Corporate Income Tax Vermont Department of Taxes 2021-2026

Understanding the Corporate Income Tax in Vermont

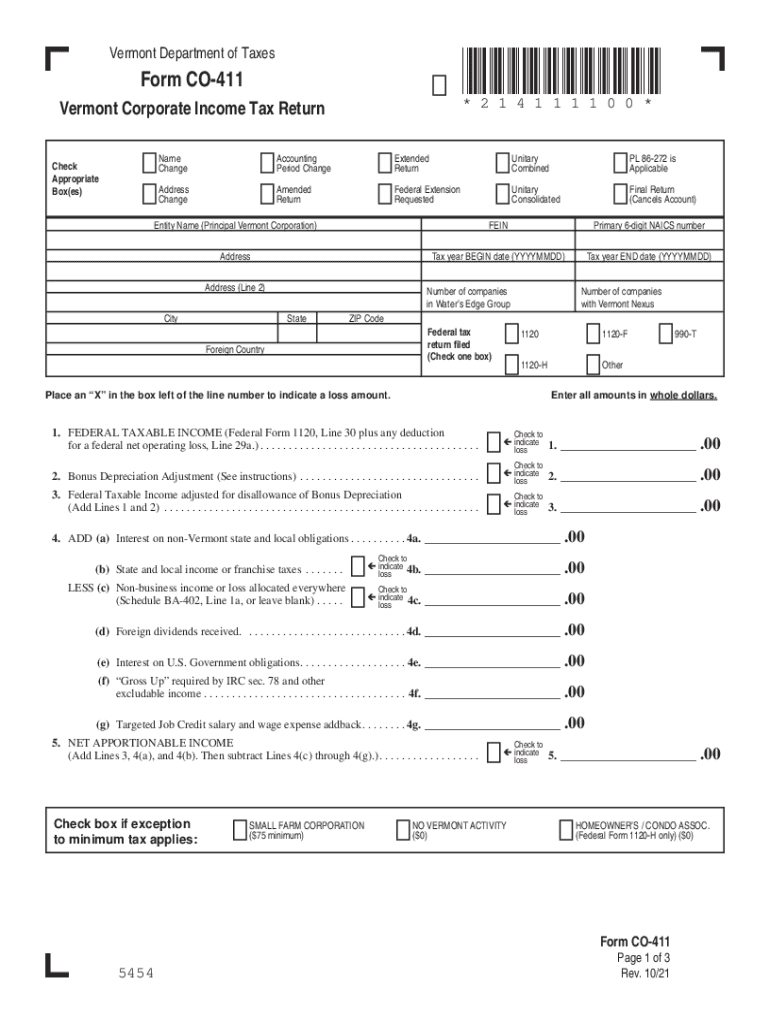

The Corporate Income Tax in Vermont is a tax levied on the income of corporations operating within the state. This tax applies to both domestic and foreign corporations that conduct business in Vermont. The tax rate varies based on the amount of taxable income, which is calculated after allowable deductions. It is essential for businesses to understand their obligations under this tax to ensure compliance and avoid penalties.

Steps to Complete the Corporate Income Tax in Vermont

Completing the Corporate Income Tax involves several key steps:

- Gather Financial Records: Collect all necessary financial documents, including income statements, balance sheets, and expense records.

- Calculate Taxable Income: Determine the corporation's taxable income by subtracting allowable deductions from total income.

- Complete the 411 Form: Fill out the Corporate Income Tax form accurately, ensuring all information is correct and complete.

- Review and Sign: Review the completed form for accuracy and sign it to certify that the information is true and correct.

- Submit the Form: File the completed form with the Vermont Department of Taxes by the designated deadline.

Filing Deadlines for the Corporate Income Tax in Vermont

Understanding the filing deadlines is crucial for compliance. Generally, the Corporate Income Tax return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the return is due by April 15. Late filings may incur penalties, so timely submission is essential.

Required Documents for the Corporate Income Tax in Vermont

To complete the Corporate Income Tax, businesses must provide specific documentation, including:

- Financial statements for the tax year.

