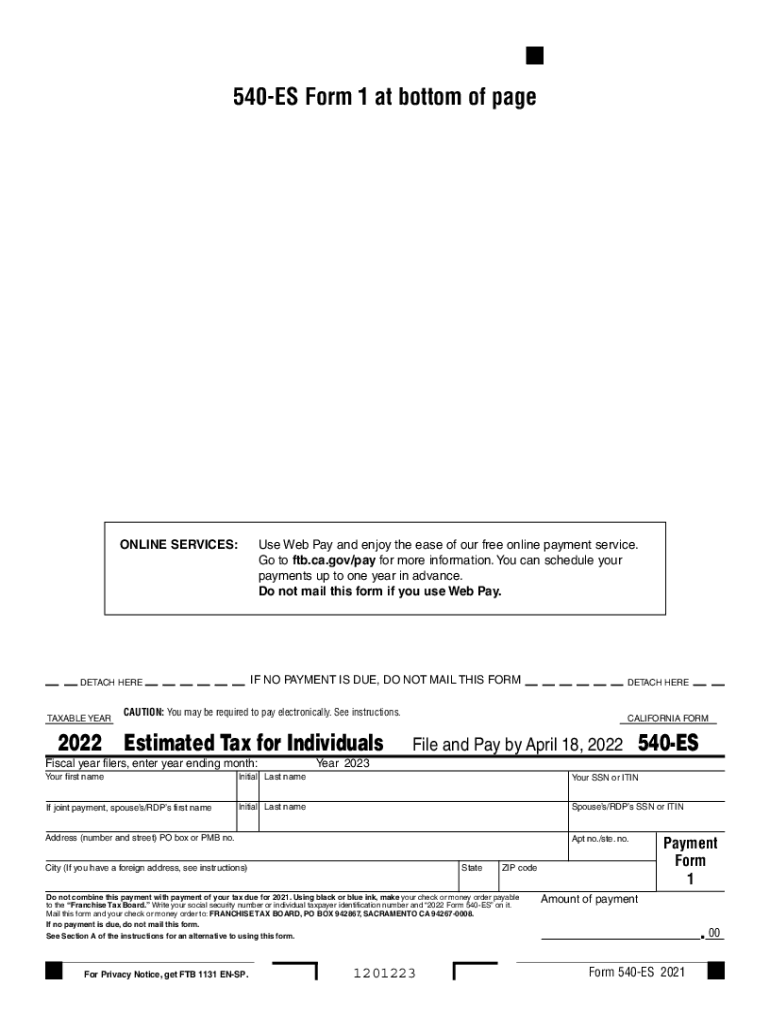

California Form 540 ES Estimated Tax for Individuals 2022

What is the California Form 540 ES Estimated Tax For Individuals

The California Form 540 ES is designed for individuals to report and pay estimated tax on income that is not subject to withholding. This form is essential for those who expect to owe tax of five hundred dollars or more when they file their annual tax return. It helps taxpayers manage their tax obligations throughout the year, ensuring that they meet their financial responsibilities to the state of California.

Steps to Complete the California Form 540 ES Estimated Tax For Individuals

Completing the California Form 540 ES involves several key steps:

- Gather your financial information, including income sources and deductions.

- Calculate your estimated annual income and the corresponding tax liability.

- Determine the amount of estimated tax you need to pay for each quarter.

- Fill out the Form 540 ES, including your personal information and estimated tax amounts.

- Submit the form by the due date, along with your payment if applicable.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the California Form 540 ES to avoid penalties. The estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

These dates may vary slightly if they fall on a weekend or holiday, so it is advisable to check the California Franchise Tax Board website for updates.

Required Documents

To accurately complete the California Form 540 ES, you will need several documents, including:

- Your previous year's tax return for reference.

- Income statements such as W-2s or 1099s.

- Records of any deductions or credits you plan to claim.

- Any other relevant financial documents that provide insight into your income and expenses.

Legal Use of the California Form 540 ES Estimated Tax For Individuals

The California Form 540 ES is legally binding and must be used in accordance with California tax laws. Filing this form ensures compliance with state regulations regarding estimated tax payments. Failure to file or pay the estimated tax can result in penalties and interest charges, making it essential for individuals to adhere to the guidelines set forth by the California Franchise Tax Board.

Who Issues the Form

The California Form 540 ES is issued by the California Franchise Tax Board (FTB). This state agency is responsible for administering California's income tax laws and ensuring that taxpayers fulfill their obligations. The FTB provides resources and support to help individuals understand their tax responsibilities and navigate the filing process effectively.

Quick guide on how to complete california form 540 es estimated tax for individuals

Effortlessly Prepare California Form 540 ES Estimated Tax For Individuals on Any Device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage California Form 540 ES Estimated Tax For Individuals on any device using the airSlate SignNow Android or iOS applications and simplify any document-based process today.

The most efficient method to modify and eSign California Form 540 ES Estimated Tax For Individuals effortlessly

- Locate California Form 540 ES Estimated Tax For Individuals and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you would like to send your form, through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign California Form 540 ES Estimated Tax For Individuals and ensure excellent communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 540 es estimated tax for individuals

Create this form in 5 minutes!

How to create an eSignature for the california form 540 es estimated tax for individuals

How to create an e-signature for a PDF file in the online mode

How to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

How to generate an e-signature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is the CA 540 form 2021?

The CA 540 form 2021 is the California Resident Income Tax Return, which residents must file each year to report their income and calculate state taxes. Understanding this form is crucial for ensuring compliance with state tax regulations and avoiding penalties.

-

How can airSlate SignNow help with the CA 540 form 2021?

airSlate SignNow offers a seamless solution for eSigning and sending the CA 540 form 2021. Our platform allows users to easily prepare, sign, and share documents electronically, streamlining the tax filing process.

-

Is there a cost associated with using airSlate SignNow for the CA 540 form 2021?

Yes, airSlate SignNow is a cost-effective solution with competitive pricing plans suitable for individuals and businesses. By using our service for the CA 540 form 2021, users can save time and reduce costs related to paper processing and mailing.

-

What features does airSlate SignNow offer for handling the CA 540 form 2021?

airSlate SignNow provides features such as easy document uploads, customizable templates for the CA 540 form 2021, secure eSigning, and real-time tracking of document status. These features ensure a smooth and efficient experience for users during tax season.

-

Can I integrate airSlate SignNow with other software for the CA 540 form 2021?

Yes, airSlate SignNow offers integration capabilities with various software platforms and tools, making it simple to import or export data related to the CA 540 form 2021. This ensures that users can effortlessly manage their tax documents alongside other financial software.

-

What are the benefits of using airSlate SignNow for my CA 540 form 2021?

Using airSlate SignNow for your CA 540 form 2021 offers numerous benefits, including enhanced document security, faster turnaround times, and improved accessibility. You'll be able to keep track of your submission status and have peace of mind knowing your information is protected.

-

How long does it take to complete the CA 540 form 2021 using airSlate SignNow?

The time it takes to complete the CA 540 form 2021 using airSlate SignNow varies depending on the complexity of your tax situation. However, our platform is designed to streamline the process, allowing users to complete their forms quickly and efficiently.

Get more for California Form 540 ES Estimated Tax For Individuals

- Letter landlord repair sample form

- Massachusetts cori records form

- Ma letter demand form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles massachusetts form

- Letter from tenant to landlord about landlords failure to make repairs massachusetts form

- Massachusetts notice rent form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession massachusetts form

- Letter from tenant to landlord about illegal entry by landlord massachusetts form

Find out other California Form 540 ES Estimated Tax For Individuals

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now