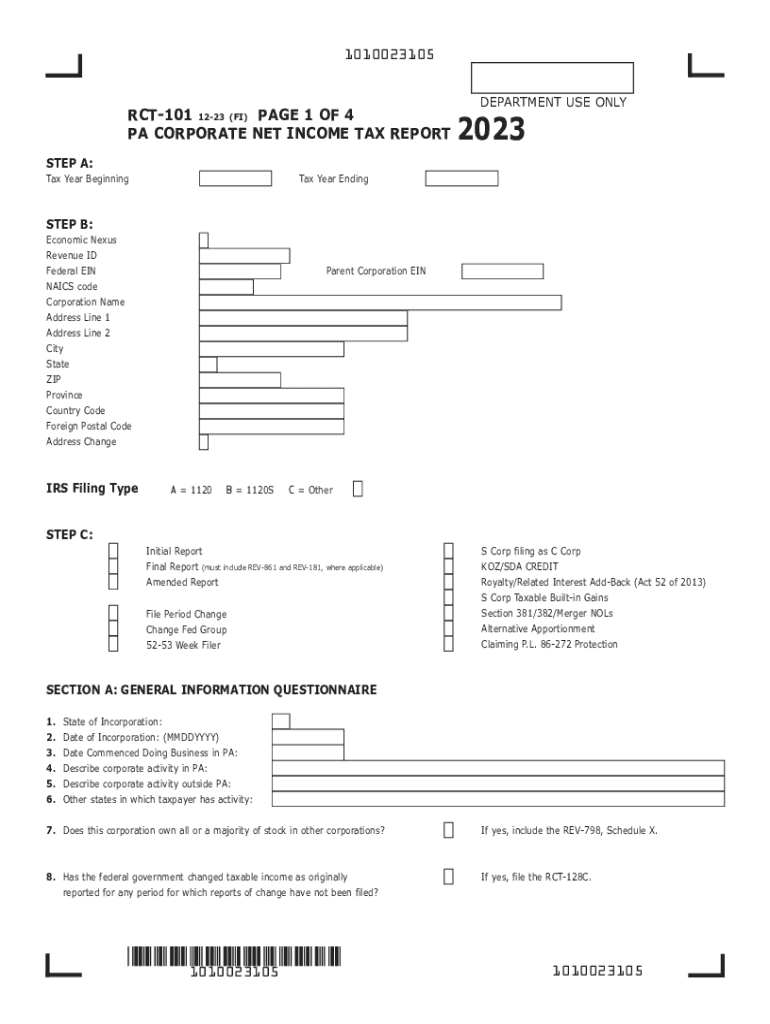

The 2023 Pennsylvania Form RCT 101 is a tax document that corporations in Pennsylvania must file to report their net income. This form is essential for determining the amount of corporate net income tax owed to the state. It provides a comprehensive overview of a corporation's financial performance over the tax year, enabling the state to assess tax liability accurately. The RCT 101 is specifically designed for corporations, including C corporations and S corporations, that conduct business activities within Pennsylvania.

How to use the PA Corporate Net Income Report RCT 101

Using the 2023 Pennsylvania Form RCT 101 involves gathering necessary financial information and accurately completing each section of the form. Corporations must report total income, deductions, and any applicable credits. It is crucial to follow the instructions provided with the form to ensure compliance with Pennsylvania tax laws. After completing the form, corporations can submit it electronically or via mail, depending on their preference and eligibility. Utilizing digital tools can streamline the process, making it easier to fill out and sign the form securely.

Steps to complete the PA Corporate Net Income Report RCT 101

Completing the 2023 Pennsylvania Form RCT 101 involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the identification section with the corporation's name, address, and federal employer identification number (EIN).

- Report total income for the tax year, including sales, services, and other revenue sources.

- List all allowable deductions, such as operating expenses and depreciation.

- Calculate the net income by subtracting deductions from total income.

- Determine any tax credits applicable to the corporation.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the 2023 Pennsylvania Form RCT 101 to avoid penalties. Typically, the form is due on the fifteenth day of the fourth month following the close of the corporation's fiscal year. For corporations that operate on a calendar year, this means the deadline is April 15, 2024. It is advisable for corporations to mark important dates on their calendars and prepare the necessary documentation well in advance to ensure timely filing.