- Records of all income and expenses.

- Any relevant tax credits or deductions claimed.

- Previous year's tax returns for reference.

Legal Use of the Corporate Income Tax in Vermont

The Corporate Income Tax is governed by Vermont state law, which outlines the legal framework for taxation. Corporations must comply with these laws to ensure that their tax filings are valid and enforceable. Understanding the legal requirements helps businesses avoid potential disputes with tax authorities.

Form Submission Methods for the Corporate Income Tax in Vermont

Corporations in Vermont can submit their Corporate Income Tax forms through various methods:

- Online Submission: Many businesses opt to file electronically through the Vermont Department of Taxes’ online portal.

- Mail: Forms can be printed and mailed to the appropriate tax office address.

- In-Person: Corporations may also choose to deliver their forms in person at designated tax offices.

Penalties for Non-Compliance with the Corporate Income Tax in Vermont

Failure to comply with the Corporate Income Tax regulations can result in significant penalties. These may include:

- Late filing penalties, which can add up quickly.

- Interest on unpaid taxes, accruing from the due date until payment is made.

- Potential legal action for persistent non-compliance.

Quick guide on how to complete corporate income tax vermont department of taxes

Complete Corporate Income Tax Vermont Department Of Taxes effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle Corporate Income Tax Vermont Department Of Taxes on any device with airSlate SignNow's Android or iOS applications and streamline your document-centric operations today.

The easiest way to edit and eSign Corporate Income Tax Vermont Department Of Taxes without hassle

- Find Corporate Income Tax Vermont Department Of Taxes and click Get Form to start.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, arduous form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and eSign Corporate Income Tax Vermont Department Of Taxes and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporate income tax vermont department of taxes

Create this form in 5 minutes!

How to create an eSignature for the corporate income tax vermont department of taxes

How to create an e-signature for a PDF online

How to create an e-signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an e-signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is a 411 form and how can airSlate SignNow help with it?

A 411 form is a document used for various administrative purposes, and airSlate SignNow streamlines the process of preparing and signing these forms. With our platform, you can create, send, and eSign 411 forms easily, reducing turnaround time and improving efficiency.

-

Is there a cost associated with using the 411 form feature in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include access to features for handling 411 forms. Depending on your selected plan, you can enjoy a range of features tailored to your business needs while keeping your costs economical.

-

What features does airSlate SignNow offer for 411 forms?

airSlate SignNow provides a variety of features for 411 forms such as customizable templates, eSignature capabilities, and an intuitive user interface. You can also track document status and ensure compliance with ease, making the process efficient and straightforward.

-

Can I integrate airSlate SignNow with other tools I use for my 411 form needs?

Absolutely! airSlate SignNow offers seamless integrations with many popular applications, allowing you to manage your 411 forms alongside your existing workflows effortlessly. This helps to centralize documentation and improve overall productivity.

-

How does airSlate SignNow ensure the security of my 411 forms?

Security is a top priority for airSlate SignNow, and we utilize advanced encryption protocols to protect your 411 forms and sensitive data. Additionally, we comply with industry regulations to ensure that your documents remain secure and confidential.

-

Can I track the status of my 411 form after sending it through airSlate SignNow?

Yes, once you send a 411 form through airSlate SignNow, you can easily track its status. The platform provides real-time updates, allowing you to see when the document has been viewed, signed, or completed, which helps you manage your timelines effectively.

-

Are there any mobile capabilities for handling 411 forms with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile, allowing you to manage your 411 forms on the go. Whether you’re sending, eSigning, or reviewing documents, you can do so from your smartphone or tablet, ensuring flexibility and convenience.

Get more for Corporate Income Tax Vermont Department Of Taxes

- Massachusetts dissolution form

- Massachusetts quitclaim deed 497309633 form

- Warranty deed from individual to llc massachusetts form

- Massachusetts lien form

- Massachusetts bond form

- Massachusetts quitclaim deed 497309638 form

- Warranty deed from husband and wife to corporation massachusetts form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form massachusetts

Find out other Corporate Income Tax Vermont Department Of Taxes

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online