Required Documents

To complete the 2023 Pennsylvania Form RCT 101, corporations need to gather several key documents:

- Income statements detailing revenue for the tax year.

- Balance sheets to provide a snapshot of the corporation's financial position.

- Records of deductions and credits claimed in previous filings.

- Any additional documentation required to substantiate income and expenses.

Form Submission Methods (Online / Mail / In-Person)

The 2023 Pennsylvania Form RCT 101 can be submitted through various methods. Corporations have the option to file online using the Pennsylvania Department of Revenue's e-filing system, which offers a secure and efficient way to submit the form. Alternatively, corporations can print the completed form and mail it to the appropriate address specified in the filing instructions. In-person submissions are also possible, although they are less common. Each submission method has its own guidelines that must be followed to ensure compliance.

Quick guide on how to complete pa corporate net income report rct 101

Effortlessly Prepare PA Corporate Net Income Report RCT 101 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It provides an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow offers all the tools you require to create, modify, and electronically sign your documents promptly without delays. Manage PA Corporate Net Income Report RCT 101 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The Easiest Method to Modify and Electronically Sign PA Corporate Net Income Report RCT 101 with Ease

- Obtain PA Corporate Net Income Report RCT 101 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and electronically sign PA Corporate Net Income Report RCT 101 while ensuring excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa corporate net income report rct 101

Create this form in 5 minutes!

How to create an eSignature for the pa corporate net income report rct 101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 Pennsylvania Form RCT-101?

The 2023 Pennsylvania Form RCT-101 is a key document used by businesses to report their Pennsylvania corporate net income tax. It provides essential information regarding your business's revenue and tax obligations. Completing this form accurately is crucial to ensure compliance and avoid penalties.

-

How can airSlate SignNow assist with the 2023 Pennsylvania Form RCT-101?

airSlate SignNow simplifies the process of completing and submitting the 2023 Pennsylvania Form RCT-101 by allowing you to eSign and manage documents seamlessly. Our easy-to-use interface ensures you can fill out the necessary information quickly and securely, making tax season less stressful for your business.

-

Is there a cost associated with using airSlate SignNow to file the 2023 Pennsylvania Form RCT-101?

Yes, there is a subscription fee associated with airSlate SignNow, which offers various pricing plans based on your business needs. These plans ensure you receive a cost-effective solution to manage not only the 2023 Pennsylvania Form RCT-101 but all your eSigning needs. Consider the value and convenience gained from using our platform.

-

What features does airSlate SignNow offer for managing the 2023 Pennsylvania Form RCT-101?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all essential for effectively managing the 2023 Pennsylvania Form RCT-101. Our platform allows you to streamline your workflow, reduce paperwork, and enhance collaboration among team members when filing your taxes.

-

Can I integrate airSlate SignNow with other software to handle the 2023 Pennsylvania Form RCT-101?

Absolutely! airSlate SignNow offers integration with a range of popular software, including CRM and accounting systems, to help manage the 2023 Pennsylvania Form RCT-101 seamlessly. These integrations enhance productivity by allowing you to sync data and reduce manual entry, making the filing process more efficient.

-

What are the benefits of using airSlate SignNow for the 2023 Pennsylvania Form RCT-101?

Using airSlate SignNow for the 2023 Pennsylvania Form RCT-101 offers numerous benefits, including improved accuracy, time savings, and enhanced security. Our solution minimizes the risk of errors and ensures your documents are securely stored, providing peace of mind during the tax filing process.

-

Is airSlate SignNow suitable for all business sizes preparing the 2023 Pennsylvania Form RCT-101?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, from startups to large enterprises, preparing the 2023 Pennsylvania Form RCT-101. Our flexible pricing and comprehensive features make it accessible for any organization seeking to streamline their document management and eSigning processes.

Get more for PA Corporate Net Income Report RCT 101

- Board of governors handbook rutgers university form

- Instructions for form aia02 substitute statement in li united

- Ey tax covid 19 response tracker readkongcom form

- Temporary on premises sign application form

- Application for licensure new jersey division of consumer form

- Ots 2 go screening form hamilton health sciences

- Faculty of nursing student academic appeals committee form

- Access and overview for new personnel english form

Find out other PA Corporate Net Income Report RCT 101

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word